- APAC stocks traded mixed as most major indices took impetus from the gains on Wall St after President Trump's first full day back in office although Chinese markets lagged after Trump suggested 10% tariffs on China.

- US President Trump said they are talking about a 10% tariff on China from 1st February for them sending fentanyl to Canada and Mexico, while he added that the European Union treats the US badly and that the EU will be in for tariffs.

- US President Trump announced an AI project with OpenAI, SoftBank (9984 JT) and Oracle (ORCL) to form a JV called Stargate which will invest at least USD 500bln in AI infrastructure in the US and will create 100k jobs.

- European equity futures indicate a positive cash open with Euro Stoxx 50 futures up 0.3% after the cash market closed flat on Tuesday.

- Looking ahead, highlights include UK PSNB, ECB’s Villeroy, Knot & Lagarde, Supply from Germany & US, Earnings from Procter & Gamble Co., Abbott, Johnson & Johnson, Halliburton Company, Ally Financial, Amphenol Corp., Comerica, GE Vernova Inc., Travelers Companies, Commerce Bancshares Inc., First Community Corp., Kinder Morgan, Inc., Alcoa, Discover Financial Services, RLI Corp. & Steel Dynamics.

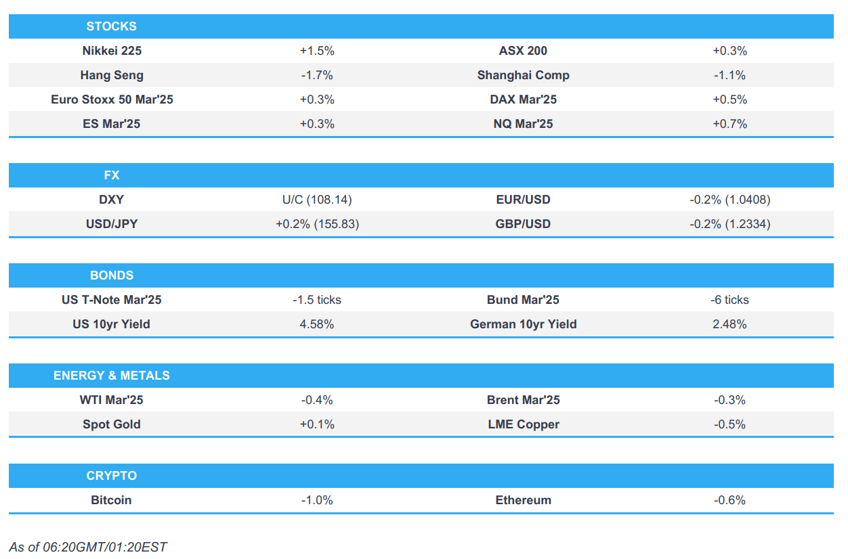

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks gained with the vast majority of sectors in the green and with only the Energy sector in the red as President Trump's executive orders and initial dollar firmness weighed on the crude complex. Nonetheless, it was a relatively quiet session with little fresh catalysts.

- In terms of stock specifics, MMM and SCHW reported strong earnings, while Oracle was buoyed in the wake of CBS reporting that Trump is set to announce billions of dollars in private sector investment to build AI infrastructure in the US with OpenAI, Softbank (SFTBY) and Oracle (ORCL) planning a JV.

- SPX +0.88% at 6,049, NDX +0.58% at 21,567, DJIA +1.24% at 44,026, RUT +1.85% at 2,318.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President Trump said they are talking about a 10% tariff on China from 1st February for them sending fentanyl to Canada and Mexico, while he added that the European Union treats the US badly and that the EU will be in for tariffs.

- US President Trump is using tariffs threat to push for an early renegotiation of US trade deal with Mexico and Canada, according to WSJ.

- US President Trump announced an AI project with OpenAI, SoftBank (9984 JT) and Oracle (ORCL) to form a JV called Stargate which will invest at least USD 500bln in AI infrastructure in the US and will create 100k jobs. Trump said he is going to help through emergency declarations and will make it possible to get the electricity production needed. Furthermore, Stargate will begin immediately to build infrastructure, while Oracle's Chairman Ellison said data centres are under construction in Texas with expansion to other locations too and SoftBank CEO Son said they will immediately deploy USD 100bln in AI investment.

APAC TRADE

EQUITIES

- APAC stocks traded mixed as most major indices took impetus from the gains on Wall St after President Trump's first full day back in office although Chinese markets lagged after Trump suggested 10% tariffs on China for sending fentanyl to Mexico and Canada which ends up in the US.

- ASX 200 notched mild gains amid strength in tech, industrials and financials but with gains capped by losses in miners.

- Nikkei 225 outperformed and surged above the 39,000 level with SoftBank among the biggest gainers after President Trump announced an AI project with OpenAI, SoftBank and Oracle to form a JV which will invest at least USD 500bln in AI infrastructure.

