Jobless claims not good, housing data bad, Philly Fed ugly... and that meant the US macro surprise index plunged to early-2019 lows... near the lowest level since 2016...

Source: Bloomberg

But that 'bad news' had no (good news) influence on rate-cut expectations (which worsened marginally)....

Source: Bloomberg

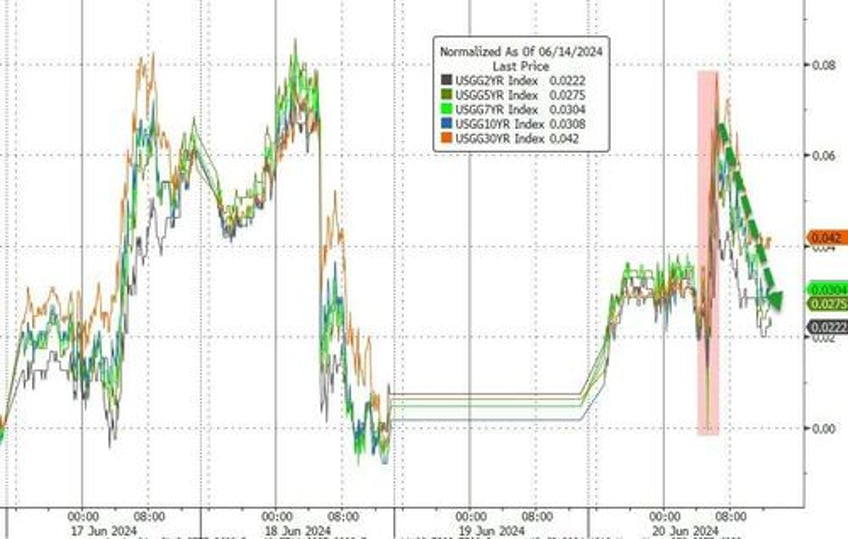

Treasury yields ended the day marginally higher after recovering from the spike early on after claims data...

Source: Bloomberg

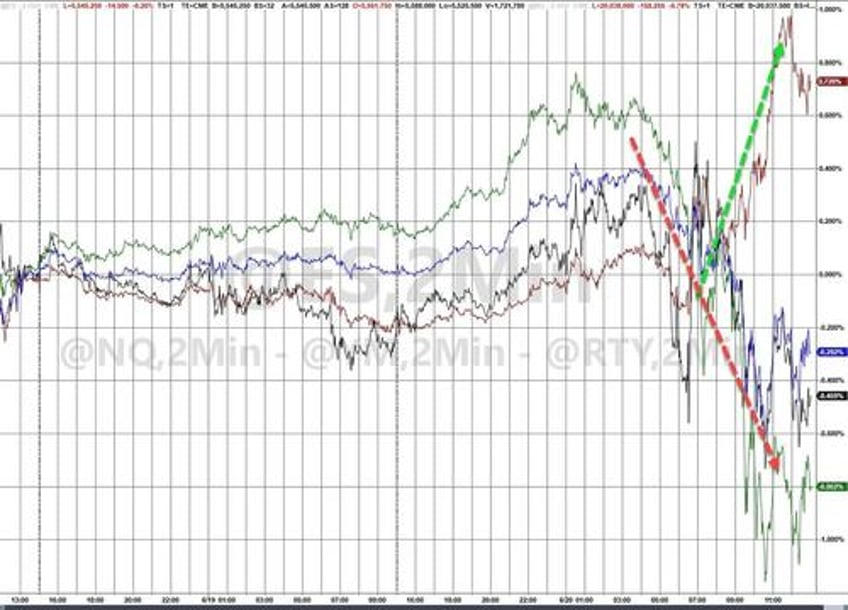

That 'bad news' was also bad news for the momo names too as The Dow dramatically outperformed the rest of the majors today (the only index positive) with Nasdaq the biggest loser from Tuesday's cash close...

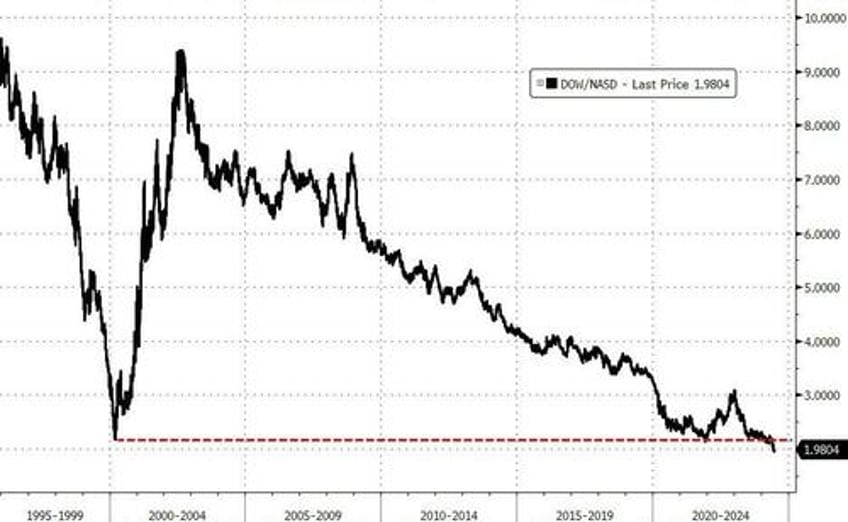

This was the second best day for The Dow relative to Nasdaq year-to-date with The Dow trading below 2x Nasdaq (below the peak dotcom bubble lows)...

