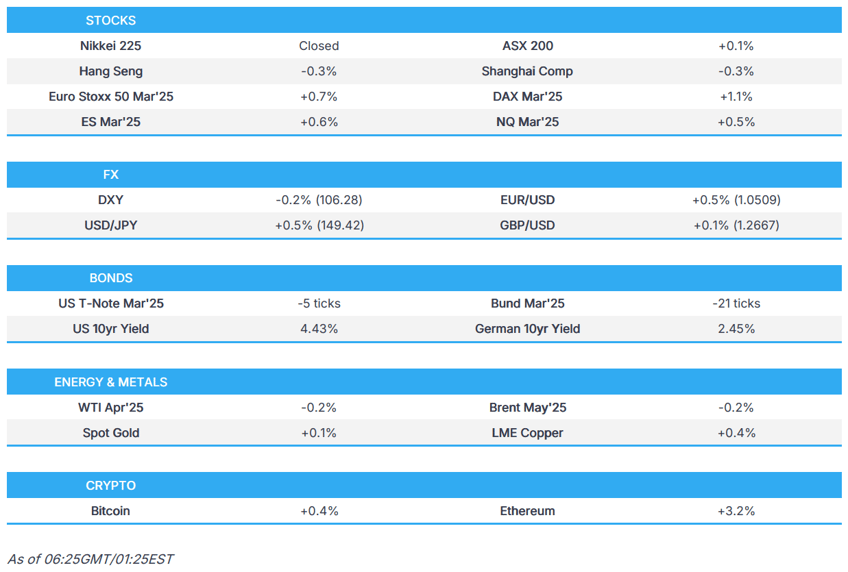

- APAC stocks began the week mixed after last Friday's sell-off on Wall St and amid holiday-quietened trade with Japanese markets closed for the Emperor's Birthday, while participants also reflected on the results from Sunday's German election.

- DAX futures rallied by 1%, Bund futures marginally softened, EUR/USD outperformed and reclaimed the 1.0500 handle as Germany’s CDU/CSU won the election on Sunday with a Grand coalition possible; far-right AfD came second.

- US President Trump said on Friday that he spoke with Chinese President Xi on fentanyl. US President Trump’s team is reportedly pushing Mexico towards tariffs on Chinese imports, according to Bloomberg.

- Ukrainian President Zelensky said the issue of elections is a step to apply pressure on Ukraine and he is willing to quit the presidency if it means peace in Ukraine which he said could be exchanged for NATO membership.

- European equity futures indicate a higher cash market open with Euro Stoxx 50 futures up 0.7% after the cash market closed with gains of 0.3% on Friday.

- Looking ahead, highlights include German Ifo Expectations, US National Activity Index, Speakers including BoE’s Lombardelli, Pill, Ramsden, Dhingra & BoC’s Gravelle, Supply from the EU & US, Earnings from Domino's Pizza, Him & Hers, Riot Platforms, Tempus AI, Cleveland Cliffs & Zoom.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks tumbled on OpEx Friday and T-notes rallied across the curve in which the pressure in US stocks began in the morning amid the backdrop of the deterioration of Ukraine relations with the US and lingering tariff deadlines, while the attention was on weak US PMI data and reports of a potentially pandemic-inducing Coronavirus being found in China.

- SPX -1.71% at 6,013, NDX -2.06% at 21,614, DJI -1.69% at 43,428, RUT -2.94% at 2,195.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump’s team is reportedly pushing Mexico towards tariffs on Chinese imports, according to Bloomberg.

- US President Trump said on Friday that the US will establish new rules to stop US firms from investing in industries that advance China’s national military-civil fusion strategy and will establish rules to stop China-affiliated people from buying critical US businesses and assets.

- US President Trump said on Friday that he spoke with Chinese President Xi on fentanyl. It was also reported on Friday that a White House official said President Trump is to sign a national security memorandum aimed at promoting foreign investment while protecting US national security interests from threats posed by foreign adversaries like China.

- US House Chair Jordan criticised EU tech fines and European taxes on US companies and wants the European Commission to brief the judiciary committee by March 10th and called for EU antitrust chief Ribera to clarify rules reining in big tech.

NOTABLE HEADLINES

- Fed’s Goolsbee (2025 voter) downplayed a report from last week which showed an increase in consumers’ expectations for future inflation whereby he stated that it wasn’t a great number but added it is only one month of data and at least two or three months for it to count, according to Bloomberg.

