The complacency of stocks (and volatility) amid dramatically tightening financial conditions and a shift to '11' in geopolitical has been unprecedented (and recently prompted BofA to suggest crash hedges in light of the fact that "equities remain comfortably numb to macro challenges" as investors piled into large cap Tech as if it was the "new gold".

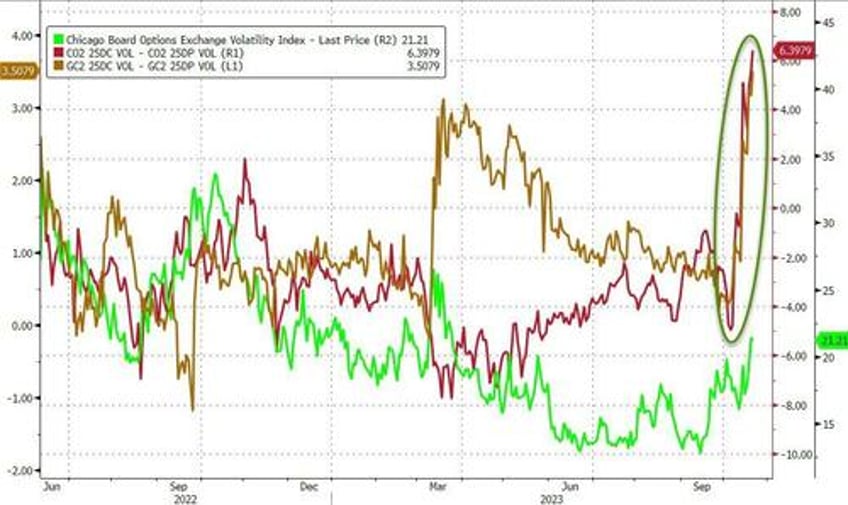

But, if tech is the new gold; gold (and oil) are the new VIX as investors have been aggressively bidding upside calls in both the crisis-commodities (as VIX has only just started to show signs of concern).