Source: Bloomberg

Much of that big rebound was Energy's dramatic outperformance of Mag7 stocks in the last two days...

Source: Bloomberg

Goldman's equity trading desk noted that their activity levels are up 20% vs. the trailing 2 weeks with overall market volumes +10%.

Our floor is 3% better for sale, with both HFs and LOs moving the same direction.

HFs are 4% better for sale with the largest sell skews in Info tech and Consumer.

LOs are also better for sale at -11% overall, with supply in Info Tech and Consumer, while buying Fins and Materials.

The dollar rebounded from Tuesday's tumble...

Source: Bloomberg

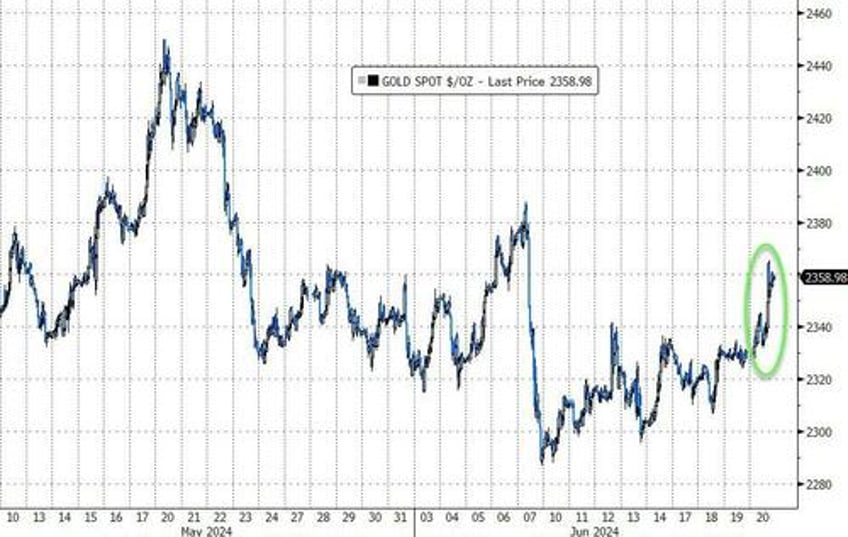

And despite the dollar strength, spot gold rallied back up to $2060, erasing most of the CPI plunge...

Source: Bloomberg

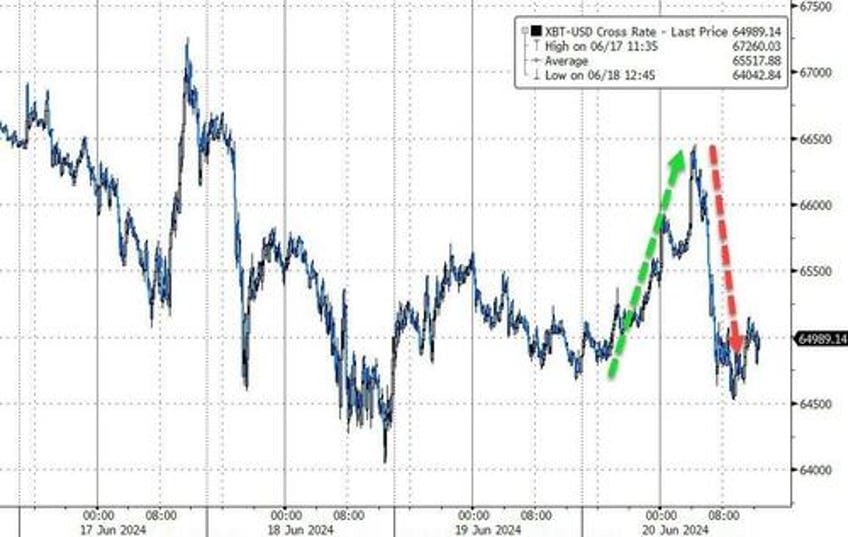

Bitcoin pumped and dumped to end the day unchanged around $65,000...

