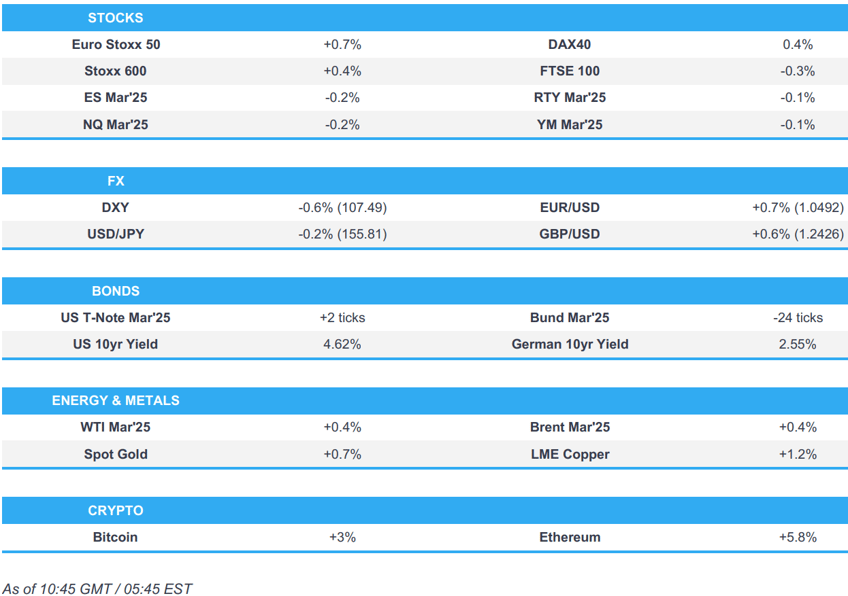

- European bourses mostly firmer, whilst US futures tilt a little lower; Burberry +15% post-results.

- DXY in the doldrums as Trump waters down tariff rhetoric and calls for lower interest rates.

- USTs a little firmer, Bunds pressured by EZ PMIs and BoJ Governor Ueda spurs JGB action.

- Base metals soar amid Trump's China commentary and a weaker dollar.

- BoJ hiked rates by 25bps to 0.50%, as expected via an 8-1 vote with Nakamura the dissenter. Governor Ueda said the Board has judged that spring wage talks will result in strong hikes again this year. No preset idea on future adjustments. No preconceived ideas around the scope/timing of the next rate rise. Next rate hike will depend less on economic growth but more on price moves.

- Looking ahead, US PMIs, Speakers include ECB’s Cipollone. Earnings from Verizon, American Express.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

BOJ

- BoJ hiked rates by 25bps to 0.50%, as expected via an 8-1 vote with Nakamura the dissenter, while it reiterated it will continue to raise rates if the economy and prices move in line with forecasts and it will conduct monetary policy as appropriate from the perspective of sustainably and stably achieving the 2% inflation target. BoJ said real interest rates are at very low levels and inflation expectations have risen moderately, as well as noted the chance of Japan's economy moving in line with the forecast is heightening and that many firms are saying they will offer solid pay hikes in this spring's wage talks.

- Dissenter Nakamura said the BoJ should decide on changing the guideline for money market operations after confirming a rise in firms' earnings power from sources, and after checking sources such as financial statements and statistics of corporations at the next monetary policy meeting.

- Furthermore, the Outlook Report projections were somewhat varied as Core CPI forecasts were lifted across the entire horizon period, while the Real GDP projection was cut for Fiscal 2024 but maintained for the subsequent years after.

UEDA

- No preset idea on future adjustments. No preconceived ideas around the scope/timing of the next rate rise. Next rate hike will depend less on economic growth but more on price moves.

- Board has judged that spring wage talks will result in strong hikes again this year. Growing number of firms expressed intentions to continue increasing wages steadily. Growing number of firms factoring in plans to raise wages, in view of the medium-term projection.

- Financial markets have been stable as a whole. Markets have been calm post-Trump

- Click for full details, reaction and analysis.

EUROPEAN TRADE

EQUITIES

- European bourses (Stoxx 600 +0.3%) began the session almost entirely in the green and continued to gradually extend higher as the morning progressed. A slew of PMI metrics from within the EZ had little impact on the complex.

