The penultimate trading day of the year was 'mixed' with Small Cap stocks and Treasury Bonds down; The dollar and The Dow up; and crypto, credit, and crude all falling as what little macro data there was disappointed (wholesale inventories declined for the 9th month in a row; claims rising more than expected and pending home sales weaker than expected).

March rate-cut odds remain around 85-90% with around 160bps of rate-cuts priced-in still for 2024.

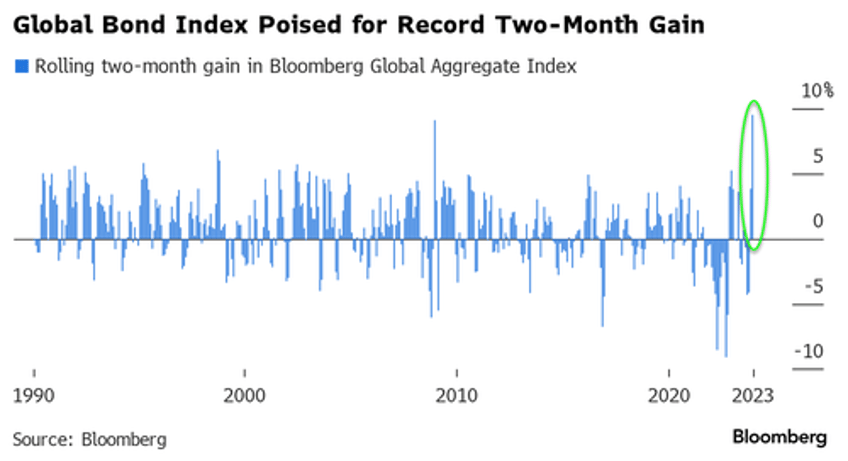

“What we are seeing now is a bond carnival,” said Hideo Shimomura, a senior portfolio manager at Fivestar Asset Management Co. in Tokyo.

“Bond investors have been hibernating and now I feel that their explosive desire is to come out of their lair.”

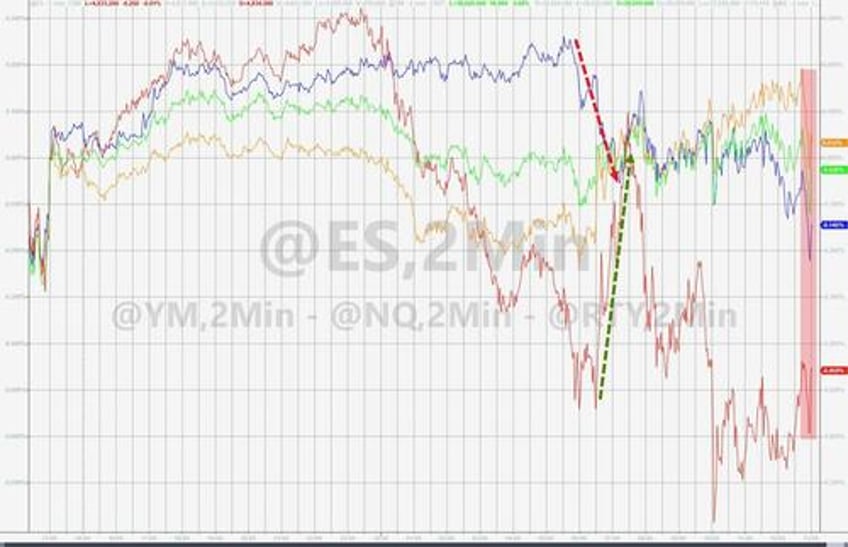

Small Caps were the day's biggest losers as yields spiked with The Dow outperforming. But a late-day sell-off spoiled the party for the S&P 500 (but The Dow ended just green)...

The S&P traded up to 4793 intraday (just shy of the closing high of 4796), but a late-day selloff tested unchanged and managed to close just green...