Source: Bloomberg

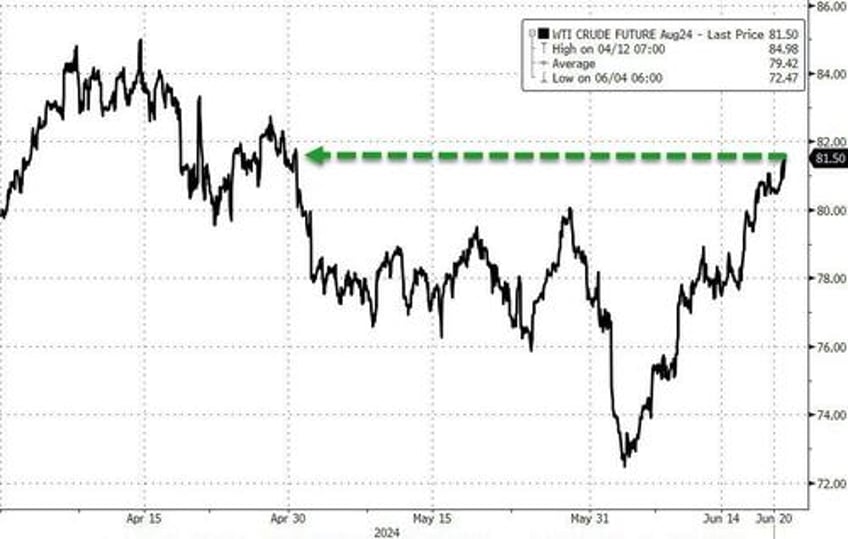

Oil prices extended gains with front-month WTI (Aug '24) up to its highest since April...

Source: Bloomberg

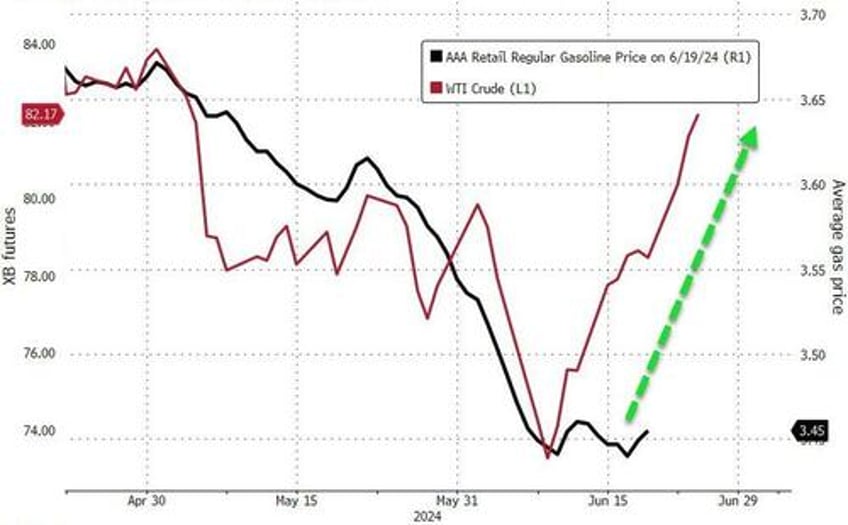

...which is bad news for Biden and Powell as pump-prices are about to reignite...

Source: Bloomberg

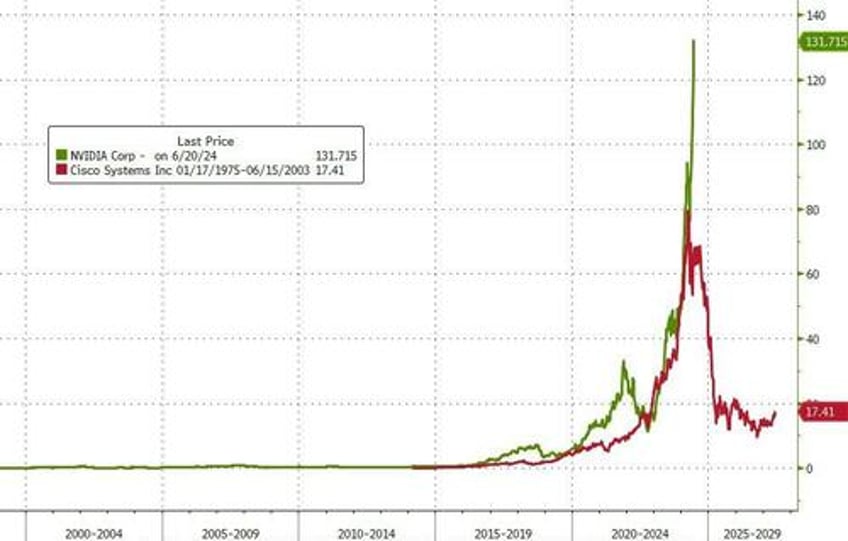

Finally, NVDA had a bad day - its worst day in two months - after hitting a new record high early in the day...

Arguably, it could be a tad overbought here? Blow-off-toppy?

Source: Bloomberg

Was today, the start of the end? We doubt it - but July 17th might be.