- European sectors hold a slight positive bias, with the gainers for the day generally attributed to comments via US President Trump overnight; he noted that that talks with Chinese President Xi went fine and added that he would rather not have to use tariffs over China in a pre-taped interview with Fox News. Basic Resources, Autos and Consumer Products all lead; the latter also benefiting from post-earning strength in Burberry (+15%). Telecoms is the underperformer today, stemming from particular post-earning weakness in Ericsson (-7.9%); the co. reported weak Q4 results and highlighted particular weakness in India.

- US equity futures are essentially flat/incrementally lower, ES & NQ -0.2%, in a slight paring to some of the upside seen in the prior session.

- Novo Nordisk (NOVOB DC) has completed the phase 1B/2A trial with subcutaneous Amycretin in people with overweight or obesity. People treated with Amycretin achieved an estimated body weight loss of 9.7% on 1.25mg over the course of 20 weeks, 16.2% on 5mg over 28 weeks and 22% on 20mg over 36 weeks.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- Hefty losses in the DXY in a continuation of the price action seen yesterday and overnight after US President Trump suggested a preference of not using tariffs on China, while the greenback was also not helped by Trump's recent calls for lower interest rates during his address to the WEF. Further losses were seen following the EZ PMI metrics (detailed in EUR section). DXY fell from a 108.19 high to a low of 107.27 at the time of writing, dipping under its 50 DMA (107.63) with the next level to the downside the low from 18th December 2024 (106.82).

- EUR is firmer on the back of the aforementioned dollar softness, sanguine Trump tariff rhetoric on China, and with mostly constructive EZ PMI data. To recap, French services missed forecasts and dipped from the prior, in turn dragging down the pan-EZ services metrics. Aside from that, other French metrics beat while all German figures topped forecasts. The EZ-wide figures saw stronger Manufacturing/Composite figures whilst the Services metric was a little lower. EUR/USD rose from a 1.0410 intraday low to test and eventually breach 1.0500 to the upside, rising above its 50 DMA at 1.0431.

- A choppy session for the JPY with the BoJ in focus overnight and in the European morning. The BoJ hiked rates by 25bps to 0.50%, via an 8-1 vote split. Furthermore, the Outlook Report projections were somewhat varied as Core CPI forecasts were lifted across the entire horizon period, while the Real GDP projection was cut for Fiscal 2024 but maintained for the subsequent years after. USD/JPY sits around the middle of a 154.83-156.37 range, back around 155.50, after briefly dipping under its 50 DMA (154.94).

- GBP was supported by the aforementioned weak dollar and boosted by above-forecast UK flash PMIs. GBP/USD resides closer to the top of a 1.2345-1.2447 range as it eyes the 8th January high (1.2494).

- Firmer cross antipodeans amid the softer dollar and after US President Trump suggested a preference of not using tariffs on China.

- PBoC set USD/CNY mid-point at 7.1705 vs exp. 7.2779 (prev. 7.1708).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- JGBs came under modest pressure on the BoJ announcement which saw a hike, 8-1 vote split, and upgrades to the inflation forecasts. Thereafter, a more pronounced move was seen at Governor Ueda’s press conference with his initial remarks around the spring wage talks weighing on JGBs which slipped from 140.72 to 140.61 over the course of six minutes. Following this, JGBs lifted from 140.62 to 140.78, echoing the upward move in USD/JPY, as Ueda said they have no preset idea on future adjustments.

- USTs are moving in tandem with JGBs, Bunds and Gilts thus far. However, USTs remain just about in the green at the low end of a 108-09+ to 108-19+ band. US Flash PMIs due later.

- For Bunds, initial action modestly influenced by JGBs. Thereafter, no move on the French Flash PMIs (beats, ex-Services). Thereafter, the German figures printed firmer than forecast with Composite surprisingly returning to expansionary territory. A print that weighed on Bunds to the tune of 20 ticks with the contract slipping further to a 131.29 low just before the pan-EZ figure. Thereafter, the UK numbers (see below) added to this and a 131.12 trough printed.

- Gilts followed the above into their own data releases, however Gilts were initially outperforming after gapping higher by a handful of ticks and thereafter hit a 92.25 session high. Thereafter, the session’s main move came on the Flash PMI release for January which beat across the board and weighed on Gilts by 20 ticks in an immediate move, taking it below 92.00 and thereafter extended further to a 91.55 session low.