- US President Trump said Elon Musk is doing a good job but he would like to see him get more aggressive. It was separately reported that Elon Musk said consistent with President Trump’s instructions, all federal employees will receive an email requesting to understand what they got done last week and a failure to respond will be taken as a resignation, although some agencies told workers not to reply to Musk’s email.

- US President Trump nominated Air Force Lt General Dan Caine as the next Chairman of the Joint Chief of Staff to replace General Brown, while several other top officials were also pushed out.

- US President Trump reportedly told CEOs of pharmaceutical companies during a meeting to move their production to the US.

- American Airlines (AAL) flight was diverted to Rome over ‘possible security issue’, according to ABC News. However, the airline later stated that the flight landed safely in Rome and after inspection by law enforcement was cleared to re-depart with the issue determined to be non-credible.

GERMAN ELECTION

- Europe Elects reported the preliminary result showed CDU/CSU-EPP at 29% (+5), AfD-ESN at 21% (+11), SPD-S&D at 16% (-10), GRÜNE-G/EFA at 11% (-4), LINKE-LEFT at 9% (+4), BSW-NI at 5% (+5) and FDP-RE at 4% (-7) with 260 out of 299 constituencies declared.

- As it stands, CDU will need to form a coalition to govern. The most likely option is a Grand coalition with the SPD, though a three-way coalition remains possible but is somewhat dependent on the final results for the smaller parties.

- German CDU party leader Merz said they have won the election and are aware of the scale of the challenge ahead, while he added that it is important to create a government as soon as possible and that Germany must be present in Europe again. Merz also commented that he will try to form a government that represents the whole country and has always said no question of a coalition with AfD, as well as noted that forming a government will be difficult but he still hopes they will have formed a government by Easter. Furthermore, Merz said the priority is that the EU stand together and become independent from the US, as well as noted it is clear that the future of Europe is a matter of indifference to US President Trump.

- Market Reaction: DAX futures rallied by 1%, Bund futures marginally softened, EUR/USD outperformed and reclaimed the 1.0500 handle.

APAC TRADE

EQUITIES

- APAC stocks began the week mixed after last Friday's sell-off on Wall St and amid holiday-quietened trade with Japanese markets closed for the Emperor's Birthday, while participants also reflected on the results from Sunday's German election.

- ASX 200 traded little changed as gains in financials and the defensives were counterbalanced by losses in tech and the commodity-related sectors, while there was also another deluge of earnings updates.

- KOSPI underperformed amid ongoing economic concerns and ahead of tomorrow's BoK rate decision.

- Hang Seng and Shanghai Comp were choppy but were ultimately pressured amid ongoing trade-related frictions, with the US said to be pushing Mexico towards tariffs on Chinese imports. Nonetheless, there were some encouraging reports with Chinese state-backed developers beginning to buy land at a premium again, while agricultural stocks were supported after China pledged to deepen rural reforms as part of efforts to revitalise the agricultural sector and bolster food security in the State Council's annual rural policy blueprint.

- US equity futures were mildly higher in a partial rebound following Friday's sell-off.

- European equity futures indicate a higher cash market open with Euro Stoxx 50 futures up 0.7% after the cash market closed with gains of 0.3% on Friday, while DAX futures rallied by 1.1% following the German conservatives' election win with CDU leader seeking to form a government as quickly as possible.

FX

- DXY weakened which was largely a function of the gains in its transatlantic counterparts, while there were recent comments from Fed’s Goolsbee who downplayed a report from last week that showed an increase in consumers’ expectations for future inflation in which he stated that it wasn’t a great number but is only one month of data and need at least two or three months for it to count. Furthermore, the main events for the greenback are towards the latter part of the week with GDP revisions on Thursday and PCE data on Friday.

- EUR/USD outperformed and reclaimed the 1.0500 handle following the German election in which the German conservatives CDU/CSU won with around 29% of votes followed in second place by the far-right AfD at around 21% of votes and with German Chancellor Scholz's SPD in third place with over 16% of the votes. Nonetheless, the preliminary result was in line with what polls had suggested ahead of the election and CDU leader Friedrich Merz hopes they will have formed a government by Easter.

