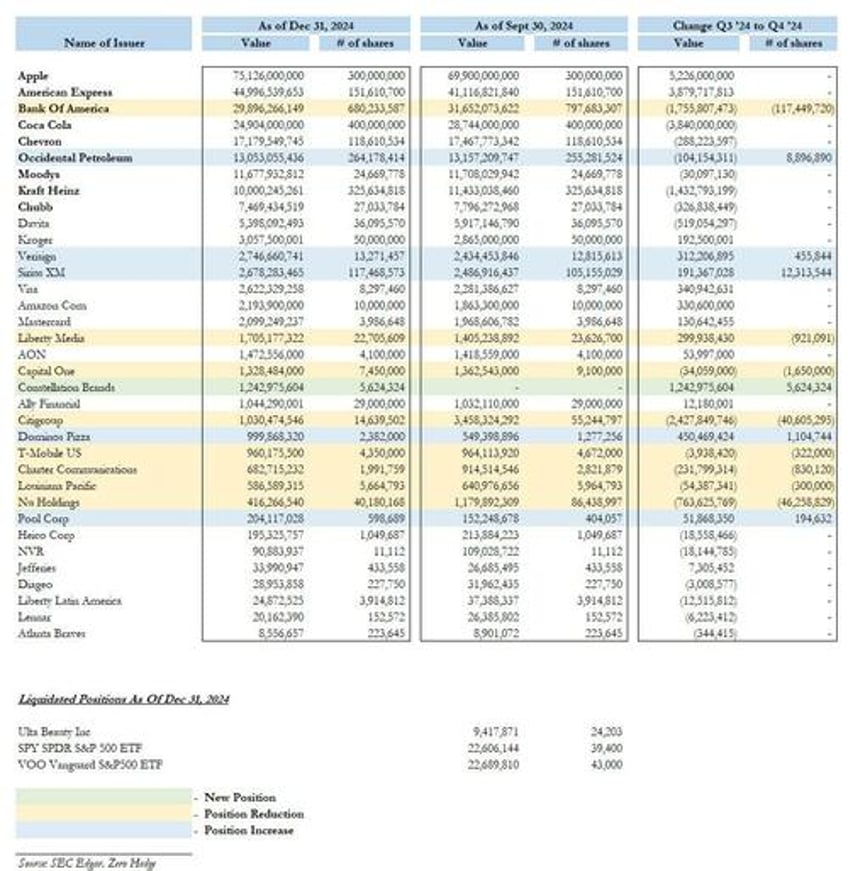

Earlier this week, and ahead of this week's 13F filing deadline around 5pm today, we said that in just a few days we would find out how much more AAPL stock Warren Buffet had sold in Q4 following 4 quarters of aggressive selling of the world's largest company. Moments ago we got the answer when Berkshire released its latest 13F, and which showed that for the first time since 2023, the Oracle of Omaha had not sold any Apple in the past quarter, and held on to 300 million shares of AAPL, equivalent to $75.1 billion in notional value, or equivalent to 28% of the conglomerate's portfolio, making it Berkshire's largest stock for yet another quarter.

But while Buffett's Berkshire did not sell any Apple this quarter, the conglomerate continued selling longtime bet on Bank of America in last year’s final months, which was trimmed by another 117.4 million shares or 14.7%, in Q4, and followed a 23.7% reduction in Q3. Bank of America executives and shareholders have waited months for the update after Berkshire’s prior sales left it with less than 10% and freed it from a requirement to quickly disclose transactions; to their disappointment the selling continued, and left Buffett with $29.9 billion in BAC as of Dec 31, a stake which was worth $31.9 billion as of Friday's close. Buffett, 94, started trimming the position, which two quarters ago was his second largest after Apple, in mid-July without providing any explanation.

Apple and Bank of America aside, here's what else Berkshire did in Q4:

It added to its positions in:

- Occidental Petroleum, +8.9 million shares to 264.2 million shares, or $13.05 billion as of Dec 31

- Verisign, +455,844 shares to 13.3 million shares or $2.75 billion as of Dec 31

- SiriusXM, +12.3 million shares to 117.5 million shares, or $2.7 billion as of Dec 31

- Pool Corp, +194,632 shares to 598.689 shares, or $204 million as of Dec 31

It reduced its positions in:

- Liberty Media by 921K shares to 22.7 million shares of $1.7 billion

- Capital One, by 1.65 million shares to 7.45 million shares, or $1.3 billion

- Citigroup, by 40.6 million shares to 14.6 million shares, or $1.03 billion

- T-Mobile, by 322K shares to 4.3 million shares, or $960 million

- Charter Communications, by 830K shares to 1.99 million shares, or $682 million

- Louisiana-Pacific, by 300K shares to 5.665 million, or $586 million

- Nu Holdings, by 46.3 million shares to 40.2 million, or $416.3 million

Finally, Berkshire also initiated a new position in Constellation Brands (5.6 million shares or $1.2 billion), and exited its entire stake in Ulta Beauty, a stock it started acquiring in the second quarter before paring back the position in the following period, as well as its positions in the SPY and VOO ETFs.

Berkshire will release annual earnings, as well as Buffett’s traditional letter to shareholders, later this month.

A full breakdown of Berkshire's holdings is below.