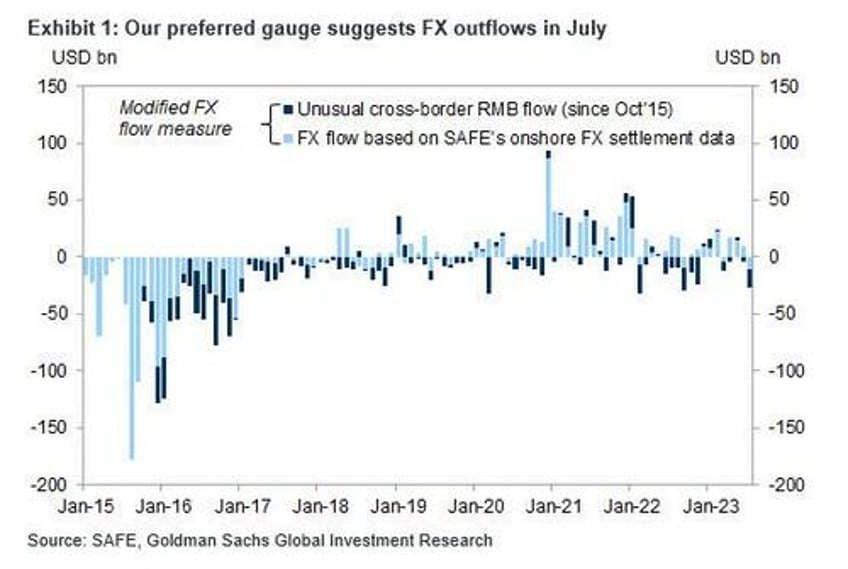

Following the news two weeks ago that China had suffered the largest FX outflow in a year...

... when in July, China suffered $25BN in net outflows via onshore outright spot transactions, offset by $14BN inflows via freshly entered and canceled forward transactions and further outflows via the SAFE dataset on "cross-border RMB flows" which amounted to another $16BN in the month, resulting in net total of $26BN in July outflows, the most since Sept 22, Beijing started taking the accelerating collapse in the yuan very seriously.

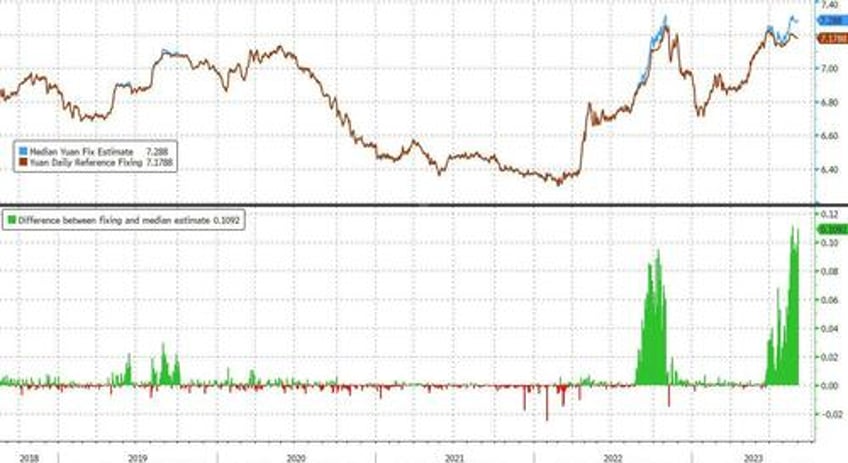

So seriously that it not only declared war on yuan bears with the first ever 1000+ pip gap between the yuan fix and estimates, one which has persisted for the past two weeks culminating with a near record gap of 1,092 moments ago...

