The big headlines for today were good (Gold bulls happy as the barbarous relic hit record highs), bad (bitcoin bulls happy then sad as the cryptocurrency broke to record highs and was then clubbed like baby seal), and ugly (Nasdaq - and MAG7 stocks - suffered their worst day since October).

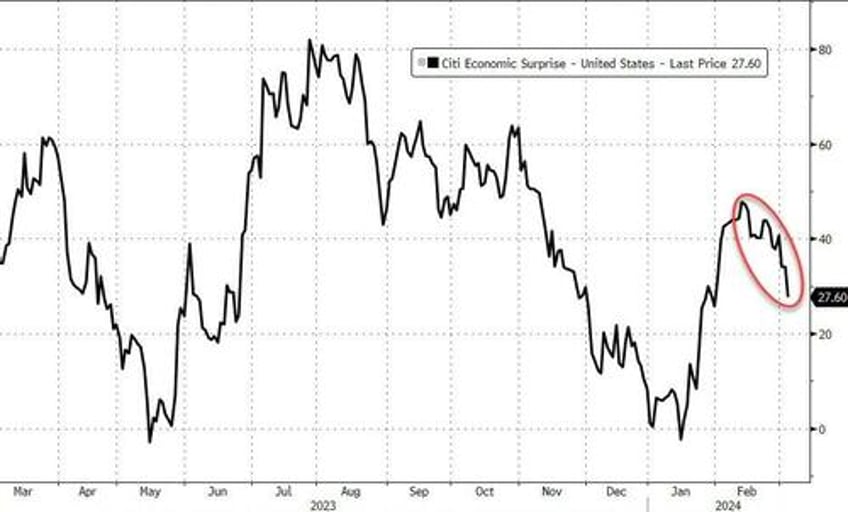

Investors also faced a slew of disappointing macro releases which may be weighing on the goldilocks growth sentiment at the margin, with ISM services printing weaker than expected and factory orders plunging...

Source: Bloomberg

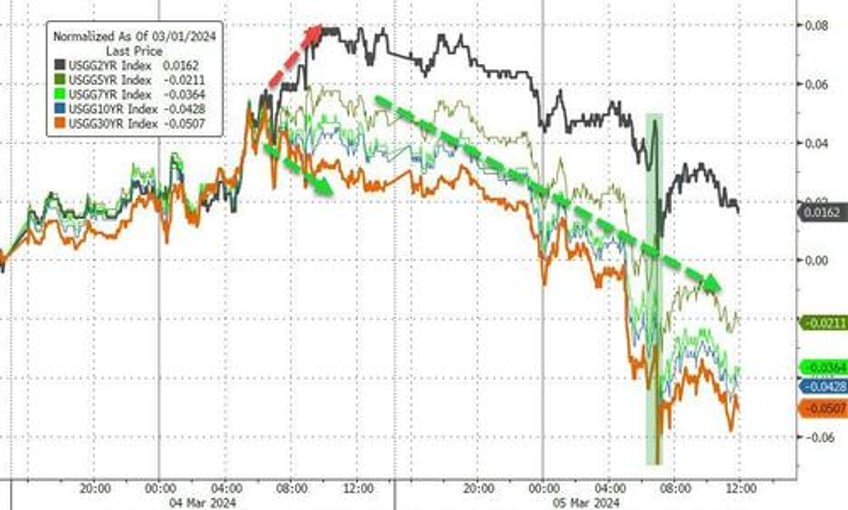

Interestingly, Goldman's Chris Hussey notes that the pullback in secular growers is driving a broader risk-off sentiment and likely even weighing on rates as 10-year US Treasury yields are down ~8bps (short-end down around 5bps)...

Source: Bloomberg

All the 'Magnificent 7' stocks are trading 2% lower (finding support at the up-trendline)...

Source: Bloomberg

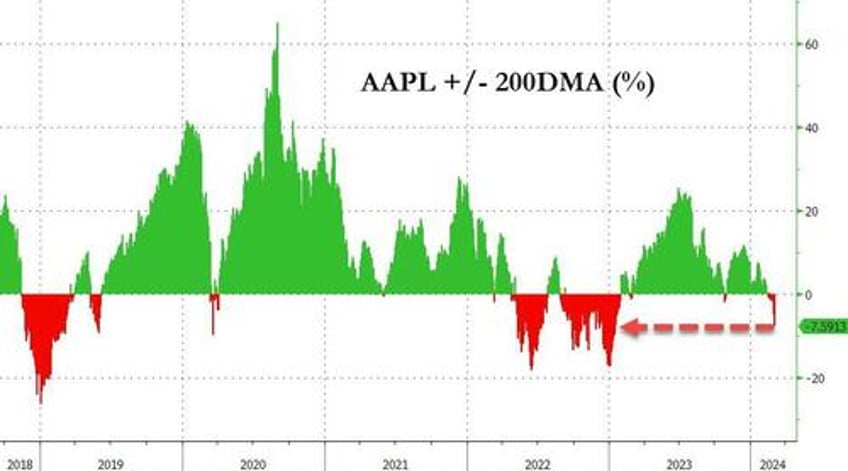

As AAPL fell faster than a Vision-Pro off your forehead...

