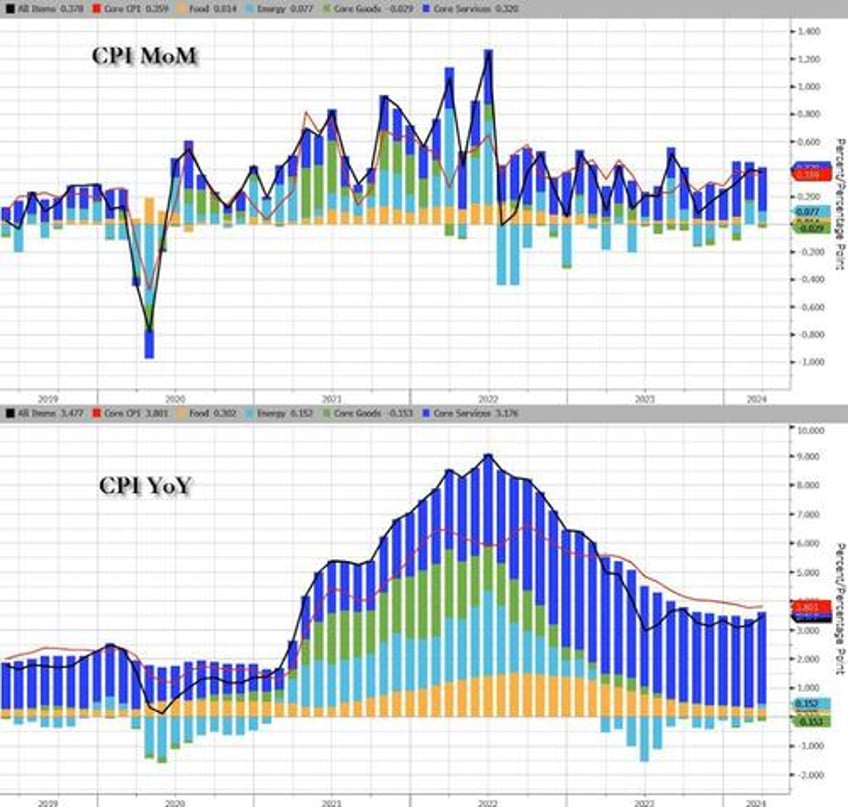

After increasing MoM for the last five months, headline CPI was expected to slow modestly in March (from +0.4% MoM to +0.3% MoM), but obviously still rising. However, it did not, rising a hotter than expected 0.4% MoM (equal highest since August 2023) and pushing it up 3.5% YoY...

Source: Bloomberg

Energy and Services dominated the rise on a YoY basis (with the former flipping from YoY deflation)...

Source: Bloomberg

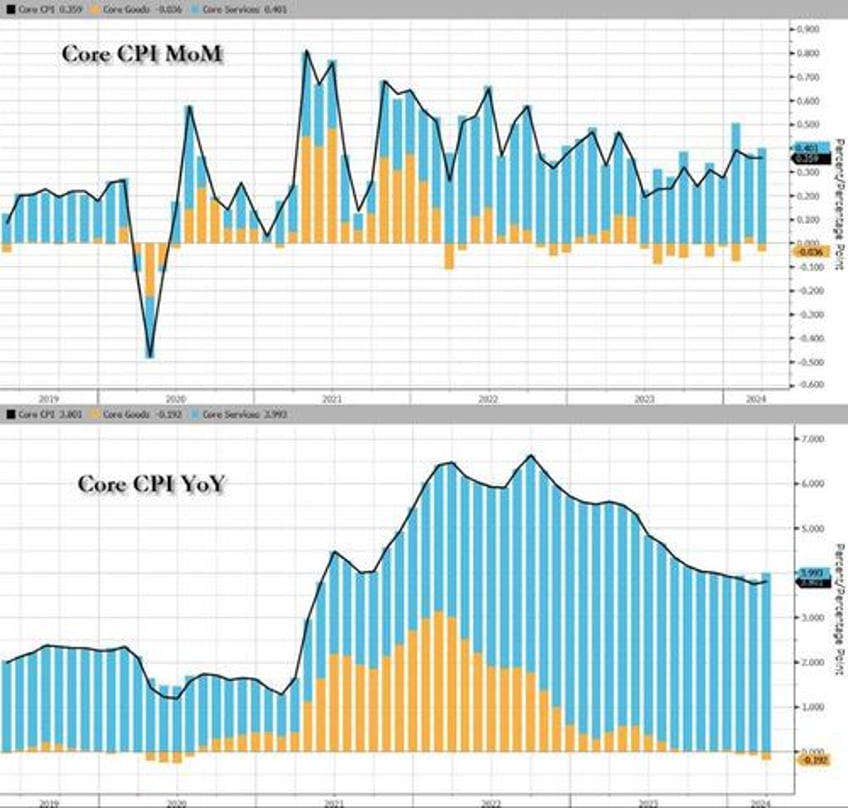

Core CPI also rose more than expected (+0.4% MoM) pushing the YoY move up 3.8% (hotter than the 3.7% exp)...

