Positioning in US Treasuries is becoming less long as the risk of persistently higher yields increases from a cyclically strong US and global economy.

Leading data have been vindicated in projecting a US and global cyclical upturn that coincident data are now unequivocally confirming. Monday’s release of the March ISM showed the index is back into expansion territory, matching the message from the manufacturing PMI.

The US manufacturing ISM is not only the best cyclical barometer of US growth, it is also the best single gauge of global growth given the sector’s outsized importance to the world economy.

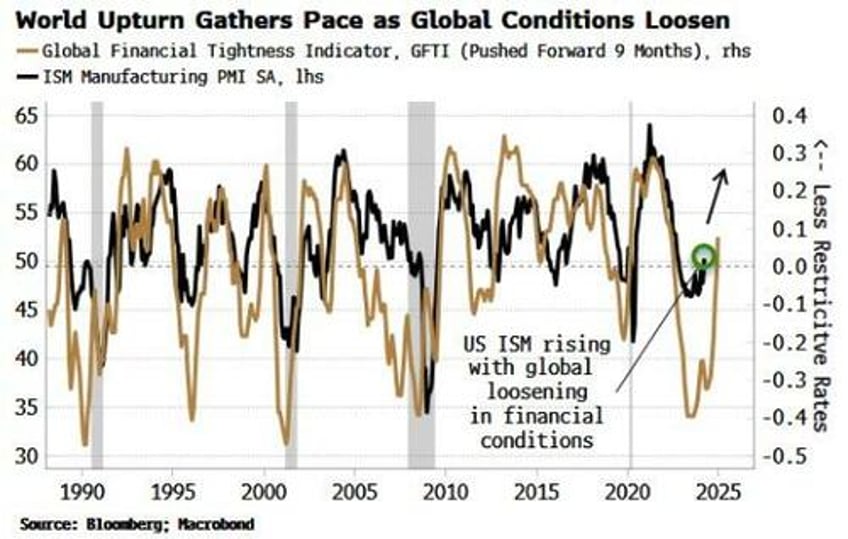

The new orders-to-inventory ratio is a very good short-term leading indicator for the ISM and has been turning up for several months. But even before that, there were strong signs from longer-leading data that the slip in the ISM was likely to be short lived. The chart below shows that the Global Financial Tightness Indicator (GFTI) – essentially a diffusion of global central bank rates – had started rising strongly last summer as global policy began to become less tight.

As the chart shows, the GFTI leads the ISM by around nine months, and anticipates the ISM’s upturn has more to go.

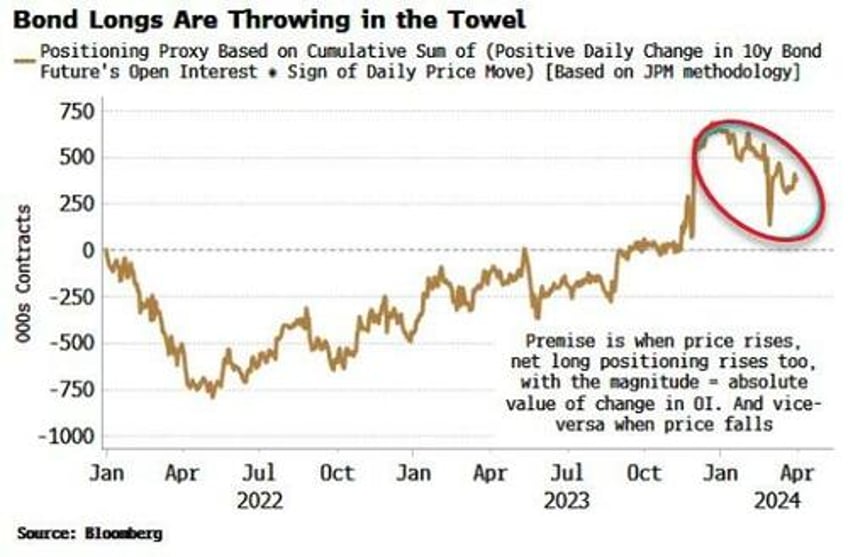

Bond investors might be getting the message that recession risk, as a consequence, is very low, and that inflation risk may be higher than they initially thought.

That would explain the continued reduction in UST longs, based on futures data.

The chart below looks at a positioning proxy for USTs based on 10-year bond futures, and shows that the sharp rise in long positioning at the start of the year when a hard landing was perceived as more likely (even though by then, leading data was clear-cut one was not imminent), is being steadily reduced.

(This proxy, whose methodology is explained in the chart, circumvents the distortion to Commitment of Traders data from the basis trade, i.e. trading the cash bond versus the future.)

Ten-year yields have been rising steadily all year, with the recent move being driven by real yields, inferring the market sees this as primarily a growth story for now.

Payrolls due Friday may challenge this, as there are some signs of slowing in the jobs market.

However, it’s unlikely to be enough to derail the burgeoning positive US and global growth story, and the concomitant rise in inflation risks.