- GBP/USD edged closer towards the 1.2700 territory as the major currencies took advantage of the softer dollar, while UK-specific newsflow was light although a recent note from TD Securities warned the BoE could cut rates more aggressively than the market expects.

- USD/JPY struggled for direction amid the mixed risk appetite in Asia and the absence of Japanese participants for a holiday.

- Antipodeans gained amid dollar weakness and strength in the yuan after some positive signals from China's property market.

- PBoC set USD/CNY mid-point at 7.1717 vs exp. 7.2495 (prev. 7.1696).

FIXED INCOME

- 10yr UST futures pulled back from around a 2-week peak after rallying on Friday amid the sell-off in stocks, while demand was also hampered by the closure of overnight cash treasuries trade due to the Tokyo holiday.

- Bund futures marginally softened following the German election on Sunday where voters shifted to the right as expected in which Germany's conservatives won the election and with CDU leader Merz calling for a quick government coalition.

COMMODITIES

- Crude futures traded marginally lower after reports over the weekend Iraqi Kurdistan authorities agreed with the federal oil ministry to restart Kurdish crude exports based on available volumes, while Iraq’s Oil Minister announced that all procedures for exporting oil through the Turkey pipeline have been completed. However, the downside in oil was limited with the losses stemmed by a weaker dollar.

- Iraq’s Oil Minister said all procedures for exporting oil through the Turkey pipeline have been completed. It was separately reported that Kurdistan authorities agreed with the federal oil ministry to restart Kurdish crude exports based on available volumes, while Iraq denied reports that it would face US sanctions if oil exports from Kurdistan were not resumed. Furthermore, Iraq is to receive 185k BPD from the Kurdistan region in the first phase after the resumption of oil exports.

- Spot gold was indecisive in the absence of any pertinent catalysts and following the choppy performance seen late last week.

- Copper futures traded rangebound near Friday's trough with price action not helped by the mixed risk appetite in Asia.

CRYPTO

- Bitcoin steadily declined throughout the session with prices retreating beneath the USD 96,000 level.

NOTABLE ASIA-PAC HEADLINES

- China is to further deepen rural reforms and advance rural revitalisation, while it will monitor and regulate pig production capacity to promote steady growth and will consolidate the results of soybean expansion, and expand rapeseed and peanut production. China is to improve the reward and subsidy systems for major grain-producing and increase support for large grain-producing counties. Furthermore, China will support the development of smart agriculture and expand application scenarios of technologies, while it will use monetary tools to encourage financial institutions to increase funding for rural revitalisation and will encourage local governments to pilot special loan interest subsidies for grain and oil crop cultivation, according to Xinhua.

- Chinese state-backed developers are beginning to buy land at a premium again after the government eased limits on home prices as the number of land parcels that sold for at least 20% above the asking price accounted for 37% of deals this year vs 14% for last year, according to a Bloomberg analysis of transactions worth at least CNY 1bln.

- Shein’s profit slumped in a fresh challenge to long-planned London IPO with its 2024 net profit down almost 40% to USD 1bln although FY sales rose 19% Y/Y to USD 38bln, according to FT.

- A report on Friday stated that a new coronavirus with pandemic potential was discovered in China, according to Daily Mail.

- UK and India relaunch trade talks in bid to boost investment opportunities, according to FT.

GEOPOLITICS

MIDDLE EAST

- Israel sent tanks into the West Bank and told troops to prepare for an extended stay, according to Reuters.

- Israeli PM Netanyahu’s office said the release of Palestinian prisoners planned for Saturday was delayed until the release of the next hostages is secured with the delay due to Hamas’s repeated violations.

- Hamas strongly condemned Israel’s decision to postpone the release of Palestinian prisoners and said Israel’s claim that a handover ceremony is humiliating is false and a pretext to evade its obligations.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said the issue of elections is a step to apply pressure on Ukraine and he is willing to quit the presidency if it means peace in Ukraine which he said could be exchanged for NATO membership, but also commented that false statements about his ratings and the amount of US aid are dangerous steps to weaken Ukraine. Zelensky said he sees Turkey as an important security guarantor for Ukraine and that Ukraine is working on Patriot system alternatives, as well as noted if the US strikes a deal with Russia to end the war, it won’t be successful if Ukraine does not agree to its conditions.

