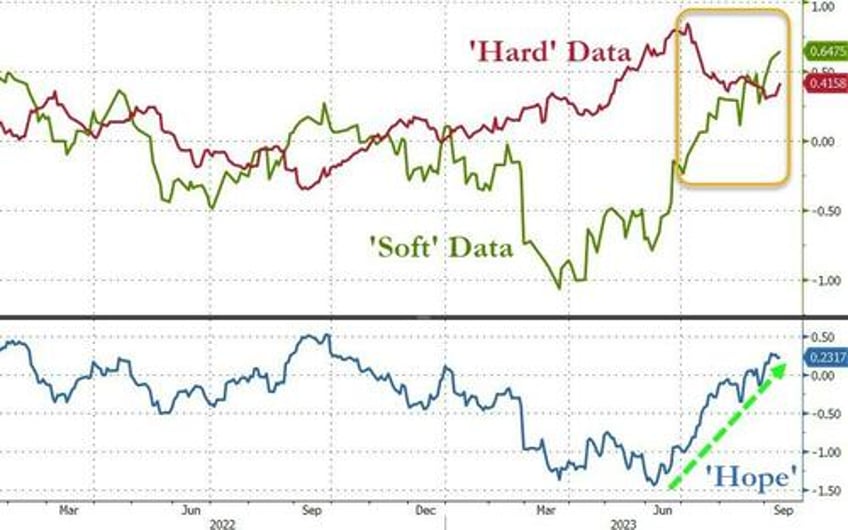

'Hope' continued to soar this week as 'soft' survey data soared to its highest since Jan 2022 while 'hard' macro data hovered near 6-month lows...

Source: Bloomberg

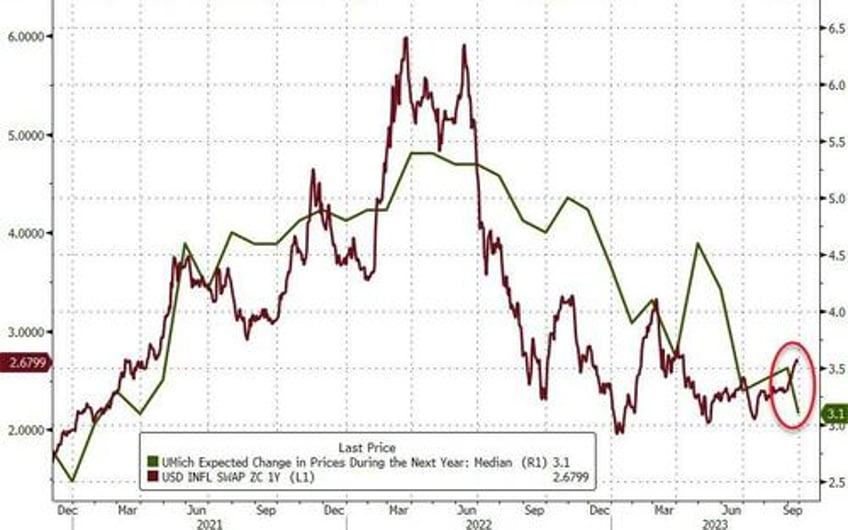

But it was inflation was spooked everyone (CPI hot, PPI hot, Import/Export prices hot) but UMich sentiment inflation expectations tumbled even as the market's inflation expectations spiked...

Source: Bloomberg

Also, bear in mind that core retail sales disappointed, industrial production slowed, and headline consumer sentiment declined. So slower growth/demand and higher inflation... brilliant.

The Nasdaq fell for the second week in a row and was the biggest loser while The Dow clung to unchanged...

All the majors fell back below their key technical levels today...

Tech stocks suffered the most this week, while Utes outperformed (even with rising rates). Energy ended around unchanged...

