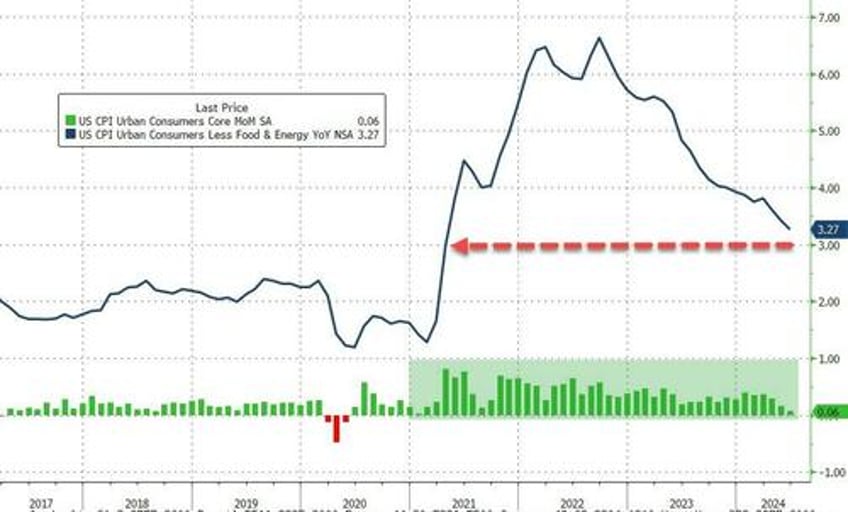

Expectations for more 'evidence' of a return to disinflationary trends were high heading into today's CPI and they were more than satisfied by a 0.1% MoM decline in headline consumer prices in June (below the +0.1% MoM exp) - the biggest MoM drop since May 2020. That pulled the headline YoY CPI down to +3.0%...

Source: Bloomberg

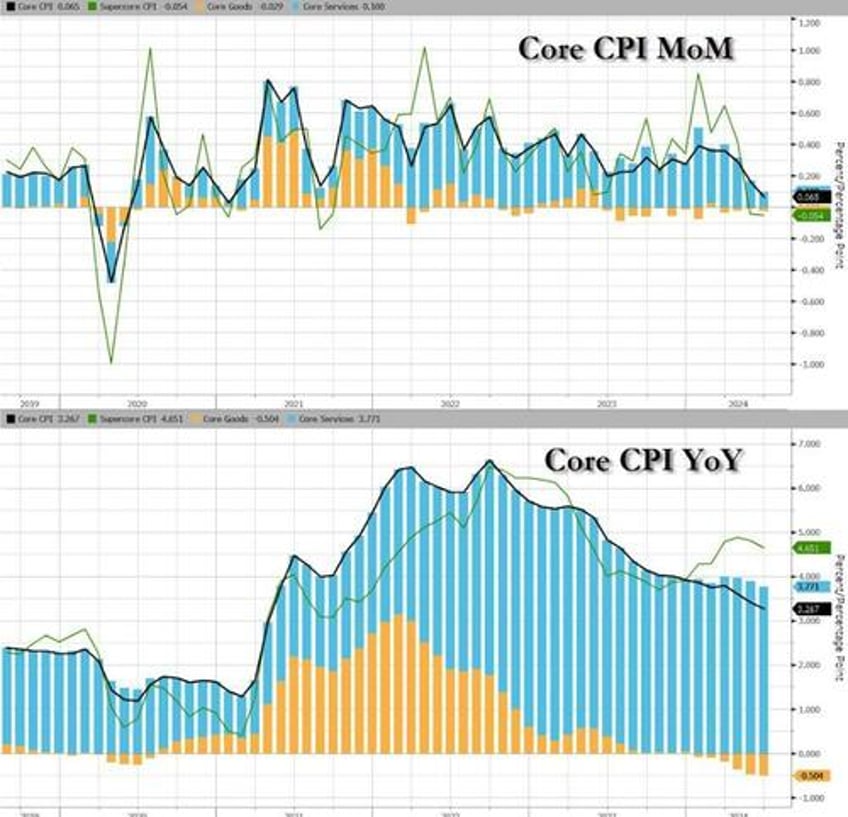

Core CPI also 'missed', rising just 0.1% MoM (vs +0.2% exp), dragging the YoY Core CPI down to +3.27% - its lowest since April 2021...

Source: Bloomberg

We do note that Core consumer prices have still not seen a single monthly decline since Bidenomics began.

The much-watched SuperCore CPI rose on a MoM basis but declined (back below 5.0%) on a YoY basis (but obviously remains extremely elevated)...

Source: Bloomberg

July rate cuts are back on the table?

Finally, we can't help but get a sense of deja vu all over again here. What if... The Fed cuts (because bad - recession - data), Biden loses (because dementia), and inflation re-accelerates (just like in the 80s)...

Source: Bloomberg

Who do you think gets the blame for the re-inflation? Well, 'economists' have already begun claiming Trump's tariff plan will prompt spiralling higher prices... so we have our answer.

There are no coincidences in Washington.. or Washington-based data.