While stocks are trading just shy of record highs, some Wall Street desks are starting to worry that the US consumer - the colossal, if extremely overindebted, driving force behind 70% of US GDP growth - is starting to sputter.

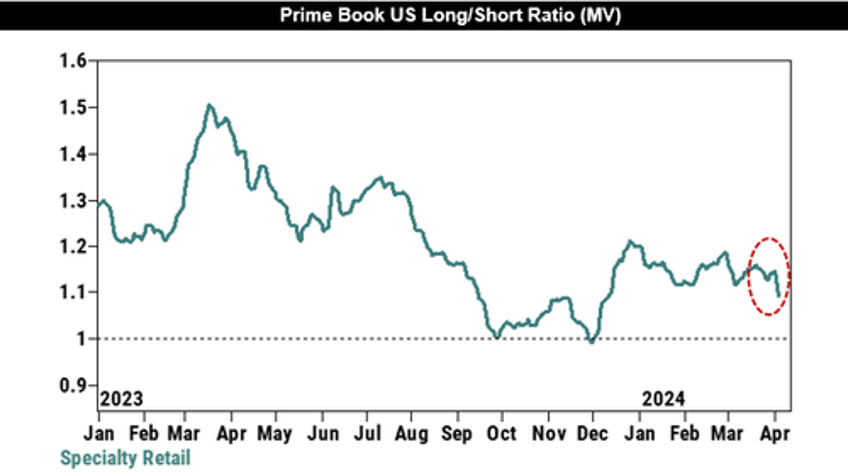

As Goldman's retail specialist Scott Feiler writes in a note today (full pdf available to professional subscribers in the usual place), while his inbounds from investors and clients continue to remain "constructive on consumers" (mainly around the various "constructive corporate tones" out of a competitor’s conference which are a mutual cheerleading circlejerk rather than any objective assessment of US spending power), Goldman's Prime Brokerage data showed that Consumer/Specialty Retail stocks were the most net sold sector in the market all of last week by a good amount.