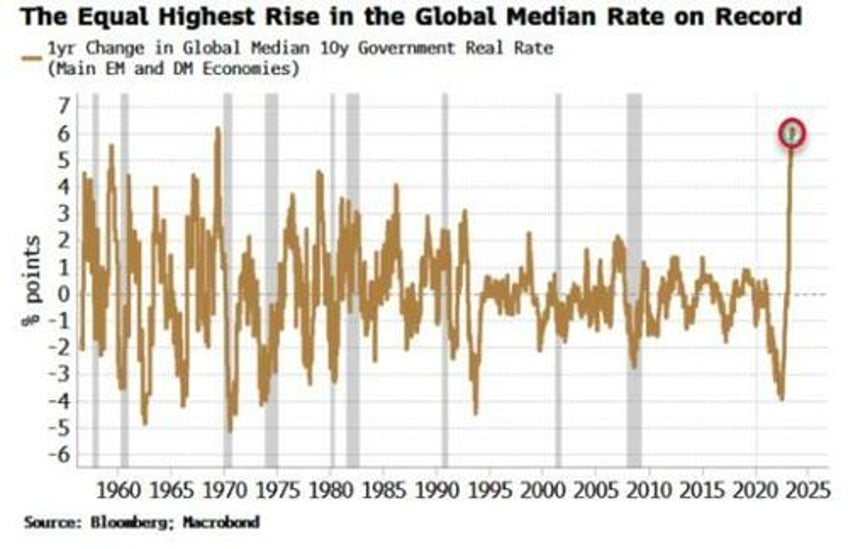

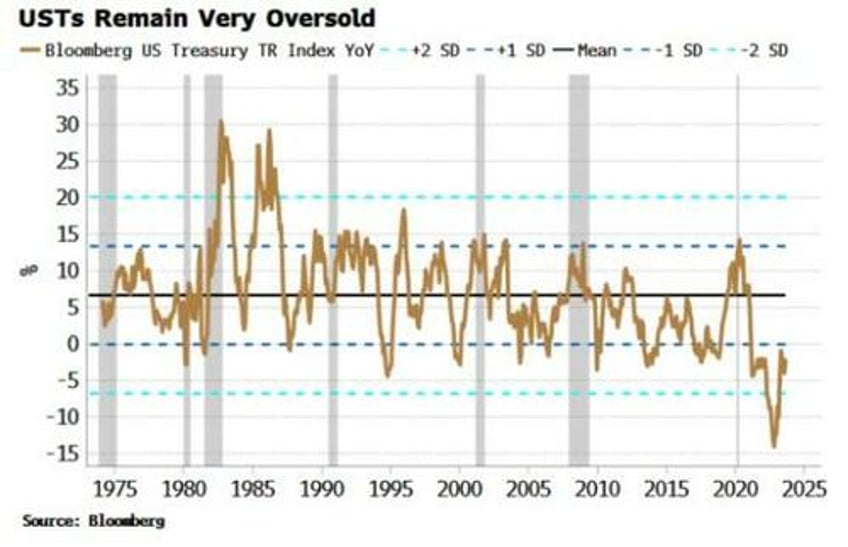

Bonds continue to look oversold after the equally-sharpest rise in the global median real yield seen in at least 60 years. More consolidation in the shorter term is anticipated as bonds continue to work off their oversold condition.

Yields across DM have hit cycle highs in recent days. They started to swing lower Thursday afternoon and are following through in the European morning.

Term premium has been rising as bonds’ efficacy as a portfolio and a recession hedge is impaired when the stock-bond correlation is positive. After most of the last two decades being negative, the correlation is positive again as inflation and inflation expectations have a greater influence on markets.

The global real yield of the largest EM and DM countries has increased by the most over one year since 1969, rising by over six percentage points.

After such a rise, bonds are likely due some interim relief or consolidation. They remain oversold on a short and a medium-term basis. The chart below shows that US bonds are still more than one-standard deviation below their long-term mean growth rate.

Positioning is generally long, so there is a risk of more selling if bonds continue to fall, but a stabilization should see positions held on to.

Moreover, +4.5% yields will start to look irresistible to many longer-term buyers of debt, such as liability matchers.

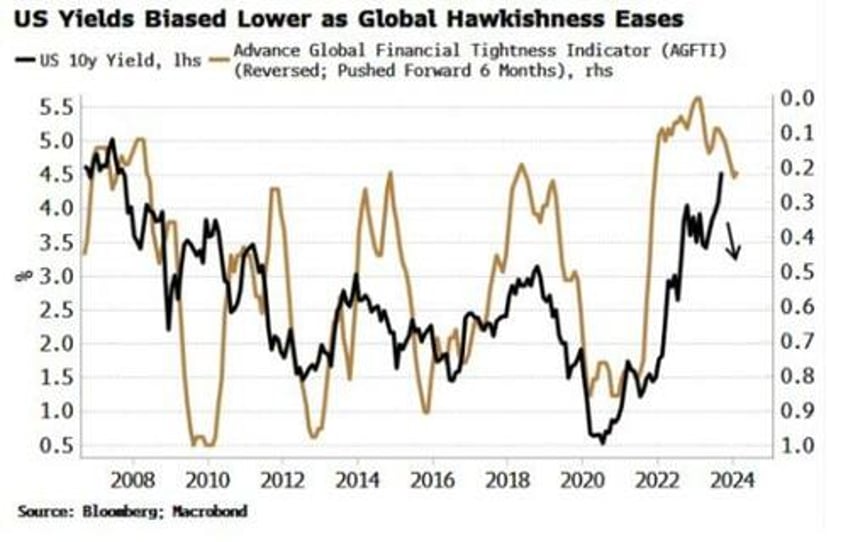

Further, peak global hawkishness is behind us. The Global Financial Tightness Indicator (GFTI) is a diffusion of central-bank rate hikes around the world. When it’s falling, as it is today, it means fewer banks are raising rates.

As the chart below of the GFTI shows, US 10-year yields tend to track its ups and downs. The easing of the GFTI should mean less impetus for higher yields (for now).

Nonetheless, the secular picture for bonds remains inhospitable. Rising inflation expectations, mounting supply, and bonds’ diminishing hedging utility (these are all sides of the same coin), mean that any rally in bonds would be considered a trade, not an investment.