Jobless claims surged higher (bad news is good news?) and PPI was cooler than expected (good news is good news) but only big-tech and bonds benefited from this glorious bad news.

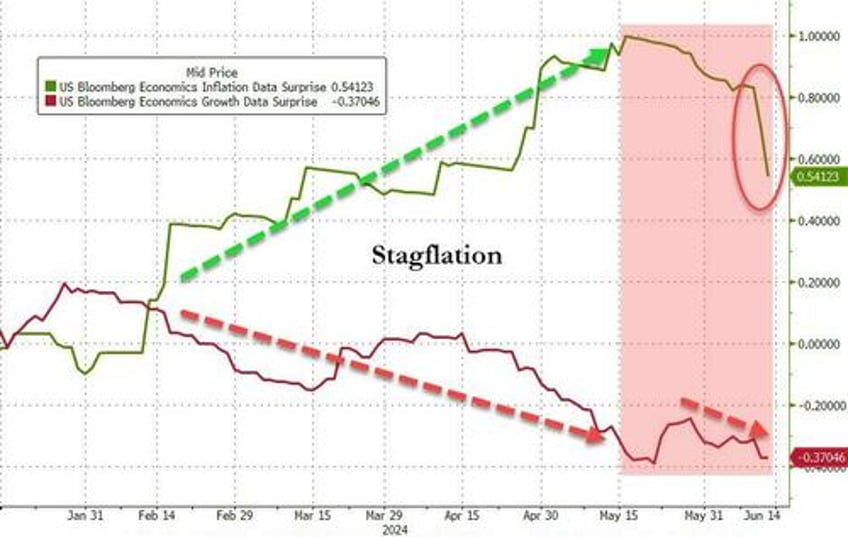

The stagflationary scenario is starting to wane as inflation 'surprises' tumble to the downside along with growth 'surprises'...

Source: Bloomberg

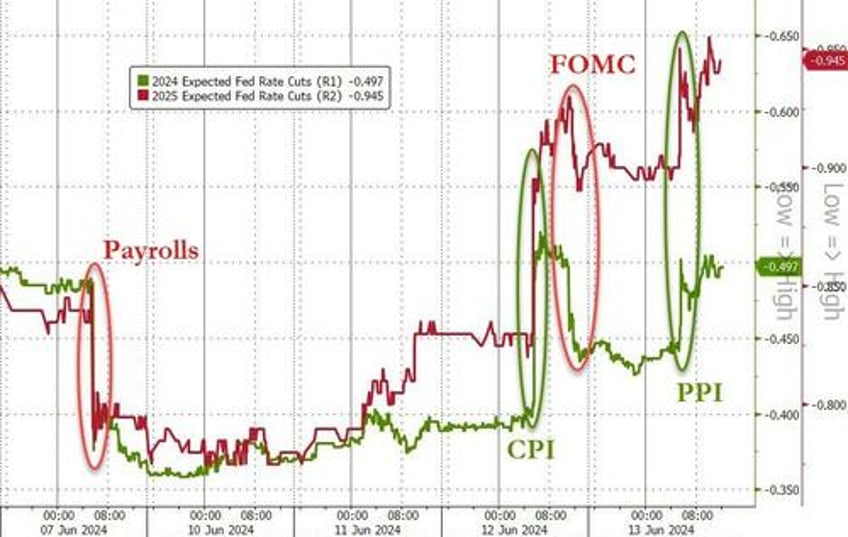

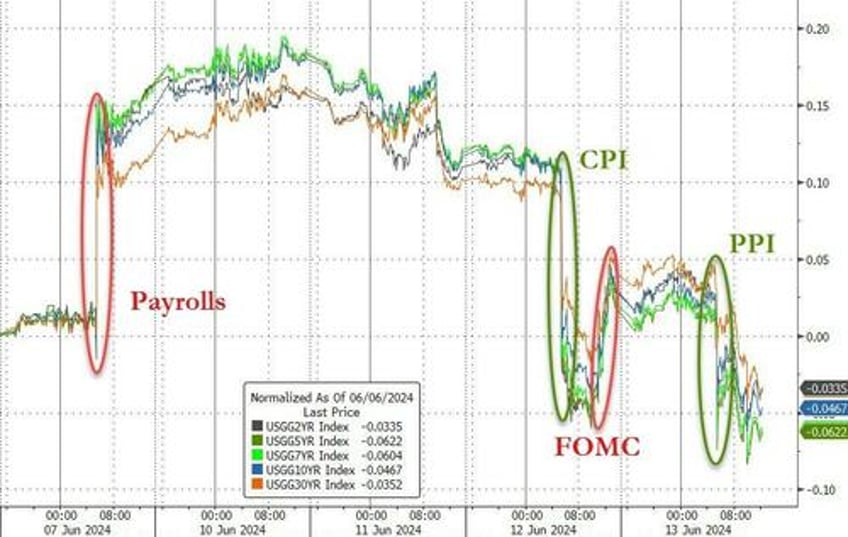

The 'bad news' was good news for doves as rate-cut expectations lifted - erasing the hawkish FOMC doubts...

