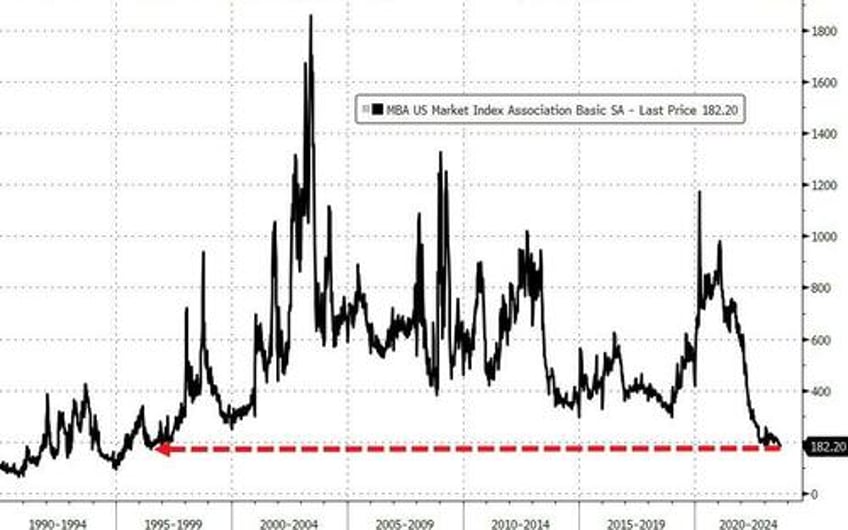

US mortgage applications plunged to the lowest since 1996 this morning...

Source: Bloomberg

...but all anyone really cared about was CPI which had something for everyone in the goldilocks narrative: 'hot' headline inflation, 'cold' shelter inflation, 'just right' core inflation... and also the little red riding hood narrative with 'my what a big mouth you have' energy inflation.

Don't forget, as Goldman noted, core CPI (ex-shelter) is expected to rise significantly for the rest of the year, because of Seasonality - Residual seasonality biased the summer inflation numbers lower. Look for travel related inflation to pick-up in particular; Health insurance - CPI’s health insurance component is due to reset sharply higher in October, when the CPI will use new data on health insurer profitability to determine the rate of monthly health insurance inflation for the next twelve months; and Services - We also expect upward pressure on core services ex-housing from health care and education services, where prices tend to lag the cost environment because both government-administered and private prices are reset infrequently. The higher cost of nurses and teachers is likely to flow through to higher fees for healthcare services and school.

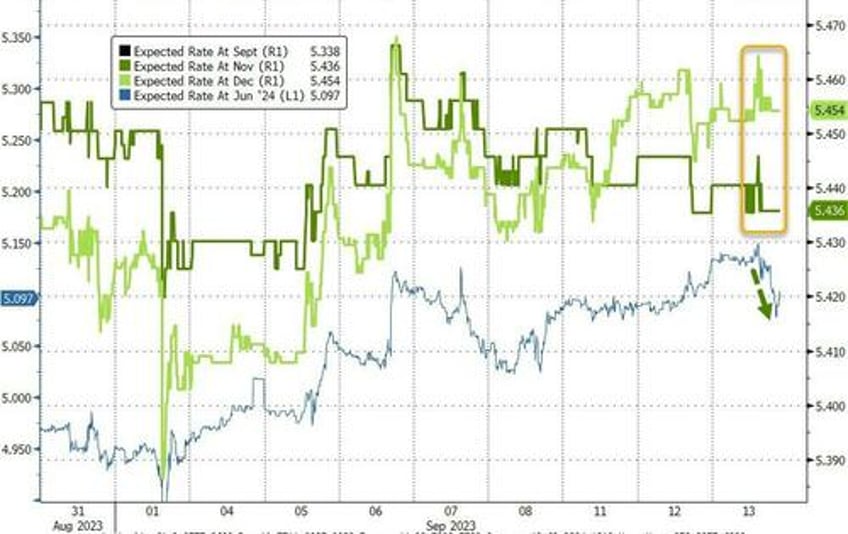

The initial reaction to the CPI data pinned off the hot headline with yields spiking, stocks dropping, dollar spiking, and rate-hike expectations rising.

