US markets chopped around today after yesterday’s risk off tape as Geopolitics remain the focus, and while Chinese stocks rallied, Goldman Sachs trading desk noted that for the first time in a week they're seeing more balance in their China flows:

"Seeing both HF and LO sell tickets today across the complex."

Certainly didn't slow the upward trajectory for now (remember China is closed for Golden Week)...

Source: Bloomberg

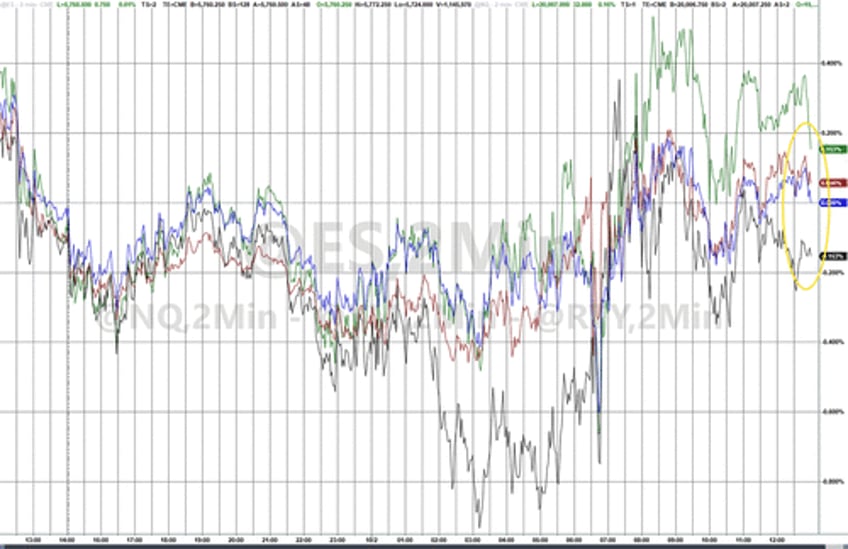

On the US side, things were quieter... Small Caps lagged, Nasdaq led the gains but the majors traded in a narrow range (which is unexpected given the drop in gamma)...

We note that the S&P 500 is back within the post-Powell spike range...

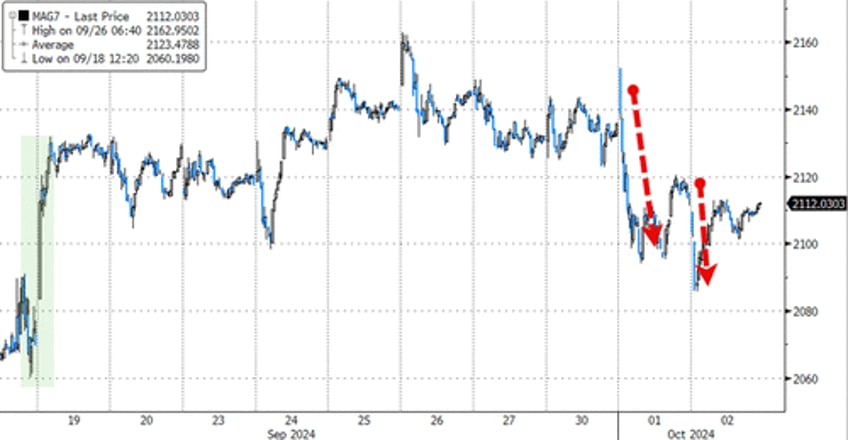

Mag7 stocks are back down into the post-Powell squeeze range...

Source: Bloomberg

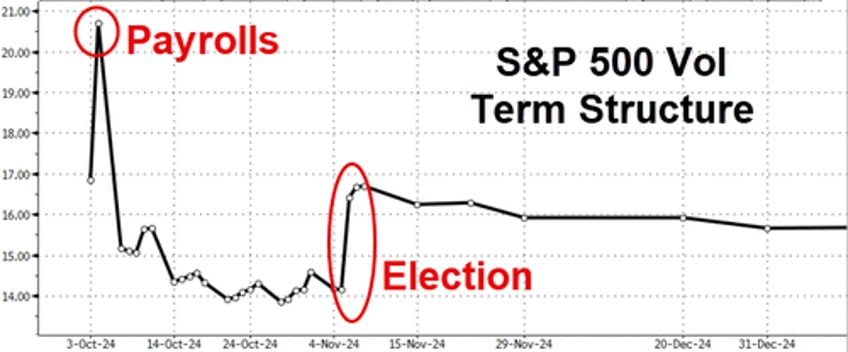

But the vol market readying itself for chaos on Friday as payrolls prints...

