By Stefan Koopman, Senior Macro Strategist at Rabobank

The ECB’s latest Bank Lending Survey paints a picture of an ongoing tightening of credit conditions and sharply falling loan demand across the eurozone. According to the survey, a net 14% of banks continued tightening lending standards in Q2. This was down from 27% in Q1 but represents a very substantial cumulative tightening over recent quarters. The tightening is driven by rising macro-economic risks and banks' declining appetite to add this risk to their balance sheet amid rising funding costs. This is, for instance, being reflected in an increase in rejected loan applications, with loans to SMEs having higher rejection rates than loans to large companies.

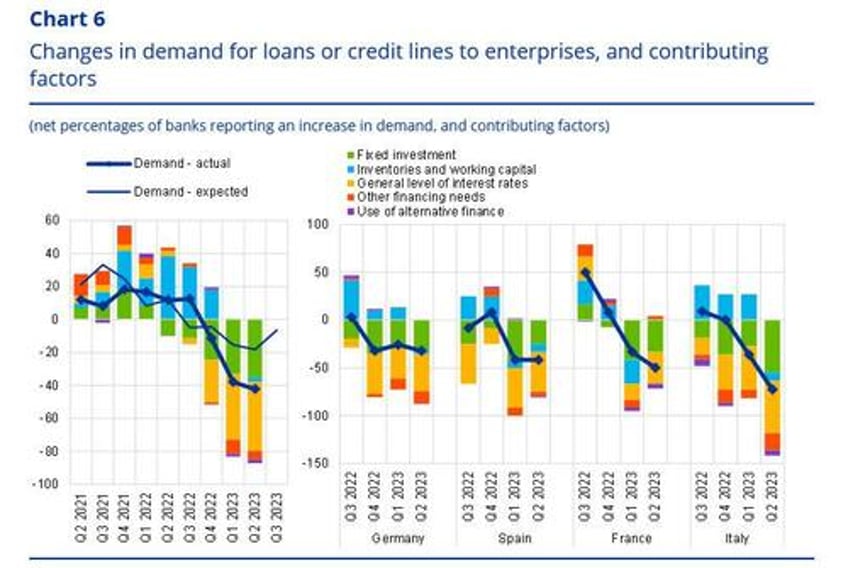

It’s not just supply that is contracting. Demand for borrowing from businesses looks to be collapsing, dropping to the lowest since the survey started in 2003 – yes, that includes the 2007-2008 credit crunch. The factors that lead to this weakness are rising rates, a drop in fixed investment plans, lower financing needs for inventories and increased internal financing. The decline was substantial across the four largest eurozone economies. Loan officers expect a further net decrease in loan demand in Q3, though at a slower pace than in Q2. The BLS finally showed that similar trends are evident in housing loans to households, with rising rejections of mortgage applications and falling demand. Consumer credit also followed suit.

This morning’s ECB money supply and credit data lent further support to the view that monetary tightening is increasingly weighing on the economy. Growth of credit to the private sector slowed to 1.5% y/y in June from 2.2% in May and net monthly flows (i.e., gross loan production minus redemptions) were broadly flat in nominal terms. According to our calculations, the Eurozone non-financial private sector credit impulse indicator fell to -3.4% y/y in June from -2.4% in May. This implies that credit is now ‘contributing’ to declining growth.

As credit growth has been slowing and excess liquidity declining, the liability side of the European banking sector naturally shows a further fall in growth of broad liquidity. The M3 growth rate fell to 0.6% y/y in June 2023 from 1.0% in May. The more liquid M1 measure, which comprises currency in circulation and overnight deposits, fell to -8.0% y/y. In real terms, it is a 12.8% fall. This is the sharpest contraction in M1 since, at least, the 1960s and historically consistent with recession. It reflects a shift out of the most liquid components as a result of relatively low rates on current accounts, but also means that more money is being locked up in term deposits or securities instead of being available to support spending.

The numbers highlight how rising rates and economic uncertainty are severely dampening credit appetite. Credit growth faces persistent headwinds, underscoring risks of ECB overtightening. In a debt-driven growth model, this credit squeeze will eventually ease price pressures but ensures a weak outlook. The ECB will likely see these figures as evidence their aggressive tightening is taking hold. This will further strengthen the doves' case into tomorrow's ECB decision as they determine what (not) to communicate alongside the 25bp hike.

Given all of this, it’s not a surprise that Germany’s ifo Business Climate Index fell for the third straight month to 87.3 in July, down from 88.6 in June. The drop was in line with the PMIs and reflects increased dissatisfaction with current business and softer expectations across all sectors - manufacturing, services, trade and construction. Indeed, the IMF singled out Germany as the only G7 economy to contract this year. Even so, the German labour market is structurally very tight and, as Erik-Jan sets out here, we expect only a very modest uptick in unemployment rate amidst sticky wage increases.

Hope is pinned on China as the Politburo pledged "counter-cyclical" measures, though the announced policies seem limited in scope for now. However, the explicit "counter-cyclical" wording signals an orientation toward stabilizing growth, implying potential for more stimulus ahead. Two key personnel changes were notable too:

- Foreign Minister Qin Gang's abrupt disappearance remains an unexplained mystery for everyone outside of Zhongnanhai. His surprising UN vote contradicting China’s stance on Russia may have triggered his ouster, but personal issues could just as well be a reason. Whatever the exact cause, he fell out of favour. Qin’s predecessor Wang Yi takes over. He is director of the CCP’s Foreign Affairs Commission and is a Politburo member, outranking Qin. The sudden reshuffle and Qin's unexplained exit is another reminder of China's opaque inner workings and potential for sudden shifts.

- The PBoC governor appointment of Pan Gongsheng follows his earlier appointment as the PBoC’s party chief. With credentials from Cambridge and Harvard, he warned about China's real estate bubble risks since 2014. While he has been involved in exchange rate reforms to promote a more market-driven renminbi, the PBoC's latest report stated it will "resolutely prevent sharp fluctuations." We expect initial moves by Pan to halt yuan depreciation and establish credibility. His appointment may also signal increased worries about the struggling recovery, suggesting more monetary policy support, starting with a 10bp cut to the 7-day RRR and 1-year MLF by end of Q3.

Earlier this morning, inflation in Australia fell more than expected in Q2, with the headline dropping to 6.1% y/y from 7% and the all-important trimmed mean to 5.9% y/y from 6.6%. Goods inflation finally slowed in Australia, but services inflation hit the highest since 2001 at 6.3%, driven by travel, rents, insurance and dining out. Short-term yields have fallen some 10bp on the news of disinflation, and rate hike expectations for next week dropped to just below 20%. However, the strong labour market in conjunction with high services inflation may still warrant a 25bp hike from the RBA to 4.35%. The retail sales numbers due out at the end of the week will be the last piece of the puzzle before the RBA meets.