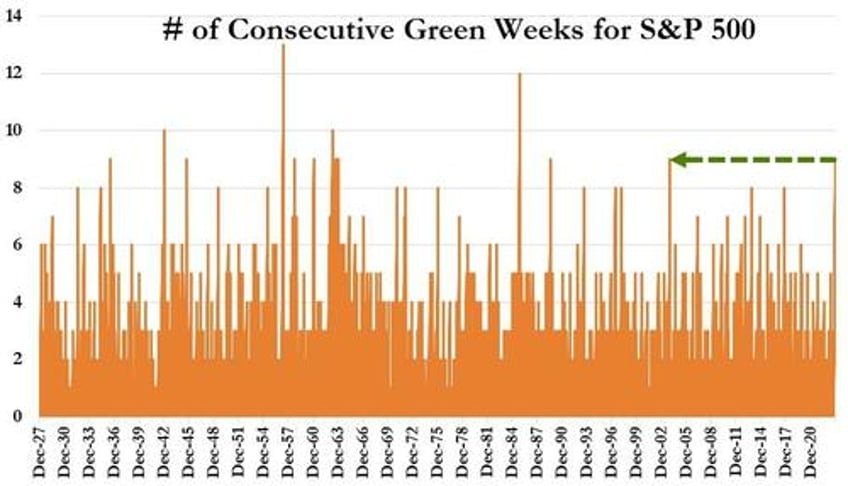

The Dow and S&P are up for 13 of the last 15 days and the S&P 500 is on track for its 9th straight green week - the longest winning streak in 20 years.

The last time the S&P 500 did a 10-week streak was in 1985.

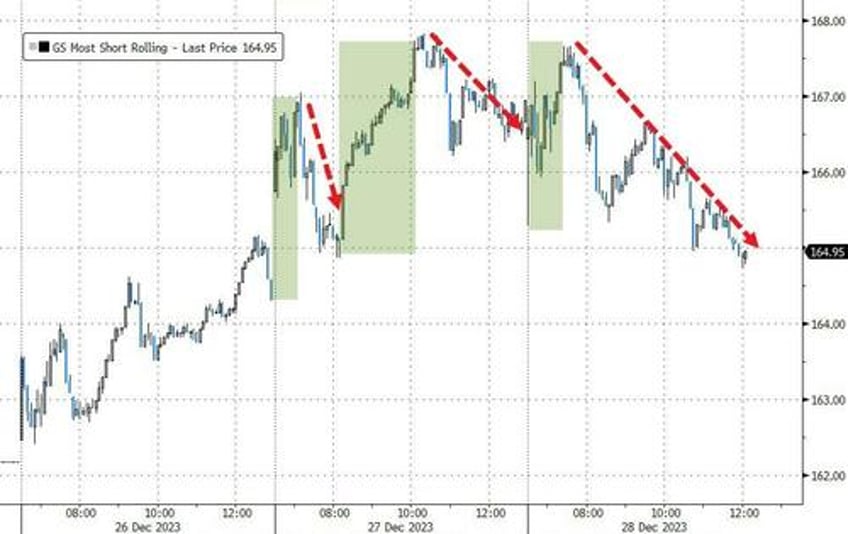

'Most Shorted' stocks squeezed higher once again at the open but were sold almost constantly after that...

Source: Bloomberg

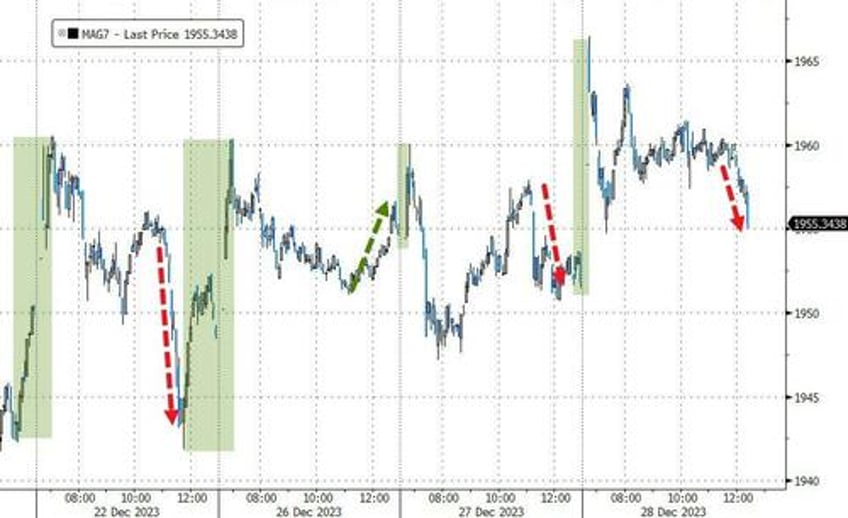

MAG7 stocks were sold late-on but ended green as a basket...

