By Bas van Geffen, CFA, Senior Macro Strategist at Rabobank

The European tariff hike on Chinese electric vehicles hasn’t even come into effect, but parties on both sides are already looking for a diplomatic solution. In a meeting between German Economy Minister Habeck and China’s Commerce Minister Wang Wentao, China reportedly offered to lower its existing tariffs on large-engine cars if the European Union cancels the punitive import duties on Chinese EVs.

It’s China dangling the carrot, after it already threatened to apply the stick on European pork exports, and the (predominantly German) car industry, for example. And at the same time that China expresses a willingness to negotiate, it also threatens to file a dispute at the World Trade Organisation.

This apparent willingness to work out an agreement underscores the completely different approach to trade between the parties involved. Brussels’ decision to impose tariffs is based on a formal procedure and an in-depth investigation into unfair state subsidies; it is not intended to be a tool for negotiations and its goal is not to get China to lower its duties on European products.

Yet, Germany’s Scholz reiterated on Monday that he would like to see a negotiated solution. And so, China’s carrots might be driving some change. Minister Habeck was “hopeful” about China’s apparent willingness to negotiate, and German industrial leaders will probably hail the prospect of lower tariffs as a victory. This raises the risk that the German government could try to revert the import duties. That could turn out to be a colossal mistake in the long run. It may bring some short-term gains to Europe’s industry, but it would not help the structural outlook for these manufacturers. It may also drive another wedge into European unity.

The current weakness of the German industry offers some explanation for Germany’s position in the car tariffs discussion. The IFO business climate survey yesterday confirmed that German manufacturing remains in a weak state, echoing the signal from last Friday’s PMI report. The IFO index dropped 0.7 points to 88.6 led by lower expectations. Services and construction (which are both more domestic-oriented sectors) actually improved a bit, but this was offset by a renewed deterioration in trade and manufacturing activity.

After the US and Europe, Canada is now also putting up no-entry signs for Chinese EVs. Finance Minister Freeland formally launched a consultation, which is a first step towards tariffs. Additionally, the Canadian government will also examine the list of electric vehicles that is currently eligible for federal consumer incentives, and potentially “broader investment restrictions” in the Canadian EV industry.

Contrary to the German opposition, the auto industry is actually pushing Trudeau’s government to impose tariffs in order to protect the domestic industry and jobs. But, more importantly, the country will feel some pressure to re-align with the US – who recently raised the import duties on Chinese EVs to prohibitive levels. A review of the North American Free Trade Agreement is coming up in less than two years, and Canada probably does not want to be scolded as the side road into the US market. At the same time, Canada will be mindful of any Chinese retaliation, its second-largest trading partner.

It once again underscores the difficult trade-off facing Western leaders. China, meanwhile, is taking a more strategic approach to its domestic industry. President Xi reiterated that several key technologies are currently controlled by others. Xi said China must strive for self-reliance when it comes to advance technologies, and he called for a greater sense of urgency in research and development in areas like artificial intelligence, quantum technology, and biotech.

But will that be the new growth impulse that the economy needs? Despite all the headwinds that still plague China’s economy, Premier Li expressed confidence that the 5% growth target for this year can be achieved. Li did acknowledge that shaking off the difficulty of growth requires new growth drivers.

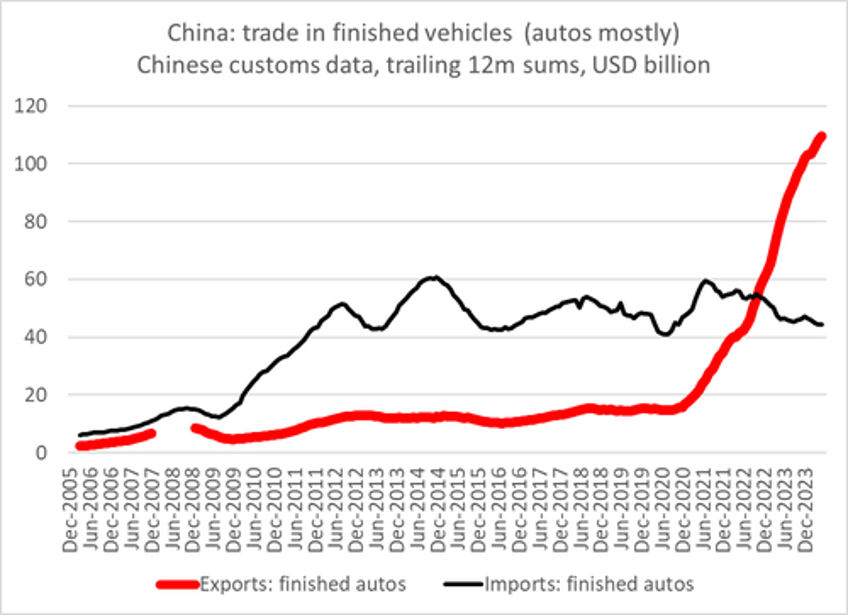

Unofficially, China may still be looking abroad for some of this growth. In fact, it may be another reason why the Chinese government expressed willingness to negotiate on the European tariffs – apart from trying to sow discord in the European ranks. Of course, officially, Premier Li rebutted accusations of industrial overcapacity and dumping: he stressed that Chinese products first and foremost satisfy domestic demand. We would add that this domestic demand has been one of the weak spots in China’s economy, though. And perhaps somewhat contradictory, Li added that China’s manufactured goods help to ease global inflationary pressures and warned that decoupling and protectionism will only raise operating costs across the global economy. At the very least, note that Li is saying this to the West while Xi has just pleaded for more decoupling in key Chinese technologies.