Bitcoin has reached a new record high in over 30 currencies this week, including India and Japan (and the euro this morning), but the cryptocurrency's nearing record highs in China has sparked renewed warnings from Chinese state media about the risks of investing in cryptocurrencies, as interest around digital assets remains strong in the country despite a sweeping ban on crypto mining and trading.

Bitcoin has passed all-time highs in 30+ countries, including China and India. pic.twitter.com/63CnC9DE0F

— Balaji (@balajis) February 28, 2024

As SMCP reports, a rebound in bitcoin prices cannot “hide” the underlying risks of the digital asset, state-owned newspaper Economic Daily said on Sunday.

Wild fluctuations in bitcoin value remain the norm, and cryptocurrencies have yet to enter the mainstream, the article said, adding that regulatory scrutiny of the market remains tight.

Investors should maintain a “clear and rational” mindset, it said.

Bitcoin in Renminbi very close to record highs...

Chinese state media has persistently tried to dissuade people from engaging in cryptocurrency-related activities, as authorities cited risks of capital flight and financial instability.

In September 2021, 10 government bodies escalated the country’s crypto ban by jointly declaring a broad range of cryptocurrency-related activities as illegal financial activities.

In 2022, as cryptocurrency prices plunged following a series of company meltdowns, the Economic Daily warned that the prices of bitcoin, which the newspaper called “nothing more than a string of digital codes”, could head to its “original value” of zero.

In the same year, executives at Blockchain-based Service Network, a state-backed Chinese initiative pushing for the commercial adoption of blockchain technology, called cryptocurrencies “the biggest Ponzi scheme in human history”.

All that sounds very familiar to the narratives of Liz Warren, Jamie Dimon, and Gary Gensler (who of course have no dog in this fight at all).

In case you're confused: yes, crypto trading and mining has been banned in China since 2021.

But, battered by a slumping stock market, Reuters reports that more and more Chinese investors are using creative ways to own bitcoin and other crypto assets that they believe are safer than investing in crumbling stock and property markets at home.

China's economic downturn "has made investment on the mainland risky, uncertain and disappointing, so people are looking to allocate assets offshore", said a senior executive of a Hong Kong-based cryptocurrency exchange, who declined to be identified due to sensitivity of the topic.

Bitcoin and crypto assets have attracted such investors, he said:

"Almost everyday, we see mainland investors coming into this market."

The underground crypto market in China is thriving as many believe that Chinese officials are cognisant of how disruptive bitcoin can be and yet aware of its huge potential, and hence their endorsement of crypto trading in Hong Kong, to keep a toehold in the crypto business booming in financial centres such as Singapore and New York.

Dylan Run, a Shanghai-based finance sector executive, started moving a bit of his money into cryptocurrencies in early 2023, when he realized that the Chinese economy and its stock markets were going downhill.

"Bitcoin is a safe haven, like gold," says Run.

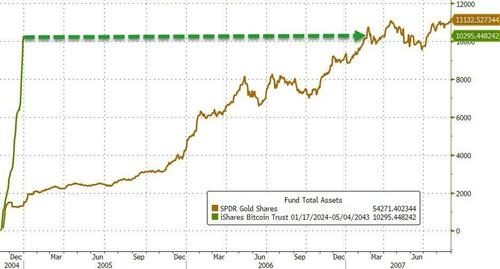

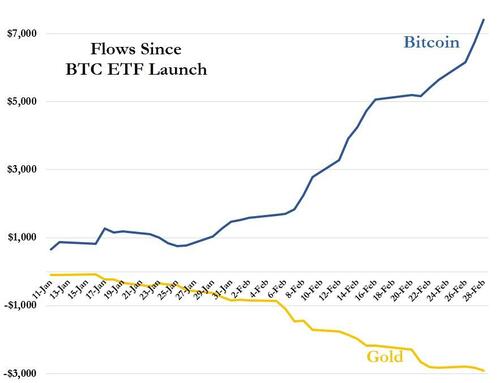

Speaking of gold, it took the first Gold ETF over two years before its AUM hit $10BN, BlackRock’s iShares Bitcoin Trust (IBIT) has amassed $10 billion in assets under management in just seven weeks.

“Bitcoin ETF inflows have absolutely blown gold’s out of the water. Not even close, utterly dwarfed, decimated,” said Reflexivity Research co-founder Will Clemente on March 3.

But, notably, while Gold ETFs have seen outflows, the price of gold is breaking out to the upside also, near record highs.

Peter Schiff remains unimpressed. On March 2, he said CNBC was so fixated on the “sideshow going on with Bitcoin and the new Bitcoin ETFs, that they haven’t even reported on today’s $43 rise in the price of gold or the new record-high price in the gold ETF GLD.”

But Michael Saylor remains committed and believes that "we’re in the Bitcoin gold rush era. It started in January of 2024 and will run until about November of 2034.”

Specifically, he explained in a recent interview, institutions will compete to capture as much of Bitcoin’s ever-decreasing supply as possible until the end of 2034, as 99% of Bitcoin will have been mined by then.

