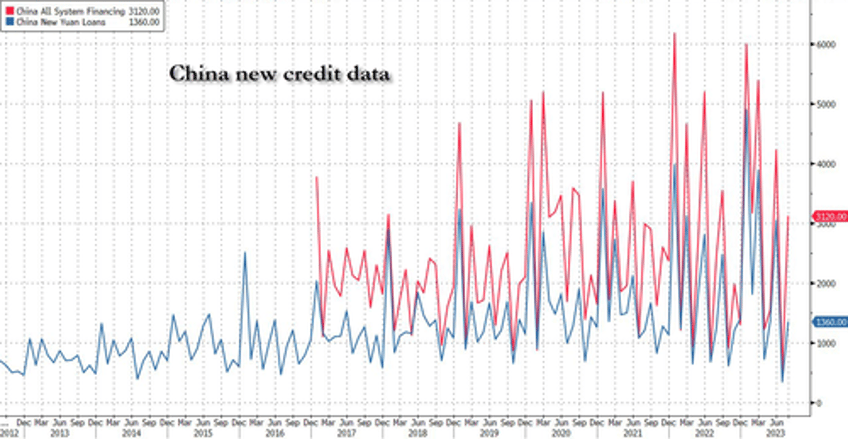

With China's economic data on a relentless downslope for the past several months, there was a sliver of hope this morning when the PBOC reported the latest credit data which came in stronger than consensus expected after a dismal July, as seasonal patterns and policy easing likely contributed to the rebound of credit growth in August.

With total social financing and new loan growth rebounding strongly last month, household loan growth rose to a still-modest 4.7% MoM annualized from 0.8% in July, mainly due to faster household short-term loan growth. Corporate medium to long term loan growth increased to 12.2% month-over-month annualized from 7.3% in July.

Key numbers:

New CNY loans: RMB 1.36tn in August, above consensus: RMB 1.25tn.

Outstanding CNY loan growth: 11.1% yoy in August; July: 11.1% yoy (+7.8% mom sa ann).

Total social financing: RMB 3.12tn in August, above consensus: RMB 2.7tn, up from July's RMB 2.5 trillion in August 2022

TSF stock growth: 9.0% yoy in August, vs. 8.9% in July.

M2: 10.6% yoy in August, missing Bloomberg consensus: 10.7% yoy; down from July's 10.7% yoy

And visually:

Credit extension is typically stronger in August after a drop-off in the prior month, although this July’s slump was particularly steep as businesses and consumers curbed demand for loans.

Monday’s figures showed new household mid- and long-term loans, a proxy for mortgages, was 160 billion yuan in August, reversing from the contraction in July. That suggests homeowners scaled back their early repayment of mortgages, possibly due to declining rates for existing mortgages.

“Mortgage loans rebounded, which indicates the rate cuts and policy easing in the property sector helped to boost buyers’ sentiment,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd. “The key question is to what extent the economic momentum can be sustained. The development in the property sector remains to be the main driver for economic outlook in the rest of this year.”

Medium and long-term loans to companies, usually driven by corporate investment appetite, climbed to 644 billion yuan last month from 271 billion yuan in the previous month.

The latest figures show possible signs of stabilization in household demand for mortgages after authorities took a number of steps to help bolster the real estate market. That adds to other recent indicators showing the worst of China’s economic slump may be over: exports contracted at a milder pace in August than the previous month, a key manufacturing gauge improved slightly and deflation pressure eased.

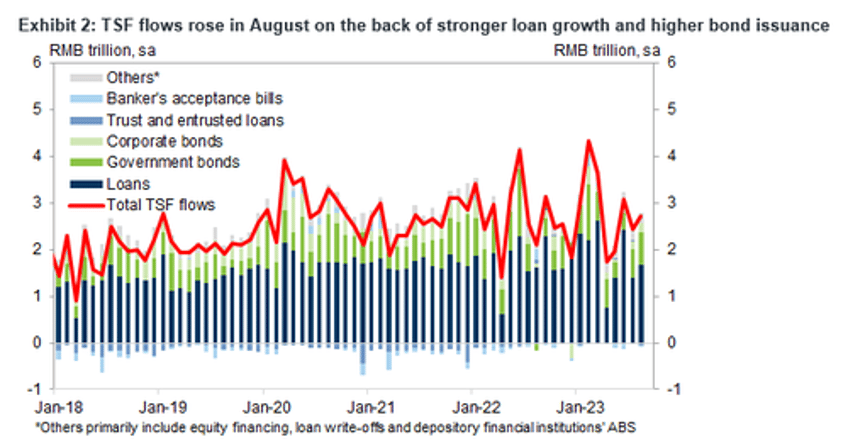

Overall total social financing growth was 8.9% month-over-month annualized, faster than 6.9% pace in July, with both bond issuance and loan extension improved in August; according to Goldman, September credit growth could remain solid (unless of course it doesn't).

