China’s export growth tumbled in March compared to last year, sparking questions about a possible yuan devaluation at a time when China's biggest mercantilist competitor in Asia - Japan - has intentionally cratered its currency.

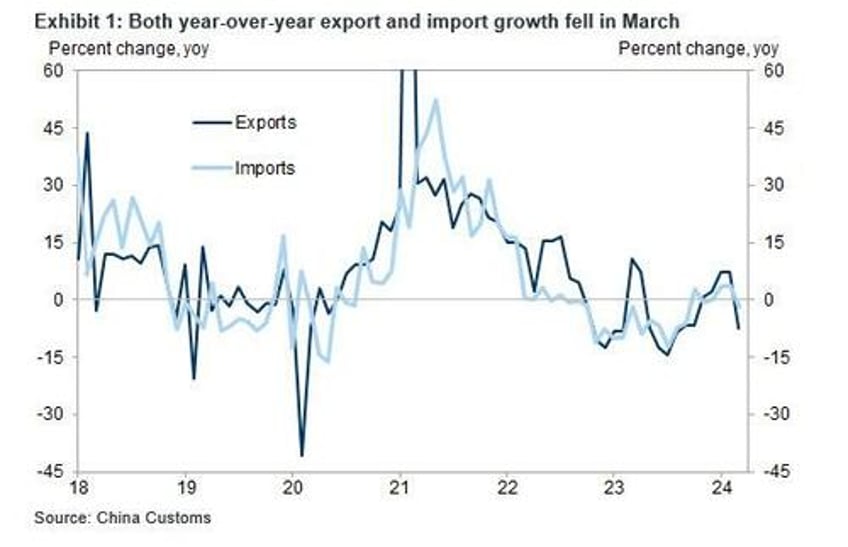

Chinese Exports declined by 7.5% from a year earlier in March to $279.7 billion, far was than the median estimate of a 1.9% drop and was in sharp contrast to the 7.1% growth in combined figures for January and February. It was dragged down due to a higher base in the same period last year, when China reported robust growth of 14.8% at $315.6 billion. Imports also slumped, sliding -1.9% yoy in March, and far below the Bloomberg consensus of a +1.0% increase.

In sequential terms, exports increased by +1.2% in March (vs. +3.5% in January-February), while imports decreased by 1.4% in March (vs. +0.8% in January-February).

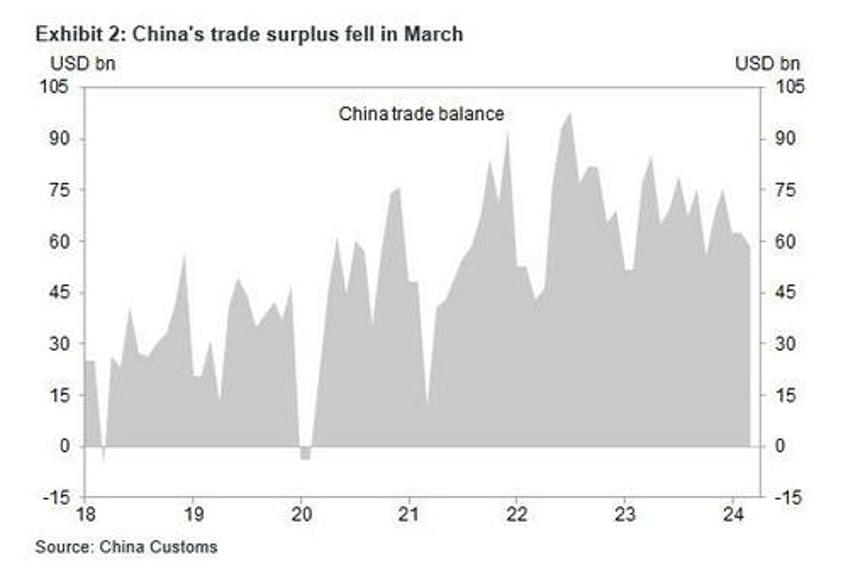

With exports collapsing, China's trade balance also slumped, dropping to just $58.6BN in March, far worse than the Bloomberg consensus of $69.1BN, and down from January-February average balance at US$62.6bn. Today's release of trade data only covers major trading partners and products. The detailed breakdown of trade by country and by product will be released on April 20.

