One day after Hong Kong stocks crashed the most since Lehman even as Chinese A-shares jumped to catch up after a weeklong holiday, on Wednesday China's mainland stocks ended a stimulus-induced winning streak with a thud as questions swirled over how far the authorities are willing to go to support the sluggish economy and as anticipation for stimulus faded.

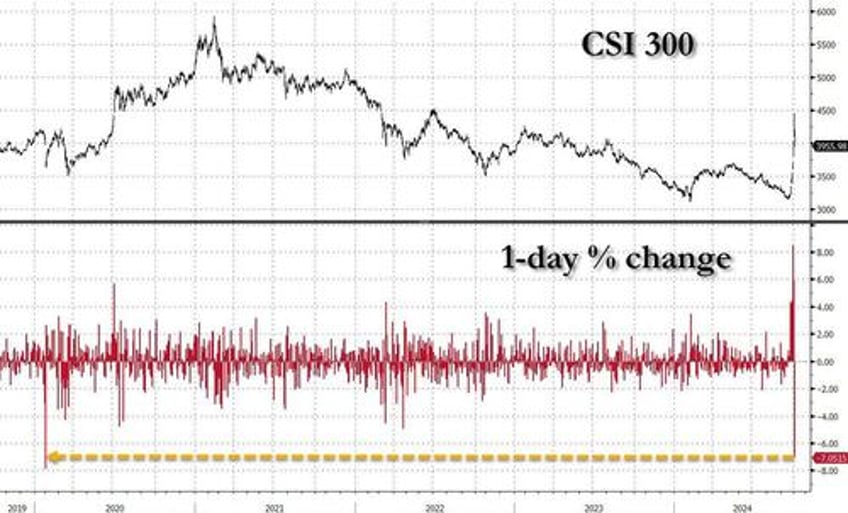

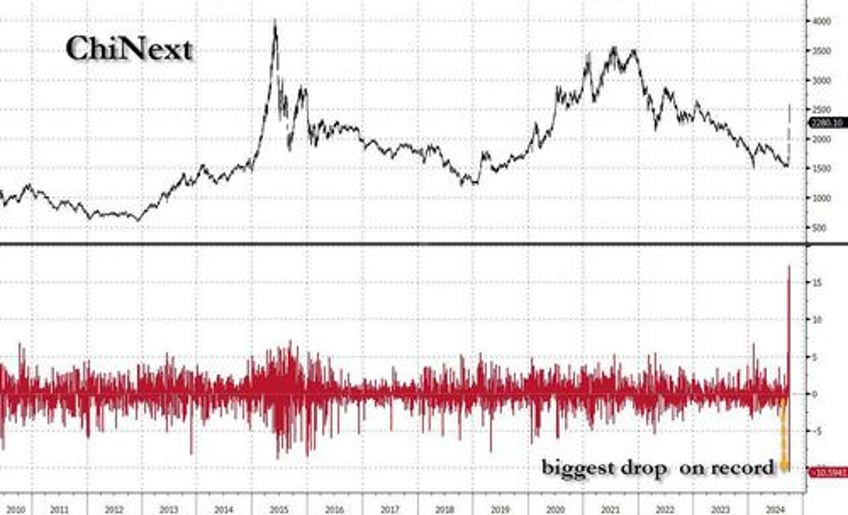

The benchmark CSI 300, which measures large-market-cap stocks listed in Shenzhen and Shanghai, crashed 7.05% from Tuesday to close at 3,955.98, its first loss in 11 sessions and its worst day since February 2020, when COVID-19 paralyzed China.

Worse, the tech-focused ChiNext fell over 10% on Wednesday, the biggest single-day decrease on record, while the STAR 50 dropped 2.55%.

Close to 3 trillion yuan ($420 billion) worth of mainland stocks exchanged hands, on par with Tuesday's record turnover.

Chinese shares had been on a tear since Sept. 24, just days after we correctly predicted that a Chinese bazooka was imminent...

Time For China To Turn On The Printing Press https://t.co/IDBjhxAs90

— zerohedge (@zerohedge) September 21, 2024

... sparked by interest rate cuts and central bank initiatives to usher billions of dollars into the markets. But a fresh policy announcement on Tuesday by the NDRC, China's central planning coordinator, stopped well short of the big fiscal stimulus package many had been hoping would lift the economy out of its debt-deflation spiral.

