As we've been writing over the last year, saturation and competitive pricing are starting to prompt chaos and disorder in the EV space.

EV startup Canoo is the latest to face scrutiny, after it was revealed that CEO Tony Aquila's private jet expenses totaled $1.7 million, twice the company's revenue for 2023.

Despite reporting a loss of $302 million last year, Canoo paid for Aquila's lavish travel, which included either first-class airfare or use of his private jet. Aquila, who also chairs the company, owns about 14% of Canoo. In 2022, Canoo spent $1.3 million on his air travel, according to a new report from Electrek.

The company, which has yet to turn a profit, generated just $886,000 in revenue in 2023.

Canoo is focused on scaling up production of its commercial vehicles and avoiding the fate of other struggling EV startups. While it faces challenges, such as the recent need for a 1-for-23 reverse stock split to prevent delisting, Canoo received a boost with a contract from the United States Postal Service for six delivery vans.

But, amidst a sea of competition and first movers like Tesla, BYD and legacy automakers, companies like Canoo and the near-bankrupt Fisker are struggling. Ergo, the company CEO's spending on private jets raises concerns about how the company manages its finances, particularly given its recent stock drop of up to 38% after reporting losses.

Reuters was first to report the massive cost/revenue divergence.

Canoo responded with a statement: “Had Reuters called Canoo for comment we would have told them that we raised $324 million in 2022, and $288 million in 2023 and we are currently in discussions with several entities and individuals about investing in the company this year.”

“We would have also told them that we have begun manufacturing, expect to step up our manufacturing effort this year, and have a backlog of orders. And, that we are not in the consumer market, we are in the commercial market," the company added.

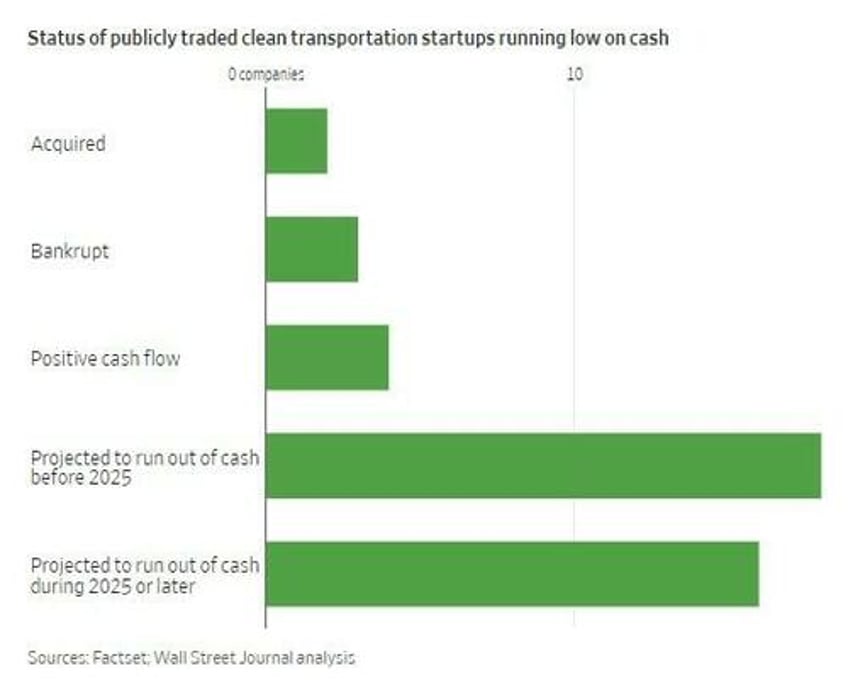

We wrote late last year that all of the Tesla-wannabe EV companies were running out of cash.

The report noted that at least 18 EV and battery startups, including high-profile names like Nikola and Fisker, face the risk of depleting their cash reserves by the end of 2024. These companies, once known for their ambitious goals to revolutionize the industry with electric trucks and SUVs, have struggled with increasing costs and manufacturing challenges.

Names like Lordstown Motors, Proterra, and Electric Last Mile Solutions have already declared bankruptcy, the report notes. Romeo Power, a battery manufacturer, and Volta, a charging company, were sold for much less than their initial public valuations. The remaining firms are reportedly focusing on cost reduction and have secured additional funding.

Gavin Baker, chief investment officer at Atreides Management, told WSJ: “It was by far the most insane bubble I have ever seen.”