Source: Bloomberg

...now trading over 7.5% below its 200DMA...

Source: Bloomberg

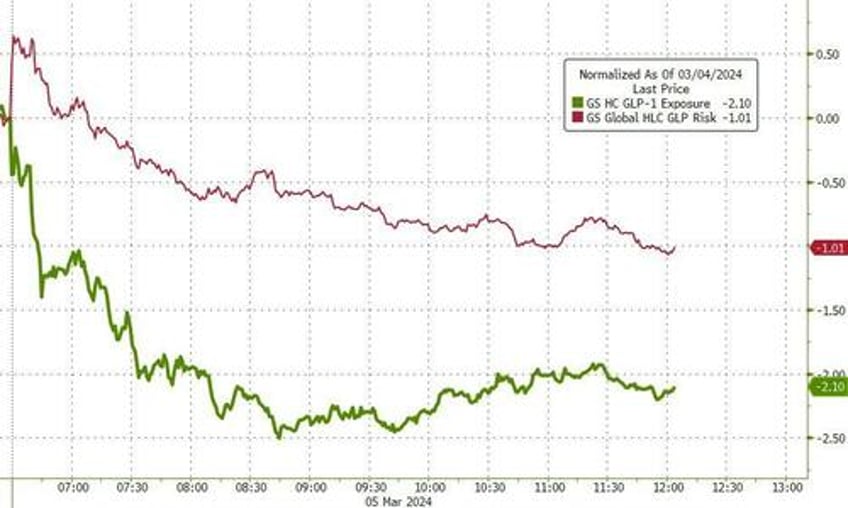

...and even GLP1-exposed names are seeing some selling pressure on the day....

Source: Bloomberg

Goldman Sachs trader Bobby Molavi summed things up well for stocks:

"It feels very much like a fomo...yolo...and momo market.

Still like the quote...’long, staying long, but slightly uncomfortable’ as the best way to describe how many investors feel at the moment."

He also added on 'positioning' (which is extremely long), that "Not a problem unless it becomes a problem."

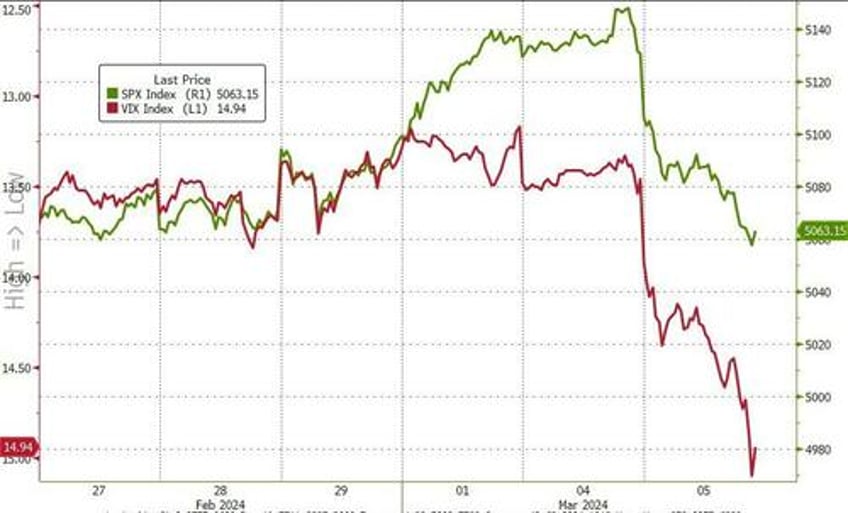

Today's 2%-plus tumble in Nasdaq was the worst day for the meg-tech index since October 2023 and makes some wonder if 'positioning is suddenly becoming a problem'. A small late-day bounce put a little lipstick on this pig

The sudden resurgence of fear prompted a decent spike in VIX, back above 15...

