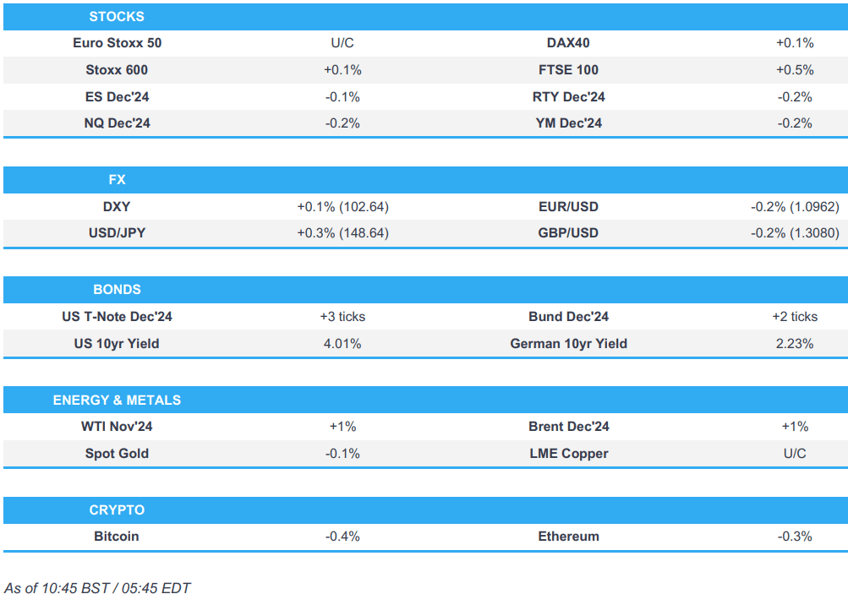

- European bourses are choppy and trading indecisively on either side of the unchanged mark, but the FTSE 100 outperforms; US futures are modestly lower.

- Dollar is firmer with G10s lower across the board to varying degrees; the Kiwi lags after the RBNZ delivered a widely expected 50bps cut and signalled the likelihood of further easing to come.

- Bonds are incrementally firmer, UK auction garnered solid demand but the tail was still large sparking some modest pressure in Gilts.

- Crude is firmer attempting to pare back the hefty losses in the prior session; XAU/base metals are modestly lower.

- Looking ahead, US Wholesale Sales, FOMC & NBH Minutes, Speakers including Fed’s Bostic, Logan, Goolsbee, Jefferson, Barkin, Collins & Daly, Supply from the US.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (U/C) are mixed, in what has been a choppy session thus far; indices opened around flat, and have traded indecisively on either side of the unchanged mark.

- European sectors are generally firmer, albeit with the breadth of the market fairly narrow vs initially opening with a slight defensive bias. Optimised Personal Care is towards the top of the pile, alongside Media whilst Banks and Tech lag.

- US Equity Futures (ES -0.1%, NQ -0.2%, RTY -0.3%) are very modestly in the red, taking a breather from the gains seen in the prior session; some of the pressure could be attributed to the Google antitrust case. In recent trade, futures have been edging off worst levels.

- US Justice Department outlines potential remedies in Alphabet's (GOOGL) Google antitrust case with the US said to be weighing a Google breakup as a remedy in monopoly case, according to Bloomberg. Says it will respond to the DoJ's ultimate proposals as the Co. makes its case in court next year, while it is concerned the DoJ is already signalling requests that go far beyond the specific legal issues in this case.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is broadly stronger vs. peers after indecisive sessions on Monday and Tuesday. DXY has climbed to a 102.70 peak with focus on a potential test of 103; not breached since 16tth August. FOMC Minutes and a slew of speakers are due.

- EUR is softer vs. the USD after a marginal session of gains yesterday, which saw the pair advance to a peak at 1.0996. Interim support kicks in via the 100DMA at 1.0932.

- GBP is softer vs. the broadly firmer USD and flat vs. the EUR. Cable has slipped below its 50DMA at 1.3088 printing a trough at 1.3056.

- JPY is marginally softer vs. the USD with not a great deal of fresh macro drivers to guide the pair. Ahead of the 150 mark, interim resistance is provided by the recent peak at 149.12 set on Monday.

- NZD is the standout laggard across the majors after the RBNZ delivered a 50bps rate cut as expected whilst signalling the likelihood of further easing to come. AUD/USD have been stemmed by the rise in the AUD/NZD which vaulted to its highest level since July 31st. Furthermore, markets continue to focus on Chinese easing measures with the Finance Ministry set to hold a briefing on 12th October.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are firmer but with upside relatively modest in nature though, with USTs shy of Tuesday’s and Monday’s respective highs of 112-24 and 112-28+. FOMC Minutes and a slew of Fed speakers are due.

- Bunds are firmer to the tune of 15 ticks and holding just shy of Tuesday’s 133.80 high, which is also just below Monday’s 134.03 peak. ECB speak today has had little impact on the complex, despite interesting commentary from Kazaks who noted that he is not as convinced as media reports on an October cut. The Bund auction passed with little issue.