- Hang Seng and Shanghai Comp were pressured after US President Trump warned of 10% tariffs on China from February 1st for sending fentanyl which overshadowed the PBoC's substantial CNY 1.16tln reverse repo operation.

- US equity futures were mostly on the front foot with the E-mini Nasdaq 100 leading the upside in the aftermath of strong earnings by Netflix which beat on top and bottom lines, as well as reported a surge in global streaming paid net additions.

- European equity futures indicate a positive cash open with Euro Stoxx 50 futures up 0.3% after the cash market closed flat on Tuesday.

FX

- DXY traded flat with only brief support seen following more tariff rhetoric from President Trump who said they are talking about a 10% tariff on China for sending fentanyl, while he added the EU treats the US badly and the EU will be in for tariffs.

- EUR/USD mildly softened and momentarily retreated beneath 1.0400 after Trump touched upon tariffs for the EU.

- GBP/USD slightly eased back from a near two-week peak after momentum was stalled by resistance around 1.2350.

- USD/JPY swung between gains and losses but ultimately edged higher amid the positive risk appetite in Japan.

- Antipodeans marginally softened alongside CNH following US President Trump's China tariff remarks and with NZD/USD gradually pressured amid increased bets for a 50bps cut by the RBNZ in February despite CPI data which matched/topped estimates.

- PBoC set USD/CNY mid-point at 7.1696 vs exp. 7.2642 (prev. 7.1703).

FIXED INCOME

- 10yr UST futures lacked demand after yesterday's choppy performance and curve flattening amid light catalysts and looming supply.

- Bund futures mildly retreated after failing to sustain the 132.00 level ahead of today's Bund issuance, while ECB officials reaffirmed data dependency.

- 10yr JGB futures were subdued amid mild upside in yields and with another recent report noting the BoJ is moving towards a hike at this week's meeting.

COMMODITIES

- Crude futures were little changed in the absence of any major oil-specific drivers and after recent indecision as markets mull over Trump policies, while the latest energy inventory data is also delayed owing to the MLK Jr. Day holiday at the start of the week.

- Citgo said it implemented a cold weather response at all three refineries which includes extra operators, maintenance crafts and management personnel in the refineries around the clock.

- Port Houston said all eight public facilities will remain closed for Tuesday and Wednesday due to cold weather conditions.

- Port Freeport said limited activity is expected due to weather conditions in the Gulf Coast area in Texas.

- Spot gold continued its recent gradual upward and eventually breached the USD 2,750/oz level.

- Copper futures mildly pulled back after the prior day's intraday rebound with prices not helped by the underperformance in China.

- World refined copper market was in a 131k MT deficit in November 2024, according to ICSG.

CRYPTO

- Bitcoin took a breather and gradually trickled lower to beneath the USD 106k level after the prior day's advances.

NOTABLE ASIA-PAC HEADLINES

- US President Trump said he has met with TikTok owners and he is open to Elon Musk buying TikTok, while he is thinking of telling someone to buy TikTok and give half of it to the US.

DATA RECAP

- New Zealand CPI QQ (Q4) 0.5% vs. Exp. 0.5% (Prev. 0.6%)

- New Zealand CPI YY (Q4) 2.2% vs. Exp. 2.1% (Prev. 2.2%)

- RBNZ Sectoral Factor Model Inflation Index (Q4) 3.1% (Prev. 3.4%)

GEOPOLITICS

RUSSIA-UKRAINE

- US President Trump said if Russian President Putin does not come to the table on Ukraine, it is likely that he would put sanctions on Russia, while he added that they are looking at the issue of sending weapons to Ukraine, as well as noted the European Union should be paying more on Ukraine and should equalise spending on Ukraine. Furthermore, Trump said he is looking to speak with Russian President Putin soon and told Chinese President Xi to help settle the Ukraine issue.

- US Secretary of State Rubio and Japanese Foreign Minister Iwata discussed concerns over North Korea's political and security alignment with Russia and China's support for Russia's defence industrial base.

OTHER

- Australia, India, Japan and the US said they reaffirmed a shared commitment to a free and open Indo-Pacific after the first Quad ministerial meeting of the new Trump presidency. Furthermore, the Quad countries strongly oppose any unilateral actions that seek to change the status quo by force or coercion, while they will meet on a regular basis in the coming months to prepare for the next leaders' summit hosted by India.

EU/UK

NOTABLE HEADLINES

- UK ministers reportedly forced out the chair of UK’s competition regulator CMA Chair Bokkerink as the government seeks to dial back regulation as part of Labour's growth agenda, according to FT.

LATAM

- Brazil's President Lula told his aides that he may not run for re-election in 2026 in a statement during a ministerial meeting yesterday, surprising the ministers, according to CNN Brasil.