- Ukrainian President Zelensky commented that Ukraine-US talks on a minerals deal are moving forward and all is okay, while he stated that the minerals deal draft said Ukraine should return two dollars for each dollar of aid supplied by the US. Zelensky also said the USD 500bln figure is not being considered in the minerals deal anymore and a top aide said he had a constructive new round of talks with the US on the minerals deal. It was also reported that the US could cut Ukraine’s access to Starlink internet services over minerals, according to sources cited by Reuters.

- US President Trump said he thinks the US is pretty close to a minerals deal with Ukraine and that they are asking for rare earth, oil and anything they can get from Ukraine to recoup the money the US put into Ukraine.

- US Secretary of State Rubio told Ukraine’s Foreign Minister that US President Trump remains committed to ending the conflict in Ukraine.

- US Treasury Secretary Bessent said an economic partnership will protect the Ukrainian people and the US taxpayer, while he added that Ukraine’s economic future in peace can be more prosperous than at any other point and a partnership with the US will ensure this prosperity. Furthermore, Bessent said the US-Ukraine partnership proposal is for revenue received by Ukraine from natural resources, infrastructure and assets to be allocated to a fund focused on reconstruction which the US will have the rights over investments, according to FT. It was separately reported that Bessent said he is quite hopeful when asked if he expected a minerals deal with Ukraine this week.

- US President Trump’s envoy Witkoff said there be an expectation that US companies may do business in Russia if a peace deal is reached in the Russia-Ukraine war, according to CBS News.

- Russian President Putin convened a meeting of his security council and discussed relations with post-Soviet states at the meeting, while he received reports from Foreign Minister Lavrov’s recent trips and asked him to share them with the security council, according to TASS. It was also reported that Putin said boosting Russia’s armed forces and meeting the needs of troops fighting in Ukraine are key strategic priorities.

- Russian sovereign wealth fund chief Dmitriev was appointed Special Envoy on International Economic Cooperation and his new mandate will include ties with the US.

- Russian Deputy Foreign Minister Ryabkov said a second meeting between representatives of Russia and the US is planned for the next two weeks and said that Russia will hold talks with the US to address irritants in bilateral relations, according to TASS. It was separately reported that Ryabkov said the US wants to achieve a quick ceasefire in Ukraine without long-term settlement and he explained to the US that a sole ceasefire in Ukraine is unacceptable, according to RIA.

- Russian Foreign Minister Lavrov is to visit Turkey on Monday and will discuss a range of topics including recent US talks on the Ukraine war and how Turkey can contribute.

- Russian Defence Ministry said Russian forces captured the villages of Ulakly and Novoandriivka in eastern Ukraine’s Donetsk region.

- Greek PM Mitsotakis told Ukrainian President Zelensky that it is up to Ukraine to decide on the peace framework acceptable to it and nothing can be decided without Ukraine.

- Poland’s President Duda told US President Trump that US presence in Poland and central Europe should be boosted.

- Hungary's PM Orban said Ukraine will never be a member of the EU against Hungary’s interests.

- EU Council President Costa said they decided to convene a Special European Council regarding Ukraine and EU defence on March 6th.

- Canadian PM Trudeau and US President Trump spoke on Saturday in which they discussed the war in Ukraine and combating fentanyl.

OTHER

- China defended its recent naval drills in the Tasman Sea and accused Australia of ‘deliberately hyping’ military exercises.

EU/UK

NOTABLE HEADLINES

- ECB's Escriva said monetary policy must be approached with caution given the current extraordinary uncertainty.

- ECB’s Villeroy reaffirmed that the ECB’s Deposit rate should be at 2% by this coming summer and said that European banking sector consolidation is generally speaking, necessary to have European banks that can compete at a global level.

- ECB's Wunsch said the ECB faces the risk of ‘sleepwalking’ into too many rate cuts, while he feels “relatively comfortable” with market expectation of 2% rates by year-end “give or take 50 basis points”, according to FT.

- Hungary's PM Orban said they are to exempt mothers of two or three children from income tax and said this will be a huge expense but the budget deficit and debt will decline, while he added the government is ready to impose food price caps unless talks with retailers on keeping prices under control succeed.

- Austria's biggest centrist parties in parliament hinted they were on the verge of agreeing to form a coalition government which would bring together Austria's conservatives, socialists and liberals, while it would sideline the far-right Freedom Party which won the election in September, according to euro news.