“Compound market returns.” During bullish markets, there is inevitably a regurgitation of this myth that was contrived to extract capital from retail investors and place it in the hands of Wall Street.

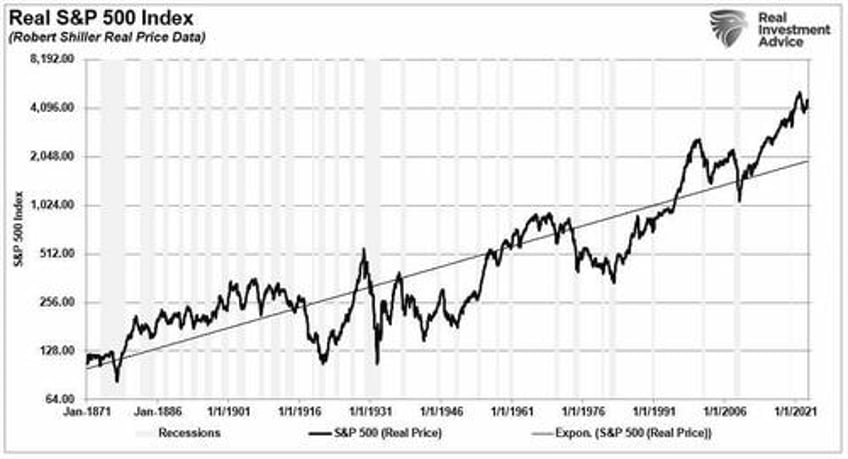

However, the compound market returns myth was contrived from the myth that “markets always go up,” therefore, it is ALWAYS a good time to invest. How often have you seen the following chart presented by an advisor suggesting if you had invested 120 years ago, you would have obtained a 10% annualized return?

It is a true statement that over the very long term, stocks have returned roughly 6% from capital appreciation and 4% from dividends on a nominal basis. However, since inflation has averaged approximately 2.3% over the same period, real returns averaged roughly 8% annually.

The obvious problem with that statement is that you don’t have 123 years to invest, that is, unless you have discovered the secret to eternal life or are a vampire.

For the rest of us, mere mortals, time matters.

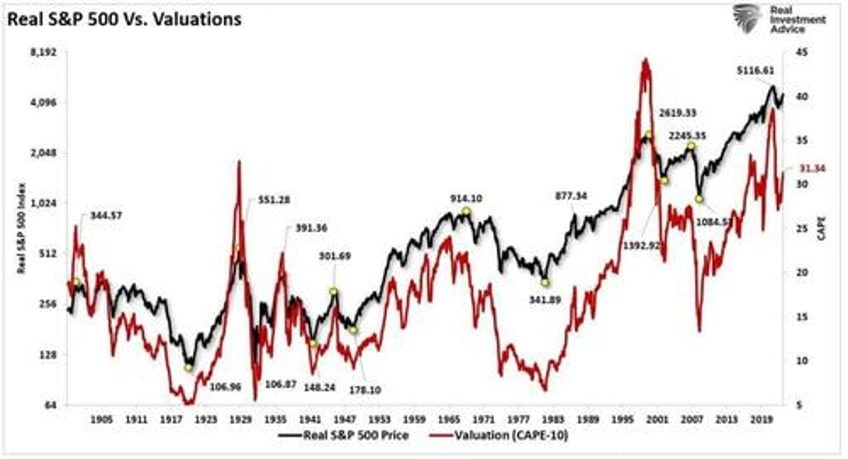

Let’s revisit the chart above, add valuations, and review the market’s various “life-cycle” periods. As you will notice, when valuations were previously elevated, the future price action of the markets was negative until that overvaluation was reversed.