But that quickly faded.

Rate-hike odds for September (next week) collapsed to basically zero (2% odds of 25bps), November's odds dipped to around 40% of a 25bps hike. Further out (June 2024) saw odds rising quickly of a rate-cut...

Source: Bloomberg

That sparked a major reversal in bonds (yields tumbled) and the dollar (dropped) as Nasdaq (longer duration stocks) rallied.

Selling pressure came back on after 1430ET (margin call time) and wiped any lipstick off today's pig with Small Caps the biggest laggard (along with The Dow and S&P also red). The S&P bounced into the green by the close as Nasdaq led with modest gains...

Opening gains for banks were erased immediately and then some...

NFLX was pummeled after admitting its ad revenues were not material...

0-DTE traders saw very heavy negative delta flow, dominated by put-buying, which faded all the bounces in the underling S&P 500...

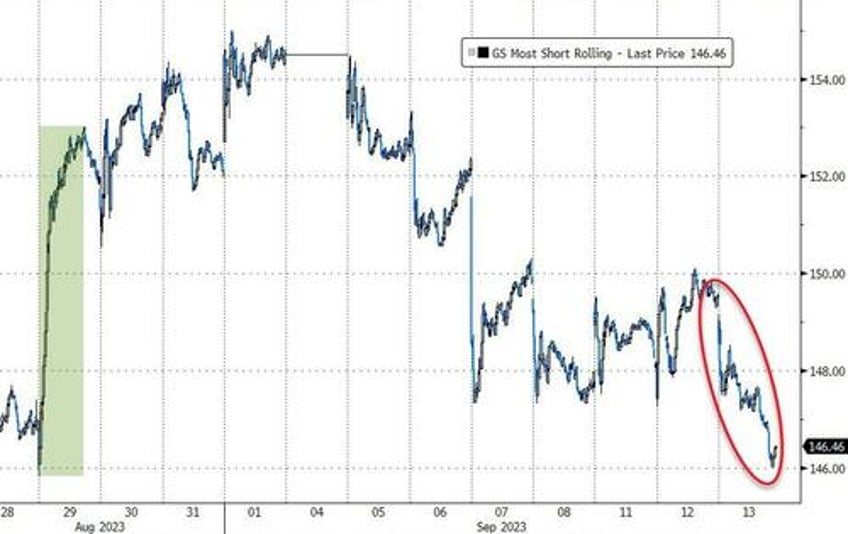

'Most Shorted' stocks were clubbed like a baby seal, erasing all the gains since late-August's big squeeze...

Source: Bloomberg

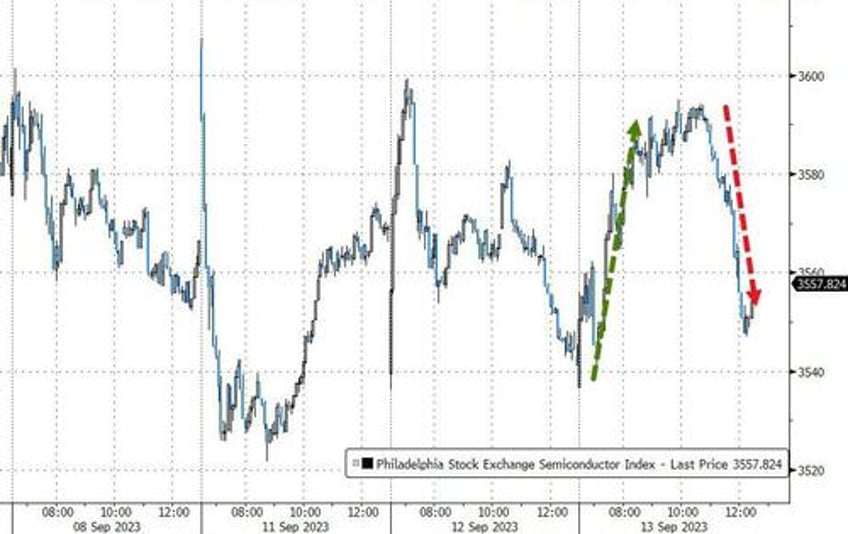

Semis pumped and dumped today ahead of tonight's ARM IPO (perhaps funding needs?)...