Source: Bloomberg

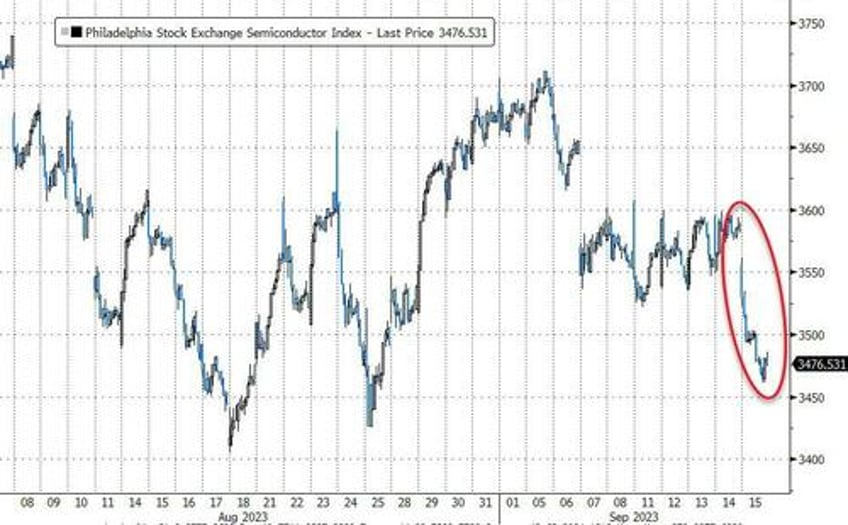

Semis were hammered lower today...

Source: Bloomberg

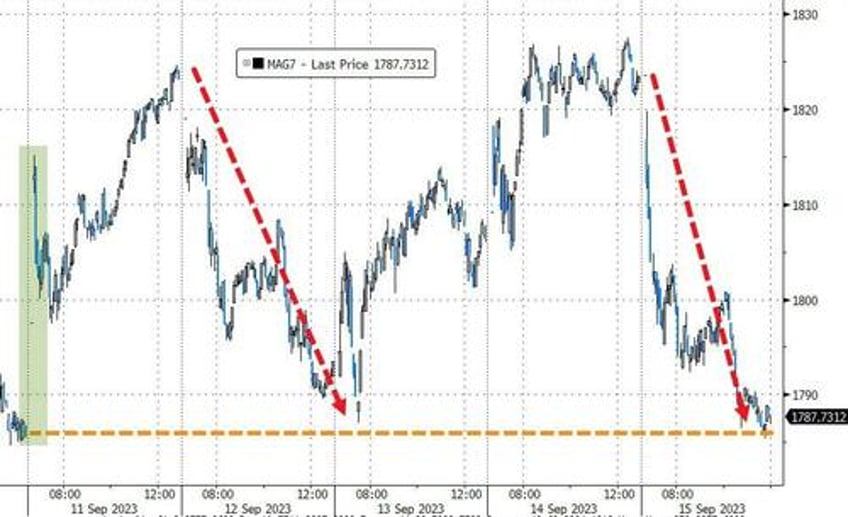

The so-called 'Magnificent 7' puked today, erasing all of the week's gains...

Source: Bloomberg

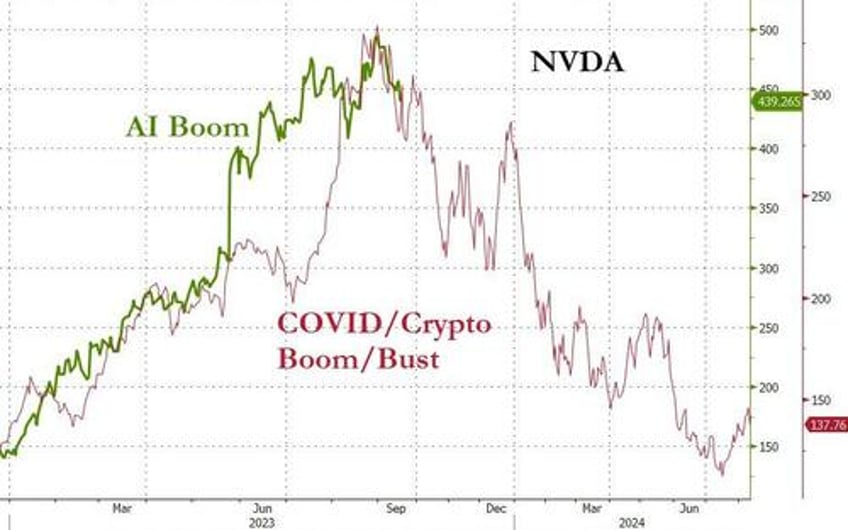

While NFLX was clubbed like a baby seal this week, AI-hero NVDA tumbled for the second straight week, back well below the last earnings level (down 13% from its record high after earnings)...