- Gilts are largely following peers, but did see some modest pressure following the UK Gilt auction, but downside which ultimately proved fleeting. Gilts currently around 96.82 after initially going as low as 96.65 following the auction.

- UK sells GBP 3.75bln 4.25% 2034 Gilt: b/c 3.25x (prev. 2.84x), average yield 4.17% (prev. 3.757%), tail 0.9bps (prev. 1.3bps).

- Germany sells EUR 0.408bln vs exp. EUR 0.5bln 0.00% 2036 and EUR 0.846bln vs exp. EUR 1bln 2.60% 2041 Bund.

- Bond investors have to wait as long as a year to transfer investments from their account on the Treasury (TreasuryDirect) to a brokerage, via WSJ citing sources.

- Click for a detailed summary

COMMODITIES

- Crude is firmer attempting to pare back the hefty declines seen in the prior session; focus today is on any geopolitical updates out of the Middle East and as Hurricane Milton is expected to make landfall on the Gulf coast of Florida later on Wednesday. Brent Dec resides in a USD 77.21-77.99/bbl parameter.

- Subdued trade across the precious metals complex with some desks citing profit-taking in the absence of a geopolitical escalation yet, although an Israeli attack on Iran is looming. Spot gold currently sits in a USD 2,609.24-2,624.37/oz range.

- Base metals are flat with a downward bias following yesterday's sizeable losses induced by the disappointing Chinese NDRC press conference. 3M LME copper trades closer to the bottom end of a USD 9,719.50-9,855.50/t range.

- NHC says Hurricane Milton is forecast to make landfall on the Gulf coast of Florida later on Wednesday, as a dangerous Major Hurricane.

- US private inventory data (bbls): Crude +10.9mln (exp. +2.0mln), Distillate -2.6mln (exp. -1.9mln), Gasoline -0.6mln (exp. -1.1mln), Cushing +1.4mln.

- Japanese aluminium premium for the October-December shipment has been set at USD 175/T, +1.7% Q/Q, via Reuters citing sources.

- India Steel Secretary says steel demand will be more than previously predicted; green steel will be the way forward.

- Carlyle Group Chief Strategy Office Jeff Currie says demand dynamic is oil supportive; says oil should be trading in the USD 80/bbl range, via Bloomberg TV.

- Russia's idle primary oil refining capacity has been revised up 67% in October, to 4.0mln/T.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Trade Balance, EUR, SA (Aug) 22.5B vs. Exp. 18.4B (Prev. 16.8B); Exports MM 1.3% vs. Exp. -1.0% (Prev. 1.7%), Imports MM -3.4% vs. Exp. -2.5% (Prev. 5.4%).

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves is pushing ahead with plans to borrow billions of pounds extra for infrastructure investment despite concerns about an increasing cost of UK government debt, with Reeves likely to free up GBP 10bln-20bln worth of borrowing room for capital investment by excluding the losses incurred by the state from the BoE's previous asset purchase programs when calculating debt, according to The Guardian.

- ECB's Stournaras sees the case for two more rate cuts in the Eurozone this year and further easing in 2025, while he said inflation could be on track to meet the ECB's target in H1 2025, according to FT.

- ECB's Villeroy says a decrease in ECB rates is "very likely" and will not be the last; French economy is resilient, via Bloomberg.

- ECB's Kazimir says he is not worried about the ECB undershooting the 2% goal; not as convinced as media reports on an October cut. Key information will be available in December.

- EU is to robustly challenge at the WTO level the announced imposition of provisional anti-dumping measures by China on imports of Brandy from the EU and is to assess all possibilities to offer appropriate support to EU producers from situations of market disturbance, or threat thereof.

- Banks are reportedly pushing the UK to soften its approach to deferred bonuses/clawbacks, via Bloomberg citing sources.

NOTABLE US HEADLINES

- Fed Vice Chair Jefferson said the Fed rate cut recalibrated policy to maintain the strength of the labour market and noted that economic growth is solid, inflation has eased substantially, and the labour market has noticeably cooled. Jefferson said he will watch the incoming data, evolving outlook, and balance of risks in considering additional policy rate adjustments and his approach to policymaking is to make decisions meeting by meeting. Furthermore, he said the Fed has not changed its approach to monetary policy and is always thinking about the balance of risks, as well as noted the size of the September rate cut was timely and that the Fed's rate cut was neither proactive nor reactive.

- Fed's Collins (2025 voter) said further rate cuts are likely needed, and future action is to be data-driven, while she added that September Fed forecasts predicted 50bps of cuts into year-end. Furthermore, Collins is more confident of inflation being on a durable path of ebbing and said core inflation has moderated but is still elevated.

GEOPOLITICS

MIDDLE EAST

- "Dozens of Iranian lawmakers wrote to the country’s Supreme National Security Council calling for urgent action towards developing nuclear weapons as Israeli threats rise in the region", according to Al Jazeera.