Source: Bloomberg

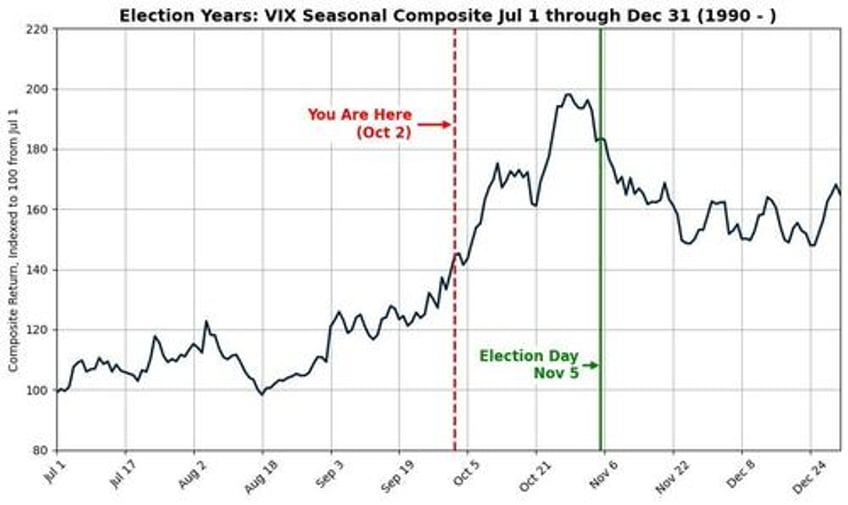

Bear in mind that 'seasonally', shit's about to get real for vol markets...

Source: Goldman Sachs

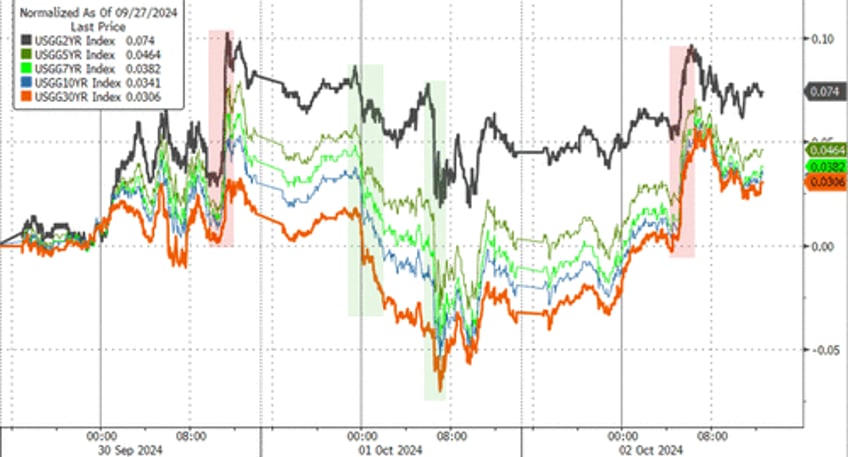

Treasury yields were higher across the board today with the long-end lagging (2Y +3bps, 30Y +6bps). All yields are higher on the week...

Source: Bloomberg

The dollar extended its rebound, back up to the post-Powell spike on FOMC day...

