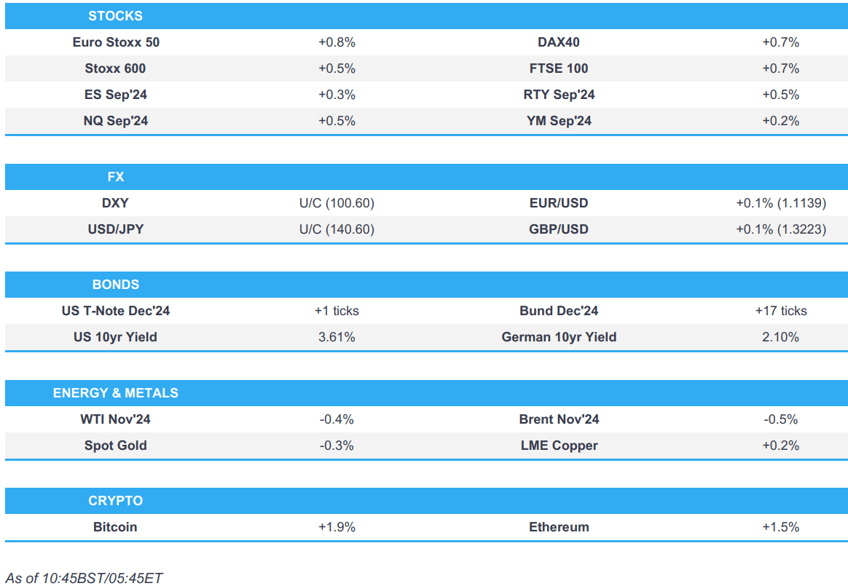

- European equities are firmer across the board, with Retail outperforming; US futures gain, the NQ outperforms attempting to pare back the prior day’s losses

- Dollar is flat, EUR edged off best levels in reaction to poor ZEW data

- Bonds are firmer as markets digest another Timiraos piece, which further highlighted that the Fed has doubts regarding the magnitude of a cut

- Crude has given back early morning strength and is now slightly lower, XAU dips whilst base metals are mixed

- Looking ahead, US Retail Sales, Canadian CPI, US Industrial Production, Business Inventories, NZ Current Account, Comments from Fed’s Logan & BoC’s Rogers, Supply from the US.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.5%) opened on a firmer footing, and have traded at session highs throughout the European morning, not deviating much from the levels seen at the cash open.

- European sectors hold a strong positive bias; Retail is the clear outperformer, propped up by post-earnings strength in Kingfisher (+7.2%). Healthcare is found at the foot of the pile, alongside Telecoms.

- US Equity Futures (ES +0.2%, NQ +0.5%, RTY +0.3%) are modestly firmer across the board, with very slight outperformance in the tech-heavy NQ, attempting to pare back some of the losses seen in the prior session.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is a touch softer vs. peers as the dovish Fed repricing continues. Markets now assign a near 70% chance of a 50bps cut by the Fed this week vs. circa. 15% in the wake of last week's CPI data. Today's US Retail Sales at 13:30 BST / 08:30 EDT is due.

- EUR is steady vs. the USD after another batch of soft data from Germany saw the pair pullback from its session high at 1.1146. If upside in the pair resumes, the 6th September high resides at 1.1155.

- GBP is flat vs. the USD with UK-specifics light in the run up to UK CPI tomorrow and the BoE policy announcement on Thursday with the former unlikely to have much impact on the latter. The 1.3218 high for today's matches that of Monday's.

- JPY is steady vs. the USD after the pair failed to hold below 140 yesterday (printed a trough at 139.57). Focus this week will no doubt be on the FOMC on Wednesday ahead of the BoJ on Friday.

- Antipodeans are both broadly steady vs. the USD. AUD/USD has just about eclipsed yesterday's best of 0.6753 and is at its highest level since 6th September; 0.6767 was the high that day.

- CAD is steady vs. the USD in the run up to today's CPI metrics. Today's release comes in the context of comments over the weekend from BoC Governor Macklem that the Bank could begin cutting rates in 50bps increments.

- Canada's ruling party has lost a key Quebec seat in the Montreal special election, framed as a blow to PM Trudeau, via CBC.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are essentially flat; overnight focus was on the latest WSJ Timiraos piece which highlighted that when the Fed has doubts around the size of its first cut it generally favours 25bps; however, “this time, it’s complicated”. This could potentially be the reason USTs caught a slight bid to a 115-21 high, where it currently resides.

- Bunds are firmer; a modest bounce was seen across fixed income as European players rejoined the session. Specific developments were slim but the move was potentially a function of participants reacting to an overnight Timiraos piece. A move which took Bunds to a 135.39 peak, stopping 10 ticks shy of last week’s 135.49 best.

- Gilts are firmer, in tandem with the broader strength seen across peers; Gilts hit a new contract peak at 101.52, but unable to matierally hold above 101.50 ahead of the 2054 Gilt auction. The tap was strong but not as stellar as the last outing, but Gilts themselves were unreactive to the auction.