- Iran has told Gulf Arab states that it would be unacceptable if they allowed the use of their airspace or military bases against Iran, and warned any such move would draw a response, according to a senior Iranian official cited by Reuters

- Israeli PM Netanyahu confirmed that Israel took out Nasrallah's successor, while it was separately reported that PM Netanyahu summoned ministers for security consultations on Tuesday evening.

- Israeli PM Netanyahu had set two conditions for Defence Minister Galant to travel to the US and refused to approve the trip to Washington that had been planned for Tuesday night until he receives a phone call with President Biden and the Israeli cabinet approves the response to Iran's missile attack, according to Axios sources.

- Israeli senior official said they are going to respond to the Iranian attack and there is no question about it but will not do it in a way that will start an all-out war with Iran, according to Axios. It was also reported that Israeli officials cited by Washington Post said that the country is preparing a significant military response to Iran's attack.

- Israeli officials stated that Israel is capable of harming Iran but the possibility of its response requires coordination with the US, while Defence Minister Galant and security leaders push to strike Iran militarily and have already submitted the plans to the political leadership.

- Israel's Channel 12 reported that Washington and Arab countries are discussing with Tehran a proposal for a ceasefire on all fronts except Gaza which would be conditional on Hezbollah's withdrawal to northern Litani and the dismantling of military structure near the border, according to Sky News Arabia.

- White House said the US continues to have discussions with Israel on its response to the Iranian attack. It was separately reported that the White House said despite the fighting, they are working with Israel and Lebanon to define a process for a return to ceasefire negotiations,according to Asharq News

- US officials cited by NBC do not believe that Israel has made a final decision on the details of the response to Iran and discussions with Tel Aviv included Washington providing intelligence support or even launching air strikes. However, Washington has not decided on any action despite its intention to support Israel's right to defend itself and Israel did not inform Washington of plans to retaliate against Iran.

- US officials feared that Israel will implement its response to Iran during the planned Israeli Defence Minister Gallant's visit to Washington although the visit has since been postponed.

- Islamic Resistance in Iraq said it attacked with drones a vital target in the north of the occupied territories, according to Al Jazeera.

OTHER

- North Korea's army said it is to completely cut off roads and railways connected to South Korea from October 9th, according to KCNA.

CRYPTO

- Bitcoin is incrementally lower and trading just above USD 62k.

APAC TRADE

- APAC stocks traded mixed and initially took impetus from the positive performance on Wall St where the major indices were led higher amid a tech rally, although Chinese stocks clouded over sentiment following the recent stimulus-related disappointment.

- ASX 200 eked marginal gains as strength in tech and telecoms offset the losses in the commodity-related industries.

- Nikkei 225 was underpinned at the open and climbed back above the 39,000 level but with gains capped by a lack of drivers.

- Hang Seng and Shanghai Comp were mixed as the Hong Kong benchmark fluctuated between gains and losses, with a late boost derived from reports China's Finance Ministry is to hold a press briefing on fiscal policy and economic development on October 12th. The mainland was pressured after the recent stimulus-related disappointment and amid China's ongoing trade frictions with the EU and US.

NOTABLE ASIA-PAC HEADLINES

- China's Finance Ministry is to hold a press briefing on fiscal policy and economic development on October 12th at 10:00 local time (03:00BST/22:00EDT), while it will introduce details of intensifying fiscal policy adjustment.

- China's Finance Ministry says they are to continue policy coordination with the PBoC and keep stable development of the bond market. To provide appropriate market conditions for PBoC treasury bond trading. Ministry and PBoC agree that treasury bond trading improves the monetary policy toolkit and improves liquidity management.

- RBNZ cut the OCR by 50bps to 4.75%, as expected, while it stated that New Zealand is now in a position of excess capacity and that low import prices have assisted disinflation. RBNZ noted that the Committee assessed annual consumer price inflation within its 1-3% target and it was appropriate to cut the OCR by 50bps to achieve and maintain low and stable inflation. RBNZ Minutes stated the Committee confirmed future changes to the OCR would depend on its evolving assessment of the economy and noted the OCR of 4.75% is still restrictive and leaves monetary policy well-placed to deal with any near-term surprises. Furthermore, the Committee discussed the respective benefits of a 25bps cut versus a 50bps cut in the OCR and stated that a 50bps cut at this time is most consistent with the mandate of maintaining low and stable inflation, while it added the economic environment provides scope to further ease the level of monetary policy restrictiveness.

- RBI kept the Repurchase Rate unchanged at 6.50%, as expected via a 5-1 vote (prev. 4-2) and it unanimously voted to switch its stance to neutral (prev. remaining focused on the withdrawal of accommodation), while Governor Das stated that macroeconomic parameters of inflation and growth are well balanced although the moderation in headline inflation is expected to reverse in September and remain elevated in the near term. Das also noted that the growth story remains intact, and prospects of private consumption look bright but added that there is difficulty in navigating the last mile of disinflation and significant risks to inflation still stare at them.

- TSMC (2330 TW) Q3 (TWD): Revenue 759.69bln (exp. 750.36bln)