In the end, Lula got his wish and won his quiet war with Brazil's central bank.

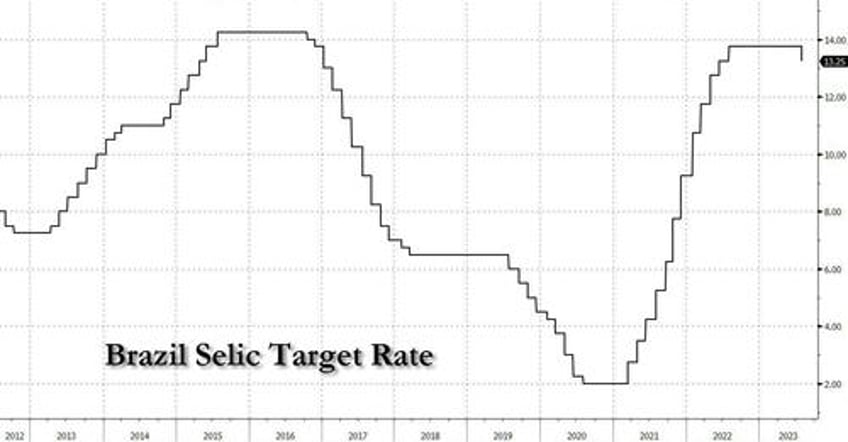

As BBG's Sebastian Boyd writes, Brazil’s central bank "couldn’t help but surprise traders today", and it did so not only with the first rate cut in three years, ending its tightening cycle - which sent the Selic target rate from 2% in March 2021 to 13.75 % in August 2022 - but also did so with a bigger cut than many expected.

The Copom cut the policy rate by 50bp to 13.25% in a tight 5-4 split decision, after keeping it at 13.75% for exactly one year. The four dissenting votes were for a milder 25bp cut.

Going into the meeting, swaps traders were roughly evenly split between 25 and 50 bps, while 30 of 41 economists in Bloomberg’s survey expected a 25-bp cut and 11 saw 50 bps. The bank said it considered cutting the Selic by a quarter-point, but chose to make a larger cut because of continuing improvement in the country’s inflation outlook.

“If the scenario evolves as expected, the committee members unanimously anticipate further reductions of the same magnitude in the next meetings, and it judges that this pace is appropriate to keep the necessary contractionary monetary policy for the disinflationary process,” the Central Bank of Brazil said in a statement.

And while Brazil wasn't the first central bank to cut its key interest rate first - Uruguay was first, and Chile also followed with a larger-than-expected cut last week - it is by far the biggest so far. Interestingly, the decision was not unanimous. Both the new appointee, Gabriel Galipolo and the president Roberto Campos Neto voted for 50 bps.

The decision was dovish to market expectations but not to market pricing. The (bi-modal) market consensus was leaning towards a 25bp rate cut: of the 41 analysts surveyed by Bloomberg, 31 expected a 25bp rate cut and 10 a larger 50bp rate cut.

Even with the larger-than-expected cut Wednesday, the gap between inflation and the Selic rate remains wide and even deeper cuts may be in store, said Gino Olivares, chief economist at Azimut Brasil Wealth Management.

If the central bank trims half a percentage point for the next three meetings, “we will have the Selic at 11.75% at the end of the year, which is still a contractionist level,” Olivares said. “In the future, they will have to evaluate whether to accelerate the pace of easing.”

As the WSJ notes, the central bank began raising the Selic after inflation started to pick up toward the end of 2020 and then rose faster as the Brazil’s economy recovered from the pandemic-induced slowdown. The Russian invasion of Ukraine later pushed inflation even higher as energy and food prices gained amid supply disruptions.

Higher interest rates are now having the expected effect on inflation and the economy, and other factors are also helping calm concerns at the central bank, said Matheus Pizzani, an economist at brokerage CM Capital Markets.

“The more recent evolution of inflation has been closer to what was hoped,” Pizzani said. High rates are helping slow the economy, concerns about the new Brazilian government’s fiscal policies have eased, and the outlook for services inflation is improving, he added.

* * *

In justifying its decision, the Copom - which just a few months ago was contemplating raising its inflation target - signaled the need to maintain a contractionary monetary stance until the disinflationary process consolidates and inflation expectations anchor around its targets. The Copom stated that the improvement of the inflation backdrop, reflecting in part the lagged effects of monetary policy, coupled with the reduction of longer-term inflation expectations provided “the necessary confidence to start a gradual cycle of monetary policy easing”.

The Copom considered the option of reducing the Selic rate to 13.50%, but concluded that it was appropriate to adopt a 50bp cut in this meeting due to an improvement in the inflation dynamics, reinforcing, however, the firm objective of keeping a contractionary monetary policy to re-anchor expectations and bring inflation to the target over the relevant horizon.

The forward guidance points to the maintenance of the current pace of rate cuts in the next meetings (view held by all directors if the macro scenario evolves as expected). The characterization of the balance of risks for inflation suffered significant modifications but remained broadly neutral. The conditional inflation forecast for end-2024 did not improve (remained at 3.4%; i.e., still above the 3.0% target by end-2024 target.