Source: Bloomberg

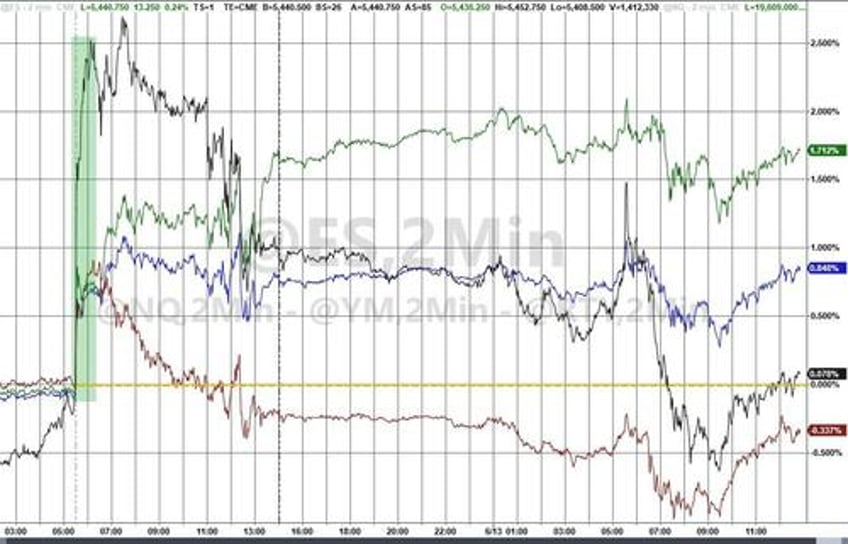

On the day, Nasdaq and S&P ended green (thanks to tech) but Small Caps and The Dow were red (with the former hit hard). Futures kneejerked higher on the softr PPI, then were sold through the US equity open. Stocks bottomed on the day at the European close and reversed higher...

For context, The Dow is red post-CPI, Small Caps unchanged, while Nasdaq is surging as the new 'defensive' vehicle...

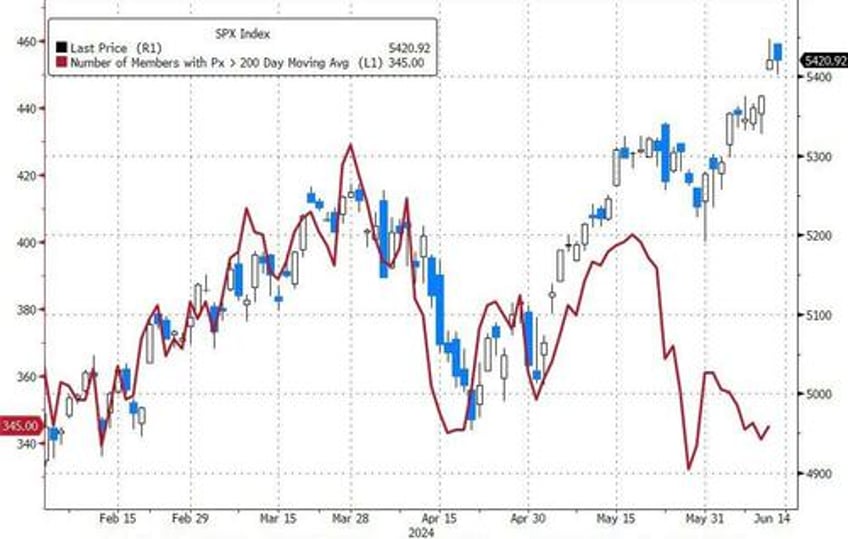

As we noted earlier, breadth was abysmal once again...

Source: Bloomberg

...with mega-cap tech dominating performance...

Source: Bloomberg

As Cap-weighted Nasdaq continued to dramatically outperform the Equal-weighted index (one of the biggest NDX-NDXE spreads in years today)...

Source: Bloomberg

...and oddly, Goldman noted that high beta momentum winners massively underperformed the index today...