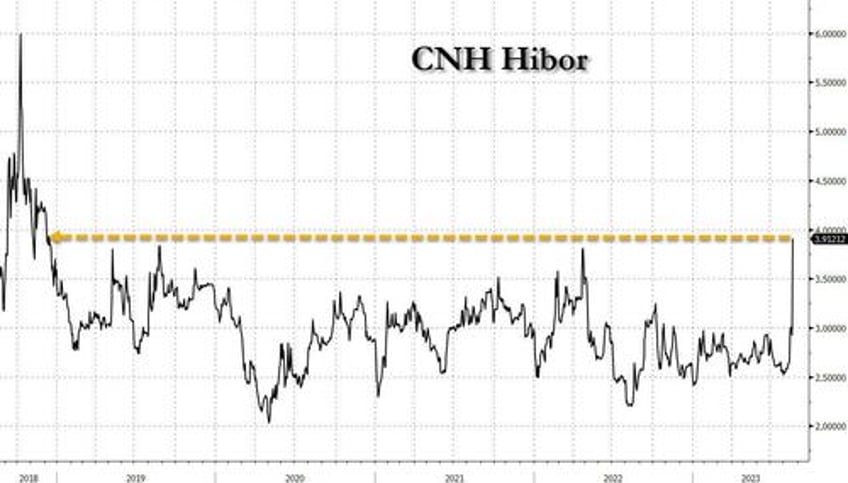

... but a few days later, the PBOC orchestrated the biggest offshore liquidity crunch in hopes of sparking a short squeeze, when the Hong Kong’s offshore yuan interbank rate climbed to the highest since 2018, making holding on to a short yuan position extremely painful.

Neither did much, and the yuan continued to drift not too far from its lowest level on record, just as Citi strategists Philip Yin and Gaurav Garg correctly predicted:

“A CNH funding squeeze could be a tactical tool and a signaling device, but unlikely the go-to tool in isolation. Overall, the combination of rate cut and other FX tools suggest that fundamental-driven yuan weakness is allowed but the pace is managed.”

So fast forward just a few more week, when Beijing revealed the latest tool in its devaluation-fighting arsenal (as the Fed is still stuck in "higher for longer" mode courtesy of the "strong" fake data published daily by the Biden admin and revised lower just a month later) when in the most visible step yet to prop up the bleeding yuan, China reduced the amount of foreign currency deposits banks are required to hold as reserves for the first time this year, to 4% from 6%, effective on Sept. 15.

Cutting FX reserve requirements has been a key part of the China’s playbook to support the yuan over the past two years. It last deployed the tool in September.

The move - which followed a bolder-than-expected deposit rate cut to alleviate potential CNY pressure - boosts the amount of foreign currency available in the local market, making it relatively more appealing for traders to buy the yuan. According to UBS estimates, a 2% cut in the FX RRR will unlock around $19Bn. The resulting increase in USD supply should cause USDCNH lower and so it did, although it is worth noting that after the previous September RRR cut, CNH strengthened by around 1% initially before weakening by 3% over the subsequent three weeks.

“Previous experience suggested that the yuan will be supported briefly by similar measures, but it has not been a step to turn around the direction of dollar-yuan in the medium-to-long term,” said Becky Liu, Head of Greater China Macro Strategy at Standard Chartered. “It is a widely expected move.”

China’s currency slid toward its weakest level since 2007 against the dollar in August, after a surprise interest-rate cut failed to boost investor sentiment damaged by ongoing economic weakness, but certainly weakened the currency further. The currency has fallen around 5% this year amid China’s yawning rate divergence with the US and is among Asia’s worst performers next to the yen and Korean won.

The offshore yuan rose 0.3% to around 7.255 per dollar after the news.

The PBOC has ramped up support for the currency via tools such as setting stronger-than-expected daily reference rate, prompting state banks to sell dollars and tightening offshore yuan liquidity to squeeze shorts. The moves are part of a series of stimulus measures, the latest of which was a reduction in down payments for mortgages to help the country’s under-pressure residential property market.

Becky Liu, head of China macro strategy at Standard Chartered, said that the PBOC’s latest move to reduce the required reserve ratio for foreign currency deposits will support the yuan (if only briefly): "It reaffirmed PBOC’s decisive stance to stabilize the CNY, and will not be a singular move", and yes - the market demands much more.

“This is a very small amount and won’t be sufficient to narrow interest rate differential between CNY and USD by itself” she said adding that previous experience suggested that the CNY will be supported briefly by similar measures, but it has not been a step to turn around the direction of USD/CNY in the medium to long term.

“USD/CNH upside is now largely capped at 7.33-7.35, and we should expect a period of stabilization of the pair near term”

“We see this as a bid by authorities to improve FX funding onshore and to further lower the US-CH rate gap,” said Eddie Cheung, Senior emerging market strategist at Credit Agricole CIB in Hong Kong. “The rate gap has also narrowed since the macro-prudential adjustment coefficient for cross border financing but this is a step further.”

Alas, as with all the other modest, piecemeal steps implemented by the PBOC in recent weeks, any initial strength in the yuan will quickly fizzle as nothing short of a "whatever it takes" bazooka stimulus will be seen by markets as sufficient to prop up the economy, the currency or local markets.