Some economists say part of the current decline in Brazil’s 12-month inflation readings are temporary, stemming from fuel tax cuts the government applied last year. That effect is likely to dissipate in coming months, leading to a possible uptick in the headline inflation measure even as the economy slows, said CM Capital’s Pizzani.

“Inflation readings will increasingly reflect actual supply and demand imbalances,” he said. He sees inflation bouncing back to 4.8% in December, before falling to 3.8% a year later.

Looking ahead, Goldman expects the Copom to cut the Selic rate by 50 bp at the three remaining 2023 meetings, driving the Selic to 11.75% by end-end.

Here are some more details on the rate cut from Goldman

- 1. For the Copom, the decision to cut 50bp to 13.25% “is compatible with the strategy of convergence of inflation to around the target over the relevant horizon for monetary policy, which includes the 2024, and to a lesser extent 2025, calendar years.” We highlight that 2025 entered the relevant horizon for monetary policy in the August meeting (previously the only relevant horizon was the 2024 calendar years).

- 2. The Copom reiterated the need to maintain a contractionary monetary stance until the disinflationary process consolidates and inflation expectations anchor around its targets.

- 3. The Copom stated that the improvement of the inflation backdrop, reflecting in part the lagged effects of monetary policy, coupled with the reduction of longer-term inflation expectations, after the recent decision of the National Monetary Council on the inflation target, “have given the necessary confidence to start a gradual cycle of monetary policy easing”.

- 4. The Copom considered the option of reducing the Selic rate to 13.50%, but it concluded that it was appropriate to adopt a 50bp in this meeting due to an improvement in the inflation dynamics, reinforcing, however, the firm objective of keeping a contractionary monetary policy to reanchor expectations and bring inflation to the target over the relevant horizon. For the Copom, the current context, characterized by a stage in which the disinflationary process tends to be slower and with partial reanchoring of inflation expectations, requires serenity and moderation in the conduct of monetary policy.

- 5. Forward guidance: No acceleration in the pace of rate cuts. For the Copom, if the macro scenario evolves as expected, its members unanimously anticipate further cuts of the same magnitude in the next meetings, and judge that this pace [-50bp] is appropriate to keep the monetary stance contractionary necessary for the disinflationary process.

- 6. Finally, the Copom emphasized that the total magnitude of the easing cycle throughout time will depend on the inflation dynamics, especially the components that are more sensitive to monetary policy and economic activity, on inflation expectations (in particular long-term expectations), on its inflation projections, on the output gap, and on the balance of risks.

- 7. The Reference Scenario with a BRL/USD that follows a PPP path starting at 4.75 (vs. 4.85 at the June meeting), the Selic path of the market scenario, and where oil prices follow approximately the futures curve for the next six-months, and rise 2% per year thereafter, shows headline inflation at 4.9% by end-2023 (5.0% at the June meeting and still above the 3.25% target), 3.4% by end-2024 (3.4% at the June meeting and closer to the 3.00% target), and 3.0% for end-2025 (vs 3.1 in the June QIR). The assumption for inflation in regulated tariffs/prices rose for 2023 (+40bp to 9.4%) and were unchanged for 2024 (at 4.6%). That is, in this scenario the conditional inflation forecasts for end-2024 remained above the target.

- 8. The characterization of the balance of risks for inflation suffered significant modifications but remained broadly neutral.

- a. As upside risks to the inflation outlook and inflation expectations, the Copom mentions: (i) greater persistence of global inflationary pressures; and (ii) stronger than expected services inflation resilience/stickiness due to a tighter output gap. The Copom added risk (ii) and deleted as upside risks to inflation: “some residual” uncertainty about the final design of fiscal framework to be approved in Congress and, more relevant for monetary policy, its impact on the expectations for public debt and inflation paths, and on risky assets and a deeper or more persistent unanchoring of long-term inflation expectations.

- b. As downside risks, the Copom stated: (i) a deeper than expected deceleration of global economic activity, particularly due to adverse conditions in the global financial system; and (ii) stronger than expected impact on global inflation from synchronized monetary policy tightening. As downside risks the Copom added risk (ii) and deleted from the statement the risks from: (i) additional decline of the price of commodities measured in local currency (although a sizeable part of this movement has already been observed); and; (ii) a slowdown in domestic credit origination that is deeper than what would be compatible with the current stance of monetary policy.

- 9. The Copom’s updated scenario can be summarized as follows.

- a. The global environment remains uncertain, with some disinflation at the margin, but against an environment with still high core inflation and labor market resilience in many countries.

- b. On the domestic front, the Copom repeated that “the recent set of indicators remains in line with the baseline scenario of activity deceleration” in the coming quarters.

- c. Notwithstanding the recent reduction of headline inflation, the Copom anticipates an increase in annual headline inflation during 2H2013. Moreover, several core inflation measures have declined recently but remain above the inflation target.