Some more highlights:

- By major destination, export value fell sequentially across major trading partners except for ASEAN. The high bases last March drove year-over-year export growth deeply negative. Among major DM countries, exports to the US dropped by 15.9% yoy in March (vs. +2.6% yoy in January-February), and exports to the European Union declined by 14.9% yoy in March (vs. -2.3% yoy in January-February). Among major EM economies, exports to ASEAN fell by 6.3% yoy in March (vs. +0.1% yoy in January-February).

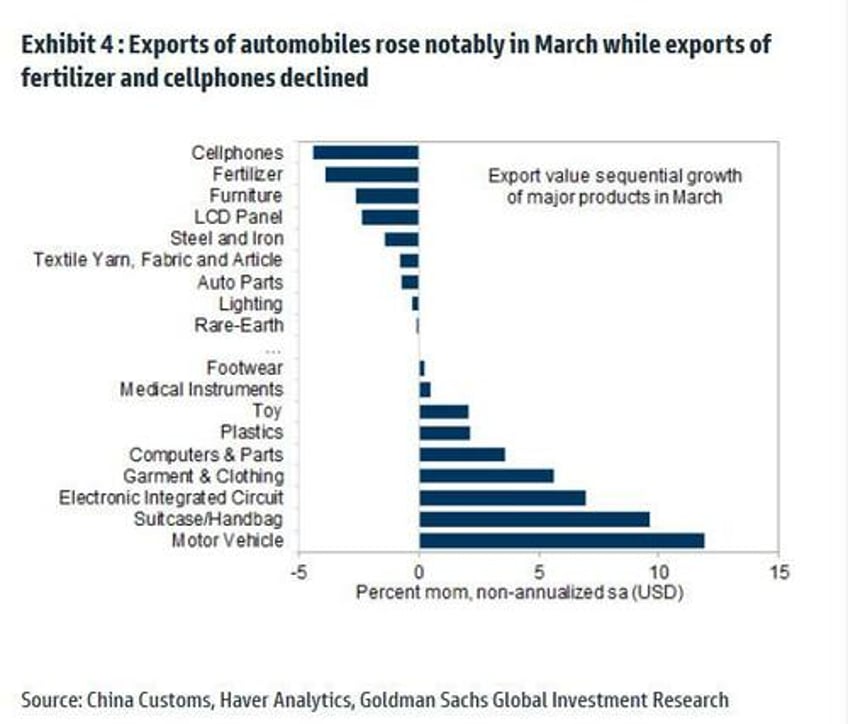

- By major category and in sequential terms, exports of automobiles rose notably in March while exports of fertilizer and cellphones declined. On a year-over-year basis, export growth of tech-related products remained strong. Export of chips increased by 11.5% yoy in March (vs. +21.4% yoy in January-February) with +7.0% sequential growth (mom non-annualized sa). Export growth of housing-related products moderated notably in March: for example, exports of furniture dropped by 12.3% yoy in March (vs. +28.7% yoy in January-February).