Source: Bloomberg

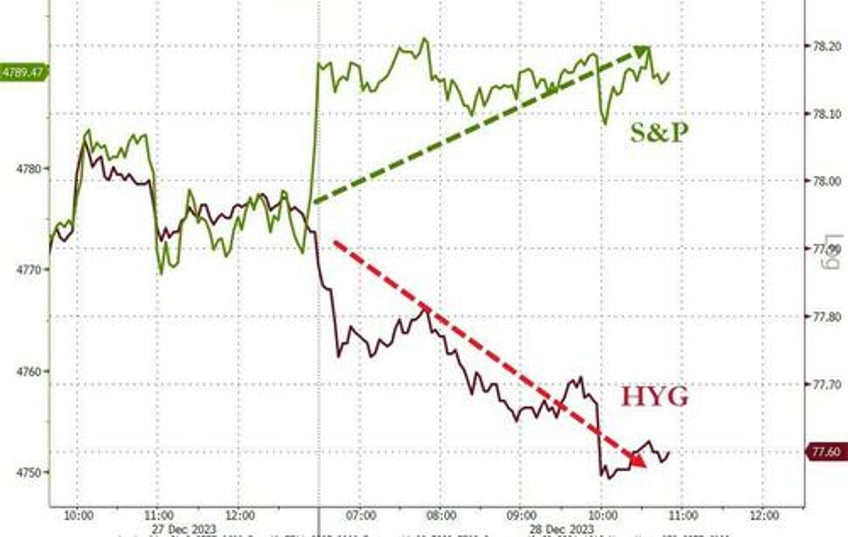

Credit markets disagreed with equities today - for a recent change - with HYG (HY Corporate bond ETF) tumbling

Source: Bloomberg

Treasuries were sold today, hurt by an ugly tail for the 7Y auction, but remain lower on the holiday shortened week. A late-day buying program in bonds reduced the pain and left the belly underperforming (5Y +5bps, 2Y and 30Y +3bps)...

Source: Bloomberg

The world’s debt market is on track to post its biggest two-month gain on record as traders ramp up expectations that central banks everywhere will slash interest rates next year.

Source: Bloomberg

The Bloomberg Global Aggregate Total Return Index has risen nearly 10% over November and December, its best two-month run in data going back to 1990.

“The ferocity of the bond market rally has really augmented the total returns for investors,” said Vishnu Varathan, head of economics and strategy at Mizuho Bank Ltd. in Singapore.

“There’s a feeling markets are signaling we’re heading half-way toward easy monetary policy again.”

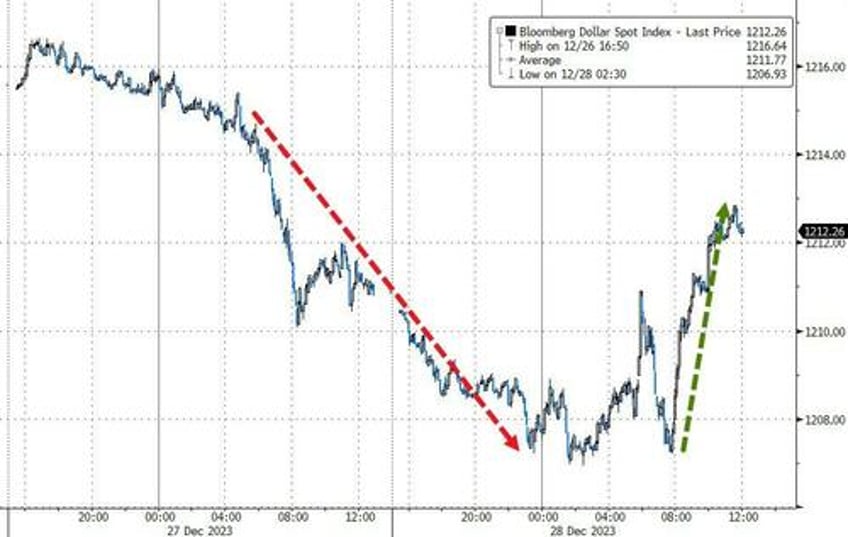

The dollar rallied back from yesterday's slump, erasing around half of that decline today...

Source: Bloomberg

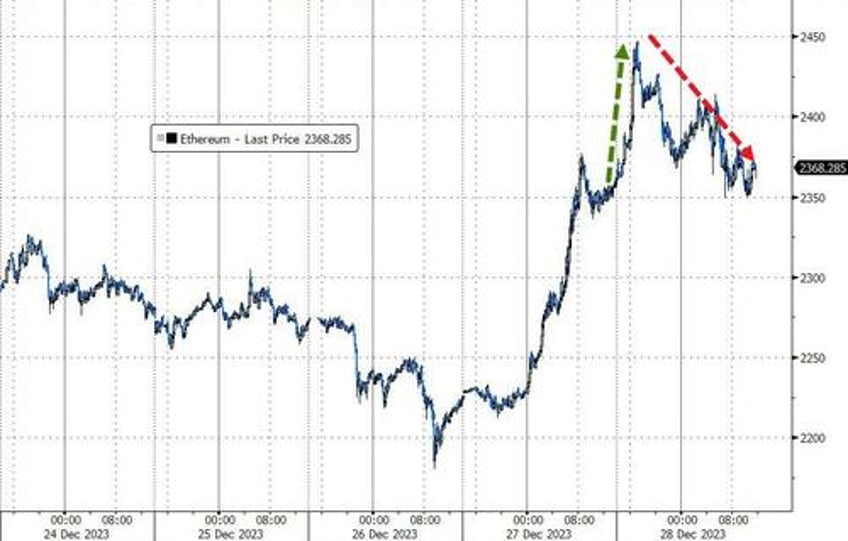

Ethereum managed to cling to green today, but was well off its overnight highs by the end of the US session...

