Unpossible...

For months, the talking heads have espoused soft-landings and disinflationary trends and rate-cut-paloozas (but hell no recession at all).

But, after the last set of inflation data hit - showing stickier than expected price rises (especially the acyclical segment)...

...it appears the market ain't buying what The Fed is selling anymore...

First things first, Breakevens are soaring (the market's bet on where inflation will be)...

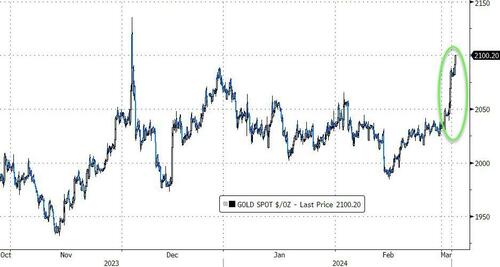

Gold is breaking out, near record highs...

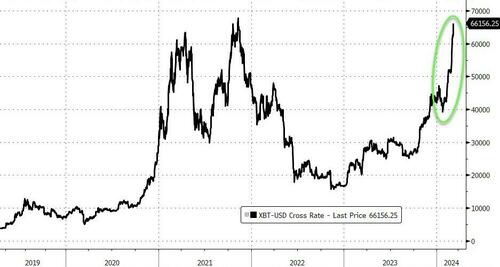

And of course, bitcoin is soaring, also back near record highs...

So is inflation under control or not? Who do you believe, The Fed or your lying eyes?

Gold record high

— zerohedge (@zerohedge) March 4, 2024

Bitcoin record high (any second)

Breakevens soaring

And the Fed hasn't even started cutting rates yet pic.twitter.com/mK4hb1GQS7

We also note that the 'juice' from last year's massive loosening of financial conditions is starting to wear off (not great timing for an incumbent in an election year)...

And as a reminder, The Fed is entirely apolitical and would never cut-rates in an election year to juice sentiment in the face of all this 'animal spirits 2.0' growth and sticky inflation, and record high stock valuations.... right?