PMI beats caught the headlines but most missed the big tumbles in the regional Fed surveys which is starting to drag 'soft' survey data lower...

Source: Bloomberg

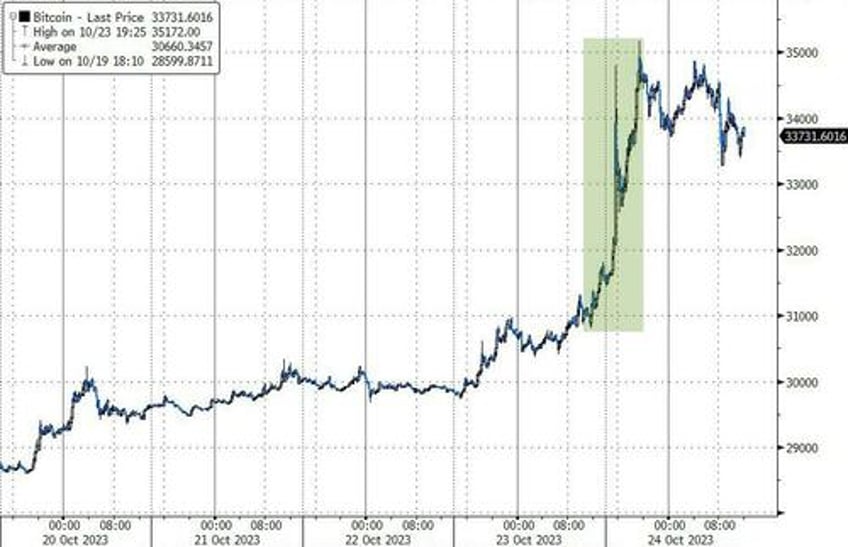

But, crypto was the story du jour with Bitcoin soaring over $2500 to top $35,000 for the first time since May 2022...

Source: Bloomberg

We discussed catalysts for the move in detail here, but note on the day, BTC did come back a little after tagging $35,000...

Source: Bloomberg

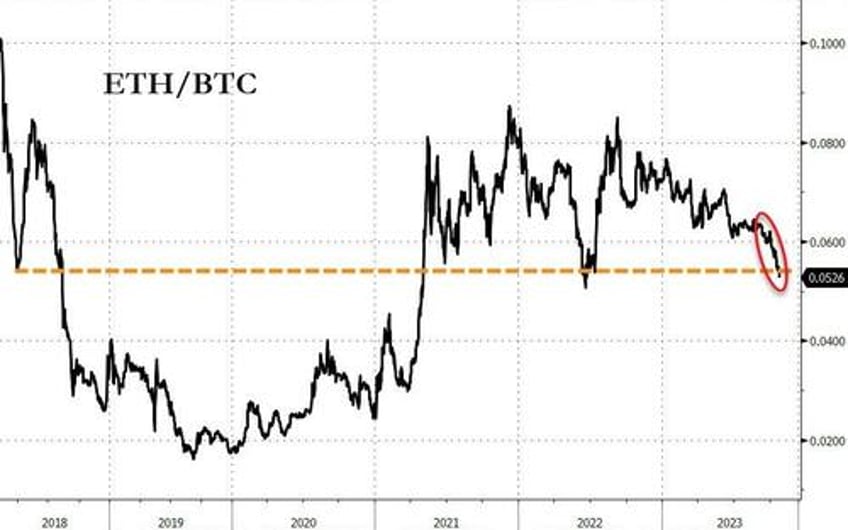

Ethereum also rallied early on but gave a lot of its gains back, as ETH relative to BTC plunged back near Jun 2022 spike lows...

Source: Bloomberg

Stocks were stronger overnight - because WW3 hadn't started - then ramped on better than expected PMIs (see here for that malarkey) but that stalled into the European close sending stocks all the way to unchanged and to the lows of the day. From there they bounced with Nasdaq leading the charge ahead of tonight's GOOGL, MSFT earnings...

The S&P broke back below its 200DMA, but found support...

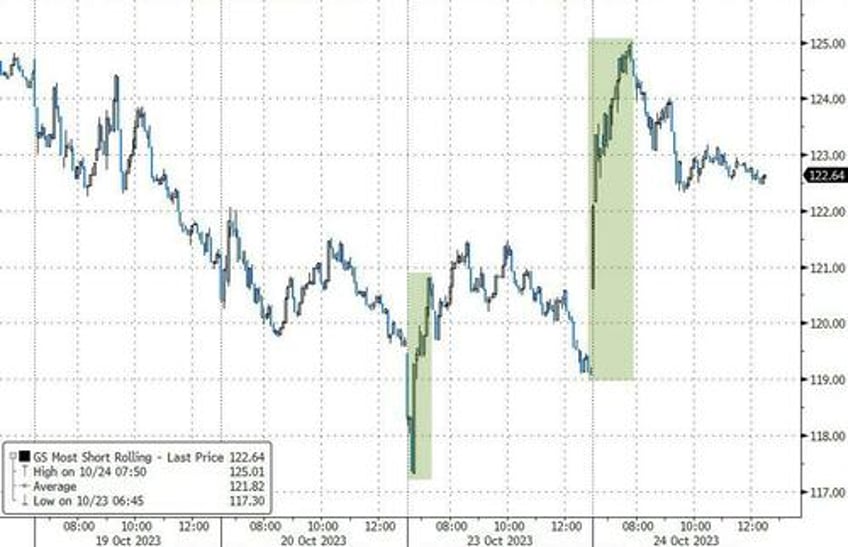

Thanks in large part to a giant short squeeze at the open...