Source: Bloomberg

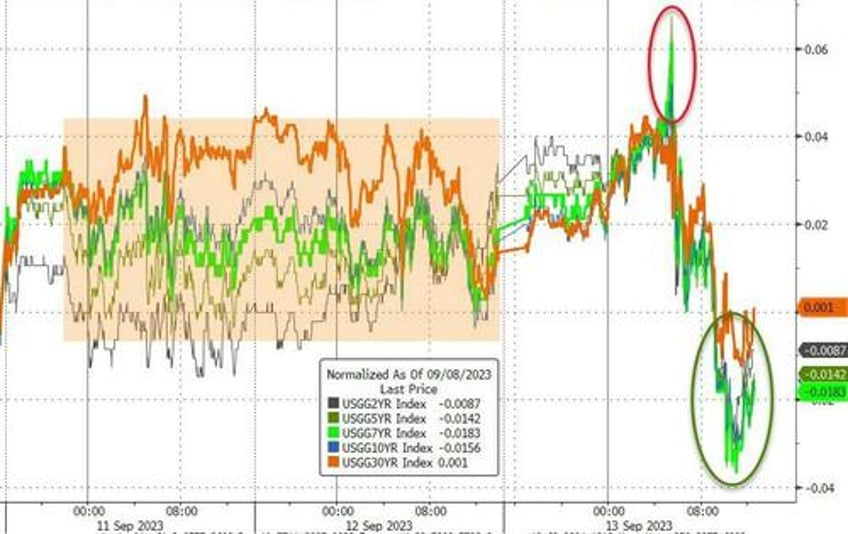

Treasuries were bid after some early weakness with the belly outperforming (2Y +4bps, 5Y +5bps, 30Y +2bps). NOTE the last two days have seen very narrow ranges and today took out the highs and lows of that range...

Source: Bloomberg

2Y Yields fell back below 5.00% again...

Source: Bloomberg

The dollar ended the day unchanged but traveled a lot on the way intraday...

Source: Bloomberg

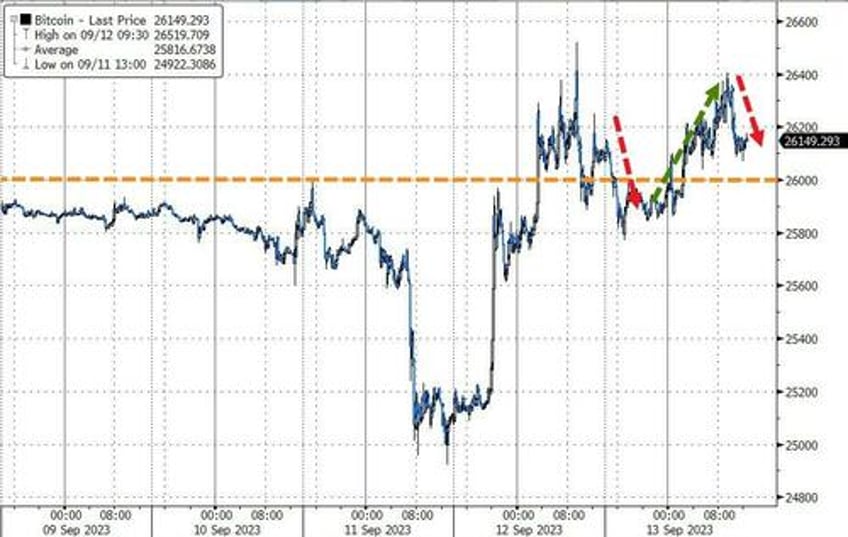

Bitcoin also ended practically unchanged, holding above $26,000...