Source: Bloomberg

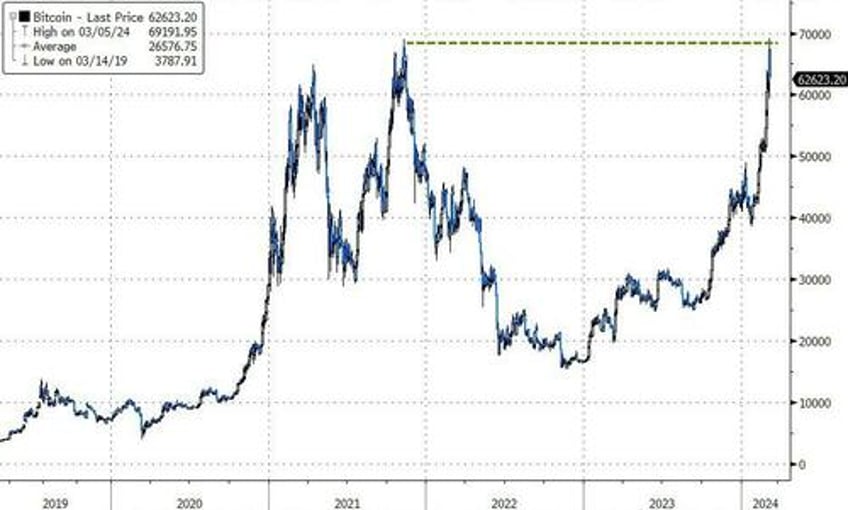

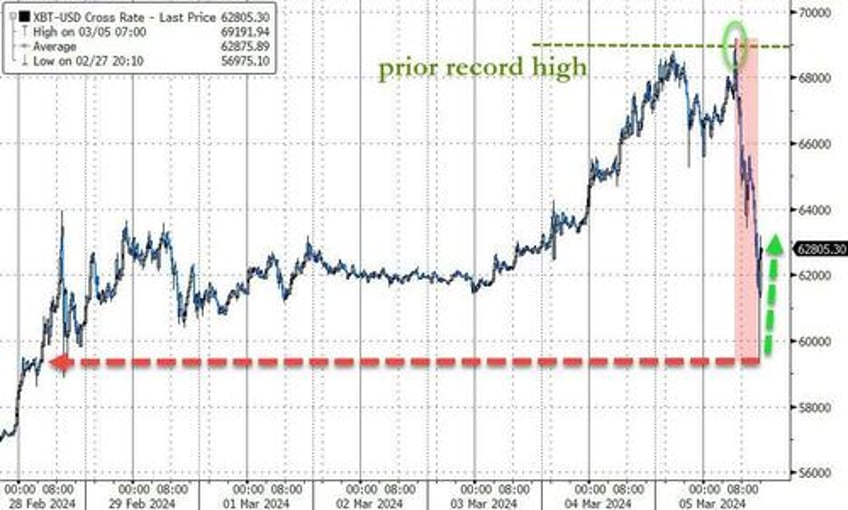

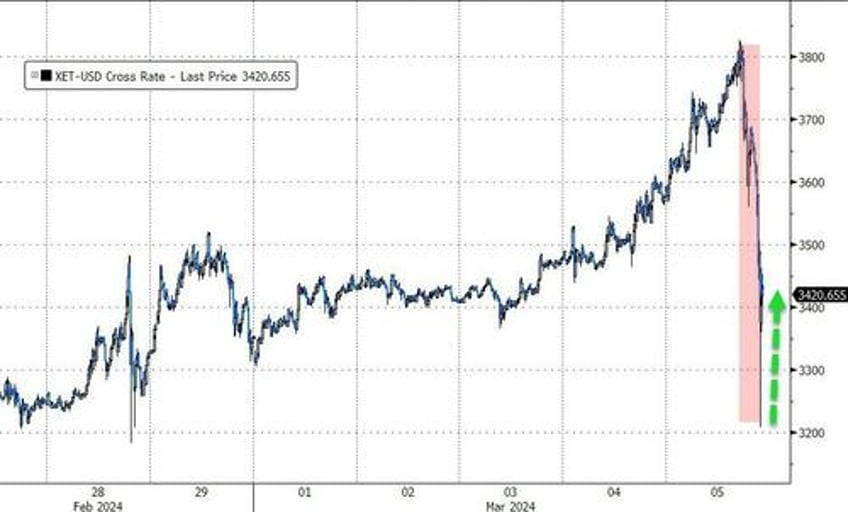

Bitcoin surged up to a new record high this morning...

Source: Bloomberg

..., but then the stops were run and the algos monkey-hammered the cryptocurrency $8500 from its highs before some buying returned...

