By Michael Every of Rabobank

I’m going to repeat an old joke I last made years ago in the Daily. In one Laurel and Hardy film, the two are broke and agree to share a last drink at the bar. Stan goes first - and finishes the whole glass in one gulp. Ollie, aghast, asks what happened. Stan replies, “Well, my half was on the bottom!” That’s where we are now in markets. To paraphrase how Bloomberg put it this morning, as long as we get January March May June(?), or even second-half 2024 *deep* rate cuts from the Fed, markets will remain drunk. And, boy, do they not want to sober up when they read the news.

My half was on the bottom.#LaurelAndHardy pic.twitter.com/ZXgb2KIOPB

— Laurel and Hardy (@Stan_And_Ollie) March 16, 2020

In China, the ‘bullish’ meeting between Xi Jinping and stock regulators saw the head of the CSRC Yi Huiman fired… and replaced by Wu Qing, known as “the broker butcher”. The regular upbeat voices on Chinese stocks are now saying this is a good sign, because… well… because. Meanwhile, we wait for actual news on how the government is going to prop this, and other, markets up. This is as Chinese CPI just dropped at its fastest pace since 2009 at -0.8% y-o-y vs. -0.5% expected, while PPI -2.5% vs. -2.7% last month. This increases the pressure on the PBOC to ease policy further, or for fiscal stimulus, or both, which put downwards pressure on CNY. Yet, as noted yesterday, that probably can’t happen until the Fed starts to ease.

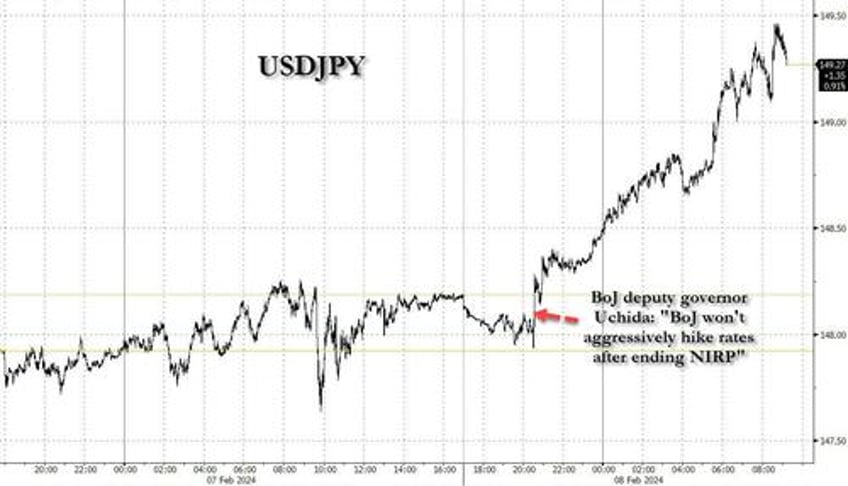

On which, New York Community Bank yo-yoed lower and named a new chair, as if that will help. Yet right after Japan, Europe is belatedly realizing ‘Hey, we bought CRE paper too!’, and as in 2008, what starts in the US may not end there, and while the Fed can acronym its way out of trouble, if needed, rather than cutting rates, the BOJ and ECB can’t as these assets aren’t under their purview: “Our CRE crisis, your problem,” to paraphrase. It’s perhaps not a surprise the BOJ’s Uchida just hinted their long-awaited rate hike ahead is going to be one and done, rather than an actual hiking cycle: really, why bother?

While this was all happening, US stocks hit a new high --albeit on a very narrow base: but then again, that’s the actual US economy too!-- and more Fed speakers said rate cuts are only going to happen towards the end of the year. That’s still at the bottom of the glass, just. But it’s also a long, painful wait for many in the US, and even more outside it.

Even looking ahead to H2 rate cuts one has to think about the 2024 election in terms of fiscal goodies thrown to voters (like $78bn tax cuts and student loan write-offs). On that front, yesterday saw Nikki Haley comprehensively lose a Republican Nevada primary where Trump was not on the ballot to ‘none of the above’, which says something about the gaps between what big political donors and actual voters want.

Today, the Supreme Court will rule on Colorado’s efforts to get former President Trump off the 2024 ballot for “insurrection or rebellion”: a Wall Street Journal editorial calls for a 9-0 vote to strike it down. Within days we may then see how the Supreme Court feels about the D.C. appeals court ruling over Trump’s January 6 court case, which struck down his claim to immunity: as the Journal op-eds separately, while Trump’s defence is “legal sophistry… the sweeping nature of the ruling means that it also risks weakening the office of the Presidency, so perhaps at least four Supreme Court Justices will be interested in having the last word.” In short, more twists and turns to come(?)

Internationally, after losing his own constitutional battle to his High Court, Israeli PM Netanyahu just called Hamas’s ceasefire demands --Israeli withdrawal, leaving it in power-- “delusional”, and stated “absolute victory” is close. The Saudis, who just made clear an irreversible path to a two-state solution with East Jerusalem as capital is required for normalisation of relations with Israel, are leading a 5-state summit, including Palestinian representatives, to thrash out a united Arab position on a ceasefire, rebuilding Gaza, and how to provide security, with Hamas not seen as having any official future role. For now, this means the war will go on, and reach the border town of Rafah; and Egypt will be both nervous and furious. And the Houthis will also escalate their attacks on global shipping.

On which, see this simple explanation of why the Red Sea crisis means higher inflation: if you have 1,000 of product X in a shipping container, and the price of moving them jumps from $1,500 to $4,500, as on some routes now, then each widget needs to add $3 to its price, arguably more including higher insurance. If it’s a product sold for $30 wholesale, that’s a 10% price bump, as least; if $60, it’s 5%; and if $100, it’s still 3%. Then the retailer is likely to pass it on, and maybe add a little more on top where they can - which we have just seen they often can and do. Then, possibly, local competitors realise that they can raise prices a little too. And if the Red Sea crisis really isn’t going away, perhaps firms rush to stock up all at once before prices rise further, and a deeper supply-demand imbalance is seen. We also have specific Red Sea pressures on diesel, where the spare maritime carrying capacity to go round Africa vs. Suez is just not available, as it is with container cargo for now.

This is to say that if you are looking for deep rate cuts at the ‘bottom’ of the year, because you don’t get them now, and are drunk on those lovely asset-price bubbles, you are betting the Red Sea situation is resolved soon.

So, yes, we aren’t even halfway through February, let alone the year. Lots can happen, and will. But if you are confidently drinking Ollie’s share of the soda to get to yours, just be aware of how often he ends up shouting, “That’s another fine mess you’ve gotten me into!”