Source: Bloomberg

Oil joined the dollar and bitcoin in the 'practically unchanged' cohort. After topping $89.60 intraday, WTI slid back into the red very marginally...

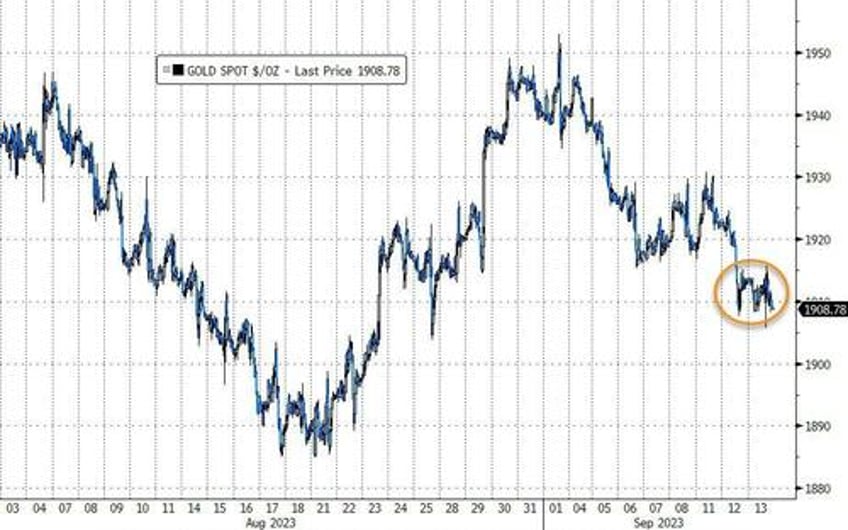

Gold (spot) drifted lower but in a very small range and held above yesterday's lows...

Source: Bloomberg

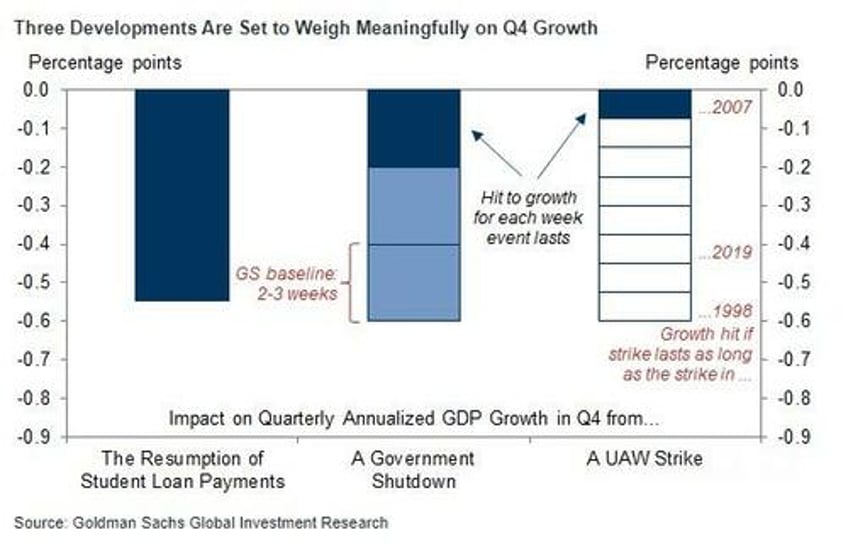

Finally, The Fed and The White House may have a problem in Q4. While inflation is top of mind today (and hotter than expected), it's growth that also matters and Goldman expects the resumption of student loan payments, a potential temporary federal government shutdown, and reduced auto production from a potential UAW strike to slow US GDP growth in 4Q23.

We love the smell of stagflation in the morning...