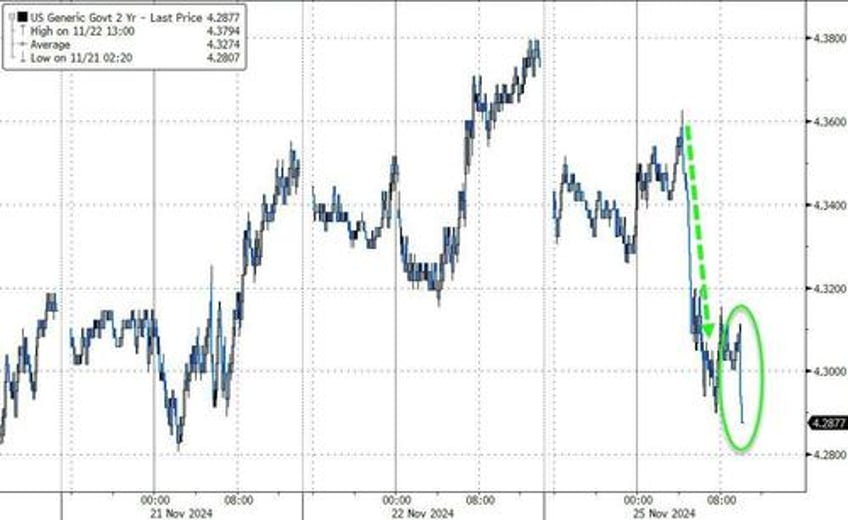

Treasury yields were already significantly lower this morning (along with crude oil prices) but the strong demand for 2Y Treasuries at this morning's auction sent them even lower...

Source: Bloomberg

Bidders were evidently happy to scoop up “cheap” paper as the offering stopped at 4.274%, nearly 2 bps through the when-issued yield...

Source: Bloomberg

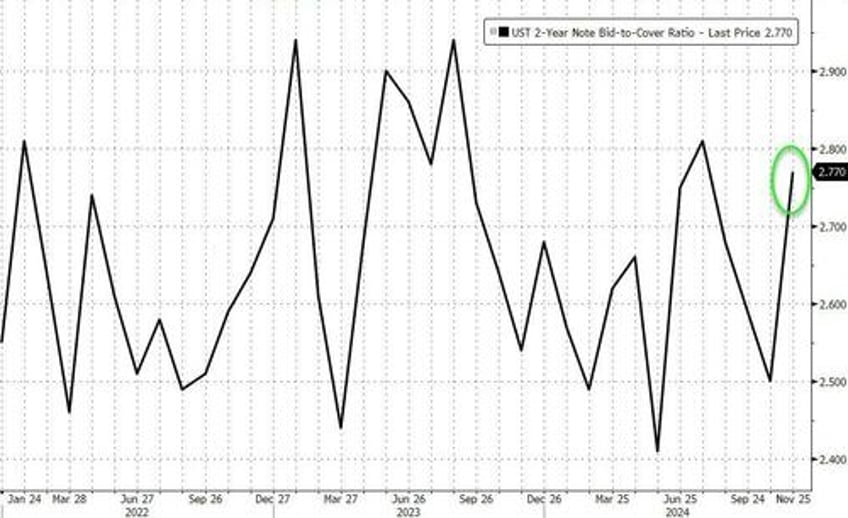

Demand was strong, with bid/cover of 2.77 the highest in four months and 1.3σ above the one-year average...

Source: Bloomberg

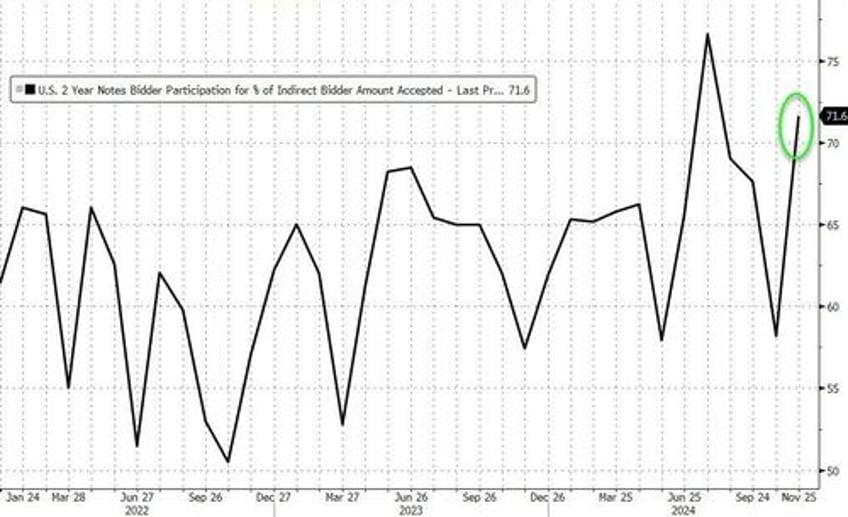

Indirects were enthusiastic buyers, with their 71.6% takedown some 1.2σ above average.

Source: Bloomberg

It appears the 'Bessent'-effect already having an impact?