Well that was a day - summarized perfectly by JPM's head of cash trading Matt Reiner who wrote this morning that "equities are trading as though hope and confidence are dwindling out of the system" before a big squeeze this afternoon slapped some lipstick on this negative gamma pig.

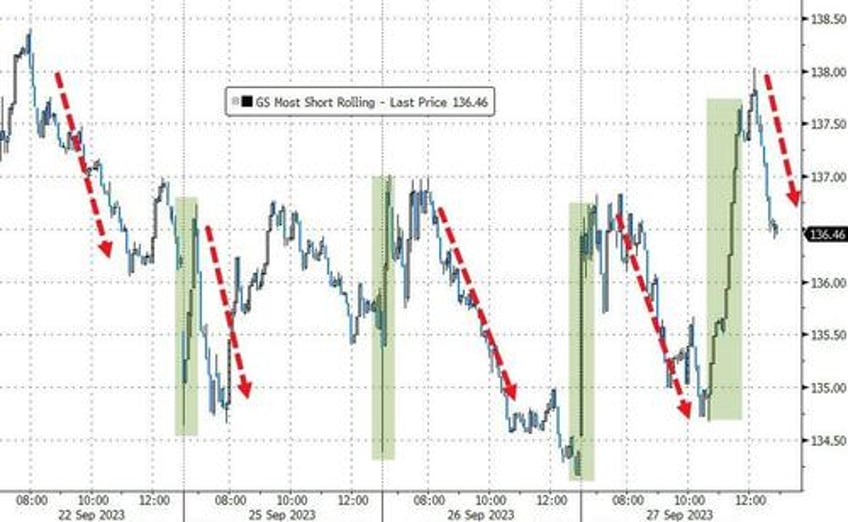

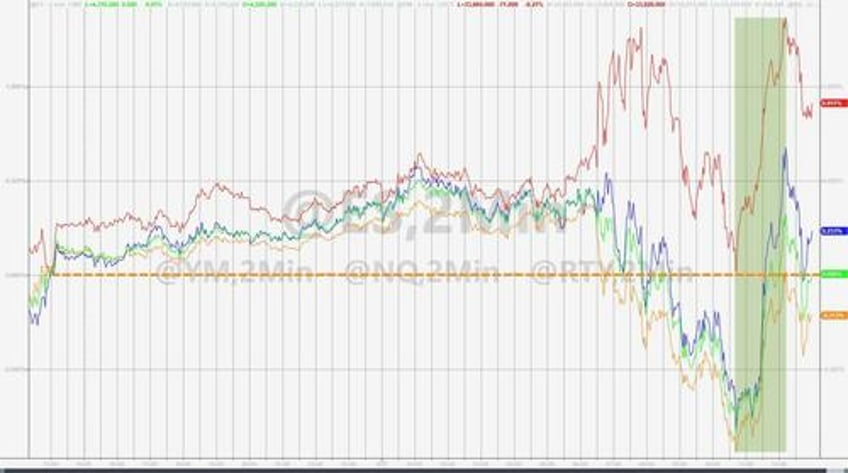

For the 3rd day in a row, the machines tried (and failed) to ignite a short-squeeze early on... but around 1400ET, something snapped and the squeeze was in and equity markets went vertical. BUT... the ignited momentum ran out of steam quite quickly...

Source: Bloomberg

The late day squeeze-gasm lifted everything green (even The Dow briefly) but as the squeeze ran out of ammo, so did the rally. The Dow was red, S&P unch, Nasdaq very modestly higher and Small Caps solidly higher...

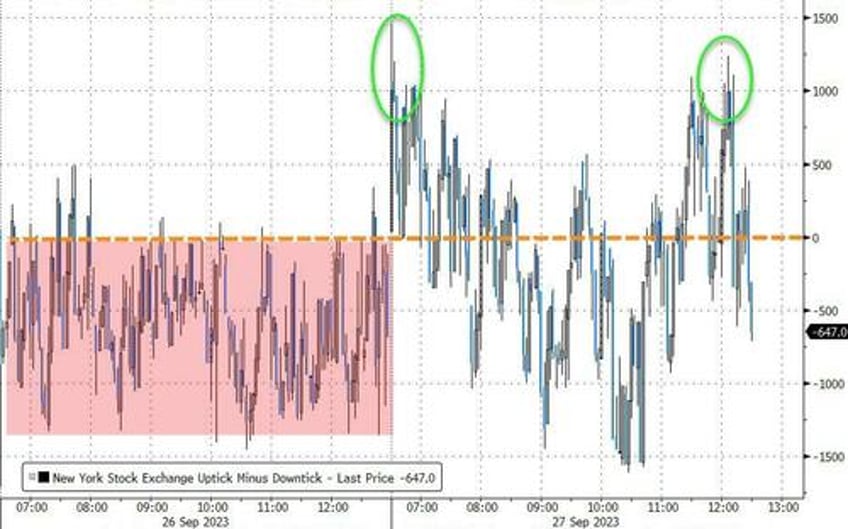

The big panic-buy program is evident in the intraday TICK data...