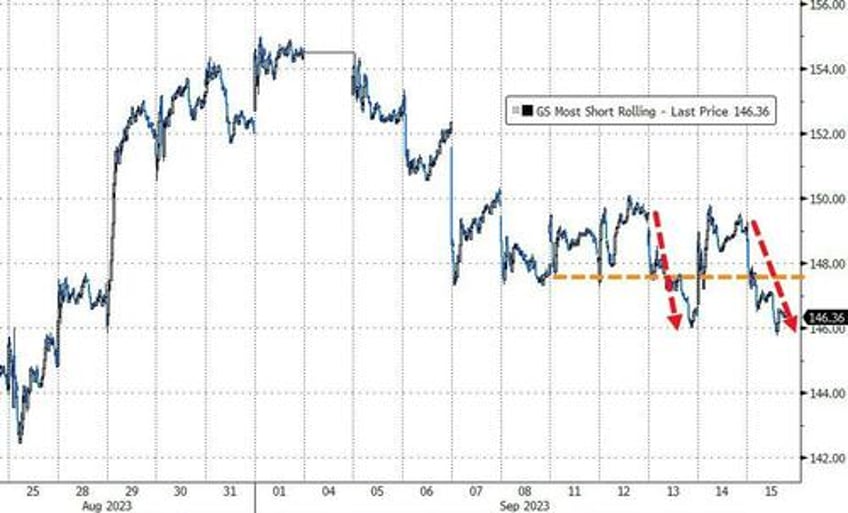

'Most Shorted' stocks fell for the 2nd week in a row (down 6 of the last 7 weeks)...

Source: Bloomberg

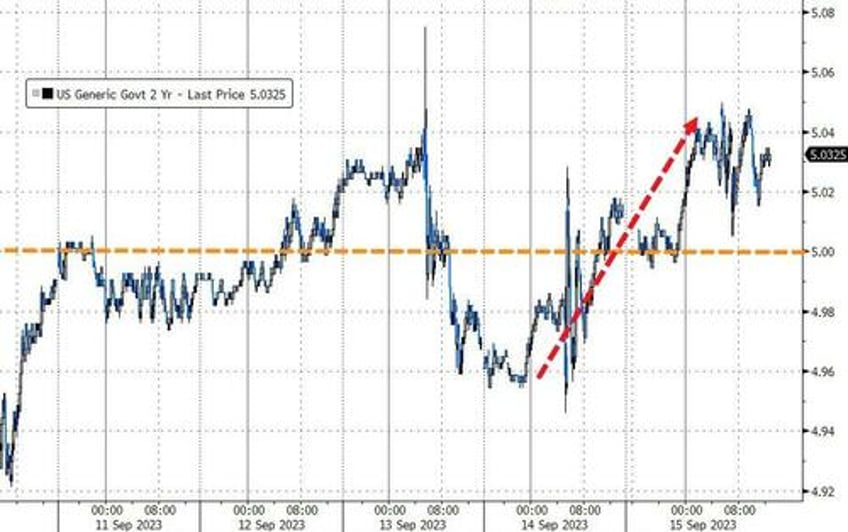

Treasuries were sold again today (2nd day in a row) with the selling starting at the European open and going thru the European close. That lifted all yields higher on the week with the long-end underperforming...

Source: Bloomberg

The 2Y Yield rose back above (and closed above) the key 5.00% level...

