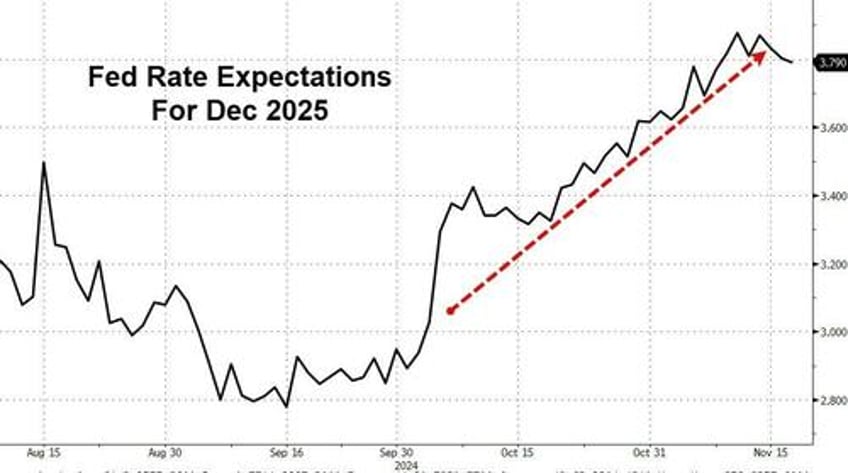

By the end of last week, many of the consensus post-Election cross-asset trades had already hit what felt like “saturation” and struggled to extend further - in particular, the recent repricing of UST term-premium and the concerns around 'upside inflation risks' via fiscal deficit spending trajectory, Trump 'Red Sweep' policy plan (quad whammy: taxes, dereg, tariffs, immigration) and a Fed which had remained asymmetrically tilted towards Labor Market downside risks, and had de-prioritized the Inflation–side of the mandate.

All of this, according to Nomura's Charlie McElligott, points to what has already been obvious to anybody outside of the ivory tower–set...i.e. that we’ve created the conditions for a much higher neutral rate @ ~3.5% to 4.5% than what the Fed is willing to acknowledge...