Source: Bloomberg

VIX was monkeyhammered lower around the 1400ET timeframe...

If you need a reason why we exploded higher this afternoon, it's simple: Kolanovic!!

JPMorgan’s Kolanovic Says Markets Today ‘Rhyme With’ 2008 Crisis: BBG

— zerohedge (@zerohedge) September 27, 2023

Time to buy everything again

And before we leave equity-land, the equal-weighted S&P just went red YTD...

Source: Bloomberg

But we are seeing multiple sigma moves across multiple markets now with bitcoin, yields, and gold all swinging violently as the dollar and crude just keep surging

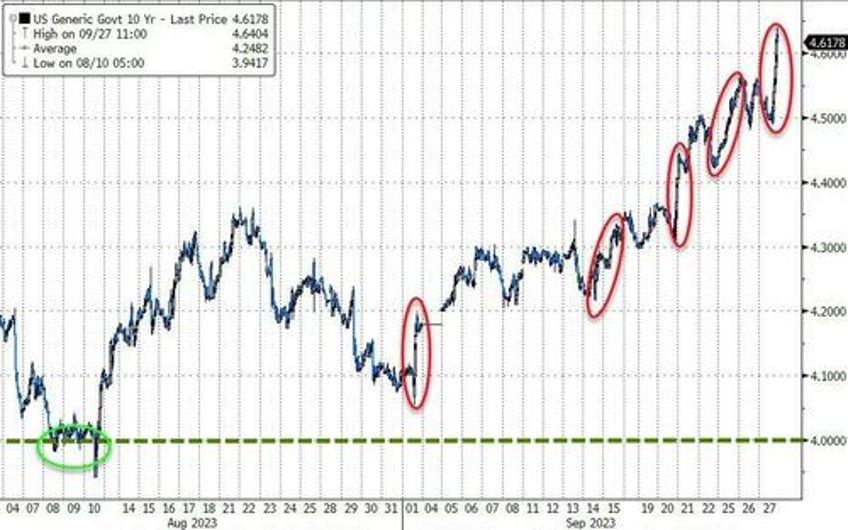

Treasuries were clubbed like a baby seal again today with whole curve up 6-9bps with 10Y blowing out above 4.60%...

Source: Bloomberg

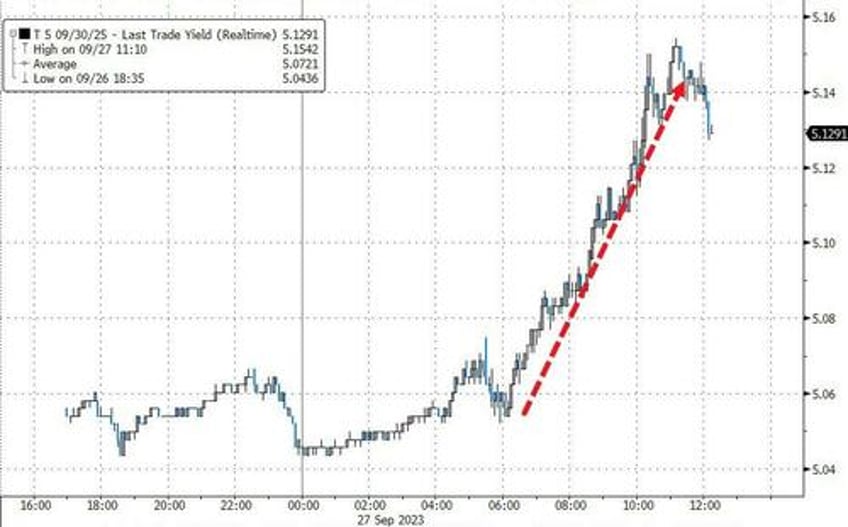

The freshly-minted 2Y yield also soared today...

