By Garfield Reynolds, Bloomberg markets live reporter and strategist

Investors are anticipating the Federal Reserve is close to the end of its tightening cycle.

Every surge in bond yields spurs fresh speculation the economy will break badly enough for policy makers to pivot rapidly away from their hawkish stance. That may set up bonds and stocks for a tough time even if Friday’s payrolls report comes in on the soft side.

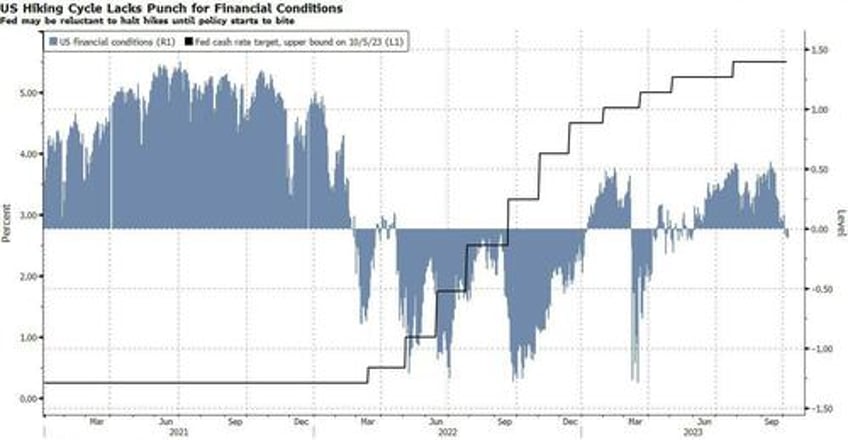

That’s because even the recent rout in Treasuries only managed to push US financial conditions to a neutral level, based on a Bloomberg gauge, well short of the sort of restrictive impact the Fed would seem to be wanting to achieve. That also helps explain the still-resilient state of the economy — Bloomberg’s US data surprise index remains at elevated levels.

A softer set of labor data is still unlikely to be stunningly bad enough to quiet the Fed hawks. But it could well set off a strong relief rally in most assets as investors move further toward pricing in an end to rate hikes that policymakers would have little sympathy for.