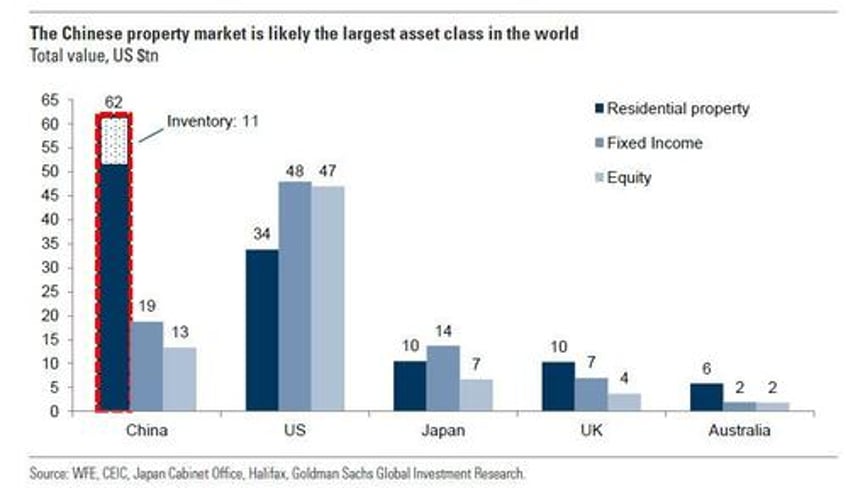

In a historic development for the bankruptcy-shy China, on Monday, a Hong Kong court ordered China Evergrande - once the country's largest real estate company - to be liquidated, opening a new and unpredictable phase in the collapse of the world’s most indebted property developer. The liquidation order comes more than two years after the company’s official default, which triggered a cash crunch for Chinese developers that has crippled what was once the world's largest asset class, and is still hobbling the world’s second-largest economy.

Hong Kong High Court Judge Linda Chan issued the order on Monday after the developer failed to come up with a last minute restructuring plan to satisfy international creditors despite lengthy negotiations.

“It would be a situation where the court says enough is enough,” Chan said. “I consider that it is appropriate for the court to make a winding-up order against the company, and I so order.

A previous deal between Evergrande and international investors fell apart in September after Chinese authorities failed to grant some regulatory approvals. Evergrande’s chair Hui Ka Yan was placed under “mandatory measures” days later on suspicion of “illegal crimes”, authorities said at the time. The winding-up lawsuit was filed in 2022 by offshore creditor Top Shine Global, which said Evergrande had failed to honor HK$863mn (US$110mn) worth of claims.

Today's historic decision to liquidate a Chinese property giant will test the reach of Hong Kong courts in the Chinese mainland, where foreign claims are widely seen to hold little sway and the property slowdown has become one of Beijing’s biggest political challenges.While Evergrande is listed in Hong Kong, almost all of its assets and the vast majority of its more than $300bn in liabilities are in China. Authorities have so far prioritised the completion of unfinished projects by developers.

The judge appointed Edward Middleton and Tiffany Wong, from the restructuring firm Alvarez & Marsal, as Evergrande’s liquidators. Speaking outside the court, Wong said they would begin by meeting management to understand the affairs of the company and discuss next steps.

It wasn't immediately clear if Evergrande's forced liquidations will lead to a fresh crisis in China's property market as true price clearing levels are discovered, often at a huge loss.

In her judgment, Chan said she had decided to order the winding up because Evergrande had “no restructuring proposal, let alone a viable proposal which has the support of the requisite majorities of the creditors”. According to the FT, her decision could trigger further lawsuits stemming from the billions of dollars of losses related to the company’s collapse.

Speaking after the hearing Fergus Saurin, a partner at law firm Kirkland and Ellis, which represents a key group of Evergrande creditors, said: “We are not surprised by the outcome. It’s a product of the company failing to engage with [us].

“There has been a history of last-minute engagement which has gone nowhere. And in the circumstances, the company only has itself to blame for being wound up.”

In theory, he ruling could pave the way for liquidators to attempt to seize control of some Evergrande assets in mainland China, since Hong Kong has a mutual recognition agreement on insolvency and restructuring that applies in some parts of China. However, in practice, that is very much impossible since it is unlikely Chinese mainland courts will accept the Hong Kong winding-up order. Asked about the issue, Saurin declined to comment.

Shortly after the court order, Chinese media reported that Evergrande’s chief executive Shawn Siu responded that the company would “do everything possible” to ensure the continued delivery of property development projects in China, adding that the operational structure of its onshore and offshore subsidiaries was “unaffected” as the court order was based in Hong Kong. Siu was also cited saying the court decision was “regrettable”.

The ruling was not only bad news for the company; creditors are also facing an uphill battle for recoveries. Brock Silvers, chief investment officer of Hong Kong private equity group Kaiyuan Capital, said: “Offshore creditors may lack good alternatives, but a wind-up order from the Hong Kong court today would be the beginning of a multiyear, very costly process ultimately unlikely to yield significant recoveries.”

The decision could have implications for other developers still locked in protracted restructuring negotiations with offshore creditors. Jiayuan, another Chinese developer, received a winding-up order from the same judge last year.

Homin Lee, an Asia macro strategist at Lombard Odier, said that order to liquidate Evergrande “is a milestone for the restructuring of China’s property sector, and how the authorities draw the line between offshore and onshore stakeholders will be a crucial issue to watch for investors."

The pricing of bonds issued by China’s distressed or defaulted developers makes it clear that investors have been assuming the “worst possible outcome for these names” since the Evergrande crisis spread to the broader real estate sector in 2021.

We “assume conservatively that onshore stakeholders e.g. contractors will be shielded at the expense of offshore investors and the credibility of these keep-well arrangements in the foreseeable future” as that is the most expedient option. Once the Evergrande case sets a precedent, investors will at least have a slightly clearer roadmap for other distressed developers. “Investors will continue to sidestep privately-owned developers in favor of state-owned ones”

Before the trading halt and following the order, shares in Evergrande fell more than 20% to HK$0.16, while outstanding dollar bonds issued by the developer traded at deeply distressed levels, with one bond maturing in 2025 trading at less than two cents on the dollar.

Trading in the Hong Kong-listed shares of Evergrande and two of its subsidiaries was halted after the ruling; China Evergrande New Energy Vehicle and Evergrande Property Services will face lots of uncertainties as China Evergrande Group heads for liquidation, according to Raymond Cheng, head of China and Hong Kong research at CGS-CIMB Securities. The prospects of these two companies, with Evergrande as its major shareholder, are unclear, Cheng says. “Both the companies will have difficulties in maintaining their business, which will dampen investor confidence.”

According to Cheng, the liquidation process of China Evergrande will take at least one to two years; “It’s also hard to know whether the HK ruling results will be implemented in mainland China.”