Source: Bloomberg

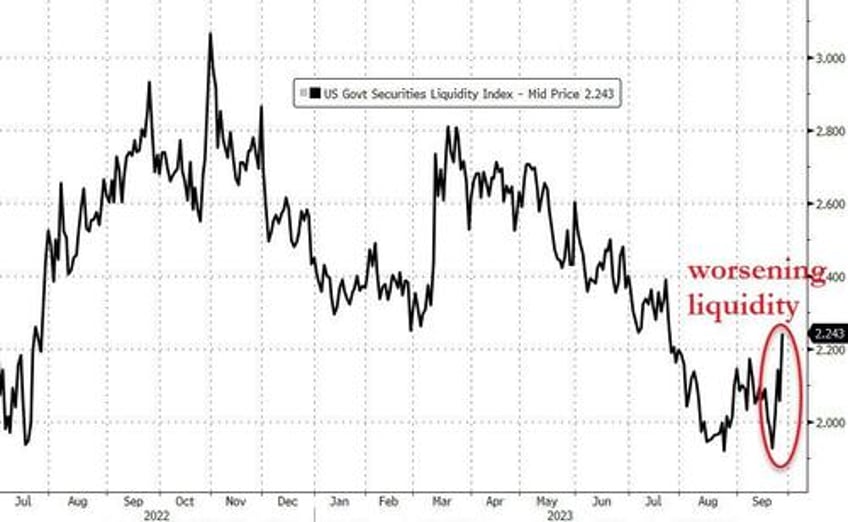

One thing of note - and its very premature - but there are some signs of liquidity stress appear in the Treasury market...

Source: Bloomberg

...and with the basis-trade threat as large as its ever been, it's worth keeping an eye on any signs of trouble.

Source: Bloomberg

Real rates continue to soar (and S&P valuations are starting to retreat)...

Source: Bloomberg

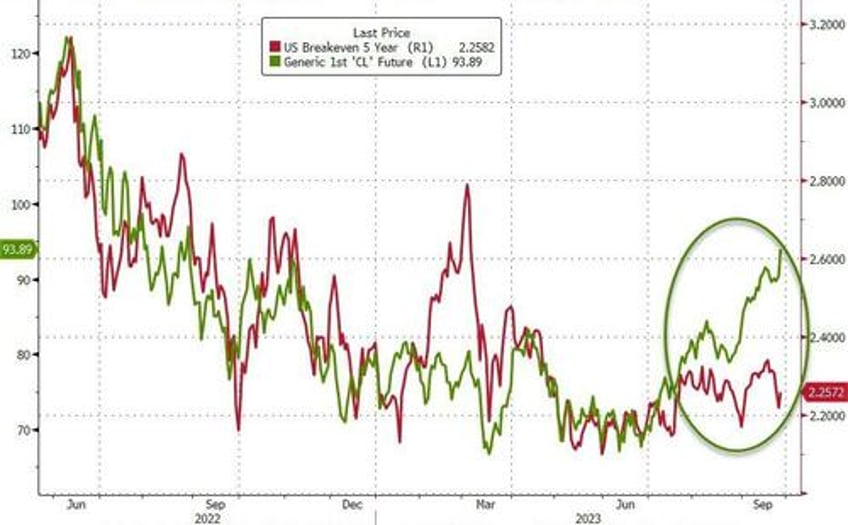

But, while crude prices are soaring, breakevens are flat...

Source: Bloomberg

The dollar surged for the 6th day in a row, now at its highest since Nov 2022...

Source: Bloomberg

...and as the dollar soars, so Emerging Market FX tumbles to its lowest since Nov 2022...

Source: Bloomberg

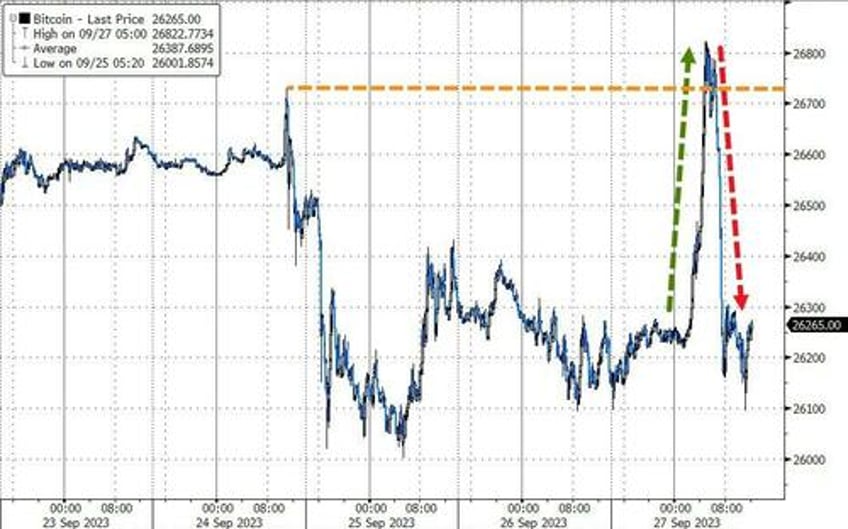

Bitcoin pumped-and-dumped on the day... for no good reason at all...