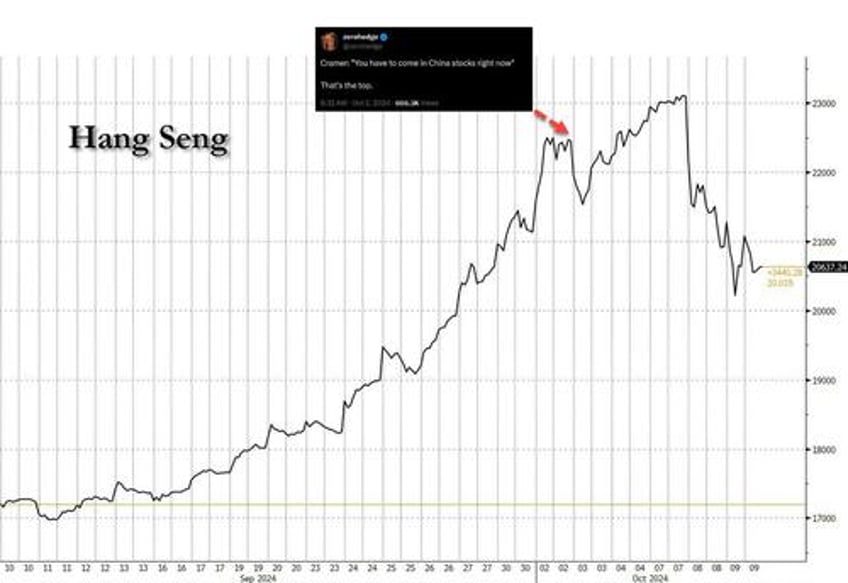

Despite that disappointment, Tuesday still ranked among the best days ever for mainland stock indexes as stocks caught up after a week-long holiday. But as we reported yesterday, Hong Kong shares plunged sharply the same day, closing down 9.41% - wiping out a 9% gain they had accumulated during a weeklong National Day break on the mainland. And then mainland markets followed with their own Wednesday swoon.

Indeed, while Hong Kong and mainland markets moved in opposite directions on Tuesday, they were fully aligned on Wednesday, when the former's Hang Seng Index closing 1.38% lower on the day at 20,637.24. That put it just a tad higher than its close on Sept. 27, three days after the first big move in the government's latest round of stimulus. In other words, easy come, easy go and as usual, Jim Cramer top-ticked the move .

Chinese brokerage CITIC and Alibaba Health led the HSI declines, falling 8.2% and 7.08%, respectively. Investors took profits from health-related stocks, with Biotech company Imeik Technology Development dropping the most out of the CSI 300 components, down 18.4%. Shenyang Xingqi Pharmaceutical, which is in the ChiNext index, dropped 20%.

In another sign of investors taking a more aligned view, the Hang Seng Stock Connect China AH Premium Index dropped 2.95% on Wednesday after surging the previous day, suggesting a narrowing divergence between the two markets.

Still, Beijing isn't going to go down without a fight and China's regulatory bodies indicated another round of eagerness to shore up investor confidence when the Ministry of Finance announced on Wednesday that it will brief reporters on Saturday about "intensifying countercyclical adjustment of fiscal policy to promote high-quality economic development", stoking expectations for another stimulus revelation.

In a note published late in the day, Morgan Stanley economists said the ministry's "press conference on Oct. 12 is Beijing's second chance to convince the market that its reflation pivot is back on firmer footing after the Oct. 8 undershoot -- but the bar is high."

Amusingly, several major banks such as Goldman Sachs upgraded their assessments of China's markets in response to the recent rally, and Goldman went overweight just in time to mark the peak, something we warned about on Monday.

Goldman Hikes S&P Price Target, Cuts Recession Odds And Raises China To Overweight https://t.co/RdCpwxVovi

— zerohedge (@zerohedge) October 7, 2024

Meanwhile, there are growing rumblings about fundamental issues in the economy -- including a prolonged property crisis, debt risks and weak consumption -- and a perceived lack of determination on the part of authorities to address them.