Source: Bloomberg

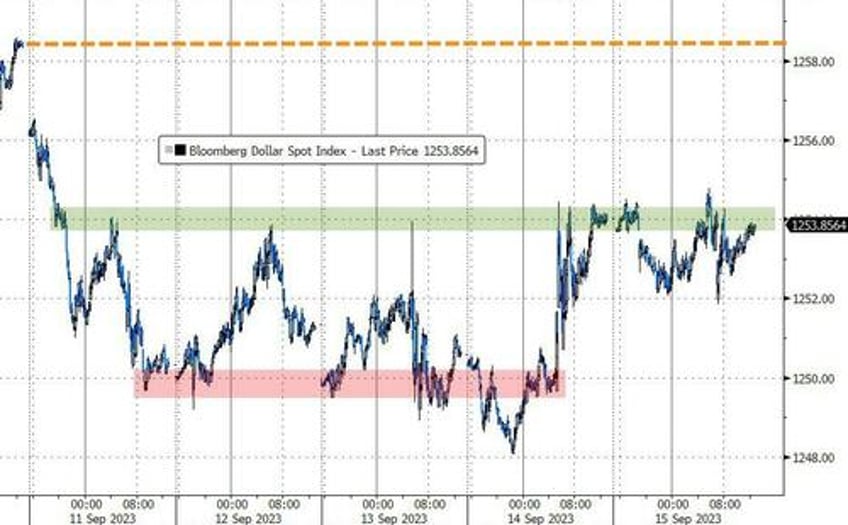

The dollar ended the week lower but at the upper end of its intra-week range...

Source: Bloomberg

Crypto was mixed this week with Bitcoin eking out modest gains (back above $26,500) and Ethereum slightly lower. Solana was the ugliest horse in the glue factory...

Source: Bloomberg

Gold (spot) ended the week higher, bouncing strongly to the week's highs after testing down to $1900 yesterday...

Source: Bloomberg

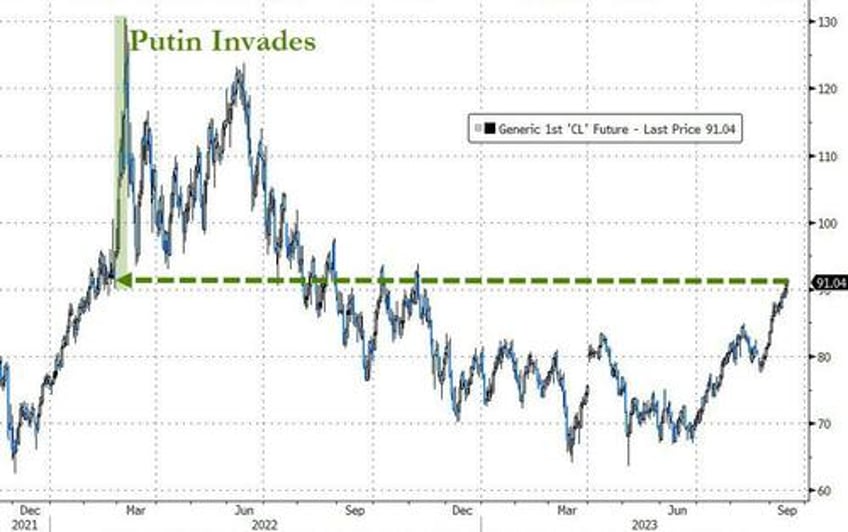

Oil prices rose for the 10th week of the last 12 with WTI topping $91, back at levels just prior to Putin's invasion of Ukraine...

Source: Bloomberg

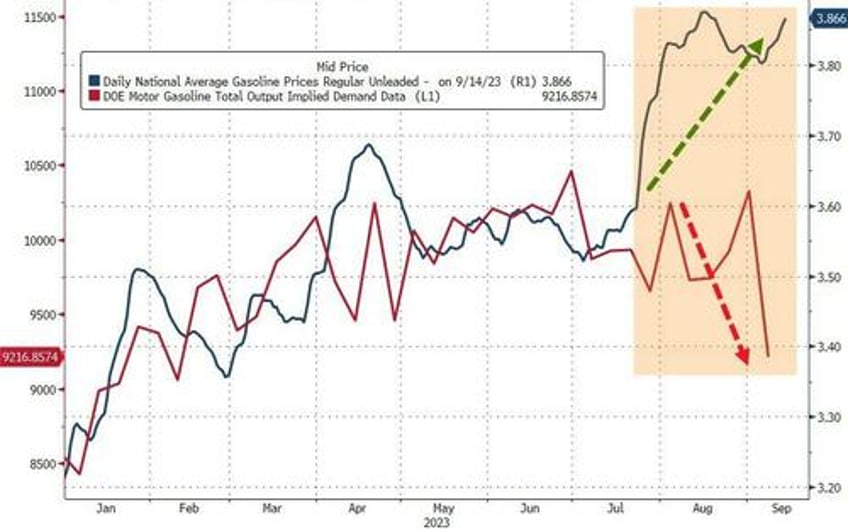

Is the soaring gas price already having an impact on demand for gasoline?

