A de minimus improvement in (the incredibly noisy) initial jobless claims was all it took to enable the machines to run stocks higher, bond yields followed suit (higher) along with another ugly auctions (30Y). Crude, bitcoin, and gold also rallied (despite the dollar being basically flat).

For some context on the size of the labor market 'surprise' in today's claims data... here is the macro surprise index...

Source: Bloomberg

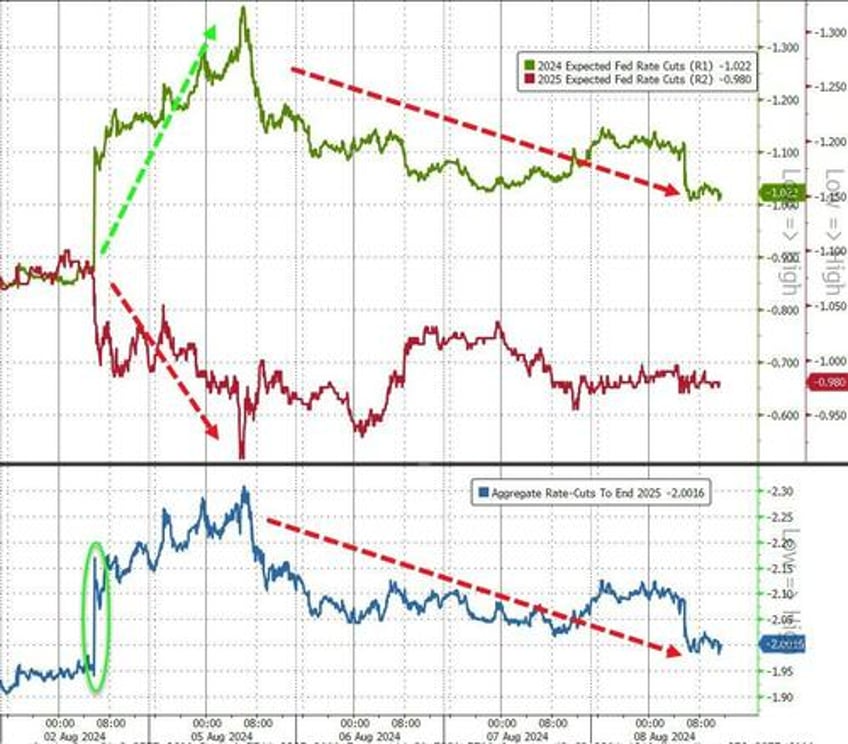

Before we get into the color, of particular note is the fact that rate-cut expectations have now retraced all of the post-payrolls spike (with the shift still biased more into 2024 than 2025)...

Source: Bloomberg

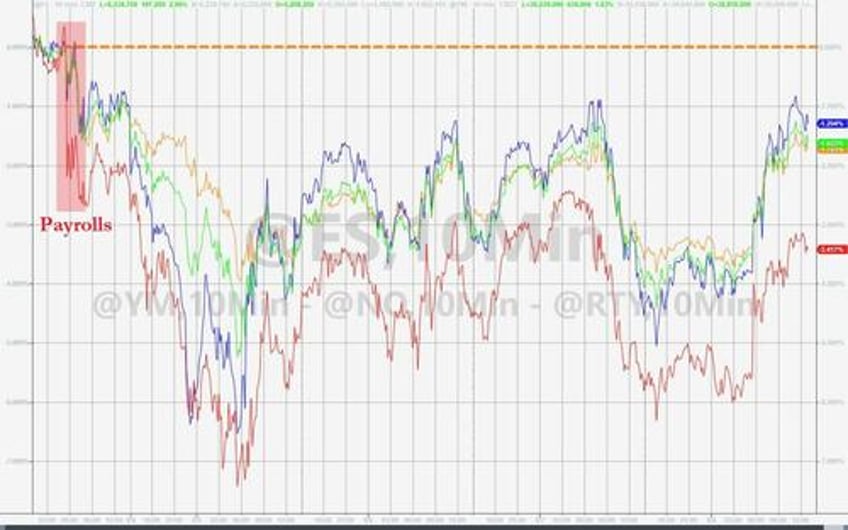

Nasdaq was the day's best performer (best day since Feb 2023) and the S&P's gain was the best day since Nov 2022...