MUST WATCH‼️ - Michael Saylor:

— Neil Jacobs (@NeilJacobs) March 1, 2024

We are in the Bitcoin Gold Rush era. It started in January 2024 and will last until the end of 2034 when 99% of all Bitcoin will have been mined. #Bitcoin pic.twitter.com/LbAAaYRgMo

As CoinTelegraph reports, Saylor also said the spot Bitcoin ETFs are currently only serving as a “distribution channel” to 10–20% of those interested at the moment, but he sees this rising upward to 100% once banks and institutional wirehouses start facilitating Bitcoin trades.

“When they can buy via their bank, their institutional wirehouse, their prime broker, they will make a $50 million decision in one hour.”

Saylor believes almost all banks will eventually be pressured into custodying Bitcoin because their largest clients demand it. “You’re going to see resistance drop," he said, adding:

“There will be a day where Bitcoin blasts past gold [and] trade more than the S&P index ETFs.”

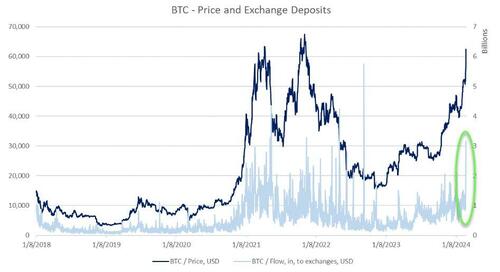

And, according to Goldman Sachs flows desk, there is a growing interest from institutional investors.

The GS ETF desk has been at the forefront of client conversations around these products, leveraging our broader digital assets team to tailor a suite of ETF-based BTC solutions.

Desk flows have been dominated by high net worth individuals and retail – the desk has been interacting with these requests via RFQ platforms and direct inquiries.

The products are starting to pick up with block volume...

'Block volume' is usually associated with large institutional traders, not HNW or Retail.

The desk has also been fielding inquiries around products switches out of spot and into the ETFs given the product efficiencies – as these ETFs continues to grow and institutional investors enter the space, would expect to see an uptick in this type of flow.

But bitcoin getting big again raises the specter of the kind of government intervention we have seen before (just as China did above).

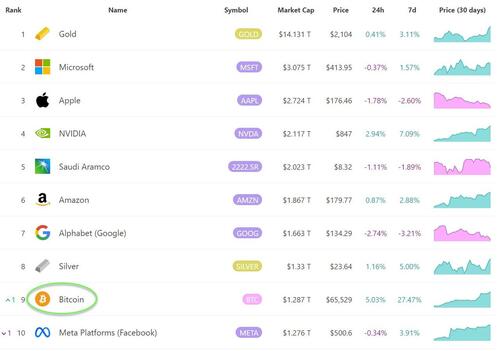

Big? Bitcoin just overtook Meta in terms of market cap...

And how will governments intervene.

Well we have already seen some hints, with claims that crypto-mining is sucking the grid dry, killing the climate, and leaving us all cold and starving (ok some hyperbole offered there, but it's coming). Michael Saylor has an answer for that canard too as he sees some of the heat coming off of Bitcoin when it comes to environmental concerns in the future, if not already.

He argued that as Bitcoin has become increasingly energy-efficient, politicians and environmental lobbyists are starting to shift their attention to AI’s energy demands.

“If you look at AI, a lot of these hyper scalers are looking to scale up 60 gigawatts this year, and they’re wanting to go to 600 gigawatts within a decade, so what’s going to happen is they’re going to inherit all of the energy FUD [fear, uncertainty and doubt] that we used to have.”

“So they will actually throw all their lobbyists at that.”

Correct.

— John Bottomley (@BitcoinVeritus) March 3, 2024

AI is extremely dirty (energy wise) and thirsty (water demand).#Bitcoin is increasingly powered by clean renewables and doesn’t need water.

The other potential way for governments to intervene is directly.

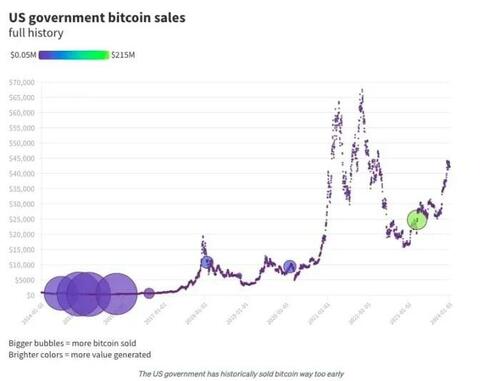

As Landon Manning writes at Bitcoin Magazine, the US federal government has once again added to its substantial Bitcoin hoard, transferring $922 million worth from wallets associated with Bitfinex hackers in a seizure.

Over the course of a series of various seizures and other asset forfeitures, the United States federal government has accumulated and holds enough Bitcoin to unquestionably count as one of the largest whales.