Source: Bloomberg

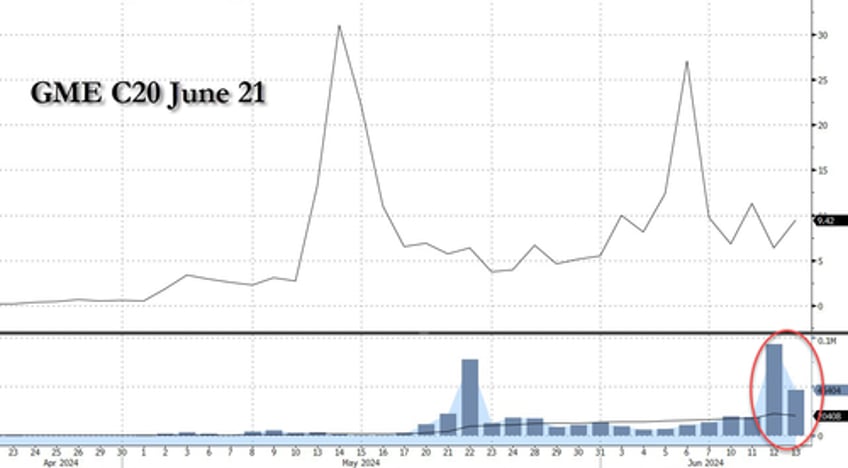

And 'roaring kitty' appears to have left the building...

Source: Bloomberg

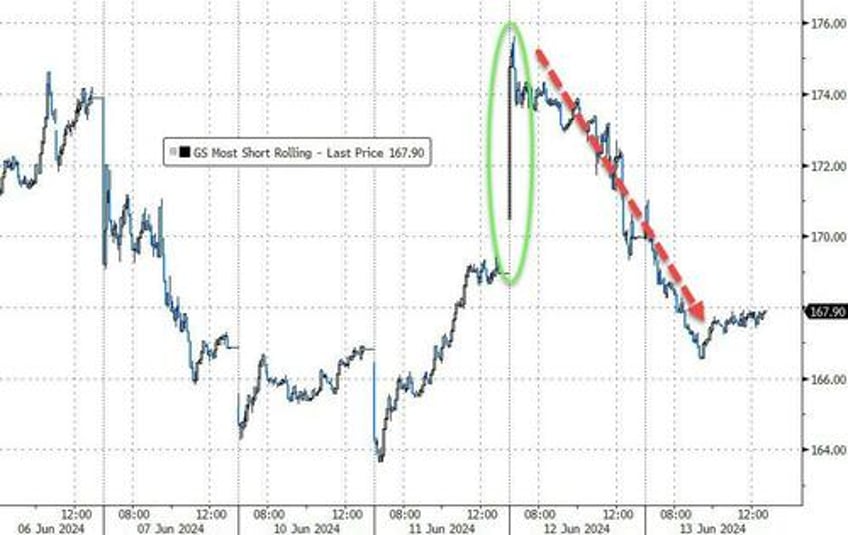

'Most Shorted' stocks extended yesterday's post-squeeze-open decline

Source: Bloomberg

The only other thing that was bid today were bonds with UST yields down 7-8bps across the curve, erasing all the post-payrolls increase in yields...

Source: Bloomberg

10Y yields closed at three-month lows...

Source: Bloomberg

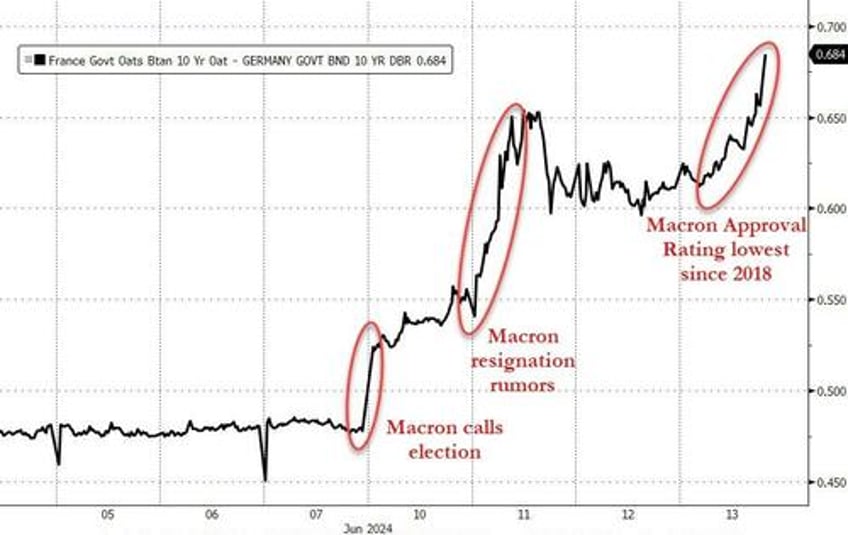

In the bond world across the pond, French yields continue to blow out relative to Germany as Macron messes shit up... not a good sign...