Source: Bloomberg

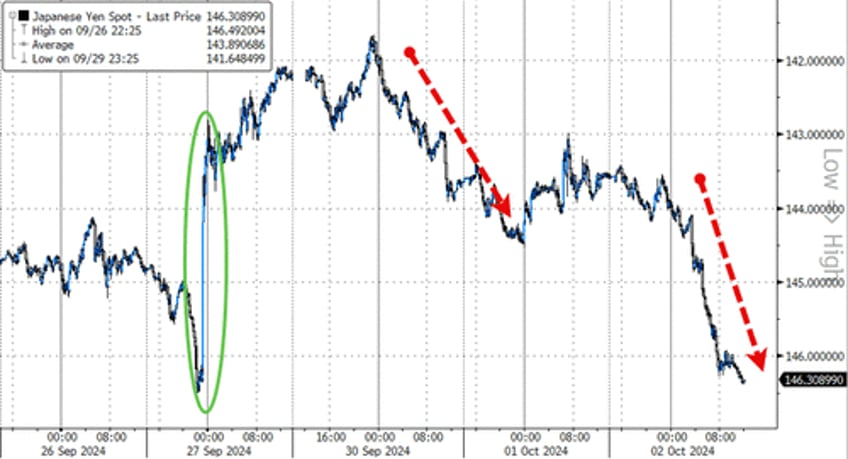

...as JPY weakened, erasing all of Friday's election panic bid...

Source: Bloomberg

Gold ended marginally lower on the day...

Source: Bloomberg

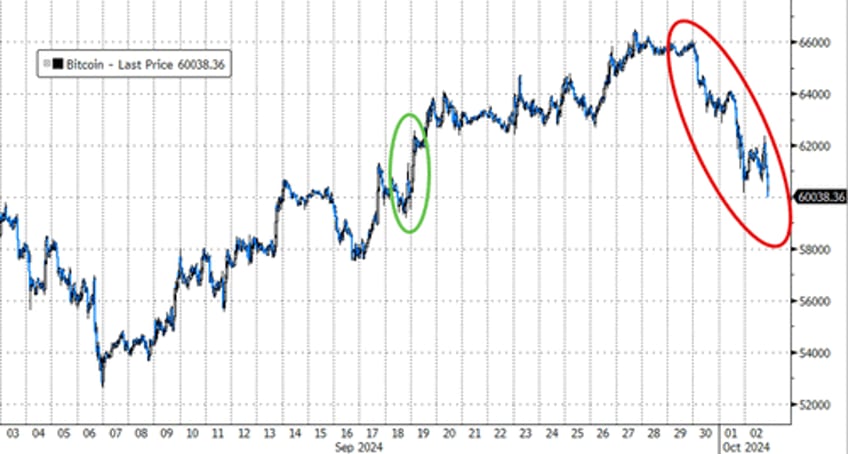

Crypto was monkeyhammered again with Bitcoin dumped back to FOMC-Day levels ($60,000)...

Source: Bloomberg

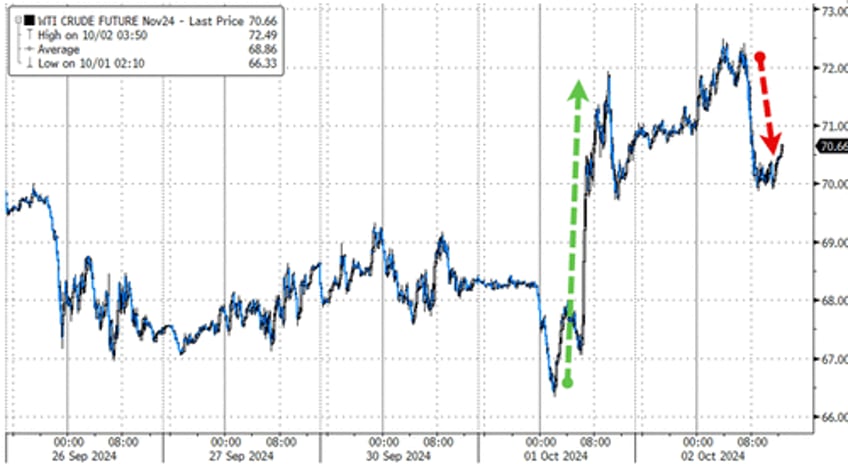

Crude prices pumped and dumped amid inventory data, further escalations in Israel/Lebanon, and OPEC+ headlines...

Source: Bloomberg

Finally, despite the fact that we have crossed the month-/quarter-end rubicon, the plumbing in the financial services sewage remains a little clogged...

Source: Bloomberg

The last time this happened, the repo market blew up... just saying.