Source: Bloomberg

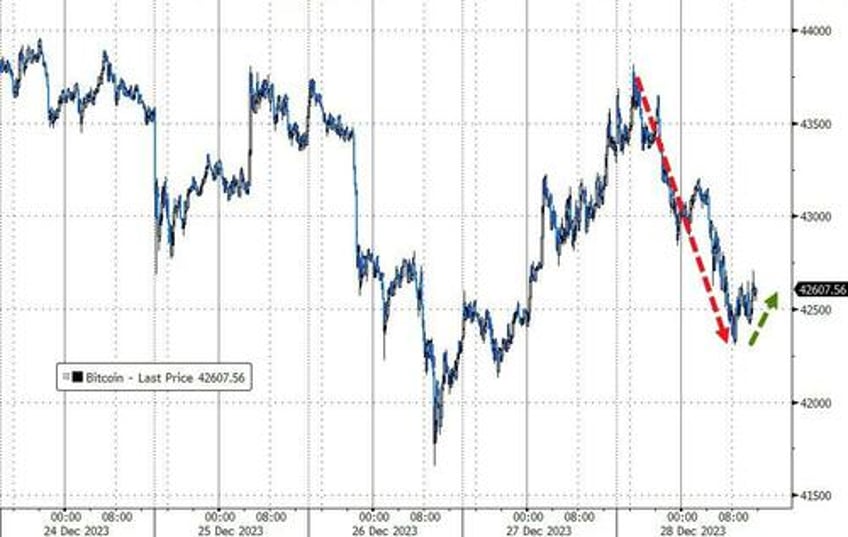

Bitcoin, however, was pummeled back below $42,500 before finding support...

