It's only appropriate that a year which saw 10Y rates soar above 5%, the most in 16 years, before sliding on fears of an imminent recession and/or Fed easing cycle, that the final coupon auction of the year was a dog with a capital D.

Yesterday's far stronger than expected 5Y auction surprised many: not only was there no concession with yields tumbling all day, but there was no tangible reason for the burst in demand that lead to one of the strongest stop-throughs on record, besides perhaps a big squeeze overhang as shorts sought to cover in the year's last trading hours. Well, moments ago we did get confirmation that yesterday's strength was indeed technically-driven because the $40BN in 7Y paper that was just sold by the Treasury could be described by just one word: ugly.

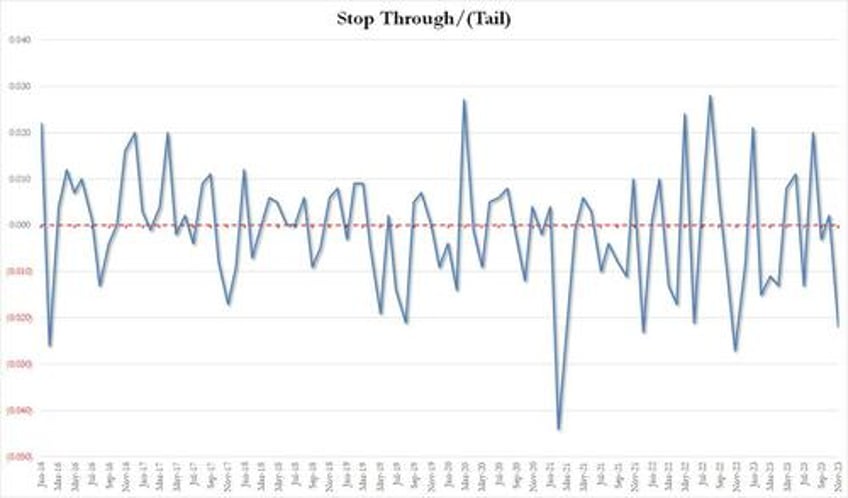

The high yield of 3.859% was a sharp drop from the 4.399% last month and was also the lowest since June's 3.839%... to be expected in the post-Fed pivot environment. But more importantly, the high yield tailed the 3.837% When Issued by 2.2bps, worse than last month's 2.1bps tail and the worst showing since November 2022 when the 7Y tailed by 2.7bps.

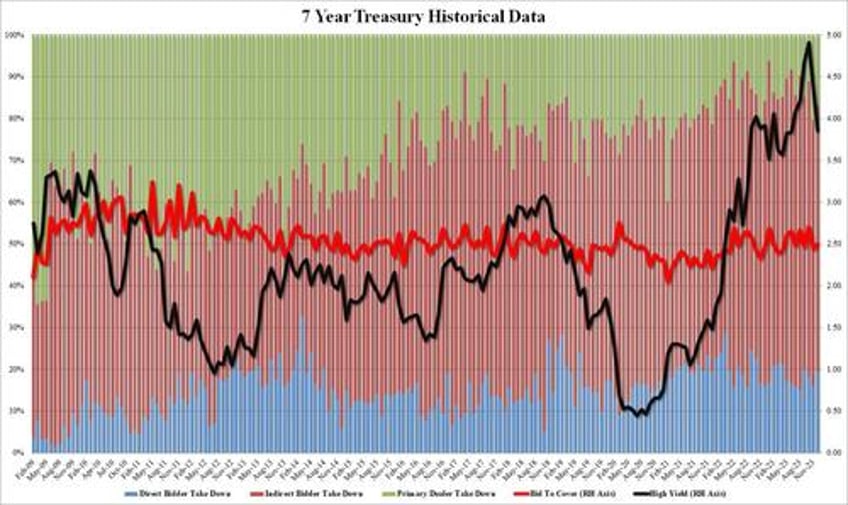

The bid to cover was also ugly at 2.498, and while not as ugly as last month's 2.442 it came in well below the recent average of 2.57.

The internals were even worse: Indirects took down 63.7%, down from 63.9% and the lowest since March (naturally it was well below the 6-auction average of 70.0%). And with Directs awarded 19.4%, the most since September, that left Dealers with 16.9% of the auction, well above the recent average of 13.0% and yet another confirmation that the Fed will soon have to step in again.

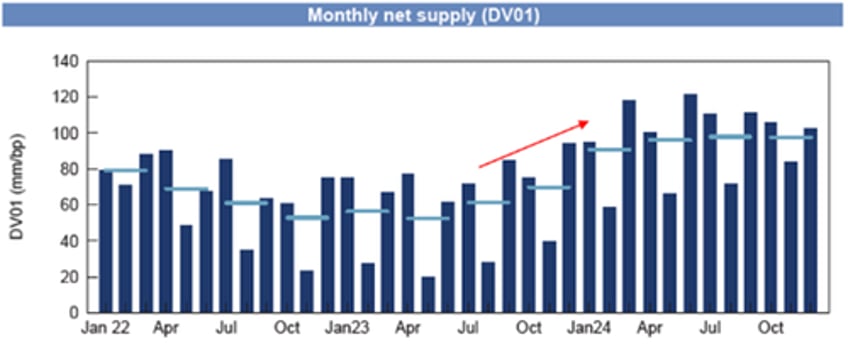

Overall, this was one of the ugliest coupon auctions in recent months, and was - according to several metrics - also the ugliest 7Y auction of the year. The good news: there will be many more ugly auctions in 2024 because the flood of new issuance is only just starting - after all Biden is about to double the net supply to maintain the illusion that the debt-fueled economy is going strong ahead of the Nov 24 election.

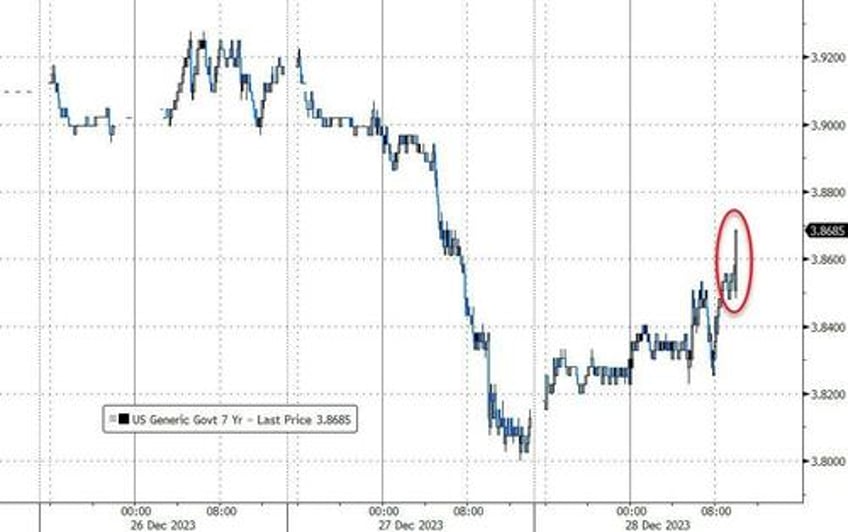

As for the market reaction, no surprises there - yields spiked to session highs and have undone all of yesterday's post5Y auction slide. As for stocks, they remain in a world of their own for now.