By John Liu and Zhu Lin, Bloomberg Markets Live reporters and strategists

An intervention in the stock market. Liquidity injections by the central bank. More curbs on short selling. And yet, Chinese stocks can’t escape the real estate sector’s spiral of gloom.

Data last week showed that property investment — a key driver of China’s economic activity — continued to slump, while home prices fell at the fastest pace in almost a year in September. That negated investor optimism over data showing a pickup in third-quarter economic growth.

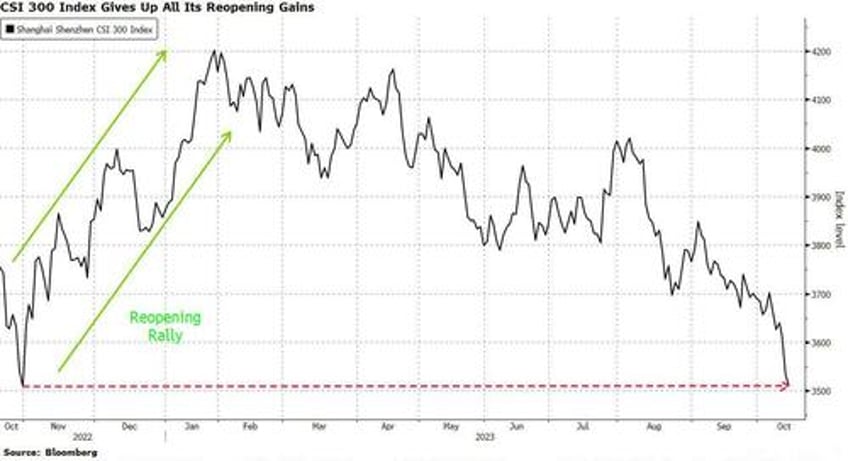

The main CSI 300 Index slid more than 4% last week, its worst in a year, erasing all the gains seen during its epic reopening rally that took off late last year. The selloff came despite the slew of market-boosting policies, including tightening of curbs on short-selling activities.

“Investors need to see a way out of all the major problems, like the property woes,” said Hao Hong, chief economist at Grow Investment Group. “How Beijing manages its property market and handles its relationship with the US” are key, he said, adding that “nobody cares about economic data” right now.

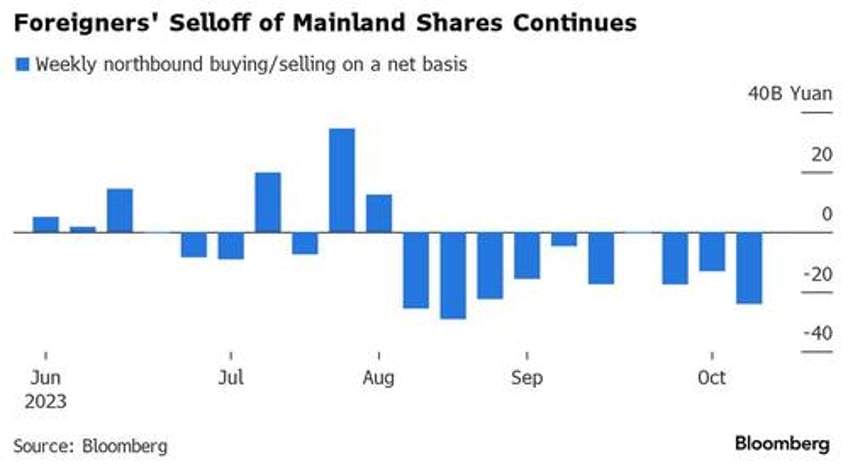

Weakness in global stocks spurred by geopolitical tensions in the Middle East worsened the pain for China’s market, with foreigners offloading 24 billion yuan ($3.3 billion) of onshore stocks on a net basis last week. That’s the most since the week ended Aug. 18. Still, Morgan Stanley advised against buying the dip, cautioning that sentiment is likely to stay fragile and foreign fund outflows could persist.

A Bloomberg Intelligence gauge of Chinese developers’ stocks hit its lowest level since 2009 last week as efforts to boost the housing market failed to win over investors. Homebuyers remain cautious and several large developers like Country Garden Holdings Co. continue to suffer from liquidity woes.

“If there’s stabilization on the real estate side and a pick up in consumer confidence, that will be the next thing that will drive the rally we’ve been waiting for,” Elizabeth Kwik, investment director of Asian Equities at abrdn, said in a Bloomberg Television interview.

Some market watchers say upcoming events including the politburo meeting and Third Plenum, and a potential meeting between US President Joe Biden and President Xi Jinping at the APEC Summit next month could offer catalysts.

“We do see two key risks hanging over China’s economy — the first one is property and the second is local government debt,” said Minyue Liu, an investment specialist for Asian and Greater China equities at BNP Paribas Asset Management in Hong Kong. “These issues have not yet been resolved. We heard that the government is working on a comprehensive plan. We do hope this will be announced soon.”

China is considering forming a state-backed stabilization fund to lift confidence in its $9.1 trillion stock market, Bloomberg reported earlier this month, citing people familiar with the matter. The CSI 300 Index briefly pared losses following the news but finished the day in the red.

Down nearly 10% in 2023, the gauge is set for an unprecedented third straight year of losses, as investors set a high bar for good news.

“Recent measures taken by the government cannot solve the economic issue that China is facing, particular in the property sector,” said Tina Teng, an analyst at CMC Markets in New Zealand. “Despite the recent positive data, investors remain cautious. The data has to be consistent and keep improving to convince them.”