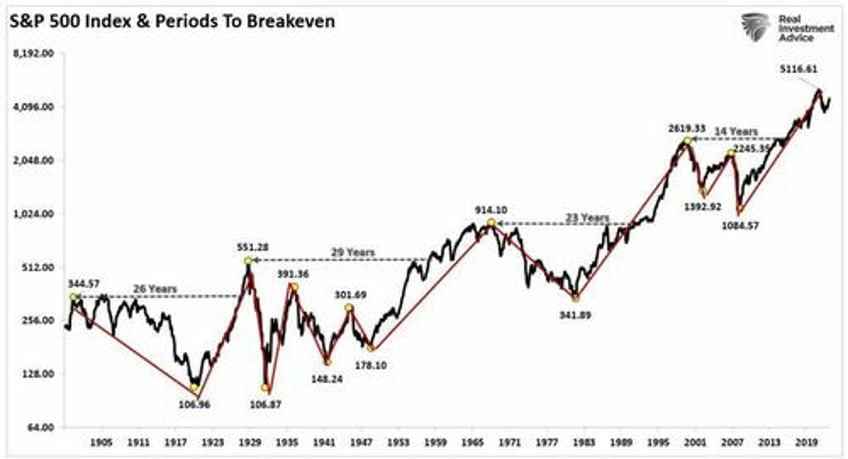

Unfortunately, individuals only have a finite investing time horizon until they retire. Therefore, as opposed to studies discussing “long-term investing” without defining what the “long term” actually is – it is “TIME” that we should be focusing on.

When I give lectures and seminars, I always take the same poll:

“How long do you have until retirement?”

The results are always the same. The majority of attendees responded that they have about 15 years until retirement. Wait…what happened to the 30 or 40 years always discussed by advisors?

Think about it for a moment. Most investors don’t start seriously saving for retirement until their mid-40s. This is because by the time they graduate college, land a job, get married, have kids, and send them off to college, a real push toward saving for retirement is tough to do as incomes haven’t reached their peak. This leaves most individuals with 20 to 25 productive work years before retirement age to achieve investment goals.

Let’s review the chart above concerning starting valuations. As shown below, market returns approached zero during periods throughout market history. Those periods were the result of the reversion of previous overvaluation.

What should be evident is that “WHEN” you start your investing journey is incredibly important to future outcomes.

This analysis leads us to the second market myth, “Compound Market Returns.”

The Eighth Wonder Of The World

Albert Einstein once stated:

“Compound interest is the eighth wonder of the world. He who understands it earns it; he who doesn’t pays it.”

Notice that Einstein said “interest,” not “stock market returns.”

Financial advisors and the media latched on that quote to promote the idea of dollar-cost averaging into the stock market. Of course, this is good for those charging a fee on assets they hold for you. Here is a good example.

“Let’s say you invest $500 a month in a brokerage account over a 20-year period. All told, you’re sinking $120,000 into your account, which is a lot of money. But if your investments during that time generate an average annual 8% return, which is below the stock market’s average, you’ll end up with about $275,000. All told, that’s a gain of $155,000. And compounding is what helps make that possible.” – Motley Fool

Here is the problem. Compound Interest and Compound Market Returns are two different things.

Einstein was correct. If I buy an investment, like a bond or a CD, that pays INTEREST, my money compounds over time. This is because the interest payment is fixed, and the principal is returned at maturity.

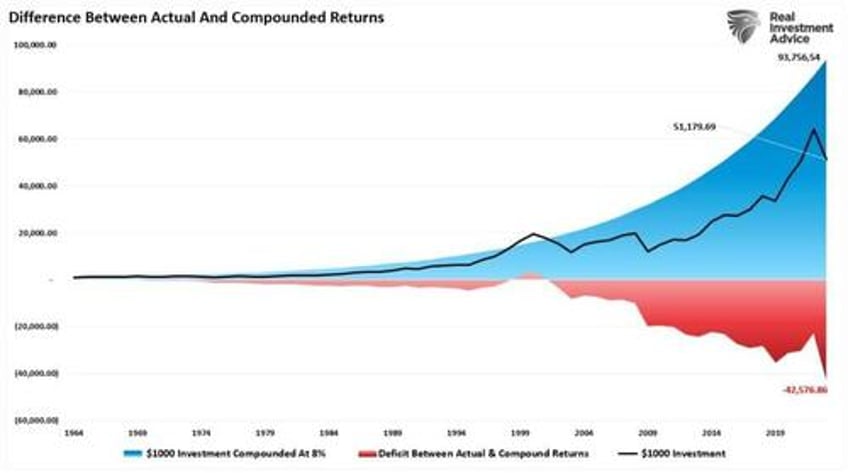

However, as shown above, the stock market does NOT provide a fixed annual rate of return over time. It is variable, and that variability impacts the ending return of the investment over time. The chart below shows an investment in the stock market over time versus a compound market rate of return of 8%, as suggested by Motley Fool.

