Claims data just released imply an economy with few signs of an imminent recession.

The rise in yields is consistent with this outlook, although the Fed’s altered reaction function remains most pivotal for them.

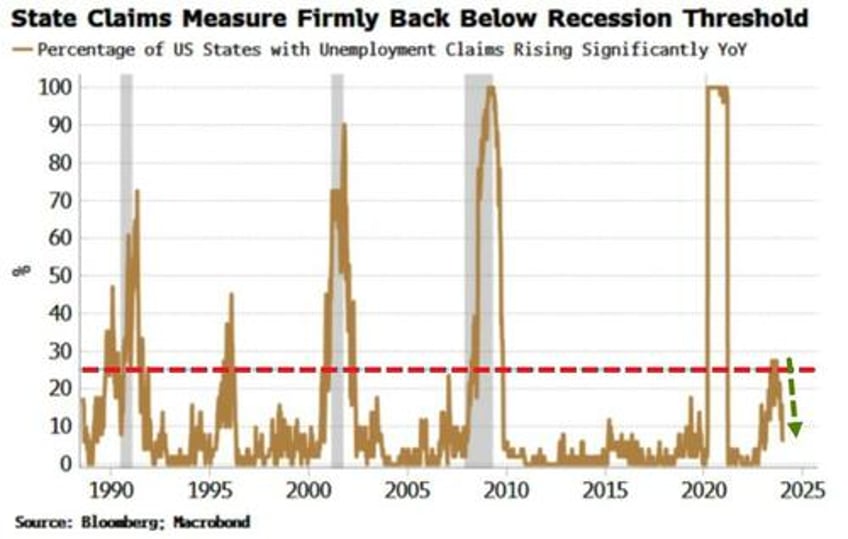

The information content in claims comes from looking at a diffusion of them state by state.

When a rising percentage of states are seeing their claims – initial or continuing – notably weaken on an annual basis, this is very a reliable sign of an imminent recession.

This cycle, state claims were an indication that a downturn was on its way, but the measure has now decisively fallen back below the recession threshold -- similarly for continuing claims.

Claims are a more reliable indicator of job market health than JOLTS (which came out on Wednesday), which has a very low response rate and sample size.

The inflection lower in claims also supports a positive skew to Friday’s payrolls data.

Recession risk is likely to mount as the year wears on, as the cumulative impact of higher rates increasingly bites.

But today’s data is another evidential bit of the jigsaw that recession risk is retreating for now.