Even though hundreds of millions of bitcoins from this source have already been sold at government auctions or through other means, there are still billions left to go. For their part, law enforcement agencies seem to be in no hurry to wash their hands of these assets.

Regardless of what the government’s plans are with this money, a seizure like this has once again highlighted the sheer size of the federal government’s Bitcoin reserve. Thankfully, the government’s dealings with these assets are all a matter of public record, and Bitcoin transactions themselves are all completely transparent on the blockchain.

In fact, the government currently holds nearly 1% of all Bitcoin in circulation. Regardless of claims that prosecutors have no interest in maximizing profits when disposing of these assets, it’s undeniable that the government holds substantial leverage over the whole space.

These seizures are particularly interesting due to some recent comments made by exiled whistleblower Edward Snowden. Specifically, considering the rising global acceptance of Bitcoin in regulation and traditional finance, Snowden predicted that “A national government will be revealed this year to have been buying Bitcoin—the modern replacement for monetary gold—without having disclosed that fact publicly”.

Prediction: A national government will be revealed this year to have been buying Bitcoin—the modern replacement for monetary gold—without having disclosed that fact publicly.

— Edward Snowden (@Snowden) February 28, 2024

The question is, of course, will they 'sell' or are they acquiring - If Bitcoin is the digital gold, after all, it would only make sense that powerful nations would want to build up reserves.

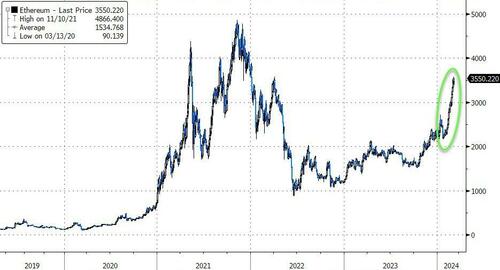

But, it's not all about Bitcoin, Ethereum has started the week strongly, topping $3500, just 9 days away from pushing the Dencun upgrade to mainnet on March 13.

As Decrypt reports, it's long been said that the upgrade, which will introduce proto-danksharding to the network, will make transactions much faster and cheaper.

Additionally, as Jack Inabinet writes at Bankless.com, while Wall Street has no woken up to bitcoin ETFs' potential, they have yet to price that into ETH's future.

Mike Novogratz, CEO of crypto investment firm Galaxy Digital, made his opinions on the matter public this week, stating that he sees spot ETH ETFs receiving approval sometime this year in a Bloomberg interview.

There is a litany of reasons that Novogratz may be eyeing this year for approval, but chief among them is the SEC’s May 23 deadline to approve or deny VanEck’s spot ETH ETF application, the earliest final approval date among active proposals.

New deadline to obsess over just dropped

— Will (@WClementeIII) January 10, 2024

May 23rd is the final deadline for decision on VanEck’s spot ETH ETF pic.twitter.com/dgi5EVbPeQ

While the SEC has listed numerous crypto assets, including the tokens of alternative proof-of-stake blockchains like Solana, as potential securities in its lawsuits against crypto exchanges, not a single enforcement action has contemplated Ether as a potential security.

Further, the SEC appears to have already provided clarity on its decision to consider ETH as a non-security by voting to approve ETH ETFs that hold commodity futures last October!

By approving ETH ETFs based on ETH commodity futures contracts, the SEC has officially provided clarity on ETH’s status as a non-security. With so much innovation being built on the Ethereum blockchain, this creates a clearer path for builders. It's ridiculous and insulting that…

— Brian Quintenz (@BrianQuintenz) October 2, 2023

Spot crypto ETFs provide a direct connection between TradFi capital stores and crypto markets; the extremely high likelihood that ETH ETFs receive approval from the SEC has some eyeing long ETH as one of the most obvious trades in crypto, especially when considering when you can have both ETH exposure and farm upcoming restaking airdrops…

The Bitcoin ETF broke records.

— RYAN SΞAN ADAMS - rsa.eth (@RyanSAdams) March 1, 2024

Next up: everyone front-running the Ethereum ETF.

We could get $10k ETH just on that.

ETH is the most obvious trade in crypto rn.

As Bitcoin’s halving approaches this April, it's equally important to pay attention to Ethereum’s ultra sound money properties and the accelerating pace of Ether deflation.

All this talk about halving and meanwhile... pic.twitter.com/TtpnOSOql6

— zerohedge (@zerohedge) March 1, 2024

Should we merely be at the beginning stages of a bull market, it is probable that a future influx of users to Ethereum (and its L2s) will increase the rate of Ether burn, allowing the ecosystem’s monetary policy to shine through to external capital who can ape via spot ETF!

Finally, as CoinDesk reports, more than 97% of BTC addresses are now "in the money," according to data tracked by analytics firm IntoTheBlock. That's the highest proportion since November 2021, when the largest cryptocurrency by market value hit a record high around $69,000.

"Given the substantial percentage of addresses in profit, the selling pressure from users attempting to break even no longer has a significant effect," IntoTheBlock said in a newsletter published Friday, when BTC traded near $62,000.

Judging by today's price action...