Stocks, broadly speaking, remain notably lower from payrolls still...

Of particular note, Nasdaq's surge was very technical - ramping up to yesterday's high and then fading back...

The Dow and S&P 500 stalled at critical technical levels too.

Dow at 50DMA...

S&P at 100DMA...

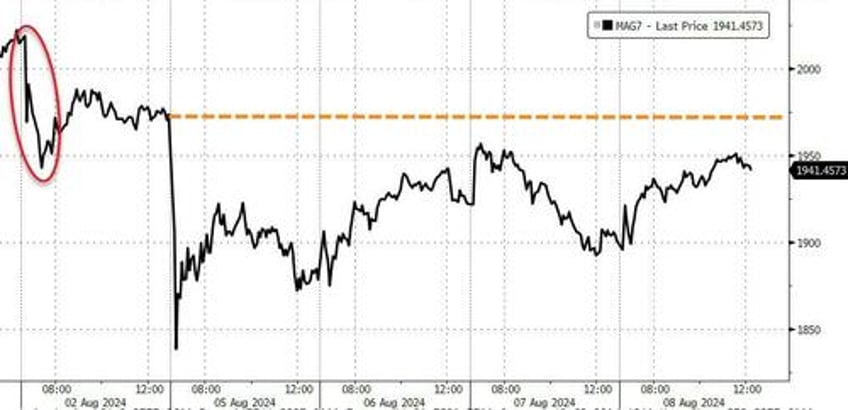

Mag7 stocks bounced to yesterday's highs too, but remain down on the week and down from pre-payrolls...

Source: Bloomberg

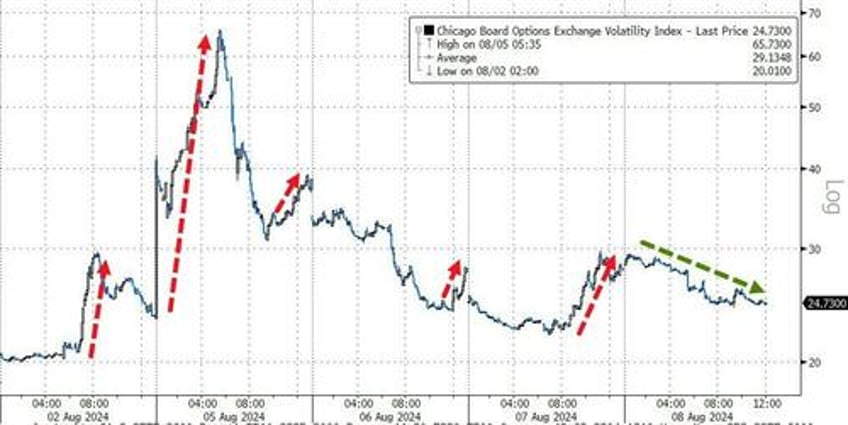

VIX slid lower once again (but remains above yesterday's lows)...

Source: Bloomberg

Finally, before we leave equities, Goldman's trading desk notes volumes were down (-15% vs this past week) and S&P top of book (liquidity) continues to be very poor sitting around the 4mm level (YTD average closer to 13mm).

LOs 4% better for sale (selling macro hedges, pockets of tech and semis on strength, and cons discretionary vs buying industrials, fins, and utes).

