Just days after Beijing concluded its Third plenum with no major announcements, disappointing markets, early on Monday China unexpectedly cut its key short-term policy rate and the mortgage reference rates, its first such broad move since August last year. Analysts said the move just days after the conclusion of a high-level meeting that had focused on reviving the national economy represented “reactive easing."

PBOC said it would cut the seven-day reverse repo rate to 1.7% from 1.8%, and would also improve the mechanism of open market operations. That is the first cut to the rate since August 2023.

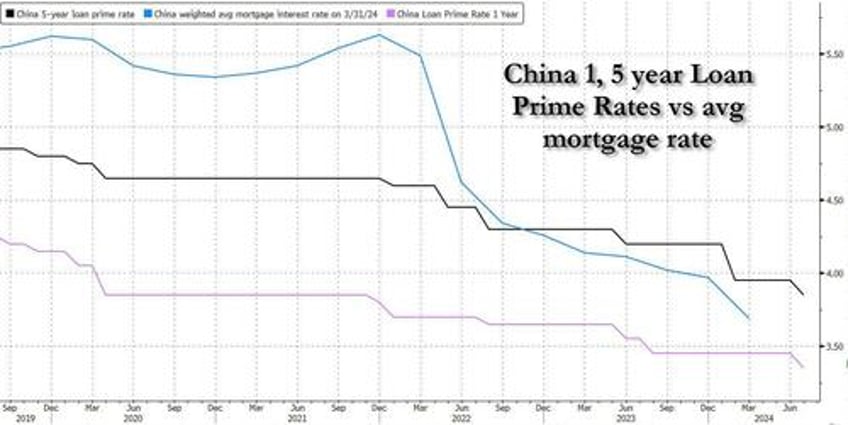

The PBOC lowered the seven-day reverse repo rate – a widely used liquidity injection tool – by 10 basis points to 1.7% in a move to increase financial support for the real economy. In total, the Chinese central bank sold 58.2 billion yuan (US$8 billion) of seven-day reverse repos. Minutes later, China cut benchmark lending rates by the same margin at the monthly fixing: The one-year loan prime rate (LPR) was lowered to 3.35% from 3.45% previously, while the five-year LPR was reduced to 3.85% from 3.95%. The change to the seven-day reverse repo rate would affect short-term market rates, while the change to the LPR reflects actual lending rates to the real economy.

And while analysts expect more rate cuts, they also urged future fiscal measures and policy support to do the “heavy lifting” to help accomplish this year’s economic growth target amid growing external challenges, the SCMP reported.

“[The] moves mark the first change in rates since February, and also the first major move since announcing a shift in the monetary policy framework in June,” said Lynn Song, chief economist for Greater China at ING.

“We will need to see if the other policy rates, such as the medium-term lending facility, follow [Monday’s] rate cuts in the coming weeks.

“Rate cuts will likely add to the pressure on Chinese banks. These pressures could increase further if the medium-term lending facility is not soon lowered.”

Louise Loo, lead economist at Oxford Economics, said that the moves on Monday were “originally anticipated” to come in by the fourth quarter following a rate-cutting cycle by the US Federal Reserve.

“We continue to expect a further 10 basis points in benchmark rate cuts in quarter four, alongside 25 basis points cuts in the reserve ratio requirement in quarter three and quarter four each to facilitate liquidity support, given the steady ramp-up in stimulus-related government bond issuances,” she said.

And Zhang Zhiwei, president and chief economist at Pinpoint Asset Management, said that more rate cuts are expected after the US Federal Reserve enters a rate cut cycle. “The rate cut [by the PBOC] is one step in the right direction,” he said.

China’s recently concluded third plenum - which failed to spark any excitement about a Chinese rebound - placed an emphasis on boosting economic capabilities to tackle growth, with the full text of the decisions from a key party conclave revealed on Sunday.

Under the section covering “healthy assurance and improvement of the social system” in the 22,000-word resolution document released on Sunday following the conclusion of the third plenum on Thursday, it stated that there is a need to speed up the formation of a new property development model to increase the supply of affordable housing.

The document added that local governments would be given ample space to regulate the property market with a series of policy modifications, such as the reduction and cancellation of housing purchase limits, the cancellation of buying thresholds for ordinary and non-ordinary housing and the reformation of housing financing and the property tax system.

“While [Monday’s] rate cuts offer some reassurance that policymakers are being responsive to the recent loss of economic momentum, the heavy lifting will need to come from fiscal, not monetary, policy,” said Julian Evans-Pritchard, head of China economics at Capital Economics. “Fortunately, the signs on that front are encouraging too.”

And Morgan Stanley said that “these moves post-plenum reaffirms reactive easing”.

“We see additional policy rate cuts in September-December,” said Robin Xing, chief China economist at Morgan Stanley.

“That said, the reactive nature of easing means our 2024 growth and inflation forecasts are facing 10-20 basis points of downside risk.”