The VIX, a measure of implied equity volatility, is biased much higher in the coming months as the lagged impact of tighter financial conditions increasingly ripple through the economy and markets. Also, the VIX curve has flattened over the last month, meaning there is less negative carry on long VIX positions.

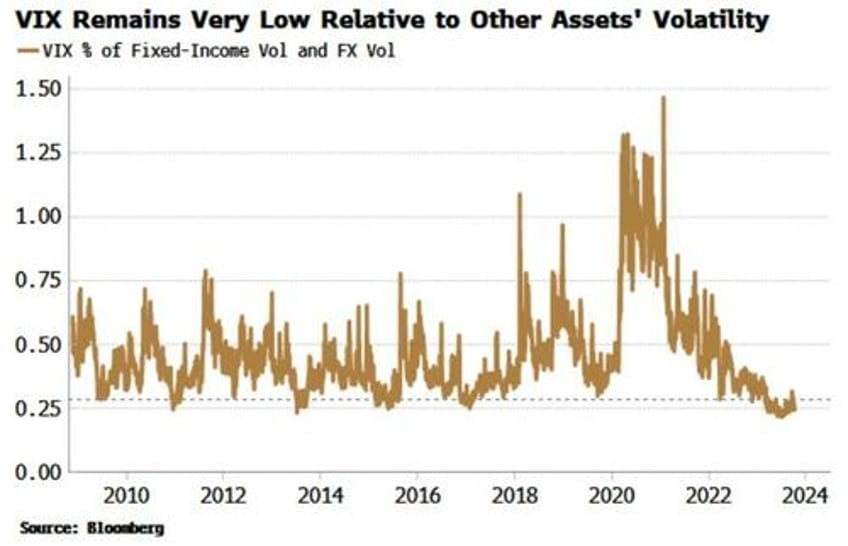

From the vantage point of an equity investor, inter-day implied volatility has been remarkably subdued. While the MOVE (fixed-income vol) and the CVIX (FX vol) are both notably above where they were in late 2019, the VIX is barely higher than its level just prior to the beginning of the pandemic.

There are several reasons for this.

The narrowness of this year’s rally in the S&P has led to implied correlations dropping. Inter-day stock moves largely cancelling each other out will subdue volatility.

Further, investors’ preference for buying puts and selling calls in recent years has helped, with call selling outpacing put buying. When an investor sells an option it adds liquidity to the market through the hedging behavior of the option dealer on the other side, which tends to keep a lid on volatility.

Also, when investors are buying puts (i.e. buying downside protection), this is less destabilizing for the market than when they are selling them as the dealer eventually has to buy the underlying asset when it falls, meaning that corrections are less likely to morph into full crashes.

So investors’ option preferences have ultimately help to keep the VIX in check.

(The VIX index is composed of options with an average of 1-month expiry, but other volatility maturities, all the way down to zero-day (0DTE), also have their vol near lows.)

But that’s unlikely to continue indefinitely.

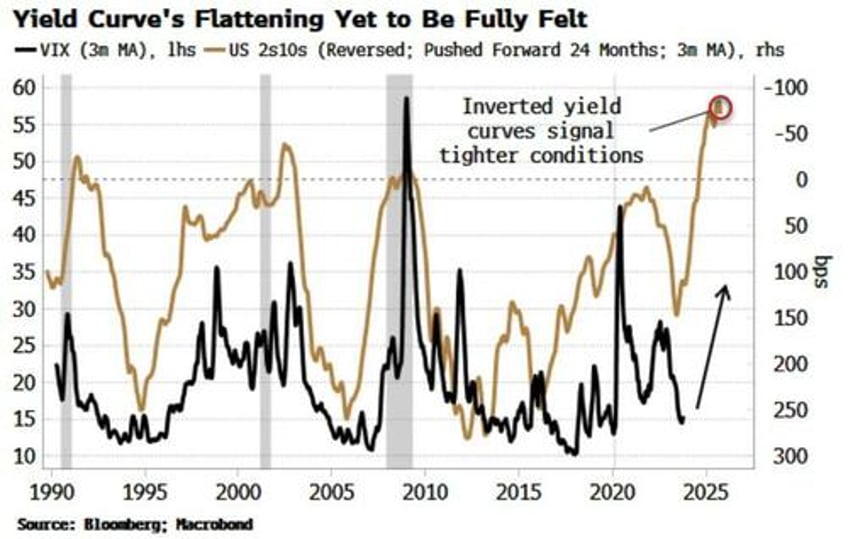

The yield curve may have been steepening of late, but the flattening and heavy inversion are emblematic of tighter financial conditions that have yet to be fully felt across markets and the economy.

An inverted yield curve stores up trouble for later.

As the chart below shows, yield-curve flattenings typically precede rises in the VIX, as the tightening of financial conditions cumulatively bleeds into the economy, while also stressing balance sheets as credit and debt become more difficult to roll.

Possible exogenous proximate causes for vol catalysts are building (today’s producer prices which surprised to the upside; Thursday’s consumer prices; the conflict in the Middle East), but the remote cause is much more restrictive rates that have yet to fully make their mark.