- UK sell GBP 2.75bln 4.375% 2054 Gilt: b/c 2.89x (prev. 3.35x), average yield 4.329% (prev. 4.636%), tail 0.2bps (prev. 0.2bps)

- Click for a detailed summary

COMMODITIES

- Crude futures began the European morning on a firmer footing, but has since slipped off best levels and currently trades towards the bottom end of today's ranges; Brent'Nov currently within a 72.35-73.21/bbl range.

- Mixed trade overall in the precious metals complex, with spot silver flat and gold dips lower but spot palladium outperforms with gains of some 1% at the time of writing. XAU sits in a narrow USD 2,574.63-2,587.02/oz range.

- Mixed trade across base metals futures with traders not committing to a particular direction ahead of the upcoming risk events. APAC trade was also tentative amidst the lack of Chinese participants amid the Mid-Autumn festival break.

- PBF's 166k BPD Torrance California refinery reports flaring due to malfunction

- Click for a detailed summary

NOTABLE DATA RECAP

- EU ZEW Survey Expectations (Sep) 9.3 (Prev. 17.9)

- German ZEW Economic Sentiment (Sep) 3.6 vs. Exp. 17.0 (Prev. 19.2); ZEW Current Conditions (Sep) -84.5 vs. Exp. -80.0 (Prev. -77.3)

- Indian WPI Inflation YY (Aug) 1.31% vs. Exp. 1.85% (Prev. 2.04%)

NOTABLE EUROPEAN HEADLINES

- ECB's Simkus says the economy is developing in line with forecasts; the likelihood of an October rate cut is very small; will not have many new data points in October.

- EU Commission President von der Leyen proposes France's Sejourne as Commissioner for Industrial Strategy and Ribera for Competition Commissioner; proposes Sefcovic as the Trade Commissioner and Dombrovskis as the Economy Commissioner. Serafin as the Budget Commissioner. Kubilius as Defence Commissioner

NOTABLE US HEADLINES

- WSJ's Timiraos wrote "Fed Prepares to Lower Rates, With Size of First Cut in Doubt: The central bank usually prefers to move in increments of a quarter point. This time, it’s complicated" which noted the decision whether to cut by 25bps or 50bps will come down to how Powell leads his colleagues through a finely balanced set of considerations, while he added that data over the past months showed inflation resumed a steady decline to the 2% goal but the labour market has cooled.

- BofA September Global Fund Manager Survey: Sentiment improves for first time since June on "Fed cuts = soft landing" optimism; cash level dips to 4.2%; Big rotation to bond sensitives from cyclicals, overweight utilities since 2008; Tactically survey says the bigger the Fed cut, the better for cyclicals.

- Microsoft (MSFT) announced a quarterly dividend increase of 10% to USD 0.83/shr and a new USD 60bln share repurchase program.

- Intel (INTC) said it and AWS (AMZN) are expanding their strategic collaboration by co-investing in custom chip designs, including an AI fabric chip and a custom Xeon 6 chip; the partnership supports US semiconductor manufacturing and AWS's data centre expansion in Ohio. Separately, it said it plans to establish Intel Foundry as an independent subsidiary to provide clearer separation for external customers and suppliers. Will be pausing manufacturing buildout projects in Poland and Germany.

GEOPOLITICS

MIDDLE EAST

- US Secretary of State Blinken will travel to Egypt today for US-Egypt strategic dialogue.

- "Houthi leader: ready to send hundreds of thousands of trained fighters to Hezbollah", via Sky News Arabia.

OTHER

- North Korea's Foreign Minister travelled to Russia, according to KCNA.

- Two Chinese Coast Guard ships arrived in Russia's Port of Vladivostok for joint drills, according to RIA.

CRYPTO

- Bitcoin gains but yet to firmly climb above USD 59k, with Ethreum holding above USD 2.3k.

APAC TRADE

- APAC stocks were mostly positive but with gains capped as participants continued to second-guess the magnitude of the looming Fed rate cut, while markets in Mainland China, Taiwan and South Korea remained closed for holidays.

- ASX 200 marginally edged higher and printed a fresh intraday record high with early advances led by real estate and tech.

- Nikkei 225 suffered on return from the long weekend and fell beneath 36,000 amid headwinds from the recent currency strength.

- Hang Seng shrugged off early cautiousness and gradually climbed higher ahead of the Mid-Autum Festival in Hong Kong, while Midea Group's H shares surged over 8% on its Hong Kong debut following Hong Kong's largest IPO in three years.

NOTABLE ASIA-PAC HEADLINES

- US and Japan are nearing a deal to curb chip technology exports to China, according to FT.

- Japanese Finance Minister Suzuki said FX fluctuations have both merits and demerits on Japan's economy, while they will respond appropriately after analysing the impact of FX moves. Furthermore, he reiterated that rapid FX moves are undesirable and it is important for currencies to move in a stable manner reflecting fundamentals.

- German KfW executive says looking to grow investments in India to USD 1bln from current USD 400mln over the next few years.

DATA RECAP

- Singapore Non-Oil Exports MM (Aug) -4.7% vs. Exp. -3.3% (Prev. 12.2%); (Aug) 10.7% vs. Exp. 15.0% (Prev. 15.7%)