Source: Bloomberg

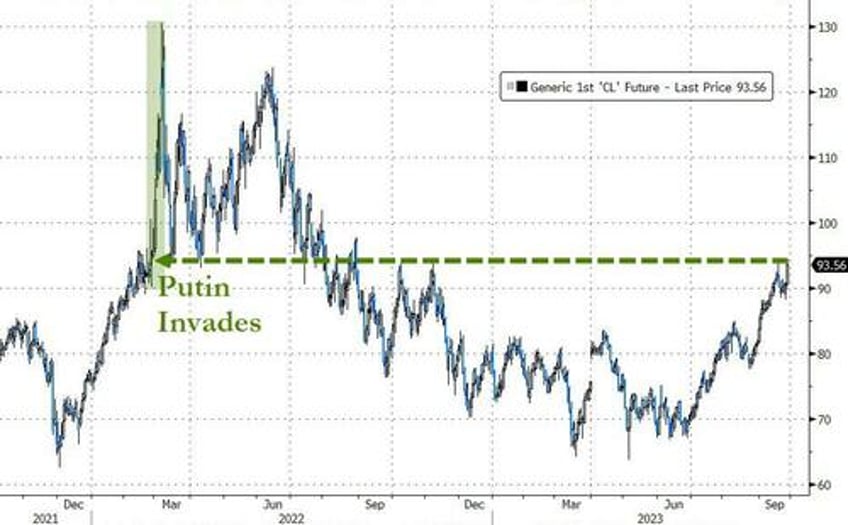

Oil prices soared after another major drawdown in stocks at Cushing (and overall crude), rallying right up to pre-Putin-Invasion levels...

Source: Bloomberg

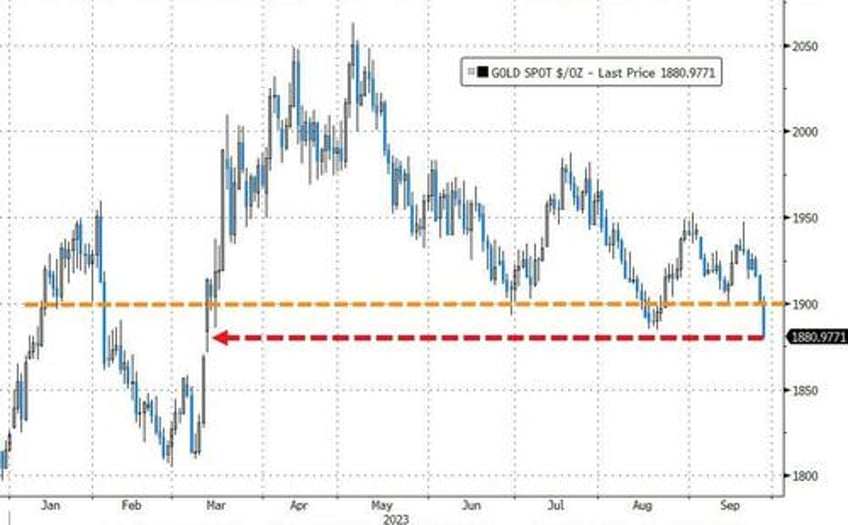

Spot gold prices extended their recent plunge below $1900, back to the lowest since March...

Source: Bloomberg

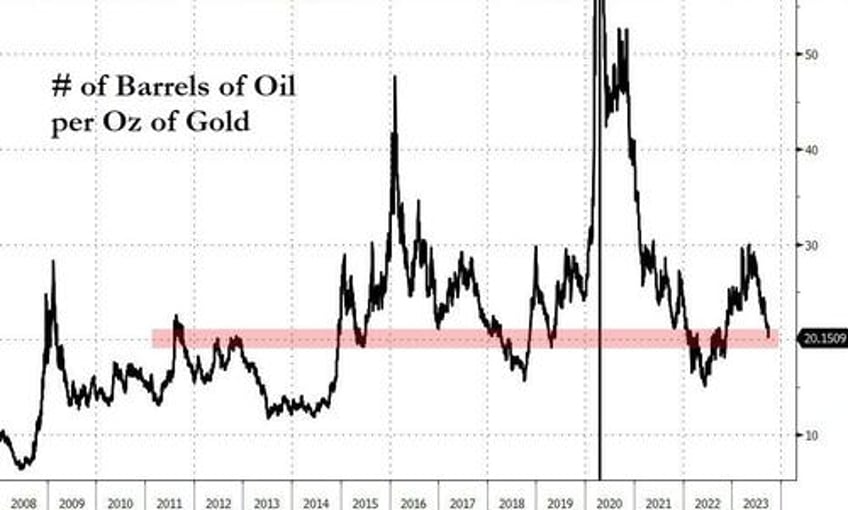

The surge in crude prices, and plunge in gold, has oil at its most expensive since Nov 2022 (at around 20 barrels/Oz)...

Source: Bloomberg

...historically that has been a level of support for the Oil/Gold ratio...

Source: Bloomberg

Finally, financial conditions are tightening significantly, now at the tightest since Nov 2022...

Source: Bloomberg

...which is what The Fed wants to see.