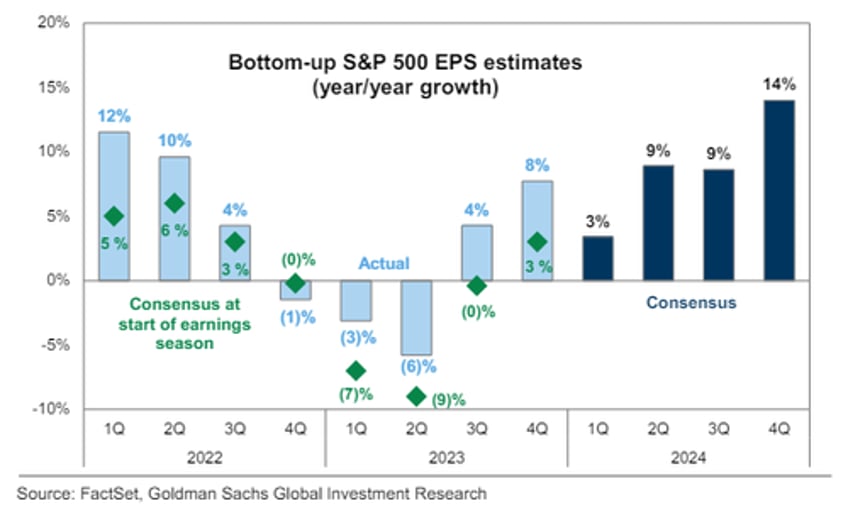

As we discussed a few weeks ago ahead of the start of Q1 earnings season, consensus estimates for Q1 earnings are a very low bar, with S&P 500 YoY growth of 3% (vs 8% realized in 4Q23).

As a result, significantly more companies are beating consensus estimates by at least 1 std dev, and fewer are missing (when compared to historical averages). However, as Goldman trader John Flood points out, beats are not being rewarded (via outperformance) and misses are getting severely punished.