Source: Bloomberg

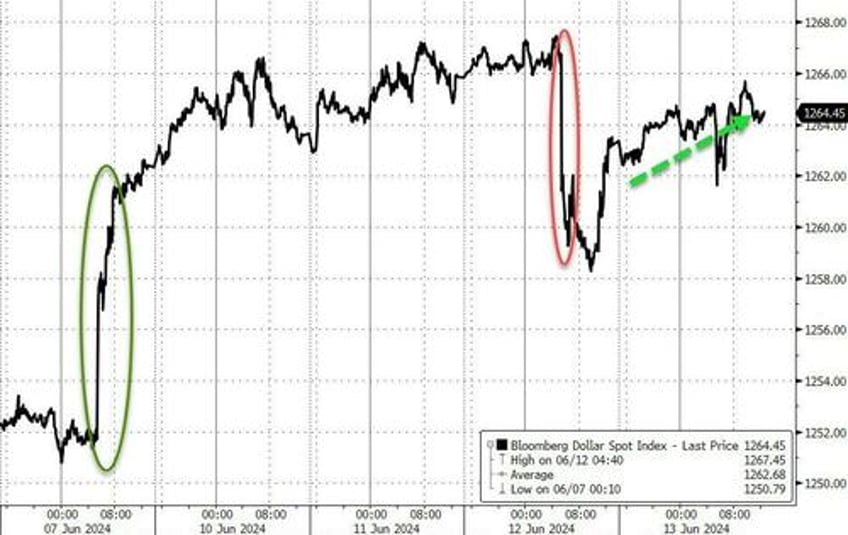

The dollar inched higher, but remains well below pre-CPI highs...

Source: Bloomberg

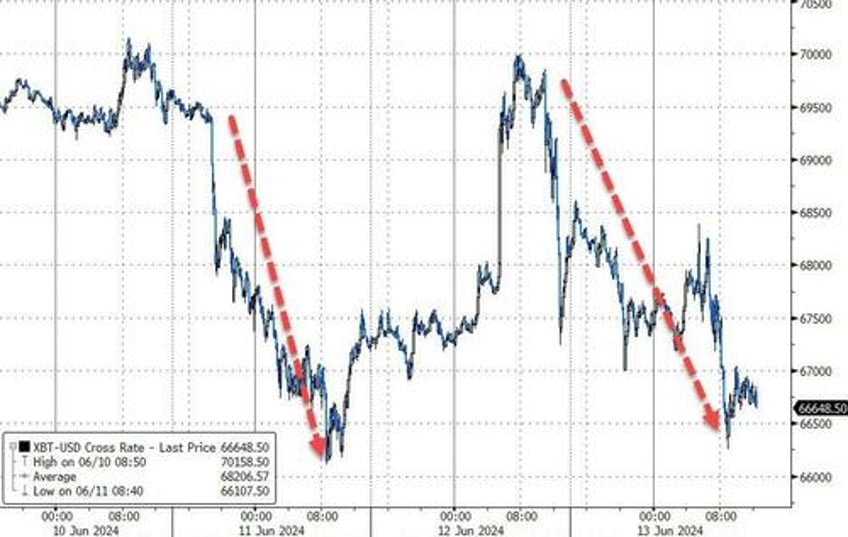

Crypto was dumped with bitcoin back below $67k...