As you can see, there is a vast difference between an actual return over time and an AVERAGE or COMPOUND market return.

The difference has everything to do with the math.

Compound Market Returns Are A Myth

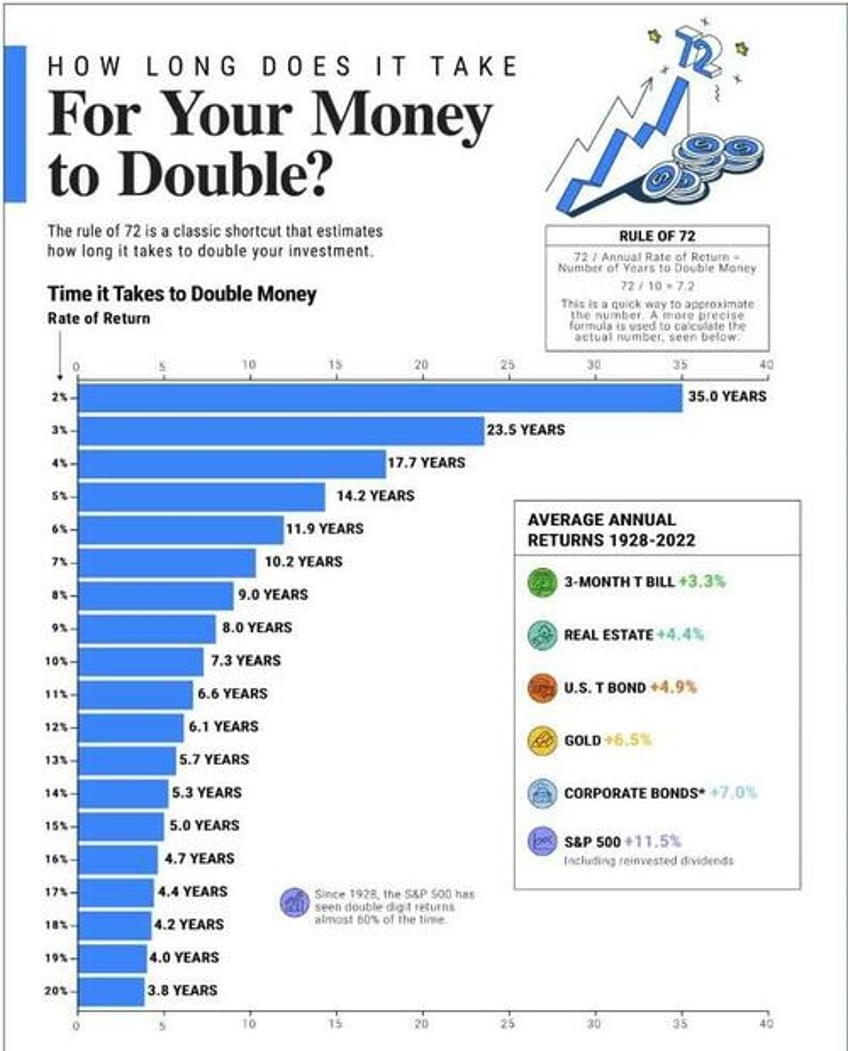

This past week, Visual Capitalist produced a chart on “The Rule Of 72.” As they note, the rule of 72 is a classic shortcut that estimates how long it takes to double your investment. The math is simple. Take any rate of return you desire, say 8%, and divide that into 72, which tells your money will double in 9 years.

