Boeing shares rose in premarket trading after the US aerospace giant reached a tentative agreement with the union representing 33,000 of its workers, narrowly avoiding a potential strike that could have disrupted commercial jet production lines.

"After 16 years, we finally got back to the bargaining table to fight for what you deserve and bargain the full agreement," International Association of Machinists and Aerospace Workers, which represents Boeing's workers at factories across the Seattle metro area and Oregon, wrote in a statement.

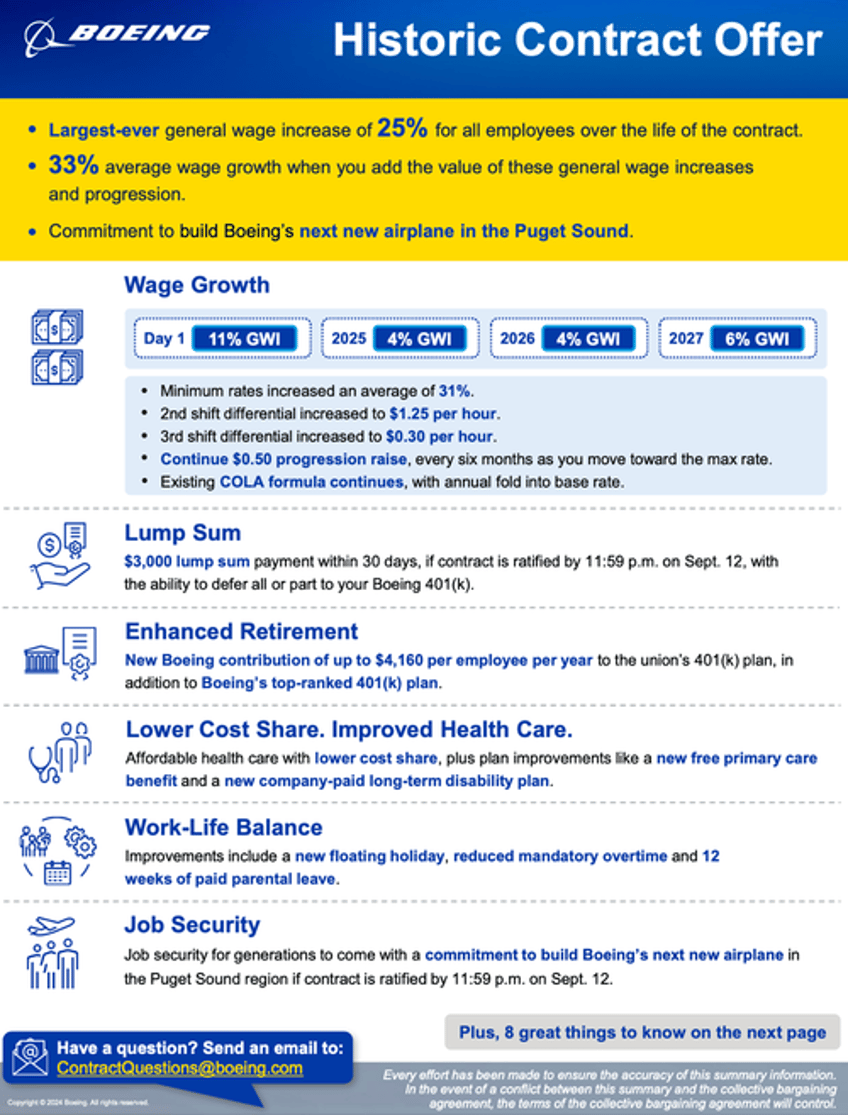

In a press release, Boeing called the new contract offer "historic" and highlighted the 25% wage increase over four years as "the largest-ever general wage increase."

"We've heard what's important to you for the new contract. And we have reached a tentative agreement with the union on a historic offer that takes care of you and your family. The contract offer provides the largest-ever general wage increase, lower medical cost share to make healthcare more affordable, greater company contributions toward your retirement, and improvements for a better work-life balance," Boeing Commercial Airplanes President and CEO Stephanie Pope told employees in a video message.

The contract offer includes several perks for IAM members, including an immediate 11% pay increase and a $3,000 bonus to be distributed to each union worker at the end of the month. Boeing has also committed to building the next generation of planes in the Seattle area, which would secure jobs at the plants for years if not decades.

Here's a snapshot of the contract that needs to be ratified by the union by 11:59 pm local time on Thursday:

Ken Herbert, an analyst at RBC Capital Markets, said if IAM members ratify the new contract later this week, it would boost shares of the troubled planemaker that have slumped 40% on the year following a series of mid-air mishaps.

In premarket trading in New York, shares are up 4%.

"We were not expecting a prolonged work stoppage, and we believe new BA CEO Ortberg will continue to enjoy an extended honeymoon period as he continues to settle into the CEO role," Herbert wrote in a note to clients. He pointed out that a ratified contract with the union would allow the company to sell equity, should it choose to, to alleviate its massive debt burden.

Here's what others are saying (courtesy of Bloomberg):

Deutsche Bank (buy)

- Analyst Scott Deuschle views the news as positive, noting that he did not expect IAM 751 leadership to "recommend a deal such as this so readily—particularly one that is not clearly better than other major labor deals reached in the last year, despite the deep scar tissue that exists between Boeing and its machinists union members"

- Stresses that workers still need to vote to ratify the deal; it is possible they may ratify as is, but Deuschle notes there is pronounced risk that members could reject deal and vote to strike

TD Cowen (buy)

- Analyst Cai von Rumohr says the contract offer addresses the key wage and job demands of the IAM union, and IAM leadership support boost likelihood of membership approval in Thursday's vote

- "Avoiding a disruptive strike should outweigh the contract's costs; and because negotiation outcome looked very uncertain, we expect the stock to move up"

Jefferies (buy)

- The contract provides four years of visibility, analyst Sheila Kahyaoglu writes

- Notes that, with IAM leaders unanimously recommending a vote to accept the proposal, a rejection of the deal is unlikely

However, there is a genuine risk that IAM members could reject Boeing's offer. This could spark a strike that could shutter Puget Sound factories and pressure the company even more amid a severe cash squeeze and increasing risk of being cut below investment grade. At the start of the year, the company suffered a series of mid-air mishaps, including the door plug that ripped off Alaska Airlines flight 1282.