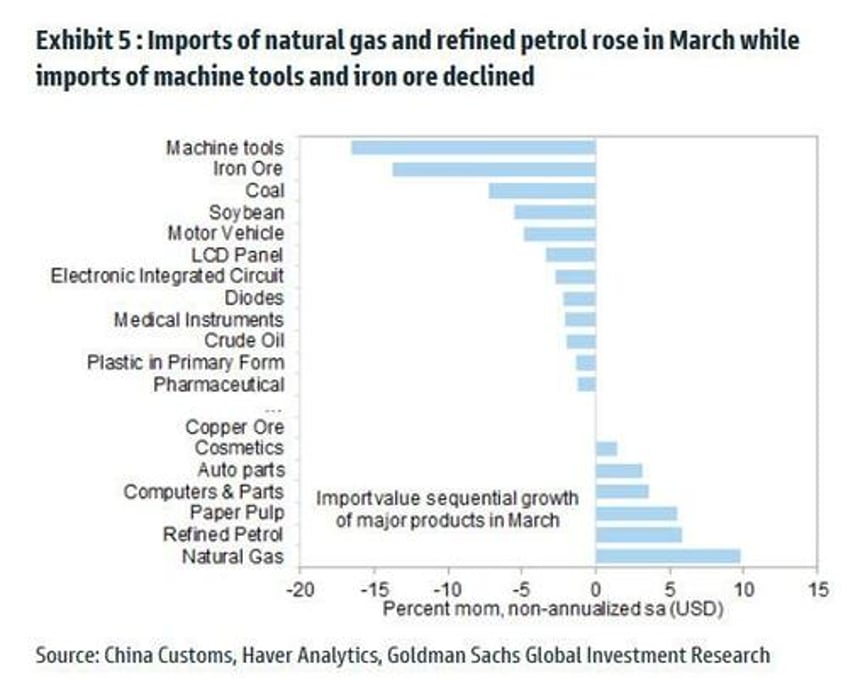

- Among major categories and in sequential terms, imports of natural gas and refined petrol rose in March while imports of machine tools and iron ore declined. For major commodities and on a year-over-year basis, import growth of metal ores remained solid in March while import growth of energy-related goods moderated. Specifically, import value of crude oil declined by 3.5% yoy in March (vs. +3.6% yoy in January-February) with import volume down 6.2% yoy (vs. +5.0% yoy in January-February). Import value of iron ore rose 7.5% yoy in March (vs. 33.0% yoy in January-February) with import volume up 0.5% yoy (vs. 7.9% yoy in January-February). On tech-related products, import growth of chips moderated significantly in March (+2.0% yoy in March vs. +14.4% yoy in January-February).

Last year, China experienced its first decline in export growth in seven years, with shipments dropping by 4.6% due to weak external demand. It created additional challenges amid Beijing’s efforts to revive the post-pandemic economy, as it was also grappling with an exodus of foreign investment, waning market confidence and potential trade barriers.

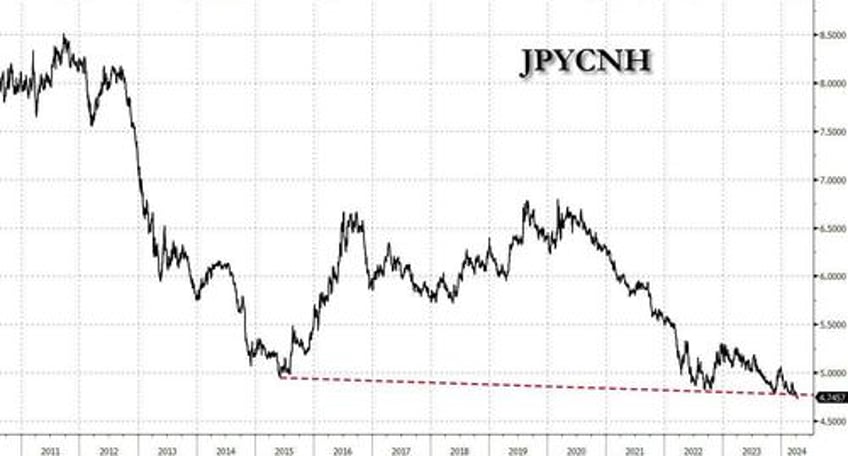

Meanwhile, as Bloomberg notes, the dismal trade numbers will only add to the worries over the world’s second-biggest economy, which bodes poorly for a yuan that’s been in retreat this year, which incidentally is just what Beijing wants since China desperately needs a weak currency to make its exports cheaper, which however is proving very difficult with the yen not only sliding to a record low against the yuan, but dropping below a key support level.

Dollar-yuan is being driven by the contrasting outlooks for central bank policy, along with the direction of USD/JPY.

Bloomberg's conclusion here is that until there is official support for the yen - which seems unlikely even as the Japanese currency crater to a new record low every single day - or a shift back to expectations for early Fed interest rate cuts, "there isn’t much Chinese authorities can do about an outperforming US dollar. Especially as the PBOC is seen easing monetary policy again this year." We disagree, especially because the PBOC is seen easing monetary policy: China can - and at this rate will have no choice but to - devalue the currency, and while so far it has been doing everything in its power to telegraph that it will defend the yuan and avoid a repeat of the record capital outflows from 2015, one day Beijing will shock everyone when it announced that the Yuan has lost 10% of its value overnight, and which point the surge in crypto and gold will truly shine.

The bottom line is that Beijing continues to be trapped: either keep the currency artificially "stable" and suffer continued trade loss to competitor Japan which is crushing its currency, or devalue the yuan and regain the mercantilist throne, however at the expense of massive capital outflows.