Source: Bloomberg

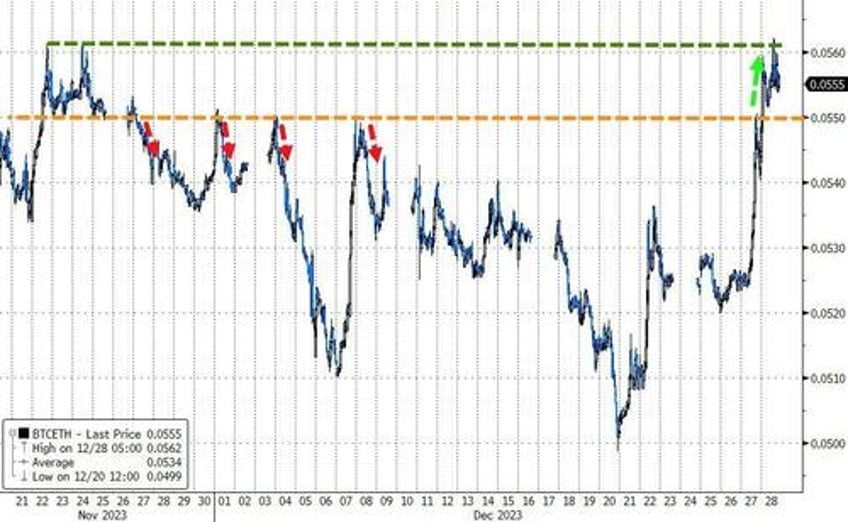

Which combined means that ETH/BTC has broken the key resistance

Source: Bloomberg

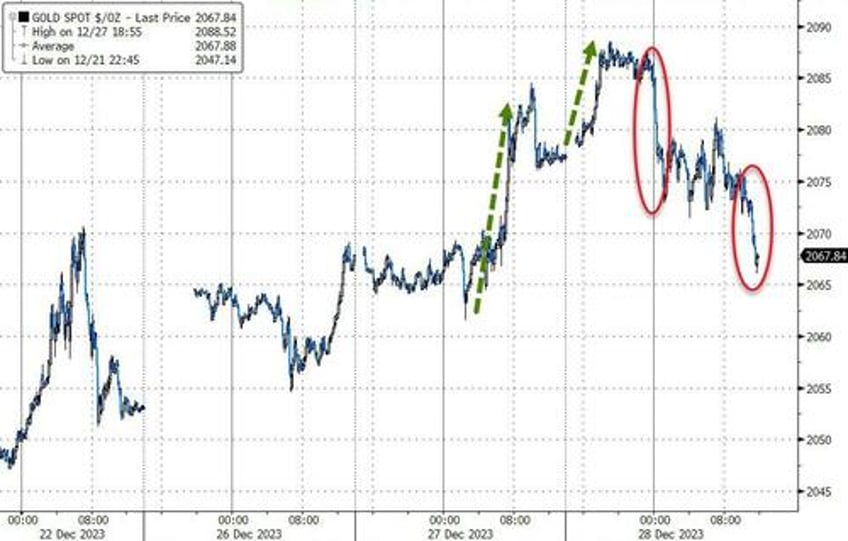

Spot Gold hit $2088 highs overnight but faded all day with a good kick from Benoit as Europe opened...

Source: Bloomberg

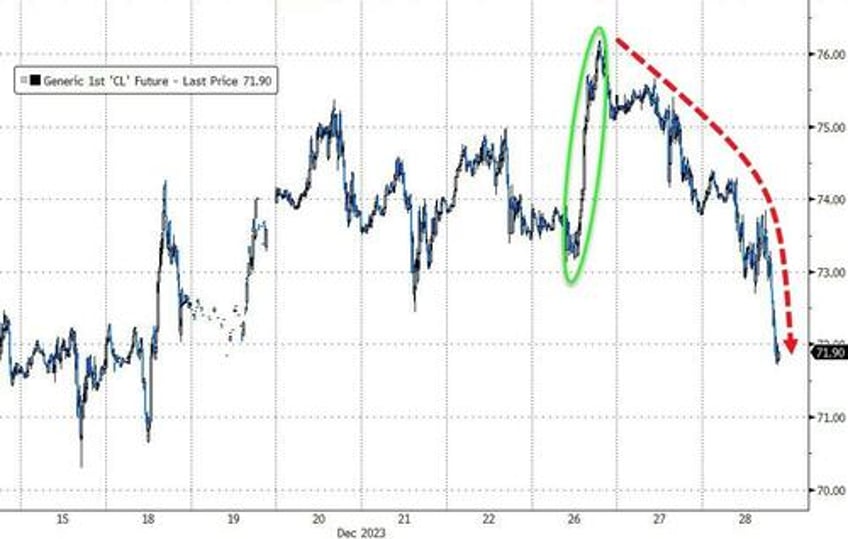

Oil prices extended yesterday's losses with WTI breaking down to a $71 handle - the lowest in a week...

Source: Bloomberg

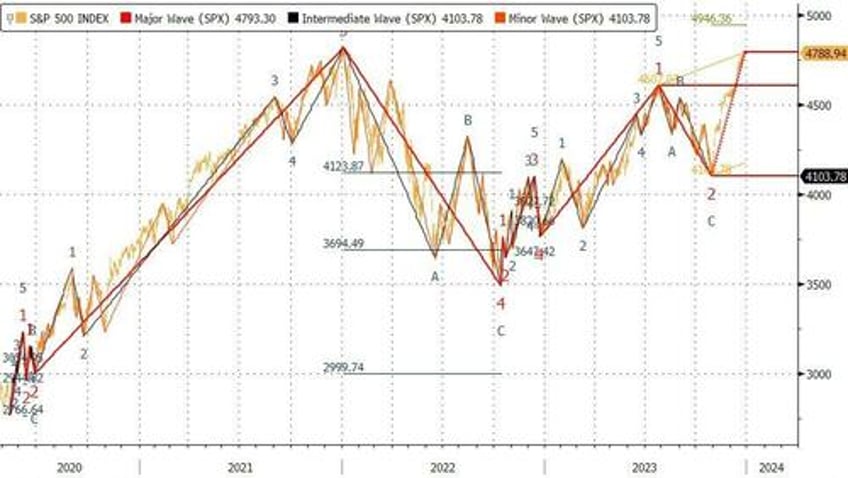

Finally, as Bloomberg's Vincent Cignarella notes, the S&P is in the 3rd wave of the 5-wave Elliott theory which is typically its most powerful and extended. Upon completion, the index will enter the 4th wave, a correction.

Source: Bloomberg

How far is anyone's guess but the last one which began in January of 2022 lasted around 10 months for a 20-25% drop.

While a correction seems a certainty, there’s plenty of time left to devise a risk-off strategy of your choosing. The chart suggests the index may still climb above 4900 - a new record high - before rolling over.