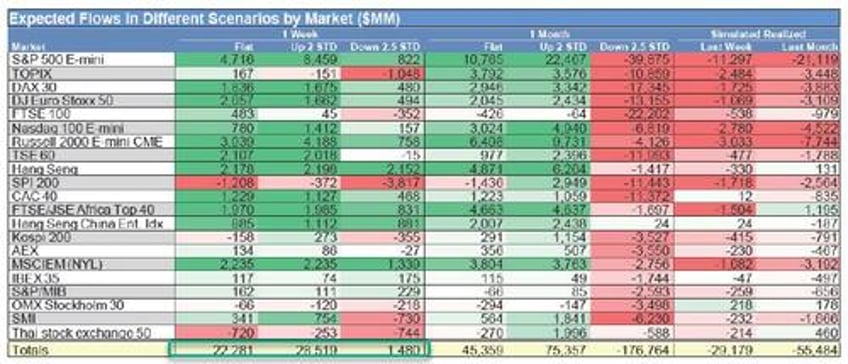

With the equity market staging a powerful rebound ever since our reminded traders last week that stock buybacks are now officially in session again after a 1 month blackout, and pushing the S&P a comfortable safe distance from the bulk of CTA sell thresholds which are mostly clustered at or just below SPX 5,000, the threat of forced systematic selling from the CTA community has been shelved for the time being, and in fact, according to Goldman's models, "CTAs are buyers of global equities & SPX in every scenario over the next week" and only a 2.5-sigma market wipeout over the next month would force CTA selling.

However, that does not mean that the risk from derivatives has now passed. As Goldman's Gillian Hood highlighted in her latest Month-End perspective, in which among other things, she notes that the GS desk models pensions as having only $1 billion to buy into month-end, which she views "as a non-event / insignificant"...