Inflation breakevens have potential to rise due to supportive conditions in the oil market.

US inflation is falling. The trend should remain intact, for the next three-six months at least. But that does not necessarily mean breakevens will keep falling. As a reminder, breakevens are the inflation rate that would need to be realized for a long TIPS position versus a short US Treasury position to break even.

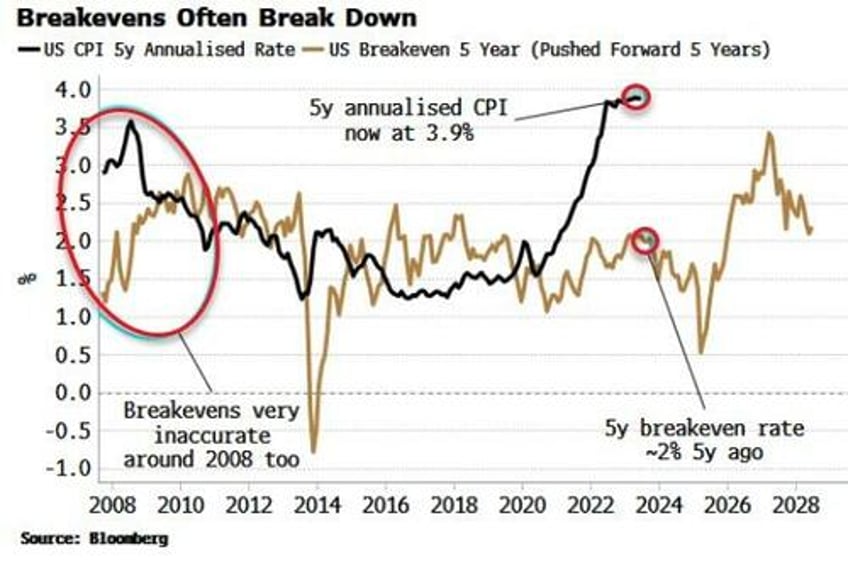

In theory it should be the average CPI over the maturity of the position (e.g. a 5-year breakeven rate should be the average annualized CPI over the following five years). It is often not, especially at turning points – 5y breakevens were about 2% five years ago, and CPI has annualized 3.9% over the last five years.

Breakevens are instead much more driven by liquidity conditions and by trading behavior. These have more influence on breakeven rates over the short-to-medium term (up to ~1 year).

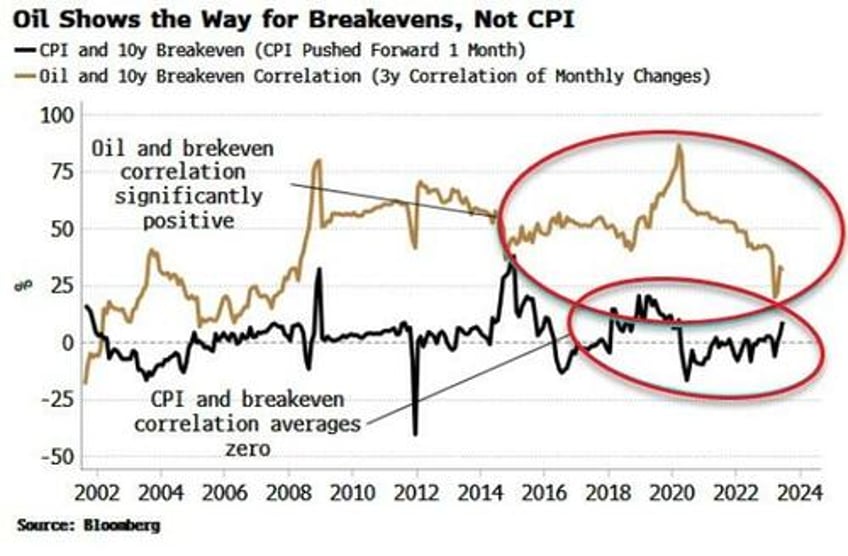

Oil, in fact, is a much a better guide to breakevens’ path than CPI as oil is often used as a hedge by commodity traders, and the rise in oil causes TIPS to be bid up by inflation traders. This explains the much higher correlation between breakeven rates and oil than between them and CPI.

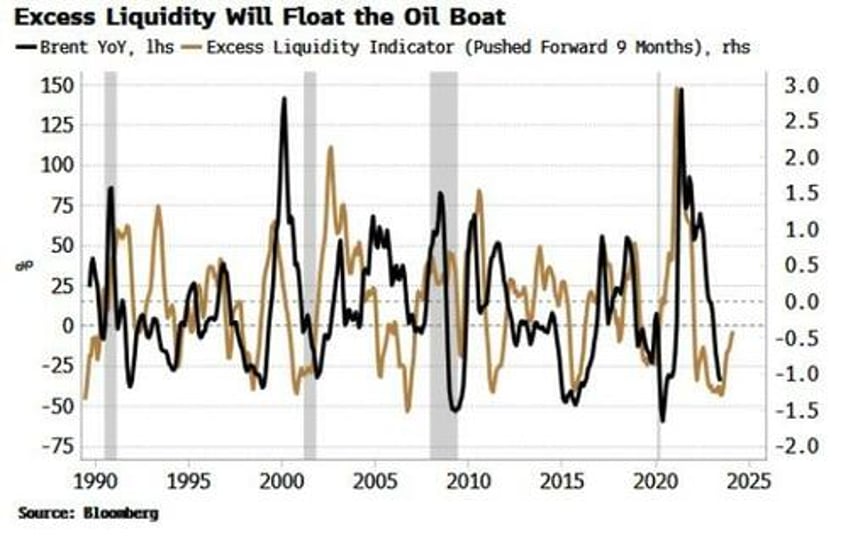

Oil is lower over the last two days, but there are several strong reasons the trend has changed (as we detailed here). China has been importing more oil, leading indicators for the commodity have turned upwards, OECD inventories look to have topped out, and sentiment is very poor. But most supportive is the pronounced upturn in excess liquidity, which points to higher oil prices over the next 3-9 months.

Brent oil is up about 8% over the last few weeks. If it continues, then this could paradoxically lead to breakevens rising despite (lagging) CPI continuing to fall.