Source: Bloomberg

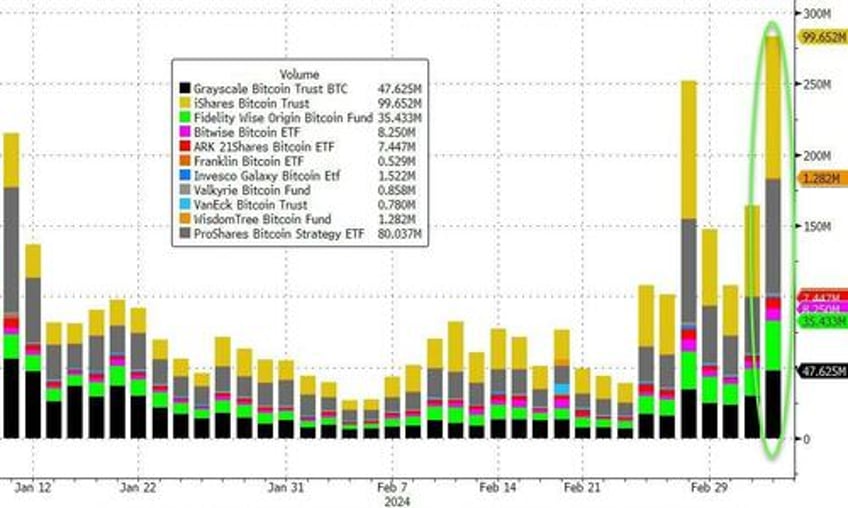

BTC ETFs saw a record volume day (with major volume in BITO)...

Source: Bloomberg

Ethereum followed a very similar trajectory, rallying up to $3825 at its highs before puking back down to $32,00 and catching a bid...

Source: Bloomberg

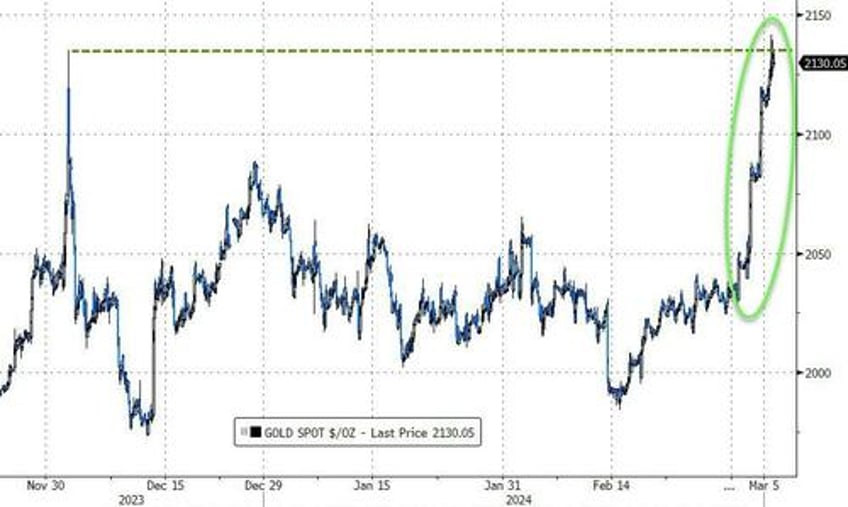

And then there's gold...

The spot price of the precious metal rose for the 5th straight day, taking out the prior record spike high on Dec 4th...

Source: Bloomberg

Pushing the yellow metal to a new record high...

Source: Bloomberg

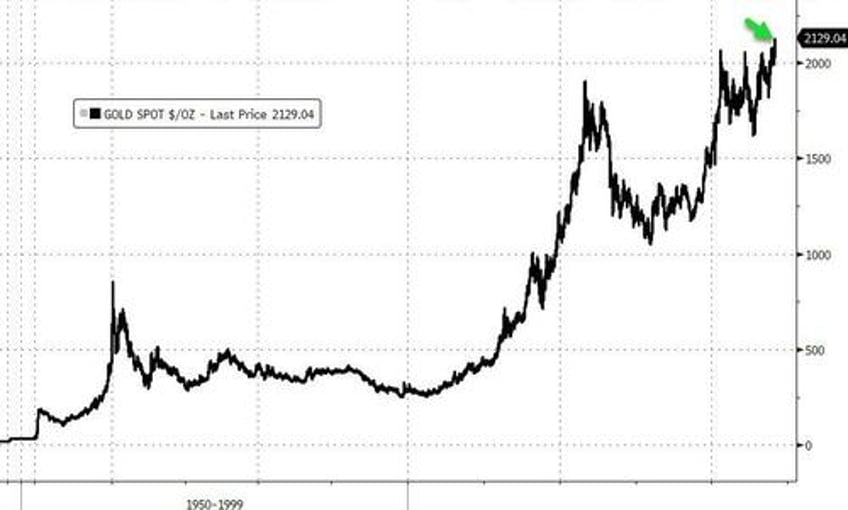

What is gold pricing in about future Fed action? Real rates dramatically negative? As Luke Gromen noted on X:

"When gold rises in your currency DESPITE positive real rates, the gold market is saying 'Your government will have a debt spiral if real rates remain positive'."