Source: Bloomberg

Within the core index, goods costs continue to deflate on a YoY basis but services are re-acclerating...

Source: Bloomberg

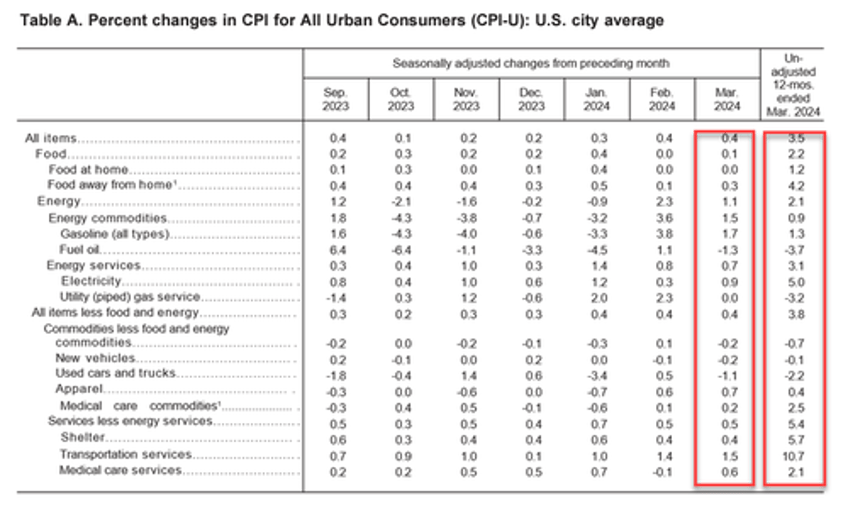

Under the hood, the surge was led by Energy & Shelter costs...

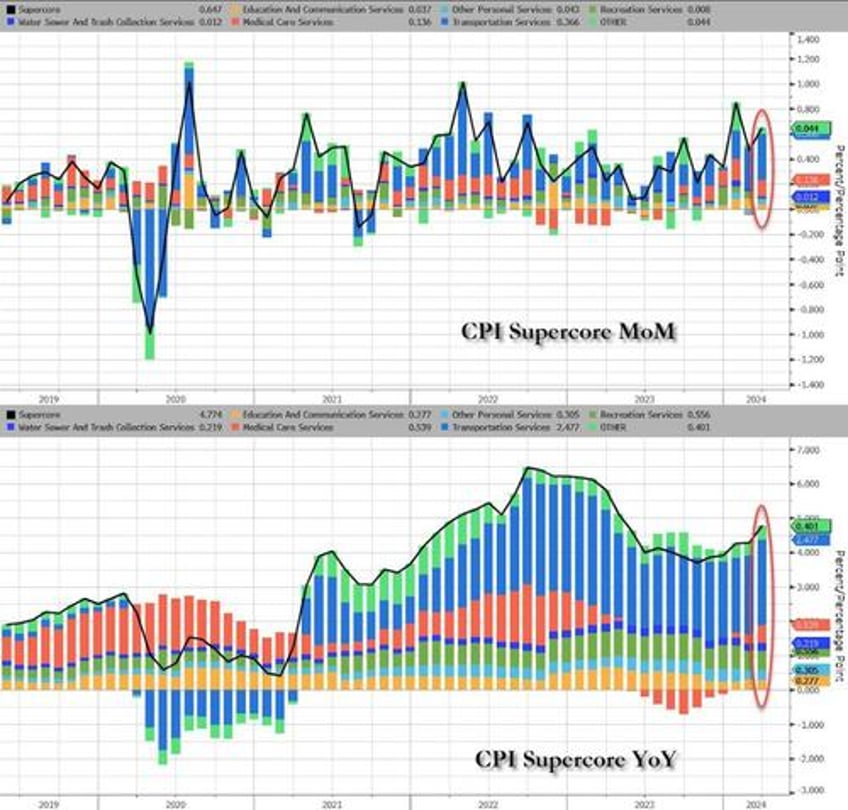

And one step deeper - the so-called SuperCore: Core CPI Services Ex-Shelter index - soared 0.7% MoM up to 5.0% YoY - the hottest since April 2023...

Source: Bloomberg

Worse still, every sub-components in SuperCore rose on a MoM and YoY basis...

Source: Bloomberg

Finally, we note that consumer prices have not fallen in a single month since President Biden's term began (July 2022 was the closest with 'unchanged'), which leaves overall prices up over 19% since Bidenomics was unleashed. And prices have never been more expensive...

Source: Bloomberg

That is an average of 5.6% per annum (more than triple the 1.9% average per annum rise in price during President Trump's term).

So, about that shrinkflation - did companies only 'get greedy' when Biden took office?

Are we going to see a replay on the '70s?

Source: Bloomberg

Not at all what the doves (and the Biden administration) were hoping to see...