UBS's global wealth management CIO said in a note on Wednesday that it expects more volatility in China equities until more concrete support measures come into view. The bank recommends investors pick individual stocks rather than "aggressively chasing market rallies."

Benjamin Bennett, head of investment strategy for Asia at Legal & General Investment Management, called the Chinese stock rally "overdone."

Skeptics point to Tuesday's announcement by the National Development and Reform Commission, China's top economic planning body, which promised to speed up the issuance of special-purpose bonds by local governments but did not offer solutions to deflationary pressure.

"I'd be surprised if the stimulus is enough to reignite the property sector," Bennett said. "I also don't think policymakers want to reflate the debt bubble. And maybe yesterday's press conference was designed to temper equity investor expectations. Volatility will stay high for now, and we'll see more large daily swings, but I'm happy to stay on the sidelines for this one."

And so, after two days of selling, the disillusioned market now turns its hopes to the just announced Ministry of Finance press conference on Saturday at 10am local (Fri 10pm ET). Goldman's Asia traders note that while yesterday's NDRC presser was perceived as lackluster, primarily by foreign investors, their conversations suggested local investors have understood that only the MOF can announce sizable stimulus packages. In addition, they felt the fact that the NDRC's RMB200bn package is to be used just over the next 2-3 months into year-end was underappreciated by the foreign investor base.

SocGen agreed with Goldman in downplaying the disappointment, and writes that the NDRC briefing yesterday was clearly disappointing for the market, "but in our view the expectation was misplaced because the NDRC, as a policy coordinator, doesn't have the authority over fiscal decisions. The MoF announced today that it will hold a briefing this Saturday morning. The chance of getting more ideas on (the first installment of) the fiscal stimulus is certainly better there, but we still caution that investors should keep the expectation in check for the size of the fiscal stimulus. So what can or cannot we expect? And more importantly, what really matters?"

Which brings up the next catalyst: Saturday's MOF announcement, where questions are already swirling: Will we get a big number on the fiscal stimulus? According to SocGen, "Maybe still not." Here is the French bank's rationale:

For this year, additional support measures <RMB1tn can take place without increasing this year's bond issuance quota, as the government can tap into past fiscal savings and use un-utilised bond quotas in the past. For a higher amount, the approval of the Standing Committee of NPC is required. But, the NPC meeting will most likely only take place in late October (possibly around 20th). So, it is quite possible that the Saturday briefing can disappoint again, given that markets now seem to expect something between RMB1-3tn - seemingly coming off from RMB3-5tn before/during the National Holiday week.

That said, if one wants to stay hopeful, we do think that the joint meeting between the PBoC and MoF on CGB trading today is quite interesting. Even if the first batch of stimulus might turn out to be limited, the closer coordination on CGB liquidity looks to be a hint of some more sizeable supply pipeline ahead.

What can we expect this Saturday? SocGen answers:

- Confirmation that the fiscal policy will be redirected to facilitate rebalancing to domestic demand. The Politburo meeting in September clearly signaled the shift from supply-side to demand-side, pledging to stabilise the housing sector, promote consumption and income of low-to-middle income groups and support employment. Given these, the MoF should further confirm the direction by highlighting areas of more spending such as stepping up fiscal transfers from central government to local governments, increasing subsidies for companies to increase employment, raising unemployment insurance payments, extending the policies during the pandemic, and even better, cash handouts to families and additional funding to resolve local government debt, as reported by Reuters previously.

- Forward guidance on more CGB issuance and/or a bigger deficit ahead. We think it is very unlikely for Beijing to commit to one super-sized fiscal stimulus (CNY5-10tn) in one go. It is almost certain that the MoF will not communicate an explicit number for the 2025 budget. What is more realistic and also sensible is a commitment to fixing the structural issues and the willingness to keep topping up fiscal efforts.

In conclusion, now that the latest China rally has reversed, expect a very nervous market on edge until this weekend when the MoF will either double down on stimulus jawboning - and actually reveal firm plans of what it will do - or the bottom will fall out of both the market and the economy, forcing Beijing to do that much more, up to and including QE (see "China Must Do QE Now, "Or It Will End Up In A Bigger Hole In 12 Months""), to prevent all out economic catastrophe.