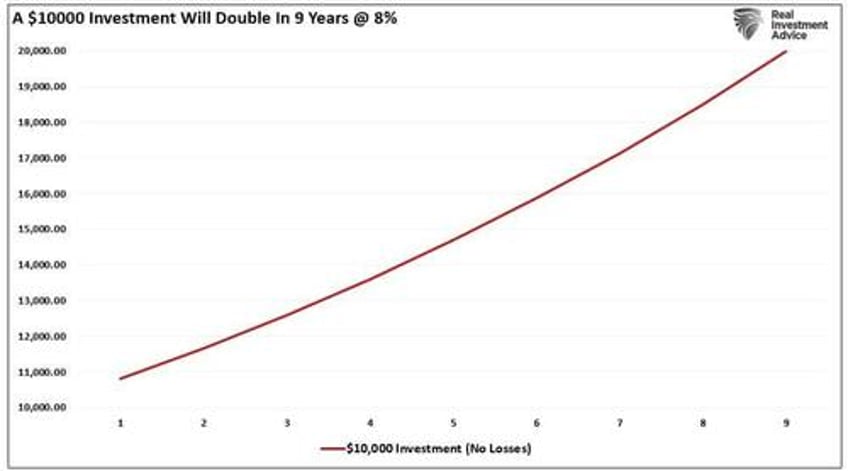

This is a true statement, as shown below. If we invest $10,000 into an investment that yields 8% annually, the value of my investment will double in 9 years.

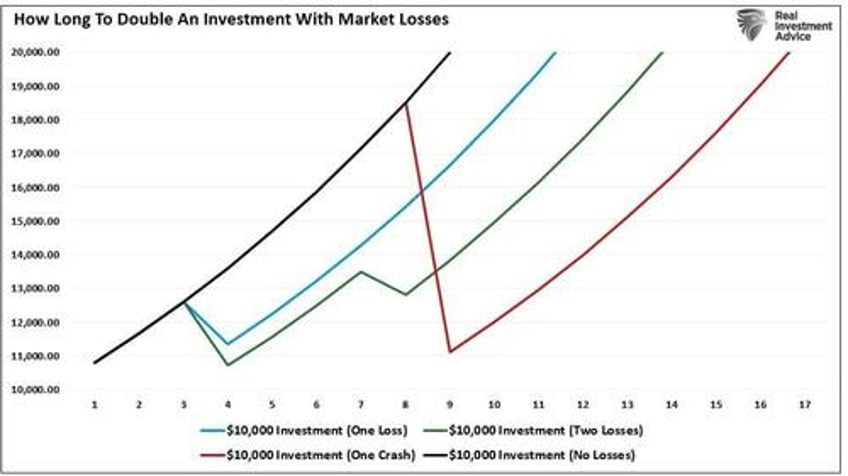

However, the math changes drastically when introducing negative return years. The chart below shows the impact of a single loss, two losses, and a singular market crash (like the Dot.com crash or the Financial Crisis) on the time to double my return.

The investment community’s promotion of “buy and hold” strategies is understandable. It is easy. It makes them money on the fees they charge, and, given that markets go up more often than they fall, it is an easy story to sell.

However, what should be clear is that compound market returns do not exist.

The real-world damage that market declines inflict on investors hoping to garner annualized 8% returns to compensate for the lack of savings is all too real and virtually impossible to recover from. When investors lose money in the market, it is possible to regain the lost principal given enough time. However, and most importantly, what can never be recovered is the lost “time” between today and retirement. “Time” is exceptionally finite and the most precious commodity investors have.

With valuations currently elevated along with high-interest rates, the risk of another market and economic downturn is too real. As such, investors should consider what that means to future market returns and the time horizon required to meet financial goals.

But one thing is for sure.

Assuming the market will go up every year by 8% is not, and has never been a reliable investment thesis.

Wouldn’t everyone who ever invested in the markets be fabulously wealthy if it was?

Conclusion

For investors, understanding potential returns from any given valuation point is crucial when considering putting their “savings” at risk. Risk is an important concept as it is a function of “loss.”

The more risk an investor takes within a portfolio, the greater the destruction of capital will be when reversions occur.

The analysis above reveals the important points that individuals should OF ANY AGE should consider:

Investors should adjust expectations for future returns and withdrawal rates downward due to current valuation levels.

The potential for front-loaded returns in the future is unlikely.

Your life expectancy plays a huge role in future outcomes.

Investors must consider the impact of taxation.

Investment allocations must carefully consider future inflation expectations.

Drawdowns from portfolios during declining market environments accelerate the principal bleed. Plans should be made during up years to harbor capital for reduced portfolio withdrawals during adverse market conditions.

Investors MUST dismiss expectations for compounded annual return rates instead of variable return rates based on current valuation levels.

Over the last two decades, two massive bear markets have left many individuals further away from retirement than they ever imagined.

The myth of “compound market returns” is dangerous to individuals trying to save and invest their way to retirement.

Bear markets matter, and they matter much more than you think.