- Click for a detailed summary

COMMODITIES

- Crude holds a modest upward bias on Friday with prices still taking a breather following the declines yesterday owing to comments from US President Trump who told the WEF in Davos that he will be asking Saudi Arabia and OPEC to bring down the cost of oil. Brent Mar sits in a USD 77.60-78.61/bbl range.

- Precious metals are bolstered by the weaker dollar as the Trump tariffs trade partially unwound following conciliatory commentary from US President Trump on China, whilst Trump also said that he will demand that US interest rates drop immediately. On China, US President Trump said the conversation with Chinese President Xi went fine and responded he can when asked if he can make a deal with China, while he added would rather not have to use tariffs over China in a pre-taped interview with Fox News.

- Firmer trade across base metals on the back of the weaker dollar coupled with US President Trump's constructive remarks on China. 3M LME copper currently resides in a USD 9,216.50-9,362.00/t range.

- UBS says risks to oil prices remain skewed to the upside in the short term. Oil demand should grow in line with long term growth rate of 1.2MBPD, with oil market almost balanced this year. Remain long gold in global strategy with target of USD 2,850/oz by the year end.

- Russian Kremlin (on the prospect of lower oil prices helping to end the war in Ukraine) says the essence of conflict for Russia is based on national security, not oil.

- Ukraine Military says drones struck a Russia's Ryazan oil refinery and other oil facilities in an overnight attack.

- China crude steel output+11.8% Y/Y to 75.0mln tonnes in December 2024; Global crude steel +5.6% Y/Y.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU HCOB Composite Flash PMI (Jan) 50.2 vs. Exp. 49.7 (Prev. 49.6); HCOB Manufacturing Flash PMI (Jan) 46.1 vs. Exp. 45.3 (Prev. 45.1); HCOB Services Flash PMI (Jan) 51.4 vs. Exp. 51.5 (Prev. 51.6); "Cost inflation has increased in the services sector, which ECB president Christine Lagarde has said to monitor closely."... "Given the weak state of the economy, the ECB will likely stick to its gradual pace of cutting interest rates, for the time being."

- French HCOB Composite Flash PMI (Jan) 48.3 vs. Exp. 47.7 (Prev. 47.5); Manufacturing Flash PMI (Jan) 45.3 vs. Exp. 42.3 (Prev. 41.9); Services Flash PMI (Jan) 48.9 vs. Exp. 49.3 (Prev. 49.3); "The French economy is not fundamentally in a dire state, as indicated by the sub-index for future output, which is neutral. It is primarily the political crisis that is economically paralysing the country."

- German HCOB Composite Flash PMI (Jan) 50.1 vs. Exp. 48.2 (Prev. 48.0); Manufacturing Flash PMI (Jan) 44.1 vs. Exp. 42.7 (Prev. 42.5); Services Flash PMI (Jan) 52.5 vs. Exp. 51.0 (Prev. 51.2); "Manufacturing output is shrinking at the slowest rate since mid-2024, and the new order situation has eased a bit too."

- UK Flash Composite PMI (Jan) 50.9 vs. Exp. 50.0 (Prev. 50.4); Flash Manufacturing PMI (Jan) 48.2 vs. Exp. 47.0 (Prev. 47.0); Flash Services PMI (Jan) 51.2 vs. Exp. 50.9 (Prev. 51.1); "Inflation pressures have meanwhile reignited, pointing to a stagflationary environment which poses a growing policy quandary for the Bank of England."... "While the stalled economy and deteriorating jobs market suggest there’s an increased need for rate cuts to stimulate growth, the rise in price pressures hints that the inflation genie is by no means back in its bottle".

- UK GfK Consumer Confidence (Jan) -22.0 vs. Exp. -18.0 (Prev. -17.0)

NOTABLE EUROPEAN HEADLINES

- Maersk (MAERSKB DC) says will continue to sail around Africa vis Cape of Good Hope until safe passage through Red Sea/Gulf of Aden is ensured for longer term.

- ECB's Lagarde says she has confidence that inflation will continue to slow.