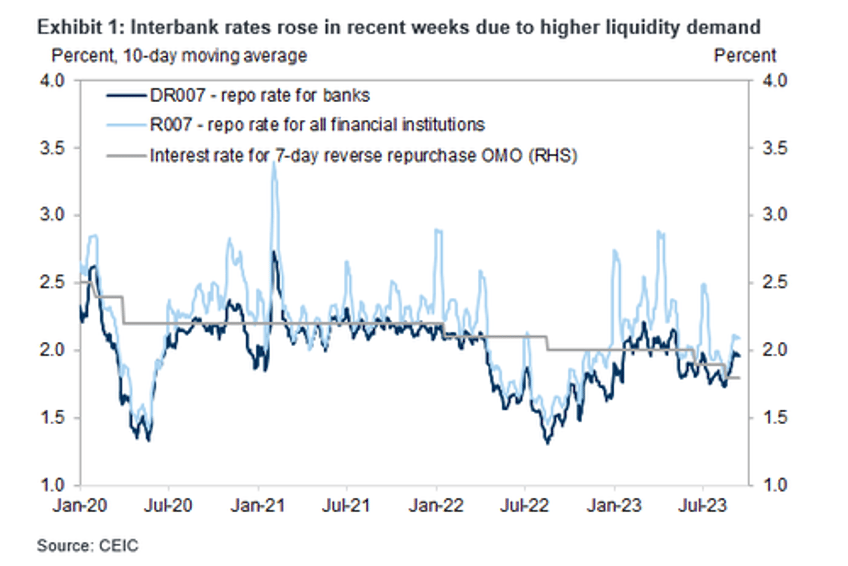

TSF growth will still be supported by strong government bond issuance as there remains around RMB 660bn local government special bond quota to be issued by the end of September. Interbank rates drifted higher in recent weeks. That said, Goldman still expects a 25bp RRR cut before the end of September to facilitate government bond issuance.

More details:

1. August total social financing (TSF) came in above expectations after the weak growth in July. The sequential growth of TSF stock rose to 8.9% mom sa annualized in August from 6.9% in July. In year-on-year terms, TSF stock growth edged up to 9.0% from 8.9% in July. New TSF flows have shown more pronounced seasonality in recent years, and the dissipation of negative seasonal factors in July added to the faster broad credit growth in August.

New loan flows rose to 1.7 trillion RMB from 1.4 trillion RMB in July. Corporate and government bond net issuance increased and shadow banking credit contracted.

Corporate bond net issuance was RMB 182bn, higher than the net issuance of RMB 156bn in July;

Government bond net issuance increased to RMB 691bn from RMB 618bn in July (On non-seasonal adjustment basis, government bond net issuance rose more materially to RMB1180bn, vs RMB411bn in July)

Trust loans, entrusted loans and undiscounted bankers’ acceptance bills combined contracted by RMB 68bn vs an expansion of RMB 17bn in July. (Exhibit 3 and Exhibit 2)

2. Overall CNY loans were stronger than market expectations as well. Both household and corporate loan growth accelerated in August. In particular, household short-term loan growth accelerated more than medium to long term loan growth, likely helped by declines in interest rates.

Household medium to long term loan growth was 3.4% month-over-month annualized, higher than 2.3% in July but still much slower than overall loan growth, dragged by sluggish property transactions in the month.

Corporate overall loan growth was 12.5% month-over-month annualized in August vs 10.2% in July, and medium to long term loans to corporate grew 12.2% month-over-month annualized, vs 7.3% in July.

Bill financing rose by 32.6% month-over-month annualized, vs a 28.2% expansion in July. The PBOC cut policy rates again in August after the cuts in June, which likely helped loan extension in the month.

Fiscal deposits fell by RMB 8.8bn this August, vs an average of RMB 109bn increase in previous five years, despite the strong government bond issuance in the month. This implied fiscal expenditures had likely been fast in August. The funding need related to project investment might have added to corporate medium to long term loans growth as well.

3. M2 growth slowed to 10.6% yoy in August from 10.7% in July. On a sequential basis, M2 growth rose to 9.6% month-over-month annualized, vs +6.4% in July, on the back of faster broad credit growth.

4. August credit and money data beat expectations after the very soft growth in July.

Seasonality and stronger policy support likely contributed to the improvement in credit data. There is more significant seasonality in TSF and loans data in recent years, and the dissipation of negative seasonal factors in July added to the broad credit growth in August in our view.

Looking forward, more favorable seasonality (credit growth tends to accelerate further in September) and the strong government bond issuance pipeline would argue for solid TSF growth.

There remains around RMB 660bn local government special bond issuance quota to be used by September. Interbank rates drifted higher in recent weeks on the back of higher liquidity demand (Exhibit 1).

5. PBOC held the nationwide FX market self-regulatory meeting today. PBOC usually holds this meeting when the authority would like to provide guidance on the FX market. The previous meeting was held in September 2022 when RMB faced depreciation pressures. The meeting statement reiterated that policymakers would maintain the broadly stable exchange rate and strictly prevent excessive moves in the market. Today's countercyclical factor in CNY fixing was also the most negative (showing the authority's strengthening bias in the currency) on record and front-end CNH funding rates rose significantly on likely CNH liquidity management.

As China's economy has foundered since its aborted post-covid recovery, the PBOC has been pushing banks to extend more loans to the private sector to help boost business confidence. Banks have also been encouraged to cut mortgage rates and China’s largest cities have been lowering down payments for homebuyers to spur the property market.

The PBOC-managed Financial News published a report shortly after the data, citing unnamed people close to regulators saying the overall amount of financial support to the economy is sufficient. Structural tools will be used to solve targeted problems in the economy, according to the report.

The newspaper cited the policy support measures for the better-than-expected credit data in August, as well as an improvement in market expectations and sentiment.