Source: Bloomberg

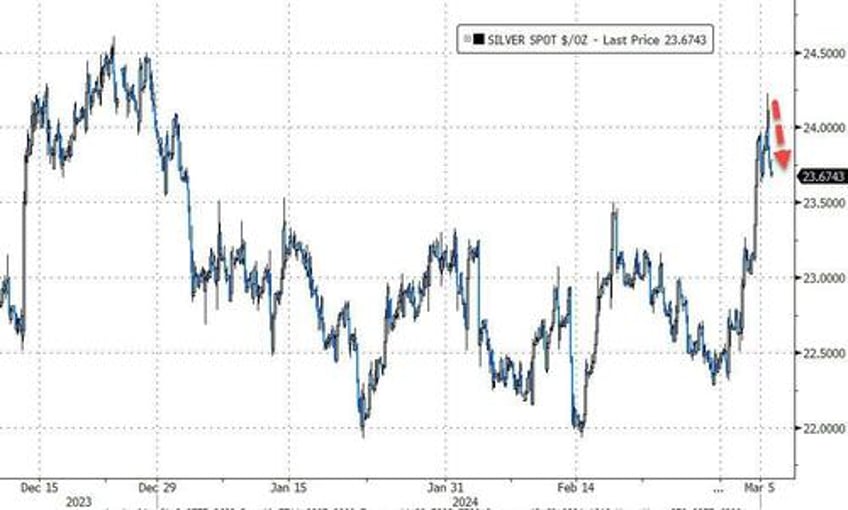

Silver closed lower on the day, after three big days topping $24...

Source: Bloomberg

With silver looking positively cheap here with gold trading at 90x...

Source: Bloomberg

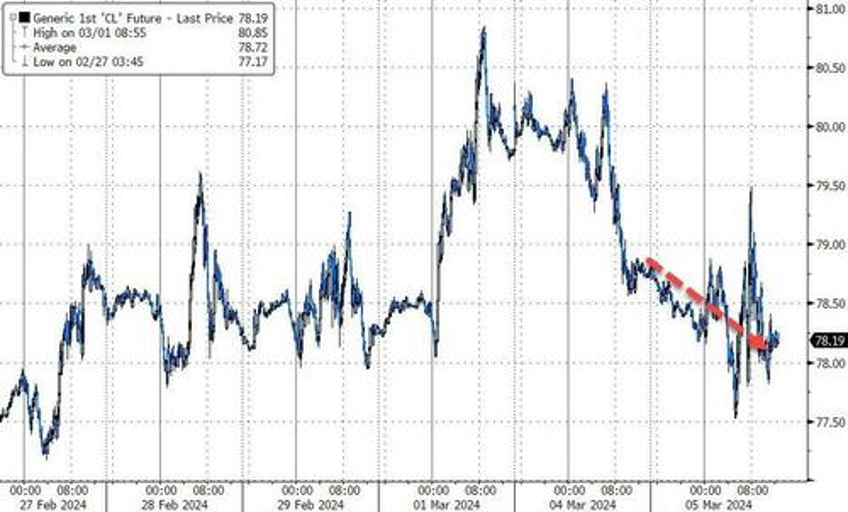

Oil prices traded in a choppy range today but closed lower ahead of tonight's API data...

Source: Bloomberg

Finally, there's Nvidia, which has stalled the last two days...

We hand the commentary back to Goldman's Molavi for his take: "A company now worth more than AT&T, Boeing, Coca-cola, Disney, Fedex, Gen motors, IBM, MCdonalds, Nike, Starbucks, UPS and Wallmart.....COMBINED.

A company with 75% margins and 75% market share.

A company that in spite of its rally trades at 33.4x forward PE for the 4th lowest multiple of the Mag 7.

One word of caution, if you plot Nvidia on a chart 2020 to today vs Cisco 1996 to 2002…and then zoom in at the year 2000…you see eerily similar graphs..."

Source: Bloomberg

"Cisco then was the belle of the ball and internet was the new new thing. At the moment in time…the prevailing thinking was that the whole internet would run on Cisco routers at 50% gross margins. Until it didn’t. "

But, it's different this time, durr!