- German Government forecasts 0.3% Economic Growth in 2025, revised down from 1.1%, via Handelsblatt

NOTABLE US HEADLINES

- The US House Republican committee chairs pitched in a private meeting what could add up to between USD 2.5-3 trillion of spending cuts and budget savings to fund Republicans’ reconciliation package, according to Punchbowl News. The Energy and Commerce Committee is eyeing up to USD 2tln of cuts, including per capita caps for Medicaid. Energy-related cuts, such as rolling back tailpipe rules and fuel efficiency benchmarks for cars and light trucks, known as CAFE standards, were also part of the committee’s pitch. The Education and Workforce panel believes it has up to USD 500bln in cuts, largely through targeting student loans. The House Agriculture Committee is targeting between USD 100bln and USD 250bln in cuts. Some would impact SNAP, aka food stamps. The Transportation and Infrastructure panel’s up to USD 26bln in savings would include raising tonnage duties for ships, and electric vehicles fees that would go into the Highway Trust Fund. Ultimately, each and every cut will have to get approved by every Republican member in the House - any GOP member could kill the bill, at least until early April.

GEOPOLITICS

CHINA

- US President Trump said the conversation with China's Xi went fine and responded he can when asked if he can make a deal with China, while he added he would rather not have to use tariffs over China, via a pre-taped interview with Fox News.

MIDDLE EAST

- Palestinian TV reported large Israeli forces stormed the city of Tulkarm in the West Bank accompanied by military bulldozers, according to Sky News Arabia.

- Trump administration officials told Israeli officials that he does not intend to start his term with a new war in the Middle East and wants to reach a very strict agreement to prevent Iran from reaching a nuclear weapon, while Trump believes that the Iranians will rush to the negotiating table under his leadership, according to Channel 12.

- UKMTO said it received a report of an incident 86NM northeast of Ras Tanura, Saudi Arabia in which a vessel was approached by a small military craft which kept hailing the vessel to turn to port towards Iranian territorial waters.

RUSSIA-UKRAINE

- Russia's Kremlin says President Putin has made clear he wants to restart Nuclear arms cuts talks as soon as possible.

- Russia's Security Council Secretary Shoigu said risk of an armed clash between nuclear powers is growing and accused NATO of increasing activities on the eastern flank of Russia and Belarus and of rehearsing offensive operations there, according to TASS.

- Moscow's Mayor announced that air defence units southeast of Moscow repel attacks by drones headed for the capital, while the Governor of Russia's Ryazan region southeast of Moscow announced that emergency services were responding to an air attack.

Other

- US Secretary of State Rubio reinforced US commitment to NATO in a call with the NATO Secretary General and discussed the importance of "real burden sharing", as well as the importance of ending Russia's war in Ukraine and the need for a peaceful solution.

CRYPTO

- Bitcoin is back on a firmer footing and tops USD 105k; Ethereum gains to a larger magnitude and climbs above USD 3.3k.

APAC TRADE

- APAC stocks were mostly higher following the continued gains on Wall St and constructive comments from US President Trump related to China tariffs but with the upside capped as the attention turned to the BoJ which delivered a widely expected rate hike.

- ASX 200 edged mild gains with sentiment helped by the encouraging tariff-related rhetoric by Trump on China.

- Nikkei 225 initially extended above the 40,000 level but then pared its advances after the BoJ hiked rates by 25bps to 0.50% and raised its Core CPI forecasts across the board which disappointed those that were hoping for an overtly dovish hike.

- Hang Seng and Shanghai Comp were encouraged by the pre-taped comments from US President Trump that conversations with Chinese President Xi went fine and that he would rather not have to use tariffs over China, although risk sentiment in the mainland was somewhat tempered after the PBoC's MLF operation resulted in a CNY 795bln drain.

NOTABLE ASIA-PAC HEADLINES

- PBoC conducted a CNY 200bln 1-year MLF operation and left the rate unchanged at 2.00% for a CNY 795bln drain.

- Monetary Authority of Singapore kept the width of the policy band and level where it is centred unchanged but announced to reduce the slope of SGD NEER policy band, while it stated the measured adjustment is consistent with a modest and gradual appreciation path for the SGD NEER policy band, aiming to ensure medium-term price stability.

DATA RECAP

- Japanese National CPI YY (Dec) 3.6% vs. Exp. 3.4% (Prev. 2.9%)

- Japanese National CPI Ex. Fresh Food YY (Dec) 3.0% vs. Exp. 3.0% (Prev. 2.7%)

- Japanese National CPI Ex. Fresh Food YY (Dec) 2.4% vs. Exp. 2.4% (Prev. 2.4%)