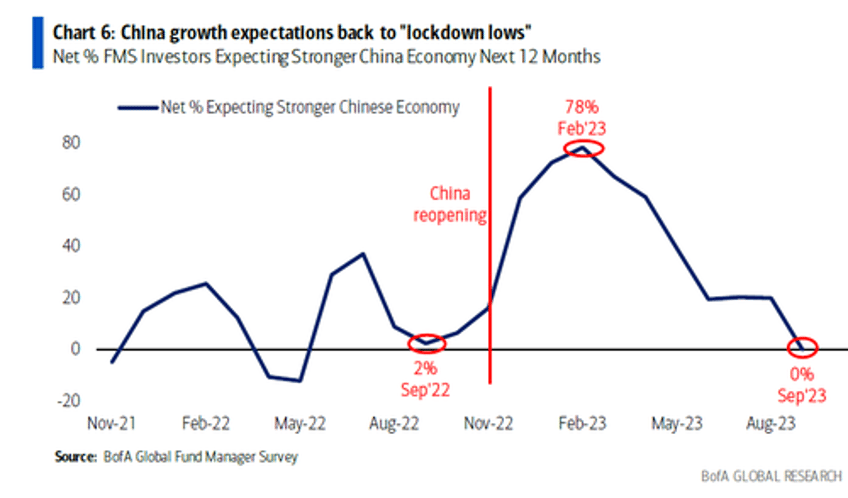

In retrospect it was clear that China was poised for a rebound when the latest edition of the BofA Fund Manager Survey published earlier this week - which without fail exposes the prevailing wrong groupthink on Wall Street and is one of the best sources of contrarian alpha - showed that China sentiment had hit rock bottom.

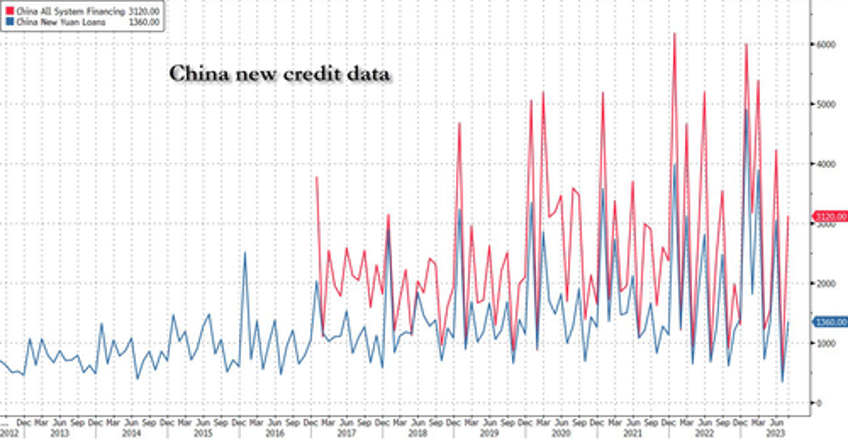

And indeed, just days after we reported that China's new credit had rebounded sharply in August thanks to a surge in new mortgage loans, leading to a 3.12TN yuan jump in China's Total Social Financing...

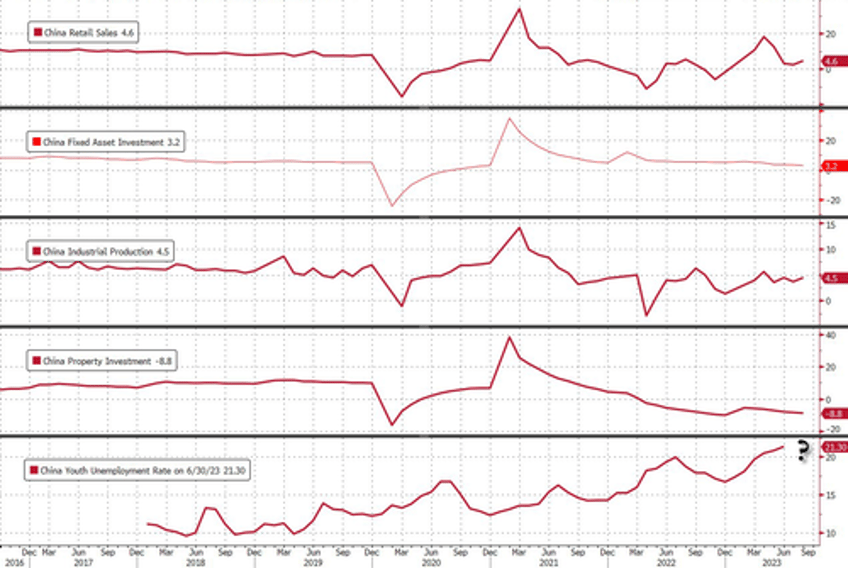

... moments ago we got the latest Chinese data dump for the month of August, which showed that - as expected - the world's 2nd biggest economy has rebounded from the bottom and may be stabilizing. Here are the highlights:

- August Retail sales +4.6%, beating exp. +3.0%, Last +2.5%

- August Industrial Output +4.5%, beating exp. +3.9%, Last +3.7%

- Jan-Aug Fixed Investment +3.2%, missing exp. +3.3%, Last 3.4%

- Jan-Aug Property Development investment -8.8%, Last -8.5%

- China apparent oil demand +22.7% to 14.74mm b/d, unchanged from July

- New property construction falls -24.4% YTD y/y to 639MM sq.m

- August new home prices, excluding affordable housing, -0.29% m/m

And while we would report the most important data point of all, China's record youth unemployment which last month hit a record high of 21.3% (and which according to some is now 50% or more), we can't because Beijing decided to suspend the data series in August after it was clear that the only way to avoid exposing the collapse of China's labor market was to stop reporting about it altogether.

Commenting on the data dump, China's National Bureau of Statistics said that domestic demand expanded as supportive policies were rolled out and employment situation improved in August, but challenges remain.

The domestic economy is still facing “structural and cyclical problems” and policy makers’ focus will be on expanding domestic demand, NBS spokesman Fu Linghui said at a briefing in Beijing Friday. Still, officials expect the domestic economy to continue to recover and improve.

Frances Cheung, a rates strategist at Oversea-Chinese Banking in Singapore, agreed and after the report said that China’s August economic data points to some some stabilization in economic activities, which will set a floor to CNY interest rates, says “The improvement in industrial production and retail sales is encouraging”

Cheung also said that the policy strategy appears to be putting forward numerous measures within a short period of time to achieve some amplified impact, and added that “the outsized MLF together with the more permanent liquidity released from the RRR cut shall provide a strong support to the market.” The unchanged MLF rate suggests policy focus moves away from the price of money to more direct support via fiscal spending and liquidity injection; The cut in the rate on the 14-day reverse repo is simply a catch-up.