Source: Bloomberg

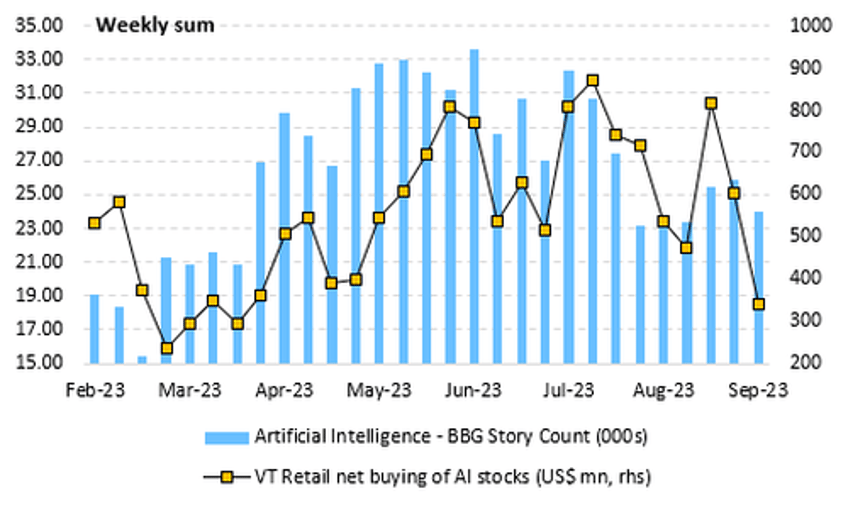

Finally, is the AI bubble froth being blown off?

As Vanda Research notes, the allure of AI stocks is steadily waning, with retail investors showing a decline in their net purchases of AI-related stocks. This diminishing interest is further evidenced by a notable reduction in the frequency of Bloomberg stories covering the AI sector.

The analog remains...