HFs +1.4% better to buy (buying ETFs, info tech, and industrials vs selling cons discretionary, HC, and Utes)

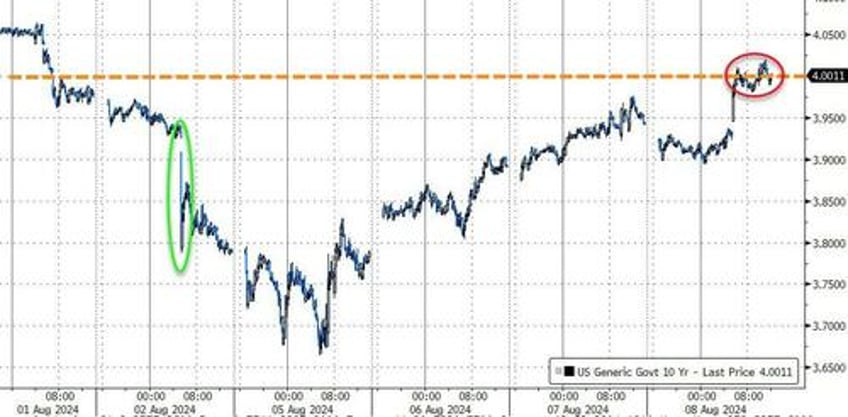

Treasury yields surged higher once again, now back above the pre-payrolls level (for all but the 2Y yield)...

Source: Bloomberg

The 10Y yield surged up to 4.00% (and 2Y moved above it)...

Source: Bloomberg

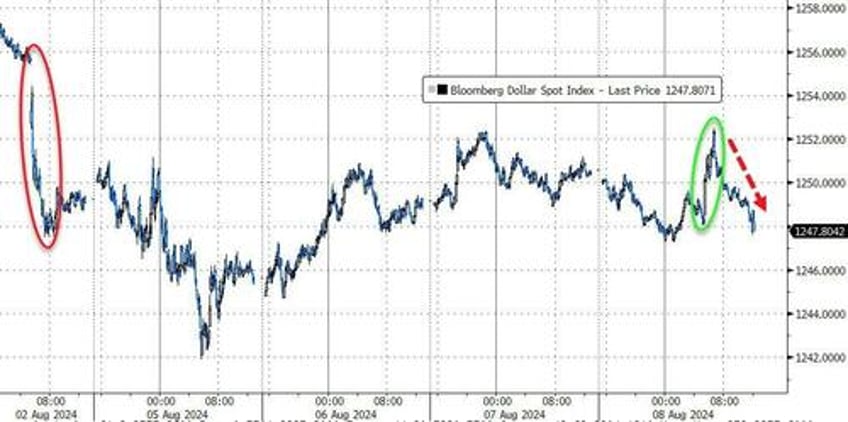

The dollar ended very modestly lower...

Source: Bloomberg

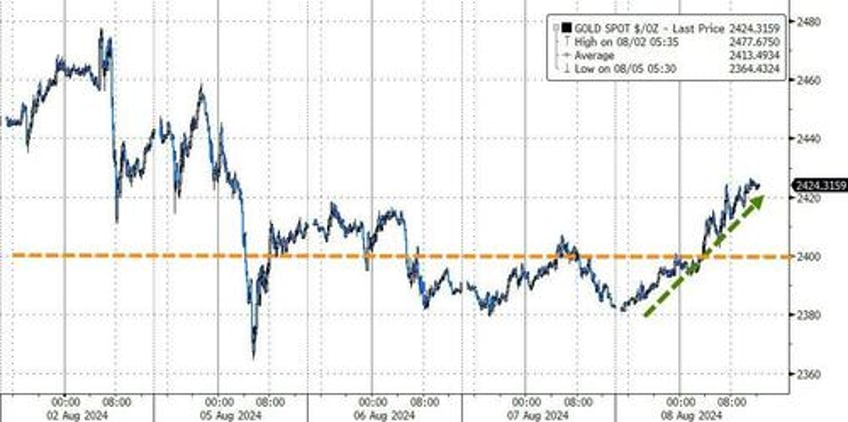

Gold rallied back above $2400...