Source: Bloomberg

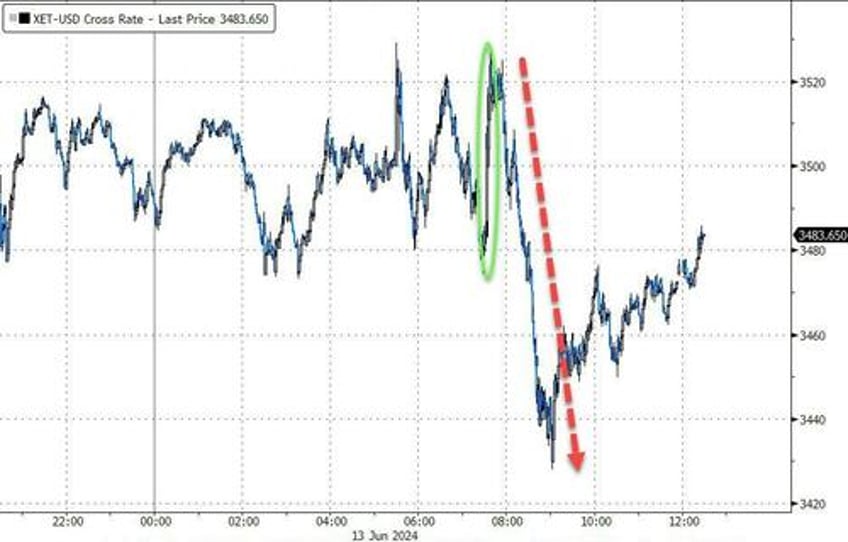

Ether was also dumped despite some positive ETF comments from Gensler...

Source: Bloomberg

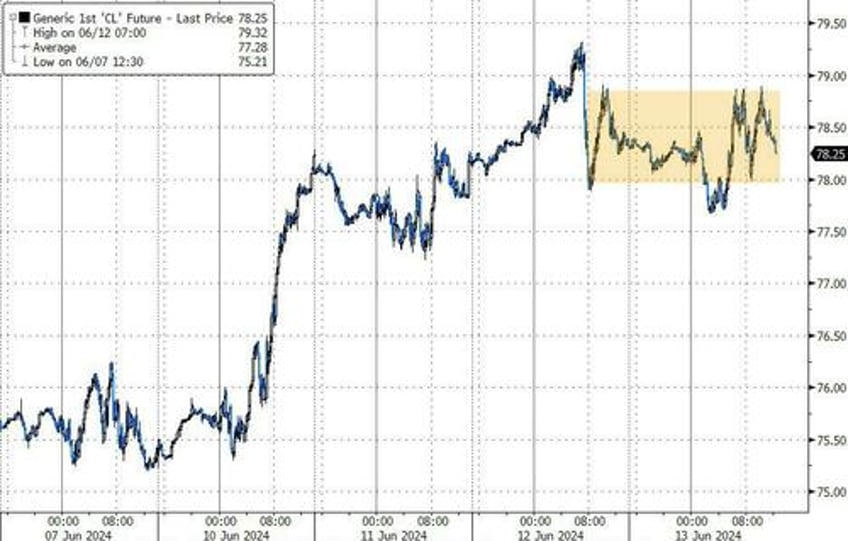

Oil prices traded sideways but ended the day lower (but above $78 on WTi)...

Source: Bloomberg

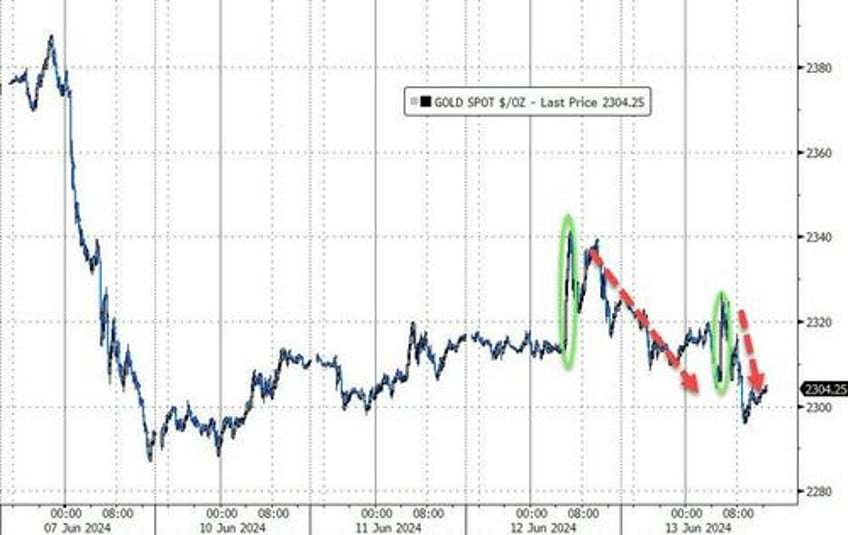

Spot Gold prices extended yesterday afternoon's post-FOMC decline...

Source: Bloomberg

Finally, which trades first - S&P 5,000 or 10Y Yield 3.5%?

Source: Bloomberg

The post-Powell-pivot regime has definitely changed.