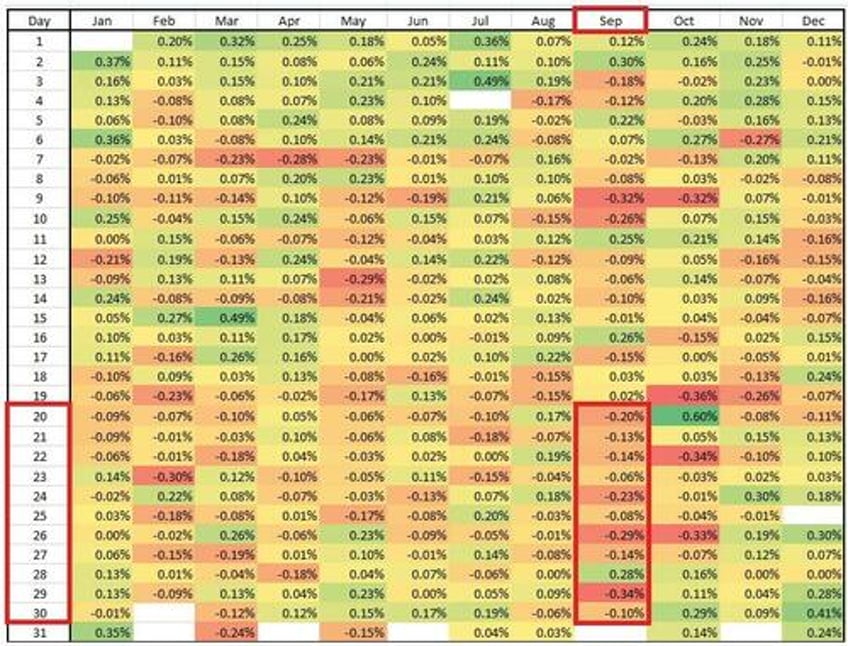

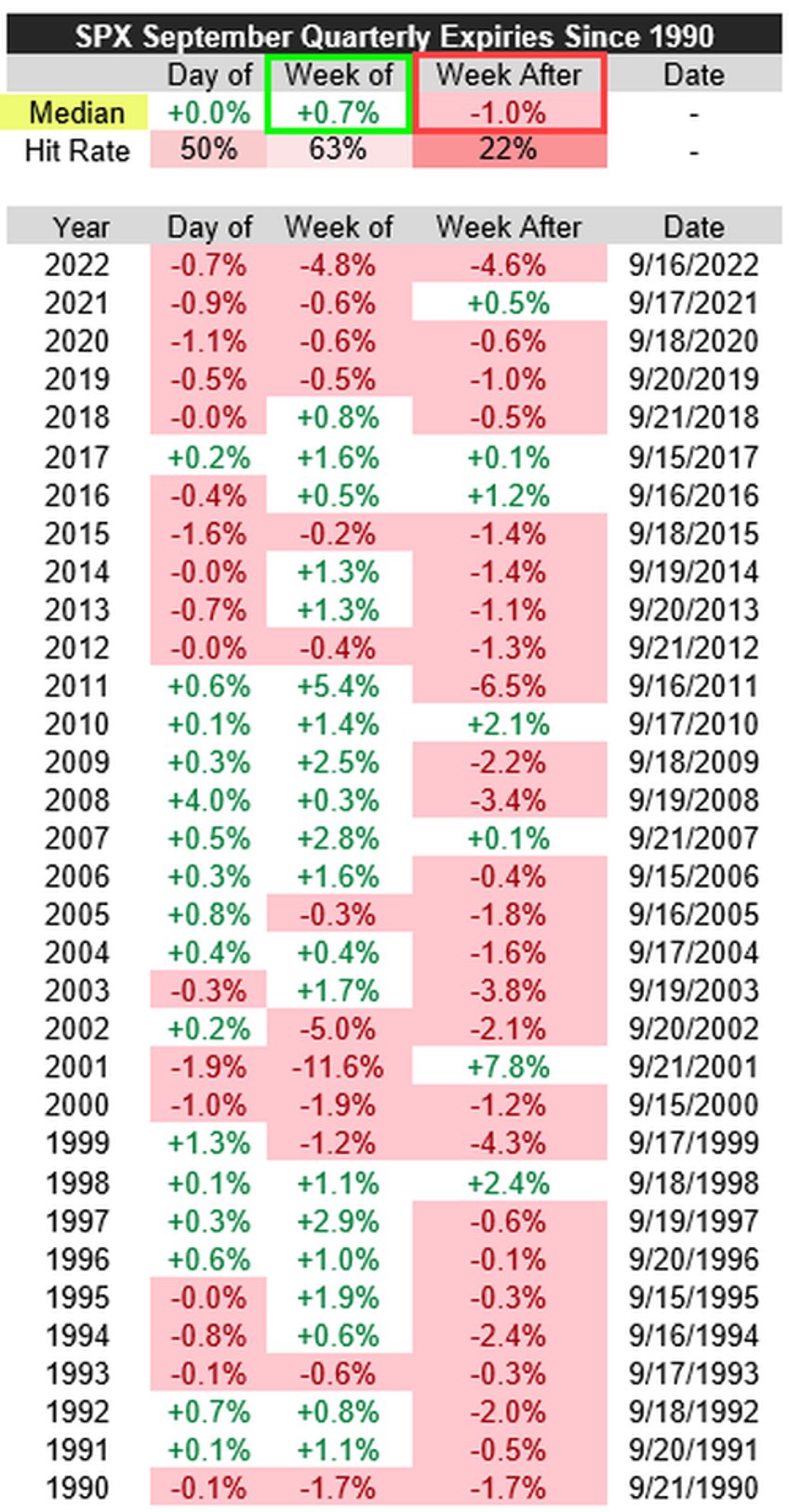

And don't forget that the period from Sept 20-month-end is the worst 'season' for US equities...

And remember the "Week After" Sep Op-Ex has been remarkable in its "consistent weakness", lower 26 of 33 times since 1990, with a median return -1.0% at a 22% hit-rate (i.e. "higher" only 22% of the time)

With the gamma unclench after today's quad-witch, do you feel lucky?