Source: Bloomberg

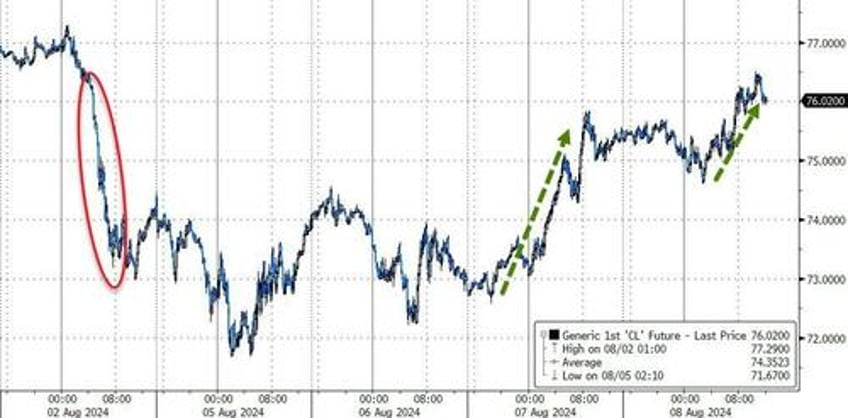

Oil prices extended their rebound today (erasing the payrolls plunge) as tensions in Ukraine and the MidEast picked up once again...

Source: Bloomberg

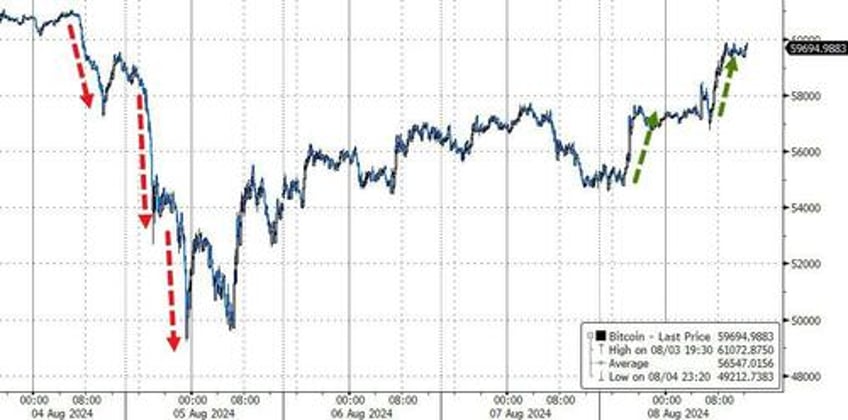

Bitcoin ripped higher today, touching $60,000 and erasing the Jump-Trading liquidation from Sunday night...

Source: Bloomberg

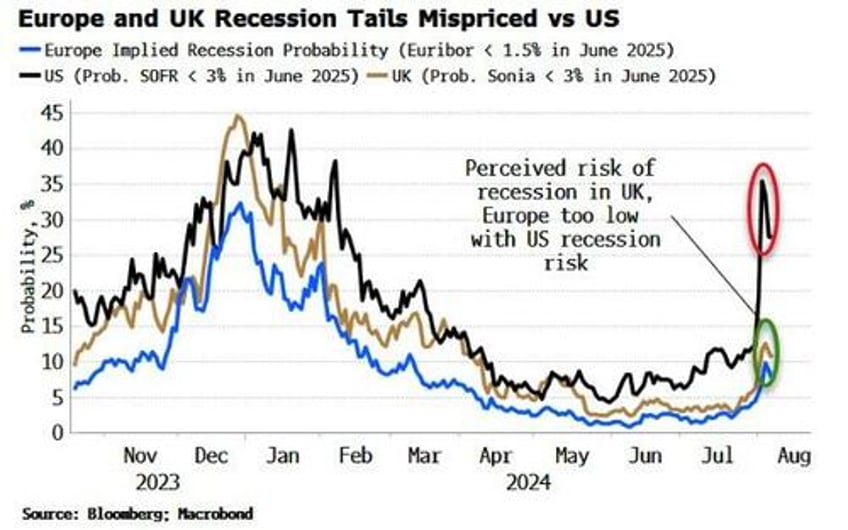

Finally, as we noted earlier, the rise in rates led to the implied odds of a US recession jumping much higher. But in the UK and Europe they are still relatively low.

Source: Bloomberg

The question is - how long can that divergence remain? Either US odds have to decline or UK and EU recession odds have to rise.