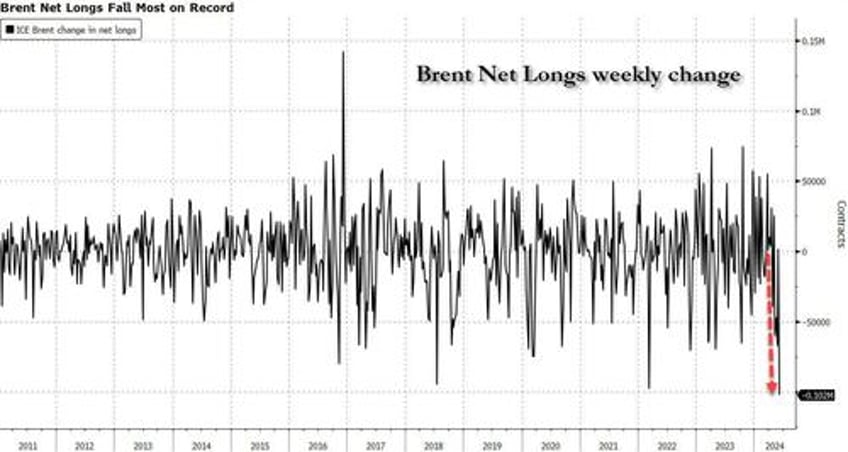

One week ago, with the price of oil tumbling, we reported that Brent crude futures had just seen the biggest weekly decline in net-bullish wagers in the history of the ICE, a clear sign of the surge in bearish sentiment and the extent of the technical selling that pressured crude, and an even clearer sign that we had just observed capitulation among the financial players, which is also why we said that a "Price Rebound was Imminent."

And sure enough, the price of brent is not only up every single day since that article, but it saved the best for last spiking almost $2 on Monday after we reported late on Sunday that CTAs, all of them 100% net short, are about to unleashing a major buying spree.