VIX was clubbed a baby seal once again, back down to almost an 18 handle from above 23 at Monday's open....

As Nomura's Charlie McElligott notes: "The Vol selling in Equities Options space has continued at an unrelenting pace these past 2 sessions, as funds look to exploit the recently “rich” VRP off the back of 1) the shock FCI tightening risking a “cycle-turn,” 2) geopol stress “fat tails” and 3) the legacy VIX Dealer “short upside convexity” problem which has made Index iVol so suddenly “squeezy,” evidenced by recent “extreme VIX Beta to SPX” and Vol of Vol."

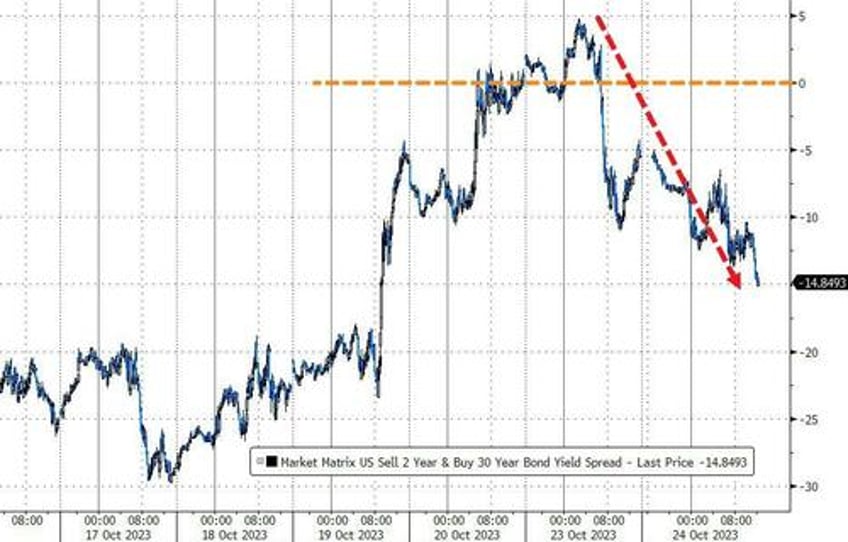

Bonds were mixed on the day with the long-end outperforming (30Y -5bps, 2Y +5bps), which leaves the 2Y yield alone higher on the week...

Source: Bloomberg

The 30Y yield closed back below 5.00%...

Source: Bloomberg

Which, obviously, flattened the yield curve dramatically with 2s30s now inverted again...

Source: Bloomberg

The dollar bounced hard off its pre-CPI lows, erasing all of yesterday's tumble...

Source: Bloomberg

Gold was basically flat on the day (in USD) but not in JPY where it reached a new record high...

Source: Bloomberg

Oil was pummeled ahead of tonight's API data, because WW3 never erupted?

As Bloomberg's Eddie Spence notes, gold’s explosive rally since Hamas’s attack on Israel has moved in tandem with oil prices, a sign some traders are hedging against stagflation.

The 15-day correlation between spot bullion and Brent crude is now at the highest in over a year. The relationship between the two commodities typically strengthens when oil begins to spike.

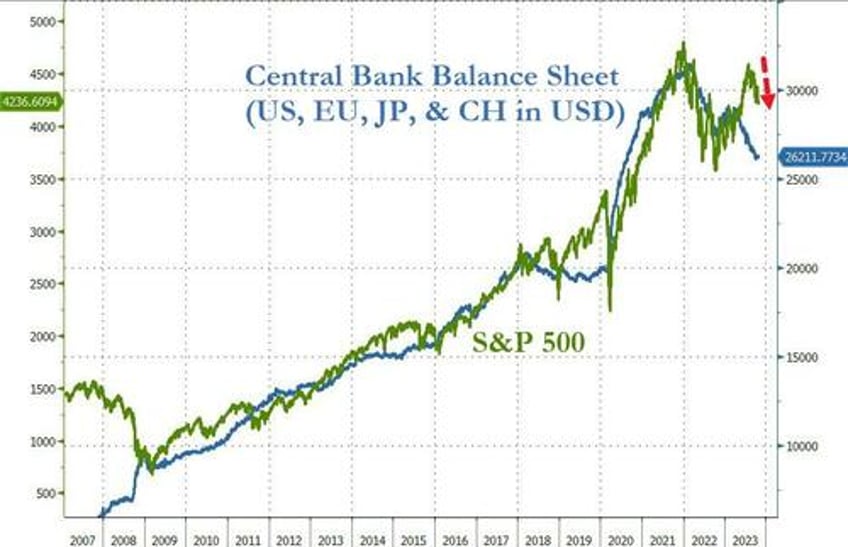

Finally, are stocks starting to catch down to central bank balance sheet realities?

Source: Bloomberg

...or will The Fed (et al.) pivot to QE before that gaping spread compresses from above?