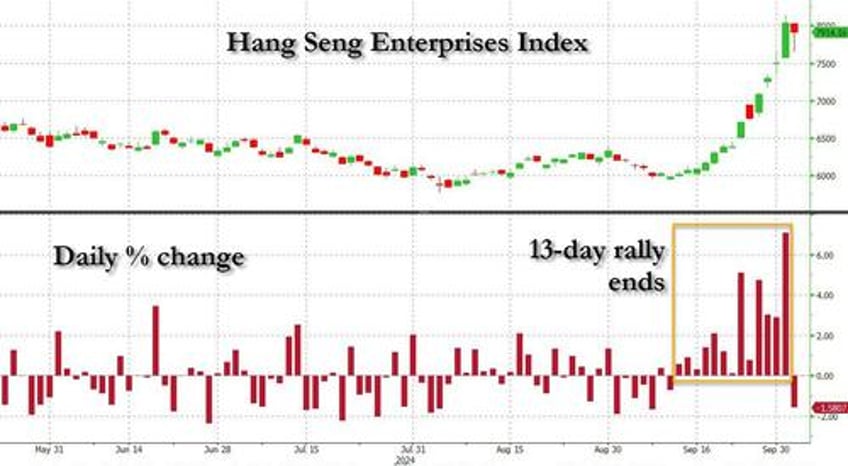

While China's mainland stock markets are closed until Monday for the Golden week holiday after an explosive move higher which included the biggest one-day jump since the Lehman disaster, Chinese stocks continued to trade in the US in the form of ETFs and also in Hong Kong which reopened from a briefer holiday, and soared higher.. but then the meltup fever finally broke on Thursday when the Hang Seng Closes down -1.47%, its first red close in 6 sessions (and first down day for the Hang Seng Enterprise Index in 13 days). That said, since Sept 13th, the market has rallied ~27%, so a pullback was inevitable.

With that in mind, here are some statistics on the latest China move excerpted from Goldman trader Saira Ansari (full note here available to pro subscribers) :